February 13, 2025

Corazon Mining (ASX:CZN) unlocks value in high-quality base and precious metals projects in Canada and Australia. Focusing on the MacBride Project reflects Corazon’s growing demand for copper, zinc and gold, while concurrently maintaining the Lynn Lake project as a significant, strategic nickel asset for the future.

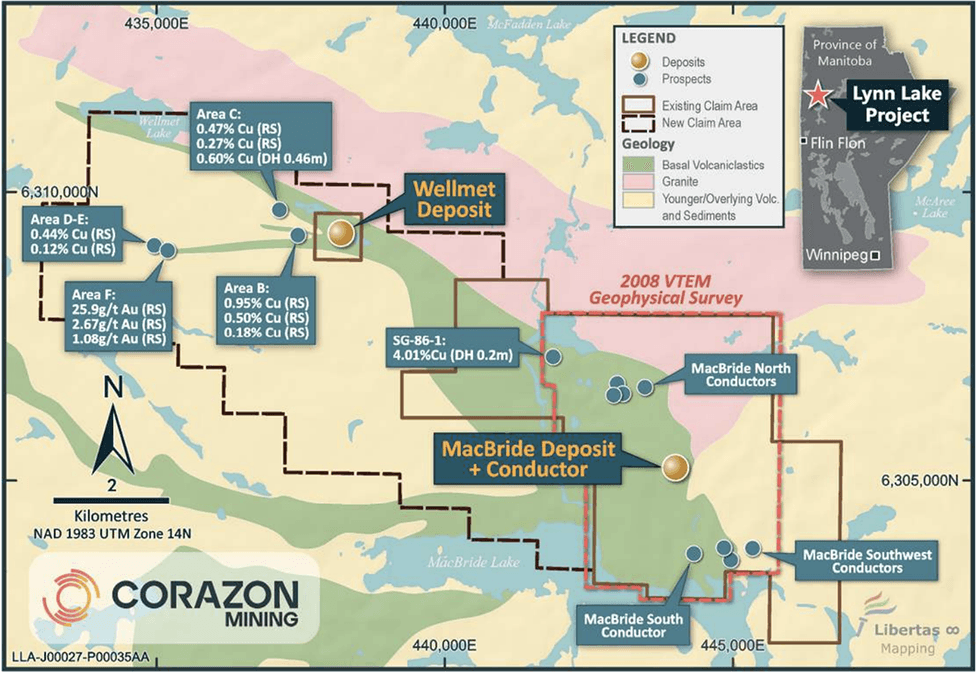

The MacBride project is Corazon Mining's recent acquisition exemplifying high-grade, near-surface mineralisation. MacBride holds drill-defined, high-grade copper-zinc-gold deposits, with multiple geophysical anomalies that indicate significant exploration upside.

Located just 60 kilometres from Lynn Lake, MacBride benefits from the infrastructure and logistical advantages of the established mining district. Corazon’s ongoing work will focus on drill testing these targets, to establish a camp of base and precious metal massive sulphide deposits at MacBride.

Company Highlights

- Corazon’s exploration focus is on its recently acquired MacBride Project, which has proven prospectivity for high-grade copper-zinc-gold-silver.

- MacBride is located in the Lynn Lake District of Manitoba, Canada, where Corazon also owns 100 percent of the entire historic Lynn Lake nickel-copper-cobalt sulphide camp.

- Lynn Lake provides a unique opportunity for the creation of a large-scale, polymetallic-processing hub, with established beneficial infrastructure, including low-cost renewable hydroelectric power.

- Corazon’s assets are positioned in a historically productive district, where large-scale deposits have been previously mined. MacBride’s proximity to other major deposits supports its potential for a new, large-scale discovery.

- With a small market cap and large, high-quality assets, Corazon offers a compelling investment opportunity. Though its nickel sulphide resources rival those of larger competitors, Corazon remains significantly underappreciated in the market.

- Lynn Lake’s location in a mining-friendly jurisdiction, with access to hydroelectric power, road and rail infrastructure, enhances project economics and accelerates development timelines.

This Corazon Mining profile is part of a paid investor education campaign.*

Click here to connect with Corazon Mining (ASX:CZN) to receive an Investor Presentation

CZN:AU

Sign up to get your FREE

Corazon Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

26 August 2025

Corazon Mining

A high-grade gold explorer in a proven Australian gold province, with a strategic portfolio of battery and base metal assets.

A high-grade gold explorer in a proven Australian gold province, with a strategic portfolio of battery and base metal assets. Keep Reading...

28 January

Quarterly Appendix 5B Cash Flow Report

Corazon Mining (CZN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

28 January

Quarterly Activities Report

Corazon Mining (CZN:AU) has announced Quarterly Activities ReportDownload the PDF here. Keep Reading...

24 November 2025

Execution of Land Access Agreement

Corazon Mining (CZN:AU) has announced Execution of Land Access AgreementDownload the PDF here. Keep Reading...

10 November 2025

Two Pools Gold Project Update

Corazon Mining (CZN:AU) has announced Two Pools Gold Project updateDownload the PDF here. Keep Reading...

29 October 2025

Quarterly Activities Report

Corazon Mining (CZN:AU) has announced Quarterly Activities ReportDownload the PDF here. Keep Reading...

23 January

Freeport-McMoRan Plans 2026 Grasberg Restart After Deadly Mud Rush

Freeport-McMoRan (NYSE:FCX) is preparing to bring one of the world’s most important copper assets back online, laying out plans for a phased restart of the Grasberg mine in Indonesia following a deadly mud rush that halted operations late last year.The Arizona-based miner said remediation and... Keep Reading...

22 January

Red Metal Resources Closes First Tranche of Financing

RED METAL RESOURCES LTD. (CSE: RMES) (OTC Pink: RMESF) (FSE: I660) ("Red Metal" or the "Company") announces that it has closed the first tranche of its previously announced non-brokered private placement financing (the "Offering") (see news releases dated January 7, 2026, and January 19, 2026)... Keep Reading...

22 January

Questcorp Mining and Riverside Resources Chip Channel Sample 30 Meters @ 20 g/t Gold and 226 g/t Silver at the Mexican Union Project

Questcorp Mining Inc. (CSE: QQQ) (OTCQB: QQCMF) (FSE: D910) (the "Company" or "Questcorp") along with its partner Riverside Resources Inc. (TSXV: RRI) (OTCQB: RVSDF) (FSE: 5YY0) ("Riverside"), is pleased to report a high grade interval of 20.2 g/t gold and 226 g/t silver with 2.7% zinc over a 30... Keep Reading...

22 January

S&P Global: Copper Becoming One of the World's Most Strategic Commodities

Copper’s role in the global economy is entering a new phase.A sweeping new outlook from S&P Global frames the metal as a central bottleneck of the electrified future, projecting that global copper demand will rise by roughly 50 percent over the next 15 years, from about 28 million metric tons in... Keep Reading...

22 January

Nine Mile Metals Announces Completion of DDH WD-25-04, Confirming 40m of Mineralization at Depth

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce that the 4th drill hole in its Wedge Western Extension Drill Program (DDH-WD-25-04) has been completed.DDH WD-25-04 was collared on the same drill pad as WD-25-01 and... Keep Reading...

Latest News

Sign up to get your FREE

Corazon Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00