Dakota Gold Corp. (NYSE American: DC) ("Dakota Gold" or the "Company") is pleased to announce assay results from a further 16 metallurgical drill holes included in its 2025 drill campaign for the Richmond Hill Oxide Heap Leach Gold Project ("Richmond Hill" or the "Project"). Dakota Gold currently has three drills operating at Richmond Hill and the Company expects to drill 27,500 meters (~90,000 feet) for the 2025 campaign using a combination of reverse circulation and core drilling.

Highlights from this update include:

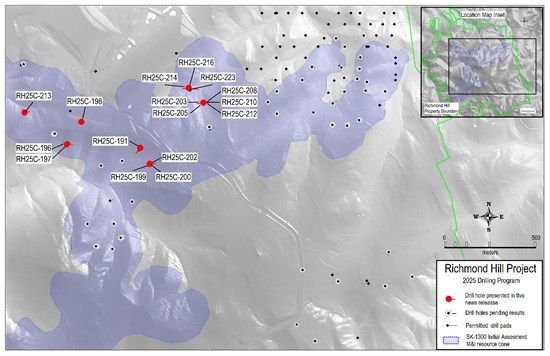

- Metallurgical drill holes continue to intercept higher gold grade than the average resource grade including drill hole RH25C-200 with 2.25 grams per tonne gold (g/t Au) over 33.4 meters (75 gram meters) and RH25C-212 with 1.44 g/t Au over 20.6 meters (30 gram meters). These holes are two of many metallurgical drill holes reported from the north central Project area (Figure 1) that intercepted significantly higher-grade than the average measured and indicated resource grade of 0.463 g/t Au (0.0135 ounces per ton Au).

- Forte Dynamics has been selected to conduct the metallurgical test work for the Feasibility Study expected for completion in early 2027. Forte Dynamics is a mining consulting firm focused on mine planning, metallurgical testing, and engineering design. Forte provides advanced research, testing, and analysis specifically tailored to optimize process design for heap leach projects.

- The Company's core drilling is currently active in the northeast Project area where we expect assay results from expansion and infill of the higher-grade zones before the end of the year. The proposed infill and expansion drilling surrounding the intercept has the potential to add to the Measured, Indicated and Inferred resources based on prior drilling and current resources in the area. The mineralization in the northeast is only limited by drilling and remains open. The area is expected to be mined at the beginning of the mine plan as outlined in the July 7, 2025 Initial Assessment with Cash Flow.

Jack Henris, President and COO of Dakota Gold, stated, "As the metallurgical drilling for the 2025 campaign is now complete, we are pleased to have formally engaged Forte Dynamics for the test work program. This program represents a critical step in advancing Richmond Hill toward feasibility and future development. It will provide the technical basis for process design, cost modeling, and permitting, thereby de-risking the Project and supporting informed decision-making by Dakota Gold's management and Board of Directors."

Dakota Gold is conducting core drilling at the northern portion of the Project area for the purposes of completing a Feasibility Study. The core drilling is designed to collect metallurgical samples for column testing, condemnation drilling beneath proposed site infrastructure for mine planning, infill drilling to upgrade the existing resource, and expansion drilling where the resource remains open. The drill core from all holes is systematically assayed for gold due to the significant halo of low-grade gold mineralization underlying much of the Project area. The drill results will inform both the oxide and sulfide resource updates for the Feasibility Study. In addition, the Company is also active with a reverse circulation drill to install monitor wells in support of environmental baseline data collection for permitting.

The group of assay results reported today in Figure 1 are from metallurgical drilling in the north central Project area. The drill results will refine the modelled boundaries and improve the precision of the geo-metallurgical model for the Feasibility and mine planning. In addition, the holes were designed to acquire samples for metallurgical tests ranging from low to high grade, various rock types, as well as oxide, transitional, and sulfide so that composites can be made for heap leach column tests.

Metallurgical test work update:

Dakota Gold has engaged Forte Dynamics, Inc. ("Forte Dynamics") to conduct a comprehensive metallurgical testing program for the Richmond Hill Gold Project. The purpose of this program is to characterize the metallurgical behavior of oxide ores and to define process design criteria supporting heap leaching as the primary extraction method. The results will directly inform feasibility-level engineering, project economics, and permitting.

The proposed scope of work includes:

- Ore Characterization & Preliminary Testing: Mineralogical, geochemical, and comminution analyses across master composite samples.

- Column Leach Testing: Detailed evaluation of crush size, leach kinetics, reagent consumption, and permeability under compaction to determine optimal heap leach parameters.

- Comminution & Crushing Studies: Development of a process model, trade-off studies, and recovery projections to establish circuit design and cost estimates.

- Process Optimization & Recovery: Bench-scale Merrill-Crowe recovery trials to establish gold and silver recovery efficiencies.

- Deleterious Elements & Environmental Testing: Assessment of copper, preg-robbing potential, acid generation potential, and leachate chemistry to support permitting and environmental compliance.

The metallurgical testing program is scheduled for Q4 2025 - Q3 2026, with staged testing and reporting milestones throughout. Forte Dynamics has allocated a specialized team of metallurgical, mining, and process engineers led by a Qualified Person to ensure compliance with industry standards and regulatory requirements.

Figure 1. Plan Map of Dakota Gold Corp. Richmond Hill 2025 Drill Campaign Highlighted Drill Results in North Central Project Area

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8218/267642_76e9c61a4437f9e9_002full.jpg

Table 1. Richmond Hill Drill Results (Metric / Imperial)1,2,3,4

| Hole # | From (m) | To (m) | Interval (m) | Grade (g/t) | g x m | From (ft) | To (ft) | Interval (ft) | Grade (oz/ton) | Program |

| RH25C-191 | 44.3 | 49.7 | 5.4 | 0.67 | 4 | 145.5 | 163.2 | 17.7 | 0.020 | Metallurgical |

| 55.3 | 59.2 | 3.9 | 1.18 | 5 | 181.4 | 194.1 | 12.7 | 0.034 | ||

| 66.9 | 94.2 | 27.2 | 0.76 | 21 | 219.6 | 309.0 | 89.4 | 0.022 | ||

| RH25C-196 | 4.0 | 18.3 | 14.3 | 0.81 | 12 | 13.0 | 60.0 | 47.0 | 0.024 | Metallurgical |

| 28.3 | 49.5 | 21.2 | 0.81 | 17 | 93.0 | 162.5 | 69.5 | 0.024 | ||

| RH25C-197 | 3.4 | 9.4 | 6.0 | 0.68 | 4 | 11.0 | 30.7 | 19.7 | 0.020 | Metallurgical |

| 44.6 | 47.9 | 3.3 | 0.98 | 3 | 146.2 | 157.1 | 10.9 | 0.028 | ||

| 119.9 | 121.3 | 4.7 | 0.83 | 4 | 393.5 | 398.0 | 15.4 | 0.024 | ||

| RH25C-198 | 85.6 | 94.9 | 9.2 | 0.82 | 8 | 281.0 | 311.2 | 30.2 | 0.024 | Metallurgical |

| 101.7 | 107.4 | 5.8 | 1.16 | 7 | 333.5 | 352.4 | 18.9 | 0.034 | ||

| 130.9 | 139.9 | 9.1 | 0.89 | 8 | 429.3 | 459.0 | 29.7 | 0.026 | ||

| 167.2 | 172.2 | 5.0 | 0.59 | 3 | 548.7 | 565.1 | 16.4 | 0.017 | ||

| RH25C-199 | 20.8 | 28.1 | 7.2 | 0.78 | 6 | 68.4 | 92.1 | 23.7 | 0.023 | Metallurgical |

| 36.9 | 40.7 | 3.8 | 0.80 | 3 | 121.0 | 133.6 | 12.6 | 0.023 | ||

| RH25C-200 | 15.1 | 18.1 | 3.0 | 0.84 | 3 | 49.5 | 59.5 | 10.0 | 0.025 | Metallurgical |

| 22.8 | 56.2 | 33.4 | 2.25 | 75 | 74.7 | 184.4 | 109.7 | 0.065 | ||

| 65.3 | 71.4 | 6.1 | 1.10 | 7 | 214.2 | 234.2 | 20.0 | 0.032 | ||

| RH25C-202 | 23.0 | 39.2 | 16.2 | 1.68 | 27 | 75.4 | 128.6 | 53.2 | 0.049 | Metallurgical |

| 48.2 | 60.0 | 11.8 | 2.35 | 28 | 158.1 | 196.7 | 38.6 | 0.068 | ||

| RH25C-203 | 19.9 | 31.1 | 11.2 | 0.83 | 9 | 65.2 | 102.0 | 36.8 | 0.024 | Metallurgical |

| 60.4 | 72.1 | 11.7 | 1.01 | 12 | 198.0 | 236.5 | 38.5 | 0.029 | ||

| RH25C-205 | 42.5 | 58.4 | 15.9 | 0.63 | 10 | 139.5 | 191.7 | 52.2 | 0.018 | Metallurgical |

| RH25C-208 | 32.2 | 40.4 | 8.2 | 1.09 | 9 | 105.6 | 132.6 | 27.0 | 0.032 | Metallurgical |

| 52.2 | 55.5 | 3.3 | 0.90 | 3 | 171.4 | 182.1 | 10.7 | 0.026 | ||

| 61.1 | 65.6 | 4.4 | 0.80 | 4 | 200.6 | 215.1 | 14.5 | 0.023 | ||

| RH25C-210 | 24.4 | 32.3 | 7.9 | 1.91 | 15 | 80.2 | 106.0 | 25.8 | 0.056 | Metallurgical |

| 46.9 | 74.1 | 27.2 | 0.77 | 21 | 153.9 | 243.0 | 89.1 | 0.022 | ||

| 110.8 | 120.7 | 9.9 | 0.60 | 6 | 363.5 | 396.0 | 32.5 | 0.017 | ||

| RH25C-212 | 31.3 | 52.0 | 20.6 | 1.44 | 30 | 102.8 | 170.5 | 67.7 | 0.042 | Metallurgical |

| 55.7 | 73.0 | 17.3 | 0.80 | 14 | 182.6 | 239.5 | 56.9 | 0.023 | ||

| 109.2 | 113.4 | 4.2 | 0.94 | 4 | 358.3 | 372.2 | 13.9 | 0.027 | ||

| RH25C-213 | 71.7 | 82.8 | 11.2 | 0.72 | 8 | 235.2 | 271.8 | 36.6 | 0.021 | Metallurgical |

| 87.4 | 102.5 | 15.1 | 0.76 | 11 | 286.9 | 336.3 | 49.4 | 0.022 | ||

| 107.6 | 112.9 | 5.3 | 1.23 | 7 | 353.0 | 370.4 | 17.4 | 0.036 | ||

| 117.1 | 129.7 | 12.6 | 0.85 | 11 | 384.3 | 425.6 | 41.3 | 0.025 | ||

| 134.5 | 140.4 | 5.9 | 0.46 | 3 | 441.3 | 460.6 | 19.3 | 0.013 | ||

| RH25C-214 | 57.2 | 61.4 | 4.2 | 0.57 | 2 | 187.6 | 201.4 | 13.8 | 0.017 | Metallurgical |

| RH25C-216 | 59.7 | 72.8 | 13.0 | 0.91 | 12 | 196.0 | 238.8 | 42.8 | 0.027 | Metallurgical |

| 76.7 | 82.4 | 5.7 | 0.73 | 4 | 251.5 | 270.3 | 18.8 | 0.021 | ||

| 100.7 | 108.5 | 7.8 | 1.47 | 11 | 330.5 | 356.0 | 25.5 | 0.043 | ||

| RH25C-223 | 55.5 | 77.5 | 22.0 | 1.10 | 24 | 182.0 | 254.3 | 72.3 | 0.032 | Metallurgical |

| 80.7 | 85.6 | 4.9 | 0.68 | 3 | 264.8 | 281.0 | 16.2 | 0.020 | ||

| 90.5 | 94.7 | 4.2 | 1.41 | 6 | 296.9 | 310.8 | 13.9 | 0.041 |

The table may contain rounding errors.

- Abbreviations in the table include ounces per ton ("oz/ton"); grams per tonne ("g/t"); feet ("ft"); meter ("m"); and gram meters ("g x m").

- True thickness unknown.

- Intervals calculated based on 0.5 g/t Au cut-off and maximum dilution of 3.05 meters.

- The July 7, 2025 Initial Assessment with Cash Flow has an open pit designed with 12.2m (40 ft) benches. The average grade for the Measured and Indicated mine plan is 0.566 g/t Au (0.017 oz/ton). A gram meter of 7 and above has been highlighted in the Table 1 based on the bench height and average grade.

About Dakota Gold Corp.

Dakota Gold is expanding the legacy of the 145-year-old Homestake Gold Mining District by advancing the Richmond Hill Oxide Heap Leach Gold Project to commercial production as soon as 2029, and outlining a high-grade underground gold resource at the Maitland Gold Project, both located on private land in South Dakota.

Subscribe to Dakota Gold's e-mail list at www.dakotagoldcorp.com to receive the latest news and other Company updates.

Shareholder and Investor Inquiries

For more information, please contact:

Jack Henris

President and COO

Tel: +1 605-717-2540

Shawn Campbell

Chief Financial Officer

Tel: +1 778-655-9638

Carling Gaze

VP of Investor Relations and Corporate Communications

Tel: +1 605-679-7429

Email: info@dakotagoldcorp.com

Qualified Person and S-K 1300 Disclosure

James M. Berry, a Registered Member of SME and Vice President of Exploration of Dakota Gold Corp., is the Company's designated qualified person (as defined in Subpart 1300 of Regulation S-K) for this news release and has reviewed and approved its scientific and technical content.

Quality Assurance/Quality Control consists of regular insertion of certified reference materials, duplicate samples, and blanks into the sample stream. Samples are submitted to the ALS Geochemistry sample preparation facility in Winnipeg, Manitoba. Gold and multi-element analyses are performed at the ALS Geochemistry laboratory in Vancouver, British Columbia. ALS Minerals is an ISO/IEC 17025:2017 accredited lab. Check samples are submitted to Bureau Veritas, Vancouver B.C. as an umpire laboratory. Assay results are reviewed, and discrepancies are investigated prior to incorporation into the Company database.

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. When used in this communication, the words "plan," "target," "anticipate," "believe," "estimate," "intend," "potential," "will" and "expect" and similar expressions are intended to identify such forward-looking statements. Any express or implied statements contained in this communication that are not statements of historical fact may be deemed to be forward-looking statements, including, without limitation: our expectations regarding additional drilling, metallurgy and modeling; our expectations for the improvement and growth of the mineral resources and potential for conversion of mineral resources into reserves; completion of a feasibility study, and/or permitting; our expectations regarding free cash flow and future financing, and our overall expectation for the possibility of near-term production at the Richmond Hill project. These forward-looking statements are based on assumptions and expectations that may not be realized and are inherently subject to numerous risks and uncertainties, which could cause actual results to differ materially from these statements. These risks and uncertainties include, among others: the execution and timing of our planned exploration activities; our use and evaluation of historic data; our ability to achieve our strategic goals; the state of the economy and financial markets generally and the effect on our industry; and the market for our common stock. The foregoing list is not exhaustive. For additional information regarding factors that may cause actual results to differ materially from those indicated in our forward-looking statements, we refer you to the risk factors included in Item 1A of the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2024, as updated by annual, quarterly and current reports that we file with the SEC, which are available at www.sec.gov. We caution investors not to place undue reliance on the forward-looking statements contained in this communication. These statements speak only as of the date of this communication, and we undertake no obligation to update or revise these statements, whether as a result of new information, future events or otherwise, except as may be required by law. We do not give any assurance that we will achieve our expectations.

All references to "$" in this communication are to U.S. dollars unless otherwise stated.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/267642