- WORLD EDITIONAustraliaNorth AmericaWorld

August 10, 2023

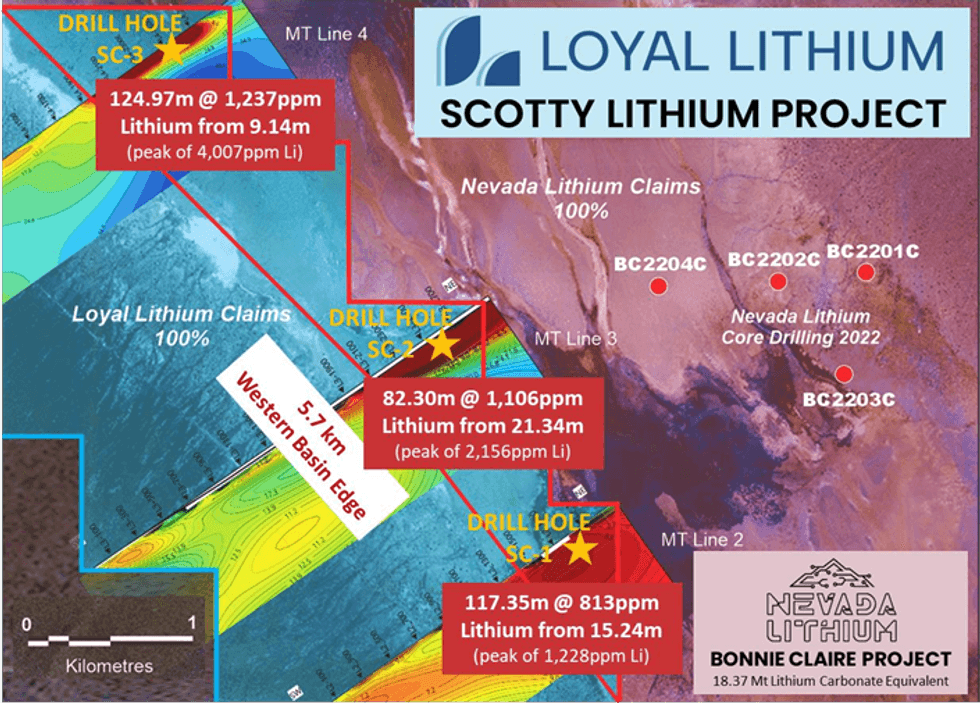

Loyal Lithium Limited (ASX: LLI) (Loyal or the Company) is thrilled to confirm the discovery of a significant lithium basin at the 100% owned Scotty Lithium Project in Nevada, USA. The average lithium grade of the drillholes measures 1,120ppm with a 700ppm cut-off, starting near the surface (9m deep) and spans a 3.6km² area with an average thickness of 108m. Drilling and geophysics data will be utilised for a 3D model and for the creation of an Exploration Target. The basin's 5.7km western edge offers the potential for cost-effective mining due to its alluvial fan rocks, providing excellent accessibility for surface mining. Nevada Lithium’s (CSE:NVLH) neighbouring Bonnie Claire Project has successfully produced battery- grade lithium carbonate from its sedimentary basin drill cores. The Scotty Lithium Project occurs within close proximity to all-weather roads and power infostructure, and is strategically located just 40km north of Beatty, 220km from Las Vegas, and 330km from Tesla’s Nevada Gigafactory.

Highlights:

- Drilling assays have confirmed the presence of a mineralised lithium basin at the 100% owned Scotty Lithium Project, with an average grade of 1,120ppm lithium at a 700ppm lithium cut-off-grade.

- The drilling assays returned spectacular results with a peak lithium value of 4,007ppm.

- Drilling results and geophysical data will now be used to create a 3D model and robust Exploration Target.

- The 5.7 km long western basin edge on Loyal Lithium’s claims (implied from magnetotellurics1) consists of alluvial fan rocks that may accommodate mining/processing infrastructure and enable access to the basin for a traditional and relatively low-cost surface mining solution.

- Nevada Lithium’s (CSE:NVLH) neighbouring Bonnie Claire Project, recently produced a sample quantity of battery grade lithium carbonate6 from the contiguous sedimentary basin drill core of the Bonnie Claire Project where drilling has found lithium only 1 km to the east of Loyal Lithium’s claims3,4,5.

- Scotty Lithium is located 40km north of the mining town of Beatty, 220km from Los Vegas and 330km from Tesla’s Nevada Gigafactory with existing all-weather roads and power infrastructure within close proximity.

Loyal Lithium’s Managing Director, Mr Adam Ritchie, commented:

"The Scotty Lithium Project continues to deliver with spectacular drilling assay results confirming strong lithium mineralisation, representing significant resource potential.”

“With the support of a 5.7km western edge, the sedimentary basin could potentially be accessed via traditional mining solutions from surface. The neighbouring Bonnie Claire Project has recently completed pilot plant test work to produce a high-grade lithium carbonate from the adjoining sedimentary clay”.

“Nevada lithium is alive, and the Scotty Lithium Project has shown its potential to play a significant role in the emerging North American lithium supply chain.”

Project and Exploration Program Overview

The Scotty Lithium Project is located 220 km northwest of Las Vegas, NV and is contained within the Sarcobatus Flat, a known lithium-bearing sediment basin. Nevada Lithium’s (CSE:NVLH) neighbouring Bonnie Claire Project is also contained within the same basin. Early this year, Nevada Lithium purchased Iconic Minerals Ltd. who in 2021 completed a PEA on the resource at the Bonnie Claire project.8

Click here for the full ASX Release

This article includes content from Loyal Lithium Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LLI:AU

The Conversation (0)

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00