Critical Metals Corp. (Nasdaq: CRML) ("Critical Metals Corp" or the "Company"), a leading critical minerals mining company, today announced for the first time three new assay results from the 2024 diamond drill hole program at the Fjord Deposit at the Tanbreez Rare Earth Project in Greenland.

Highlights – 2024 New Diamond Drill Hole Results

- Consistent high-grade rare earth mineralization intersected in all four reported holes, with Total Rare Earth Oxide (TREO) grades between 0.40% and 0.42%.

- High proportion of heavy rare earth oxides (HREO) ~26% of TREO, reinforcing the deposit's potential strategic value.

- Significant zirconium oxide (ZrO₂) grades of 1.57–1.58% across all holes.

- Gallium oxide (Ga₂O₃) assays between 93–99 ppm, providing a potential additional economic credit.

- All holes drilled vertically (-90°) through sub-horizontal, stratiform kakortokite layers, intersecting mineralisation at approximately true thicknesses.

- Mineralisation remains open at depth in all reported holes.

- Drilling confirms continuity of grade and mineralogy across multiple sections of the Fjord Deposit, consistent with historical data.

- All the drill holes were collared within the Fjord Deposit with 23.6MT @ 0.42% TREO Maiden Mineral Resource.

- The holes are part of the ongoing 2024–2025 Fjord Resource Upgrade program, with over 1900 m drilled to date in 2025 and further assays pending.

Tony Sage, Executive Chairman of the Company, commented:

"These additional 2024 diamond drill hole results indicate the consistent grades of rare earth and gallium, with a high proportion of critical heavy rare earths. Our rare earth grades and gallium concentration, position Tanbreez as a strategically important asset for Western supply chains. With China's control over the rare earth market and gallium, securing sources of these critical minerals has become paramount for U.S. defense capabilities and national security. The progress we've made, with 1,316 meters of diamond core drilling completed in 2024, and over 1,850 meters of drilling as part of our 2025 Fjord Resource Upgrade resource extension program, significantly strengthens our ability to build on our substantial resource base. With further assays pending and more drilling underway, we see strong potential to grow the scale and nature of the project's mineral inventory."

Summary New Drill Hole Results

Drill hole collars and assay Tables 1 and 2 and Figure 1 and Appendix 1, 2 and 3.

| Hole ID | Depth (m) | TREO (%) | HREO (% of TREO) | ZrO₂ (%) | Ga₂O₃ (ppm) | ||||||

| D-24 | 85.70 | 0.42 | 26.3% | 1.58 | 99 | ||||||

| E-24 | 62.30 | 0.40 | 26.5% | 1.57 | 93 | ||||||

| F-24 | 107.45 | 0.40 | 25.5 | 1.57 | 93 | ||||||

| Cut-off | 0.30 |

Table 1 – 2024 New assay results summary for D-24, E-24, F-24

New Drill Hole Results

Drill Hole D-24

Drilled vertically to 85.7m from surface and intersected high-grade rare earths and metal oxides mineralisation averaging:

- 0.42% TREO (including 25.9%,HREO)

- 1.57% ZrO 2 zirconium oxide,

- 100ppm Ta 2 O 5 tantalum pentoxide,

- 1340ppm Nb 2 O 5 niobium pentoxide,

- 99ppm Ga 2 O 3 gallium oxide,

- Mineralisation open at bottom of the hole,

- Mineralisation average from surface to 63m downhole.

Drill Hole E-24

Drilled vertically to 62.3m from surface and intersected high-grade rare earths and metal oxides mineralisation averaging:

- 0.39% TREO (including 26.2%,HREO)

- 1.56% ZrO 2 zirconium oxide,

- 100ppm Ta 2 O 5 tantalum pentoxide,

- 1330ppm Nb 2 O 5 niobium pentoxide,

- 90ppm Ga 2 O 3 gallium oxide,

- Mineralisation open at bottom of the hole,

- Mineralisation average from surface to 61.3m downhole.

Drill Hole F-24

Drilled vertically to 107.45m from surface and intersected high-grade rare earths and metal oxides mineralisation averaging:

- 0.40% TREO (including 25.6%,HREO)

- 1.57% ZrO 2 zirconium oxide,

- 100ppm Ta 2 O 5 tantalum pentoxide,

- 1260ppm Nb 2 O 5 niobium pentoxide,

- 93ppm Ga 2 O 3 gallium oxide,

- Mineralisation open at bottom of the hole,

- Mineralisation average from surface to 72m downhole.

Figure 1 - Tanbreez Site Visit August 29 Malcolm Day Director CRML, Greg Barnes JV Partner, George Karageorge CTO, Anna Wingle Tanbreez Mining Greenland

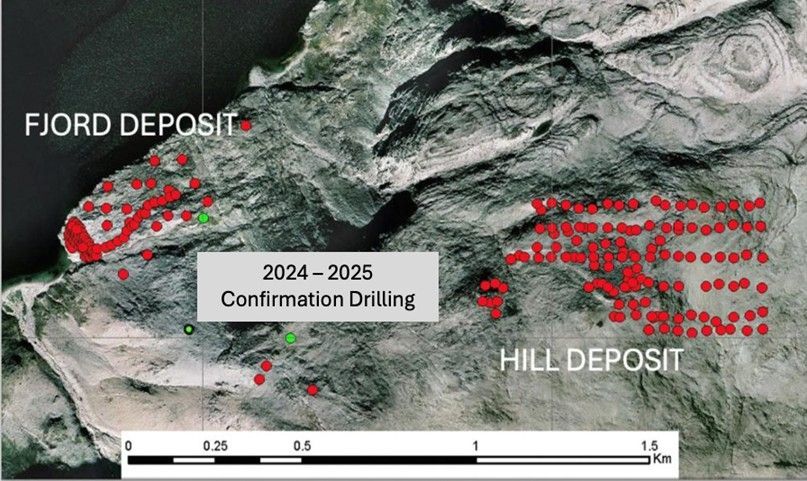

Figure 2 - Fjord and Hill Deposit drill hole locations for 2007, 2010, 2013, 2024 in red with 2025 drill hole collars completed in July with 9 diamond holes awaiting drilling.

Drill Hole Statistics

Drill hole collars and assay Tables 1 and 2 and Figure 1 and Appendix 1, 1A , 2 and 3.

| Hole ID | Depth From | Depth To | Interval | TREO% | HREO% | ZrO2 % | Ta 2 O 5 ppm | Nb 2 O 5 ppm | Ga 2 O 5 ppm | |

| A1-24 | - | 40.00 | 40.00 | 0.48 | 0.13 | 1.86 | 134 | 1513 | 103 | |

| A2-24 | - | 41.00 | 41.00 | 0.51 | 0.14 | 1.96 | 145 | 1685 | 96 | |

| B-24 | - | 58.00 | 58.00 | 0.49 | 0.13 | 1.99 | 144 | 1651 | 101 | |

| C-24 | - | 65.00 | 65.00 | 0.54 | 0.14 | 1.98 | 156 | 1741 | 89 | |

| D-24 | 1.00 | 63.00 | 62.00 | 0.42 | 0.11 | 1.58 | 112 | 1344 | 99 | |

| E-24 | 1.00 | 62.30 | 61.30 | 0.40 | 0.11 | 1.57 | 105 | 1336 | 93 | |

| F-24 | 0.00 | 72.00 | 72.00 | 0.40 | 0.10 | 1.57 | 103 | 1256 | 93 |

Table 2 - 2024 Drill Hole Assay results summary to date 2024 diamond drill hole program in the Fjord Area. Assay results are reported for drill holes D, E and F. A1, A2, B and C were reported on 22 August 2025. Remaining assay results for holes G to Z are expected to be reported in Q3, 2025.

Background – Fjord Deposit Drilling

The 2024–2025 drilling campaign in the Fjord area has targeted confirmatory and step-out holes to:

- Validate historical drilling data.

- Refine the geological model for resource estimation.

- Provide material for metallurgical and environmental test work.

All drill holes in this program are vertical, intersecting the sub-horizontal layers at true thickness. The three holes reported here return TREO grades between ~0.40% and 0.42% with approximately 26% HREO, along with ZrO₂ values of 1.57–1.58% and gallium oxide contents of 93–99 ppm. These results are consistent with historical assays and demonstrate the persistence of grade and mineralogy across the Fjord deposit.

From a deposit classification perspective, the kakortokite-hosted REE mineralisation is best described as stratiform magmatic, confined entirely to the kakortokite unit and not observed in adjacent lithologies such as lujavrite or naujaite. This strong lithological control underpins confidence in resource modelling, supports bulk mining strategies, and provides reliable input for geology domaining.

Given the continuity of mineralization over several kilometres, the Fjord deposit represents a significant portion of the overall Tanbreez mineral inventory. Ongoing drilling is expected to further delineate these resources, with pending assays from additional holes likely to extend the known mineralised envelope and refine the grade distribution.

Sampling over the 2024 diamond holes was taken over kakortokite intervals above the Black Madonna lower boundary.

- Collar data: All collar locations, RLs, azimuths, dips, and hole lengths have been clearly presented in Table 2 of the report.

- Assay data: Table 1 in the report provides the suite of weighted average downhole assay results for TREO, HREO, Ga₂O₃, and other oxides.

- True widths: All drill holes are vertical (-90°) through sub horizontal mineralised layers, so intersections are true widths.

- No cut-off grades or metal equivalents were applied. All assays are reported at face value.

Gallium Results

The gallium oxide Ga 2 O 3 mineralization assay results ranges from low to high is 90ppm to 100ppm for the four 2024 drillholes published to date.

Drill holes that were not assayed for gallium, tantalum and niobium in 2013 will be assayed from existing pulps submitted to ALS Metallurgical in Perth for analysis in the coming months.

ALS laboratories will also assay all sample for gallium for the 2024 and 2025 drill holes with results that will be published in September and October 2025. The gallium oxide results for all diamond holes published to date may add a credit to the TREO-HREO mixed concentrate.

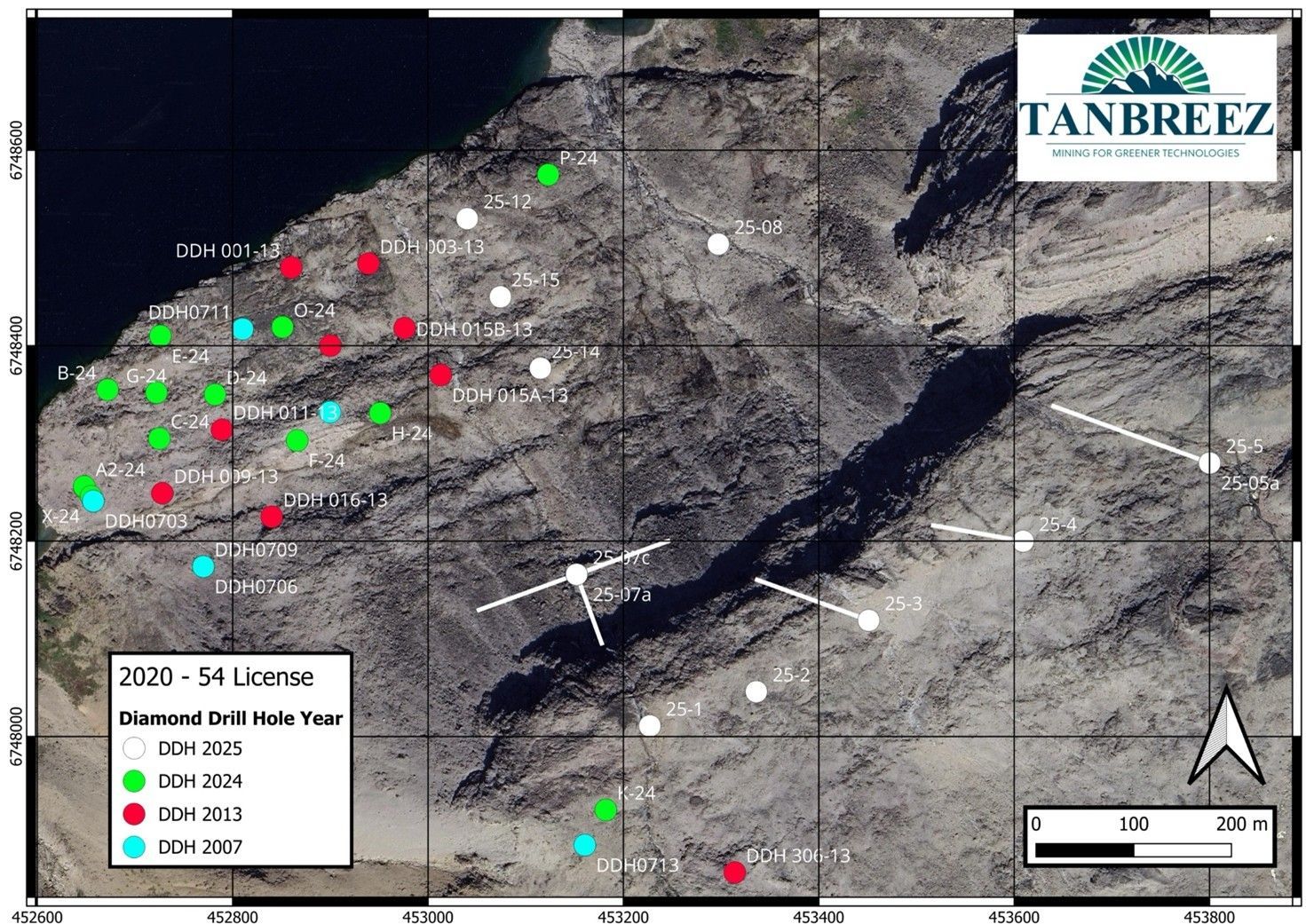

Figure 3 - Drill hole collar map with 2024 collar positions in green, 2013 collar positions in red and 2025 drill collars in white with star bursts awaiting drilling. Drill Holes 24-DD03-AS and 24-DD15-Y and D25-5A, D25-9 are sanitisation, stratigraphic and regional exploration holes and will be reported separately

Resource Confirmation Drilling: 2024 - 2025

The Company recently announced a series of historical diamond drilling results on 28 March 2025, 12 May 2025, 20 May 2025, 11 June 2025 and 18 August 2025, providing a compelling and consistent high-grade TREO and HREO comparison of results for deep diamond drill holes to the results for 2024 drilling.

The 2024 - 2025 diamond drilling program over the Fjord Deposit at the Tanbreez Project is designed to optimize and expand the 2016 mineral resource estimate for future mine planning and to extend the notional mine life of the Tanbreez Project.

The 2024 diamond drilling core samples have been processed for assaying, with seven drill holes awaiting reporting. The results of these assays will be released once ALS Laboratories in Perth completes the ICP Fusion analysis for TREO, HREO and associated metal oxides, including gallium oxide, which is expected to occur in the coming months.

Fourteen diamond holes were drilled in 2024 for a total of 1316.0m, and eleven diamond holes have been drilled so far in 2025 for a total of approximately 1900m. Three further holes are planned in the coming days. The drilling campaigns are focused on the area between the mineral resource components identified and reported in 2016 and a new Mineral Resource Estimate is scheduled to follow the complete assays have been published.

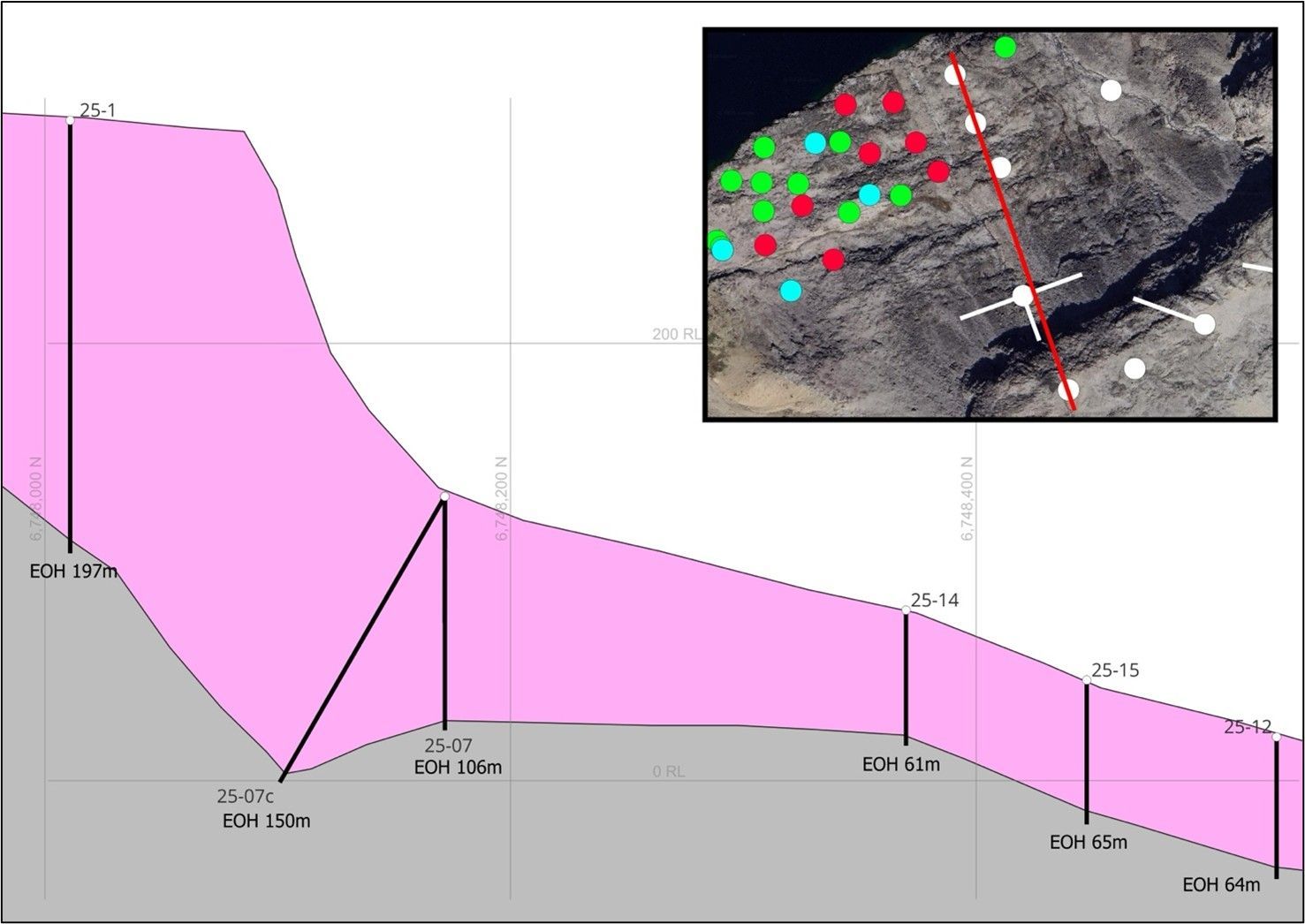

Figure 4 - 2025 Diamond Drill hole Section showing Fjord drill traces with DDH 25-1 drilled to 297m in Kakortokite (pink) terminated in the basal Tephry (grey) and lower Fjord D 25-12, D 25-15 and DDH 25-14, and D25-7, 25-7, D25-7C completed by 29 August 2025 and Table 3.

Figure 5 - Drill Pad 25-7 with drill holes 25-7, 25-7A, 25-7B,25-7C on 4 different azimuths

| HOLE ID | Easting | Northing | R.L. | AZIMUTH | DECL. | E.O.H. | |

| FJORD AREA | 2025 | ||||||

| D25-1 | 453227 | 6748011 | 301 | 0 | -90 | 193.76 | |

| D25-2 | 453336 | 6748046 | 306.3 | 0 | -90 | 192.7 | |

| D25-3 | 453451 | 6748119 | 295.9 | 290 | -61 | 250.5 | |

| D25-4 | 453609 | 6748200 | 308.3 | 280 | -66 | 230 | |

| D25-5 | 453800 | 6748280 | 320.1 | 0 | -90 | 281 | |

| D25-5A | 453800 | 6748280 | 320.1 | 290 | -60 | 295 | |

| D25-07 | 453152 | 6748166 | 174.6 | 0 | -90 | 106 | |

| D25-7A | 453152 | 6748166 | 174.6 | 250 | -45 | 150.5 | |

| D25-7B | 453152 | 6748166 | 174.6 | 160 | -60 | 141 | |

| D25-7C | 453152 | 6748166 | 174.6 | 160 | -60 | 150 | |

| D25-8 | 453297 | 6748504 | 67.6 | 0 | -90 | 155 | |

| D25-9 | 456012 | 6748978 | 441.7 | 0 | -90 | 311 | |

| D25-11 | 453170 | 6748470 | 60.4 | 0 | -90 | 61 | |

| D25-12 | 453040 | 6748530 | 30.5 | 0 | -90 | 64 | |

| D25-14 | 453115 | 6748377 | 83.7 | 0 | -90 | 61 | |

| D25-15 | 453074 | 6748450 | 52.7 | 0 | -90 | 65 | |

| Total | 2398.7 |

Table 3 - 2025 Diamond Drill Hole Campaign Progress

Figure 6 - Tanbreez Core Shed and Geologists Dr Hans Schonwandt, Greg Barnes, Ole Christianson, George Karageorge discussing core processing procedures August 2025

About Critical Metals Corp.

Critical Metals Corp (Nasdaq: CRML) is a leading mining development company focused on Critical Metals and minerals, and producing strategic products essential to electrification and next generation technologies for Europe and its western world partners. Its flagship Project, Tanbreez, is one of the world's largest rare earth deposits and is located in Southern Greenland. The deposit is expected to have access to key transportation outlets as the area features year-round direct shipping access via deep water fjords that lead directly to the North Atlantic Ocean.

Another key asset is the Wolfsberg Lithium Project located in Carinthia, 270 km south of Vienna, Austria. The Wolfsberg Lithium Project is the first fully permitted mine in Europe and is strategically located with access to established road and rail infrastructure and is expected to be the next major producer of key lithium products to support the European market. Wolfsberg is well positioned with offtake and downstream partners to become a unique and valuable asset in an expanding geostrategic Critical Metals portfolio.

With this strategic asset portfolio, Critical Metals Corp is positioned to become a reliable and sustainable supplier of critical minerals essential for defense applications, the clean energy transition, and next-generation technologies in the western world.

For more information, please visit https://www.criticalmetalscorp.com/ .

Cautionary Note Regarding Forward-Looking Statements

This news release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Forward-looking statements may include expectations of our business and the plans and objectives of management for future operations. These statements constitute projections, forecasts and forward-looking statements, and are not guarantees of performance. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. When used in this news release, forward-looking statements may be identified by the use of words such as "estimate," "plan," "project," "forecast," "intend," "will," "expect," "anticipate," "believe," "seek," "target," "designed to" or other similar expressions that predict or indicate future events or trends or that are not statements of historical facts. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements.

Forward-looking statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. Actual results could differ materially from those anticipated in forward-looking statements for many reasons, including the factors discussed under the "Risk Factors" section in the Company's Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission. These forward-looking statements are based on information available as of the date of this news release, and expectations, forecasts and assumptions as of that date, involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Critical Metals Corp.

Investor Relations: ir@criticalmetalscorp.com

Media: pr@criticalmetalscorp.com