November 29, 2023

Elixir Energy Limited (“Elixir” or the “Company”) is pleased to provide an update on its 100% owned Grandis Gas Project (ATP 2044) located in the Taroom Trough of the Bowen Basin, Queensland.

HIGHLIGHTS

- Daydream-2 intersects primary target Kianga Formation ahead of schedule

- Well intersects strong gas shows, with the first gas peak measuring 777 units (38 times above background)

- Total depth and wireline logging expected within the next week

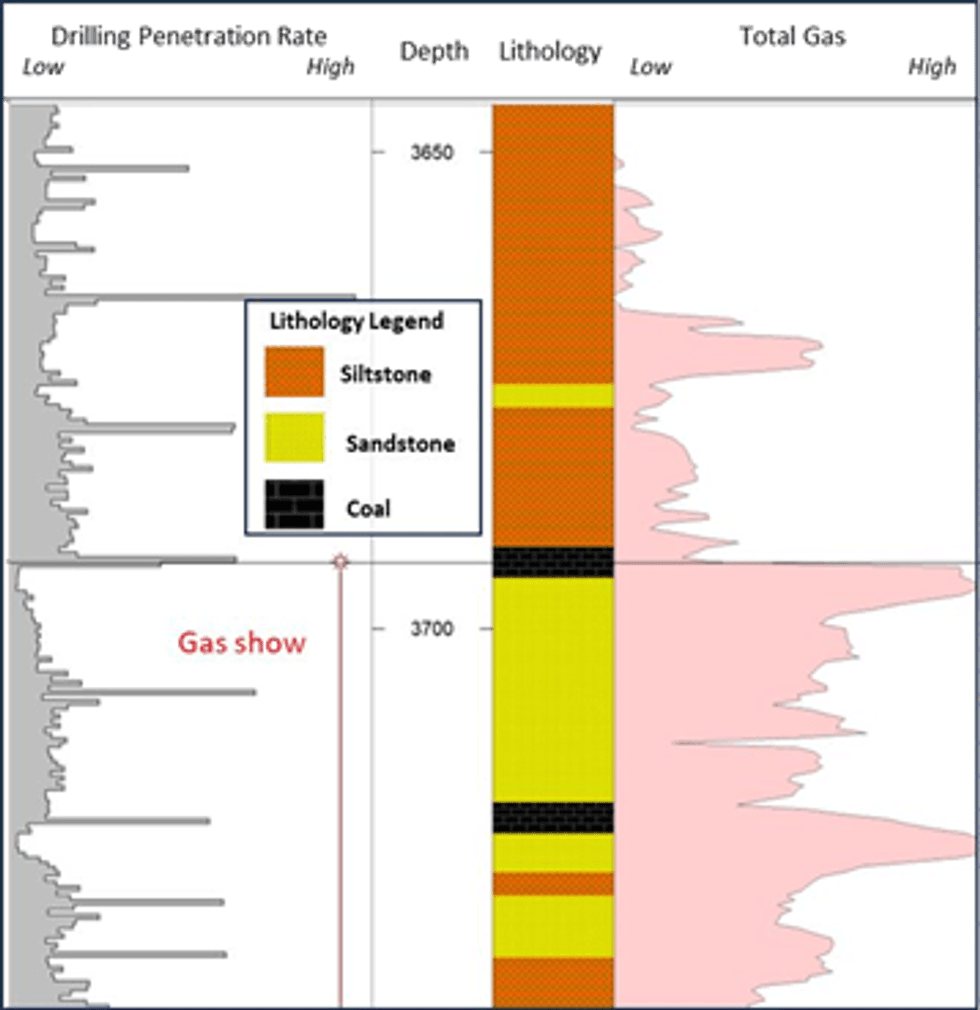

Daydream-2 has intersected the primary target Kianga Formation at 3,694 metres, close to the original prognosis, with elevated gas shows immediately recorded by the mud logging team. The well intersected the primary objective after 19 days of drilling operations, which is several days ahead of schedule. Upon intersecting the first coal and sand, the gas shows increased from 20 units to a peak of 777 units, which represents a 38 times increase above background.

The sands were described as very fine to medium grained and friable. The coal was described as vitreous to sub-vitreous and sub-blocky. These descriptions are in line with original expectations and similar to the Daydream-1 gas discovery well.

The well will now drill the remaining reservoir section to a Total Depth (TD) of approximately 4,200 metres, then wireline logs will be run and a petrophysical evaluation undertaken. The well will be then cased and suspended for future stimulation and testing operations, planned for the New Year.

Elixir’s Managing Director, Mr Neil Young, said: “The drilling performance at Daydream-2 continues to impress. So far the well has been drilled ahead of schedule and under budget. The excellent gas shows encountered as we have entered our primary target meet our appraisal objectives and we look forward to reaching total depth and determining the overall extent of the gas bearing formations very shortly.”

Click here for the full ASX Release

This article includes content from Elixir Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EXR:AU

The Conversation (0)

02 May 2024

Elixir Energy

Early-mover in natural gas exploration and appraisal in Australia and Mongolia.

Early-mover in natural gas exploration and appraisal in Australia and Mongolia. Keep Reading...

13h

Kinetiko Energy Poised to Address South Africa’s Gas Supply Gap: MST Access Report

Description:A research report by MST Access highlights Kinetiko Energy (ASX:KKO) as an emerging participant in South Africa’s domestic gas sector, supported by a base-case valuation of AU$0.49 per share. The company’s project covers 5,366 sq km, located 200 km southeast of Johannesburg within an... Keep Reading...

18 February

Half Yearly Report and Accounts

MEC Resources (MMR:AU) has announced Half Yearly Report and AccountsDownload the PDF here. Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00