July 17, 2024

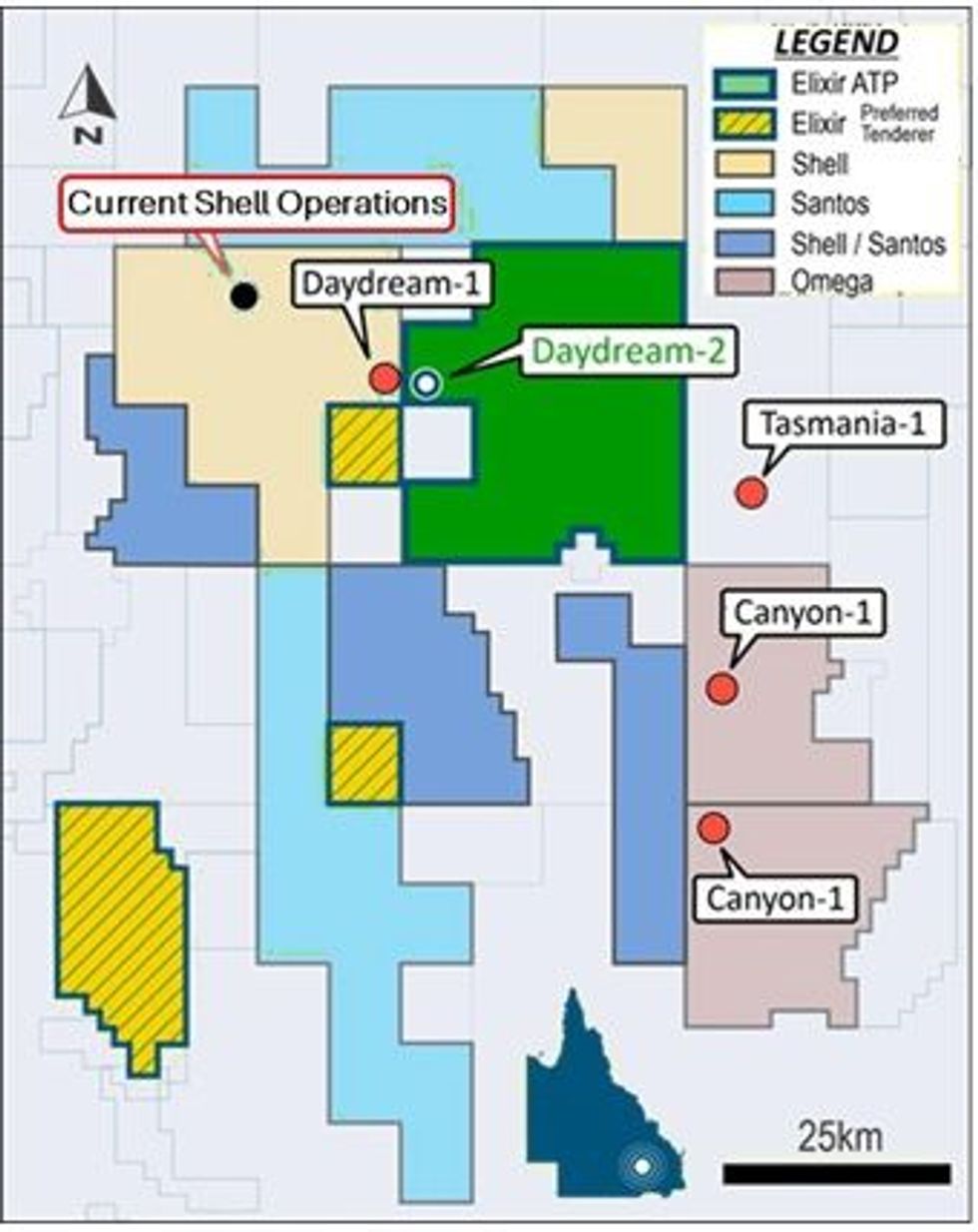

Elixir Energy Limited (“Elixir” or the “Company”) is pleased to provide an update on the recommencement of the Daydream-2 program in the 100%-owned Grandis Project in Queensland’s Taroom Trough.

HIGHLIGHTS

- Daydream-2 program to recommence in approximately two weeks

- The first stage will be to mill a plug and flow the stimulated Lorelle Sandstone

- Thereafter, it is planned that a further 5 zones will be stimulated and flow tested

Elixir’s prime contractor for this next phase of the Daydream-2 program, Condor Energy, has recently advised the Company that it has now imported from New Zealand a coil tubing unit (CTU) capable of operating at the high pressure and depths of the Taroom Trough for Elixir - and its fellow Operators in the region.

The CTU will first be deployed at Daydream-2 to mill out the plug inserted above the Lorelle Sandstone (which flowed gas at a stabilized rate of 1.3 million standard cubic feet per day (MMscfd) prior to it being stimulated earlier in the year). This will occur in approximately two weeks. The Lorelle Sandstone will then be cleaned up and flow tested to provide a rate post the stimulation of this section which was undertaken a few months ago.

Elixir is working closely with Condor and the neighbouring Operator to coordinate the optimal utilization of the CTU and other key equipment and personnel over the coming months, which may give rise to some changes in the timing of certain elements of the planned program that may be affected by unexpected geological and operational factors.

This next stage will be the perforation and stimulation of three sandstone and two coal zones in the Permian section. These will then be progressively cleaned up and flow tested for a period estimated to be a couple of weeks.

The upper most zone – a coal section – will firstly be independently flow tested - with the aim of proving up contingent resources in the coals of the Taroom Trough for the first time.

Thereafter all six zones will be flow tested on a combined basis with the intent of exceeding a flow rate of 2.5 MMscfd (as announced to the ASX on 29 April 2024).

This flow test will be from only 19% of the total gas-bearing zones of the Permian section and a higher flow rate could be extrapolated to arise from future more extensive perforations and stimulations.

Elixir’s Managing Director, Mr Neil Young, said: “We are naturally very pleased that the Daydream-2 program is scheduled to resume in a couple of weeks and come to its conclusion within a month or so after that. The current multi-operator program in the Taroom Trough gives rise to a degree of complexity on the operational management front – but is otherwise an enormously encouraging sign of the large investments being made into the vast potential of this very well-located area that can cheaply deliver to East Coast and International gas market shortfalls.”

Click here for the full ASX Release

This article includes content from Elixir Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EXR:AU

The Conversation (0)

02 May 2024

Elixir Energy

Early-mover in natural gas exploration and appraisal in Australia and Mongolia.

Early-mover in natural gas exploration and appraisal in Australia and Mongolia. Keep Reading...

18 February

Half Yearly Report and Accounts

MEC Resources (MMR:AU) has announced Half Yearly Report and AccountsDownload the PDF here. Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

17 February

Half Yearly Report and Accounts

BPH Energy (BPH:AU) has announced Half Yearly Report and AccountsDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00