August 18, 2023

MTB Metals Corp. (TSXV: MTB) (OTCQB: MBYMF) (FSE: M9U) ("MTB" or the "Company") announces that drilling on the Telegraph porphyry project is anticipated to start around August 19. Currently pads are being built and the drills are being mobilized. The first phase of drilling will be testing three areas along 2.5 kilometres of the identified Dok trend.

The geological setting of the Telegraph property is similar to four world-class porphyry copper-gold deposits in the same region, all of which are being advanced by major mining companies. MTB consolidated a 310 square kilometer land package in 2021 and is now exploring this area for the first time on a consolidated basis.

Two holes drilled in 2014 confirmed the presence of a porphyry copper-gold system at Dok, but the holes are interpreted to be peripheral to the heart of the system. For the last 2 years the MTB geological team has been compiling the historic data and systematically exploring the various identified targets with geological alteration and structural mapping, prospecting, shortwave infrared spectroscopy (SWIR), rock sampling, spectral analysis and soil geochemistry. A Volterra 3D Induced Polarization (3DIP) ground survey was also conducted in 2022 over the Red Creek area within the Dok Trend. By evaluating the SWIR data, trace element geochemistry and identified alteration, the geological team is building a porphyry model for the area. Multiple porphyry targets have been identified within the broad zone of alteration identified in the area, including the Dok trend and Strata Mountain. This initial drill program will involve 2,000 to 3,000 meters of drilling from 3 drill pads, with the details of the program evolving based on observations as the drilling progresses.

2023 Field Program and Target Selection

For the 2023 field season, exploration has been focussed primarily on the Dok trend in preparation for drilling.

Field work has consisted of further geological alteration and structural mapping, spectral analysis, shortwave infrared spectroscopy (SWIR), assay rock sampling, and soil geochemistry. A portable X-Ray Fluorescence Spectrometer (pXRF) is on site which allows the team to instantaneously analyze the soil and rock samples without having to wait for assay results from the lab. Over 650 soil samples have been collected of which assay results have been received for the first 275 samples. The assay results for copper from the lab are consistently about 30% higher than the pXRF results, providing added confidence in the identified pXRF soil anomalies.

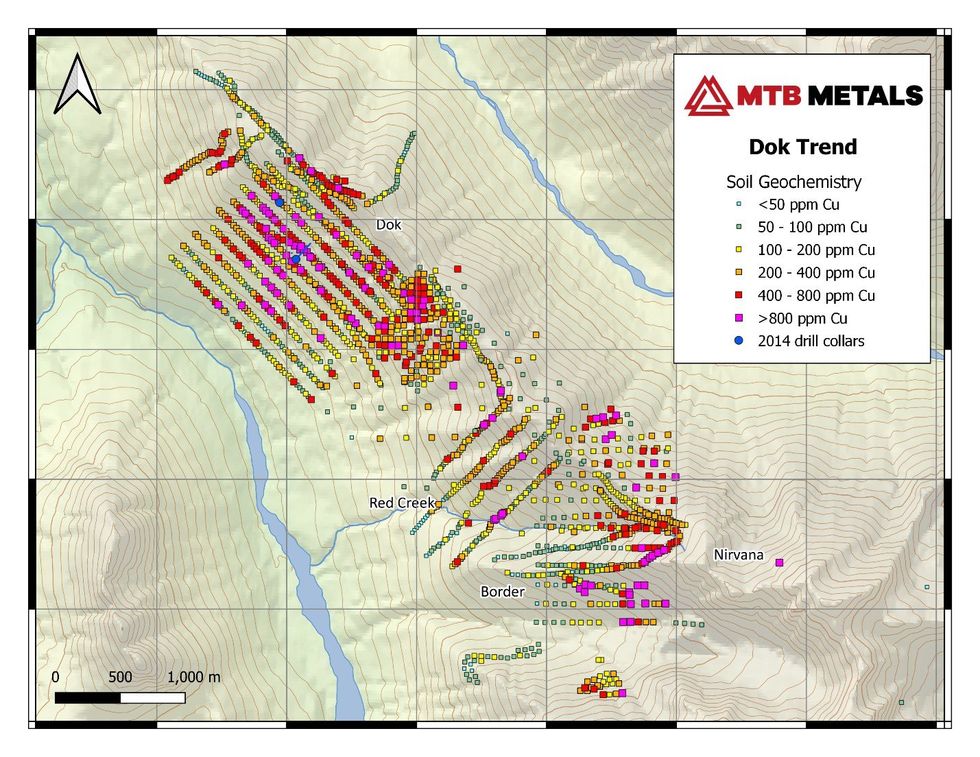

Numerous copper and gold in soil anomalies occur within Dok trend including a 1.2 km x 1 km anomaly, which includes 175 soil samples. The average concentration of copper in soils within this anomaly is 376 ppm, with a high of 3,860 ppm Cu and a low of 51 ppm. Values of up to 0.36 ppm gold also occur within this area.

Analysis of trace element geochemistry has demonstrated diagnostic zonation of metals comparable with current porphyry models. Additionally, SWIR data has identified alteration patterns, including white mica with high white mica crystallinity, a proxy for hotter temperatures and subsequently the centre of a porphyry hydrothermal system.

Figure 1- Current and Historic Soil Geochemistry for Copper on the Dok Trend

Currently, three styles of copper and gold mineralization have been identified. They include the following,

- High grade copper mineralization hosted within quartz and carbonate veins interpreted to be peripheral to a porphyry system.

- Disseminated and stockwork copper mineralization occurring with magnetite, k-feldspar, epidote and chlorite interpreted to be within the upper reaches of a porphyry system.

- Disseminated and stockwork copper mineralization with k-feldspar, biotite and sericite, interpreted to be within the hotter (deeper) parts of a porphyry system.

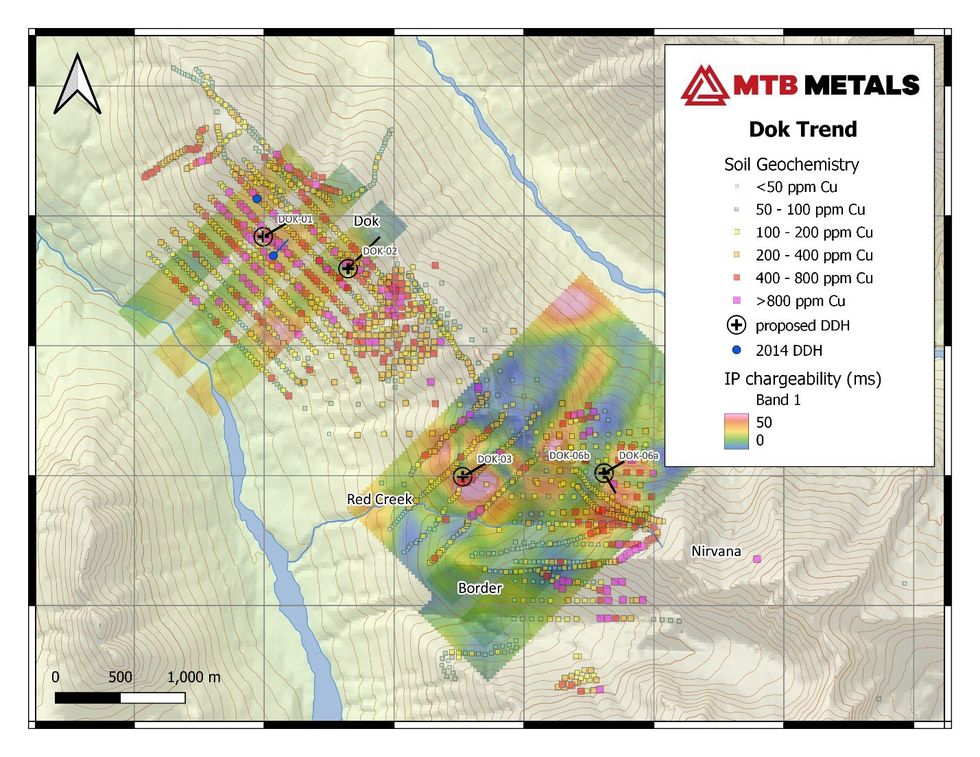

Targets along the Dok trend have been ranked based on their IP and 3DIP chargeability responses from the 2012 and 2022 ground surveys, the magnetic response from the 2012 airborne mag survey, soil geochemistry results, pXRF results, SWIR results and field observations from ground truthing of identified anomalies.

Lucia Theny, Vice President Exploration, stated: "The overlapping of multiple geological, geophysical and geochemical indicators is providing good confidence in our target selection and the team is excited to be able to test their hypothesis with the drill."

Figure 2 - Proposed Drill Holes for the Dok Trend on top of Copper Soil Geochemistry and Induced Polarization Chargeability

Lawrence Roulston, CEO, noted: "The geological team over the past two months carried out mapping, sampling and spectral analysis which confirmed the earlier information and filled in some gaps. These results provided a firm basis for selection of the initial drill targets. The team has worked methodically to advance the understanding of this huge geological system. This initial drill program will involve 2,000 to 3,000 meters of drilling from 3 drill pads, with the details of the program evolving based on observations as the drilling progresses. Use of the pXRF on the drill core will support the geological team's observations."

About MTB

MTB has six active projects spanning 670 square kilometres (67,587 hectares) in the prolific Golden Triangle of northern British Columbia. With the focus on the Telegraph project, discussions are now underway leading to joint ventures and/or spinouts of other projects.

- Telegraph is located in the vicinity of 4 world-class porphyry deposits being advanced by major mining companies: Galore (Teck / Newmont), Schaft (Teck), Saddle (Newmont) and the operating Red Chris copper-gold mine (Newcrest / Imperial Metals). Field work by MTB on its 310 square kilometre property, together with earlier results, provides compelling evidence for the presence of one or more porphyrys, similar to others in the area.

- The American Creek project is centered on the historic Mountain Boy silver mine. The project is road accessible and 20 km from the deep-water port of Stewart. There are multiple silver, gold and copper occurrences on the property, including a 2006 drill hole that encountered 5 kgs of silver over 5 metres.

- Red Cliff is a past producing gold and copper mine in which the Company holds a 35% interest. Recent drill results include 2 meters of 26 g/t gold.

- On the BA property, 182 drill holes have outlined a substantial zone of silver-lead-zinc mineralization located 4 km from the highway. Several targets with high-grade silver potential remain to be tested. Surprise Creek, to the north, hosts the same prospective stratigraphy.

- On the Theia project, work by MTB and previous explorers has outlined a silver bearing mineralized trend 500 metres long, highlighted by a 2020 grab sample that returned 39 kg per tonne silver (1,100 ounces per ton). Two other zones on the property produced copper values over 5%.

- Southmore is in the midst of some of the largest deposits in the Golden Triangle. It was explored in the 1980s through the early 1990s and was overlooked until MTB consolidated the property and carried out airborne geophysics and field work which confirmed several zones of gold and copper, with values up to 20% copper and 35 g/t gold.

On behalf of the Board of Directors:

Lawrence Roulston

President & CEO

For further information, contact:

Caroline Klukowski

info@mountainboyminerals.ca

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This news release may contain certain "forward looking statements". Forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Any forward-looking statement speaks only as of the date of this news release and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

MTB:CA

The Conversation (0)

15h

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Toronto-based company Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The company's board has authorized preparations for an initial public offering (IPO) of a new entity that would house its premier... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00