August 19, 2024

AuKing Mining Limited (ASX: AKN) is pleased to confirm that final arrangements are being made prior to the commencement of its proposed Stage 2 exploration drilling program at the Mkuju Uranium Project in southern Tanzania.

AuKing Managing Director, Paul Williams said AuKing is looking forward to proceeding with its Stage 2 drilling program at Mkuju, after the initial Stage 1 activities in late 2023 identified potential significant areas of uranium mineralization.

“The planned maximum 75 drill hole (11,000m) air core/RC drilling program at Mkuju is expected to commence within the next few weeks, now that road and drill pad access has been completed. The work we carried out last year in the Stage 1 program identified several key target areas for the proposed drilling and we are keen to start generating some results from this very prospective uranium project,” Mr Williams said.

2023 Mkuju Results

On the 31st January 2024, the Company reported some excellent results from its initial Stage 1 exploration program conducted at the Mkuju uranium project including the following:

Auger drilling

MKAU23_020 3m @ 1,273ppm U3O8 incl 1m @ 3,350ppm U3O8

MKAU23_045 3m @ 250ppm U3O8 incl 1m @ 410ppm U3O8

Soil samples

MKGS006 510ppm U3O8

MKGS017 8,800ppm U3O8

MKGS056 960ppm U3O8

Rock chip samples

MKGS056 2,250ppm

MKGS057 800ppm U3O8

(See AuKing release to ASX on 31 January 2024 for full details).

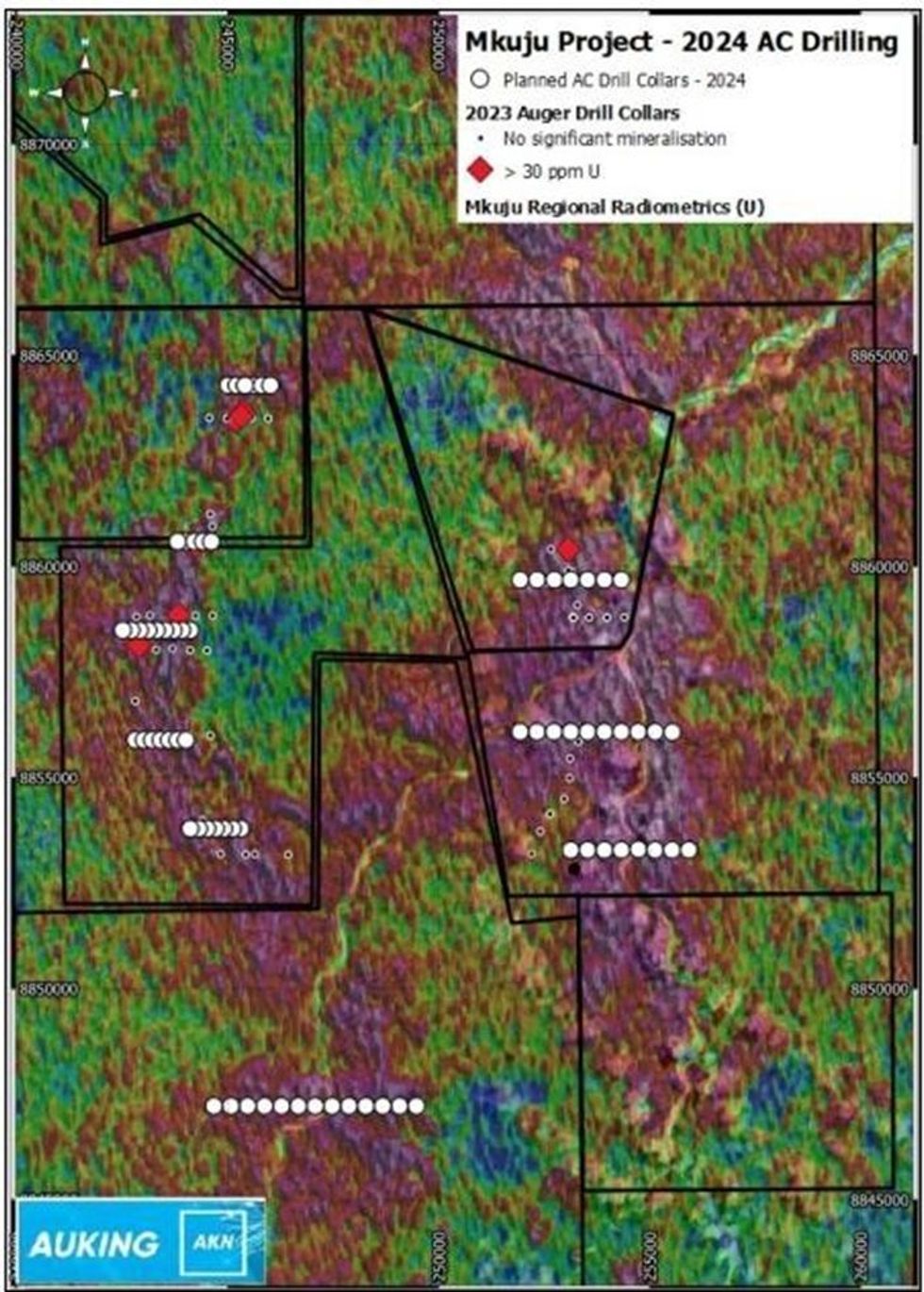

The results from the Stage 1 program (together with the historical radiometric survey previously undertaken by Mantra Resources) enabled Auking to develop the key target areas for proposed Stage 2 drilling program as illustrated in Figure 1 below:

Mkuju Stage 2 Program Aims and Activities

There are some key aims associated with the proposed Stage 2 drilling program at Mkuju as follows:

- Carry out the first detailed exploration drilling program in this region to the immediate south of the world class Nyota uranium deposit;

- Test the high priority target areas that have emerged from the Stage 1 program and sit within the historical Mantra Resources radiometric survey;

- Carry out a drilling pattern of several holes for each target area in order to maximise the prospects of intersecting uranium mineralization; and

- Test the potential mineralized extents of certain target areas in the three new Eastern PLs that coincide with the Mantra radiometric anomaly; and

- Generally, provide the basis for a further Stage of drilling that will primarily be focused on establishing an initial mineral resource estimate (MRE) at Mkuju.

Click here for the full ASX Release

This article includes content from AuKing Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AKN:AU

Sign up to get your FREE

AuKing Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

09 February

AuKing Mining

Advancing a diversified portfolio of uranium, copper and critical minerals projects across Australia, Tanzania and North America, with current priorities including the proposed tin acquisition in north-west Tasmania, the Koongie Park copper-zinc project in Western Australia, and the Mkuju uranium project in southern Tanzania.

Advancing a diversified portfolio of uranium, copper and critical minerals projects across Australia, Tanzania and North America, with current priorities including the proposed tin acquisition in north-west Tasmania, the Koongie Park copper-zinc project in Western Australia, and the Mkuju uranium project in southern Tanzania. Keep Reading...

03 February

Share Placement Update

AuKing Mining (AKN:AU) has announced Share Placement UpdateDownload the PDF here. Keep Reading...

28 January

Acquisition of Tin and Silver Prospects

AuKing Mining (AKN:AU) has announced Acquisition of Tin and Silver ProspectsDownload the PDF here. Keep Reading...

19 January

Quarterly Activities Report

AuKing Mining (AKN:AU) has announced Quarterly Activities ReportDownload the PDF here. Keep Reading...

19 January

Quarterly Cashflow Report

AuKing Mining (AKN:AU) has announced Quarterly Cashflow ReportDownload the PDF here. Keep Reading...

14 January

$1.5M Share Placement

AuKing Mining (AKN:AU) has announced $1.5M Share PlacementDownload the PDF here. Keep Reading...

04 March

Cameco Signs US$2.6 Billion Uranium Deal With India to Fuel Nuclear Expansion

Cameco (TSX:CCO,NYSE:CCJ) has secured a nine-year uranium supply agreement with India worth an estimated US$2.6 billion, accelerating its nuclear power expansion as it deepens critical mineral ties with the country.The Saskatoon-based uranium producer will supply nearly 22 million pounds of... Keep Reading...

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

Latest News

Sign up to get your FREE

AuKing Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00