(TheNewswire)

| |||||||||

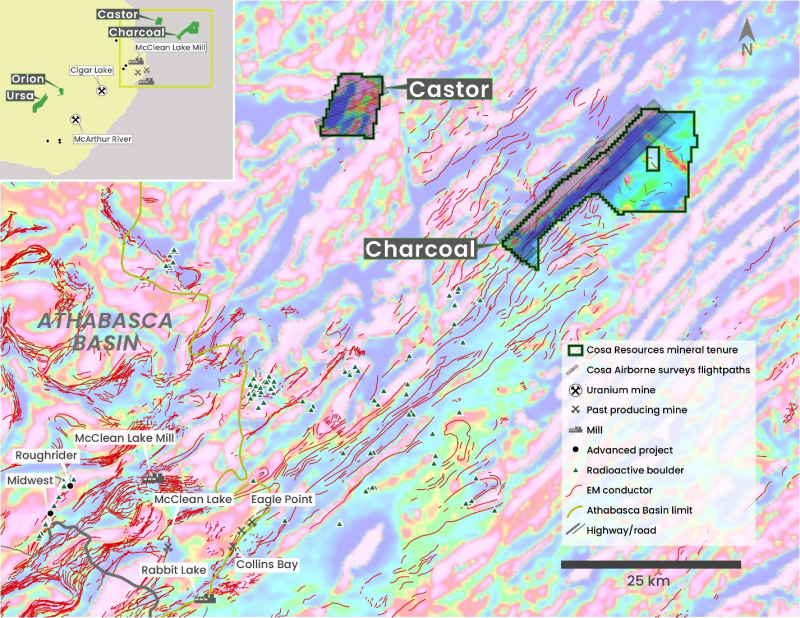

Vancouver, British Columbia TheNewswire - November 15, 2022 Cosa Resources Corp. ( CSE: COSA ) ("Cosa Resources" or the "Company") is pleased to announce the start of an airborne geophysical survey on the Charcoal and Castor uranium projects. Both projects are 100% owned by the Company and located in the prolific Athabasca Basin in Northern Saskatchewan.

Keith Bodnarchuk, President & CEO, commented: "The start of our exploration program on the recently acquired Charcoal and Castor uranium projects is an exciting development for Cosa. The timing of the airborne geophysical survey is important because it will set the Company up for more advanced exploration in 2023. We look forward to advancing our current uranium assets and continuing to explore value accretive opportunities for our team and project portfolio."

The Survey

Geotech Airborne Geophysical Surveys (Geotech Ltd.) has been contracted to fly a 1,540 line-km of Versatile Time-Domain Electromagnetic (VTEM™ Plus) and Horizontal Magnetic Gradiometer survey over the Castor and Charcoal projects. The VTEM™ Plus system will be flown over the project lands with flight lines spaced at 150m apart, providing high-resolution imaging of potential mineralizing systems associated with basement-hosted uranium deposits. The survey is now underway and will help to characterize the geology of the projects by locating conductive stratigraphy and alteration zones in areas of structural complexity. Surveying is expected to be complete within two to four weeks and data processing and interpretation of the results will follow immediately afterward.

The Projects

Charcoal

A large, 21,080 ha property, Charcoal is located 52 km northeast of Cameco Corp.'s Rabbit Lake – Eagle Point mine operations. The property sits within a prominent magnetic low anomaly that extends northeast from the mine (Figure 1). The magnetic low signature likely indicates the presence of prospective metasedimentary bedrock beneath the glacial till cover. Additionally, historical assessment records from the Government of Saskatchewan indicate the presence of numerous airborne electromagnetic conductors, possibly indicating the presence of graphitic metasediments and associated brittle faults, which are often associated with uranium mineralization in the Athabasca Basin. The property is 8 km up-ice from a historical radioactive boulder field. As Charcoal is beyond the basin edge, basement rocks extend to the top of the bedrock and there is no overlying sandstone.

Castor

Castor, like Charcoal, lies beyond the Athabasca Basin edge and therefore has no overlying sandstone cover. The property is located 55 km north of Cameco Corp.'s Rabbit Lake – Eagle Point uranium mine operations (Figure 1). Basement rocks extend to the top of the bedrock. Castor is located at the intersection of a prominent northeast trending magnetic low anomaly that is roughly parallel to the Eagle Point – Collins Bay magnetic low at Charcoal and an east-west trending magnetic low anomaly. This intersection may be an area of enhanced structural complexity that would be prospective for uranium mineralization.

Figure 1: Charcoal and Castor 2022 Airborne Geophysics Location

About Cosa Resources

Cosa Resources is a Canadian mineral exploration company based in Vancouver, BC and is currently focused on the exploration of its uranium and copper projects in northern Saskatchewan. The portfolio includes four uranium exploration properties; Ursa, Orion, Castor and Charcoal totaling 46,700 ha in the eastern Athabasca Basin. It also includes t he Heron Project: three mineral claims approximately 180 km north of La Ronge, Saskatchewan that are prospective for sedimentary-hosted copper mineralization.

The team behind Cosa Resources has a track record of success in Saskatchewan, with a combined 45 years of experience in exploration, discovery, and development in the province.

Qualified Person

The Company's disclosure of technical or scientific information in this press release has been reviewed and approved by Keith Bodnarchuk, P.Geo., President & CEO for Cosa Resources. Mr. Bodnarchuk is a Qualified Person as defined under the terms of National Instrument 43-101.

Contact

Keith Bodnarchuk, President and CEO

kbodnarchuk@cosaresources.ca

+1 888-899-2672 (COSA)

Cautionary Statements

Neither the Canadian Securities Exchange nor the Market Regulator (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release includes certain "Forward‐Looking Statements" within the meaning of applicable securities laws. When used in this news release, the words "anticipate", "believe", "estimate", "expect", "target", "plan", "forecast", "may", "would", "could", "schedule" and similar words or expressions, identify forward‐looking statements or information. These forward looking statements or information relate to, among other things: the exploration, development, and production at the Company's mineral projects.

Forward‐looking statements and forward‐looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of the Company, future growth potential for the Company and its business, and future exploration plans are based on management's reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management's experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of metals; no escalation in the severity of the COVID-19 pandemic; costs of exploration and development; the estimated costs of development of exploration projects; the Company's ability to operate in a safe and effective manner.

These statements reflect the Company's respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward‐looking statements or forward-looking information and the Company has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the Company's dependence on one mineral project; precious metals price volatility; risks associated with the conduct of the Company's mining activities; regulatory, consent or permitting delays; risks relating to reliance on the Company's management team and outside contractors; the Company's inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of COVID-19; the economic and financial implications of COVID-19 to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company's interactions with surrounding communities; the speculative nature of exploration and development; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified in the Company's public disclosure documents. Readers are cautioned against attributing undue certainty to forward‐looking statements or forward-looking information. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update these forward‐looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

Copyright (c) 2022 TheNewswire - All rights reserved.