July 21, 2024

New drill drive to provide underground drill platforms to in-fill and extend existing deposits and identify new high-grade shoots

Spartan Resources Limited (“Spartan” or “Company”) (ASX: SPR) is pleased to announce that it has awarded the contract for the development of an underground exploration drill drive at its 100%-owned Dalgaranga Gold Project (“DGP”), located in the Murchison region of Western Australia, to specialist underground mining services contractor, Barminco Limited, a wholly owned subsidiary of the ASX-listed global diversified mining services company Perenti Limited (ASX: PRN).

Highlights:

- Development contract for the underground exploration drill drive at the Dalgaranga Gold Project awarded to Barminco Limited.

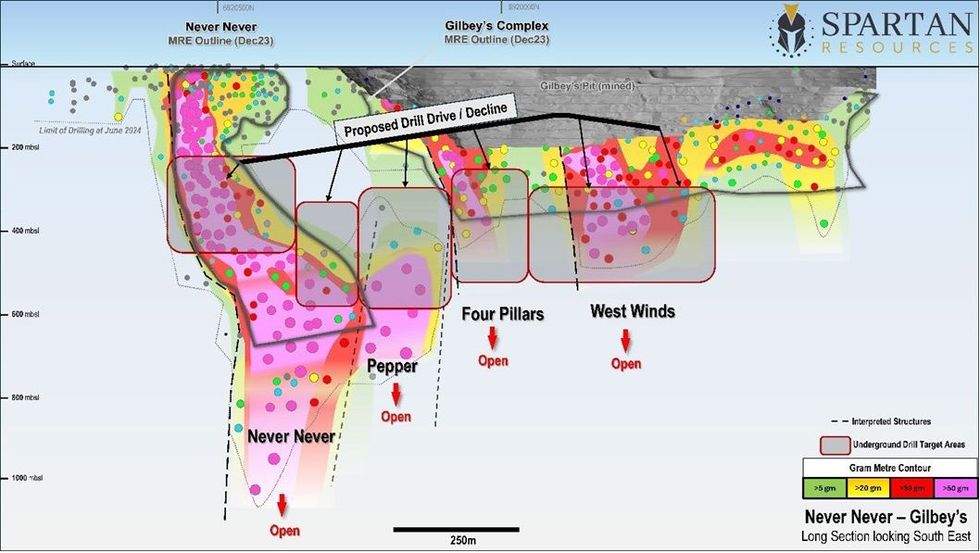

- The contract, which is valued at ~$18.3 million, provides for 2,350m of development to deliver twin decline access for the establishment of underground drilling platforms to in- fill and extend mineralisation within the Never Never, Pepper, Four Pillars and West Winds areas.

- The drill drive has also been designed to support future mine production activities.

- All regulatory mining approvals are now in place and all major support services have been engaged to facilitate the commencement of construction in the current quarter.

- Surface exploration drilling at Dalgaranga will shortly re-commence, with rigs arriving on site later this month.

The contract, which is valued at ~$18.3 million including an allowance for fuel and contingencies, provides for 2,350m of development to deliver twin decline access for the establishment of underground drilling platforms to in-fill and extend mineralisation across the Never Never, Pepper, Four Pillars and West Winds deposits.

All of these steeply-plunging, high-grade gold zones are located along a single 800m-long, semi- continuously mineralised north-south stratigraphic horizon (see Figure 1). The exploration drill drive has been designed to run parallel and adjacent to this horizon to provide underground drill platforms to more effectively define these existing deposits and prospects, as well as explore for further high-grade shoots and provide critical underground infrastructure as Spartan develops its future mine plan.

Construction of the drill drive is on-track to commence in the September Quarter, with all regulatory mining approvals and support services in place. In addition, the Company has established an experienced on- site project team to manage and oversee the development and construction process. Establishment of the drill drive, and an initial underground drilling programme, is fully funded from the Company’s existing cash reserves.

Management Comment

Spartan Managing Director and Chief Executive Officer, Simon Lawson, said: “We are delighted to have Barminco on board to complete the construction of this new drill drive, which represents a very exciting initiative that will enable us to drill from platforms located right alongside our high-grade deposits and targets. This will provide for cheaper, more accurate and quicker drilling to continue to accelerate our Resource growth and conversion to Ore Reserves.

“All of the high-grade deposits and prospects discovered at Dalgaranga over the past two years remain open at depth – with mineralisation at the Never Never deposit now defined to beyond 1km below surface – and we’re very excited to get the underground rigs in place to help determine just how deep this high- grade mineralisation extends.

“Importantly, the drill drive is being constructed using the same dimensions as a standard underground mine development, ensuring it can be incorporated into our infrastructure planning for the future re- commencement of mining operations.

“Construction of the drill drive is set to kick-off later this Quarter and is expected to take approximately 10 months to complete. In addition, we will also shortly re-commence surface drilling programs, targeting the Pepper, Four Pillars, West Winds and other near-surface anomalies, ensuring plenty of exciting news- flow for shareholders in the months ahead.”

Click here for the full ASX Release

This article includes content from Spartan Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SPR:AU

The Conversation (0)

03 April 2024

Spartan Resources

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia Keep Reading...

10h

Don Durrett: Gold, Silver Prices Going Higher, Watch These Stocks

Don Durrett of GoldStockData.com explains why gold's record-setting price run isn't over. "The reason gold is at US$5,000 (per ounce) and going higher is because the US bond market is fragile and becoming more fragile every day," he said. "But not only that — I've said this — it's going to fail,... Keep Reading...

11h

Kalgoorlie Gold Mining Targets Multimillion-Ounce Deposit in a Proven Gold Corridor

Kalgoorlie Gold Mining (ASX:KAL) is advancing a focused exploration strategy aimed at uncovering a multimillion-ounce gold resource within one of Western Australia’s most established gold corridors. With the gold price strengthening and regional activity accelerating, the company is intensifying... Keep Reading...

11h

Mayfair Gold Begins NYSE American Trading, Fast Tracks Fenn-Gib Project

Mayfair Gold (TSXV:MFG,NYSEAMERICAN:MINE) reached a significant milestone by officially commencing trading on the NYSE American under the ticker "MINE." This strategic move from the OTCQX aims to broaden the company's US shareholder base as it fast tracks its flagship property, the Fenn-Gib gold... Keep Reading...

17h

Selta Project - Gold Exploration Update

First Development Resources plc (AIM: FDR), a UK-based, Australia-focused mineral exploration company with interests in Western Australia and the Northern Territory, is pleased to provide an update on its gold ("Au") focused exploration at the Selta Project ("Selta" or the "Project"), located in... Keep Reading...

21h

Tectonic Metals Drills 4.50 g/t Au over 48.77 metres with 7.79 g/t Au over 24.38 metres at New Target, Flat Gold Project, Alaska

First-Ever Drilling by Tectonic at Black Creek Intrusion Delivers High-Grade Gold Six Kilometres North of Chicken Mountain, Validating Multi-Intrusion Gold System Across 99,800-Acre Flat Property VANCOUVER, BC / ACCESS Newswire / January 29, 2026 / Tectonic Metals Inc. ("Tectonic" or the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00