Company Highlights

- Peruvian Metals is focused on mineral processing and development of its recently acquired “mine-ready" properties in Peru, including the Cerro La Cumbre gold-silver project and a 50 percent interest in the high grade Palta Dorada Project.

- Mineral processing from third parties has yielded positive cash flow from the company's 80 percent owned Aguila Norte processing plant, with future operating margins expected to increase once production commences from its recent acquisitions.

- With operations in Peru since 1994, Peruvian Metals has the industry and regional expertise to thrive in this mining-friendly jurisdiction. This is also made possible through establishing current and past key partnerships with metals traders including Rio Alto, First Quantum, IAMGOLD, Rio Silver and mining consulting company GEXEG.

- The company is currently establishing profit-sharing partnerships with artisanal miners on the sale of concentrates, which has advanced its commitment to developing strong ties with local economies and this skilled workforce.The company has organically generated NSRs for potential free cash flow on its non-core projects.In 2019, Peruvian Metals' revenue exceeded C$1.6 million with only 50 percent plant capacity. This has demonstrated the potential for increased revenue generation for the company and an expansion of mining operations over the next couple of years. Currently showing over 70 percent capacity for third and fourth quarter 2020.

- The company's closely owned shareholder portfolio and multi-faceted revenue model has positioned it for advanced growth. The shareholder portfolio includes insiders, major shareholders and players close to the company.

- The company acquired a new high-grade Silver-Lead-Zinc property that covers an area of approximately 94 hectares and includes several old mine workings.

Overview

Peru is a prolific producer of both gold and copper. In 2019, it was one of the largest gold producers in Latin America, with an output of 128.4 metric tonnes. Even more impressively, Peru was the world's second-largest copper producer that year, with a copper-mining output of 2.4 million metric tonnes, and it hosts 13 percent of the world's copper reserves. It is no surprise that major companies are focused on this mining-friendly nation, including Barrick Gold (TSX:ABX,NYSE:GOLD), Southern Copper (NYSE:SCCO), Freeport-McMoRan (NYSE:FCX), Hudbay Minerals (NYSE:HBM,TSX:HBM) and many more. As the majors focus on production, there is a growing number of junior exploration companies searching for viable copper and gold deposits in the region.

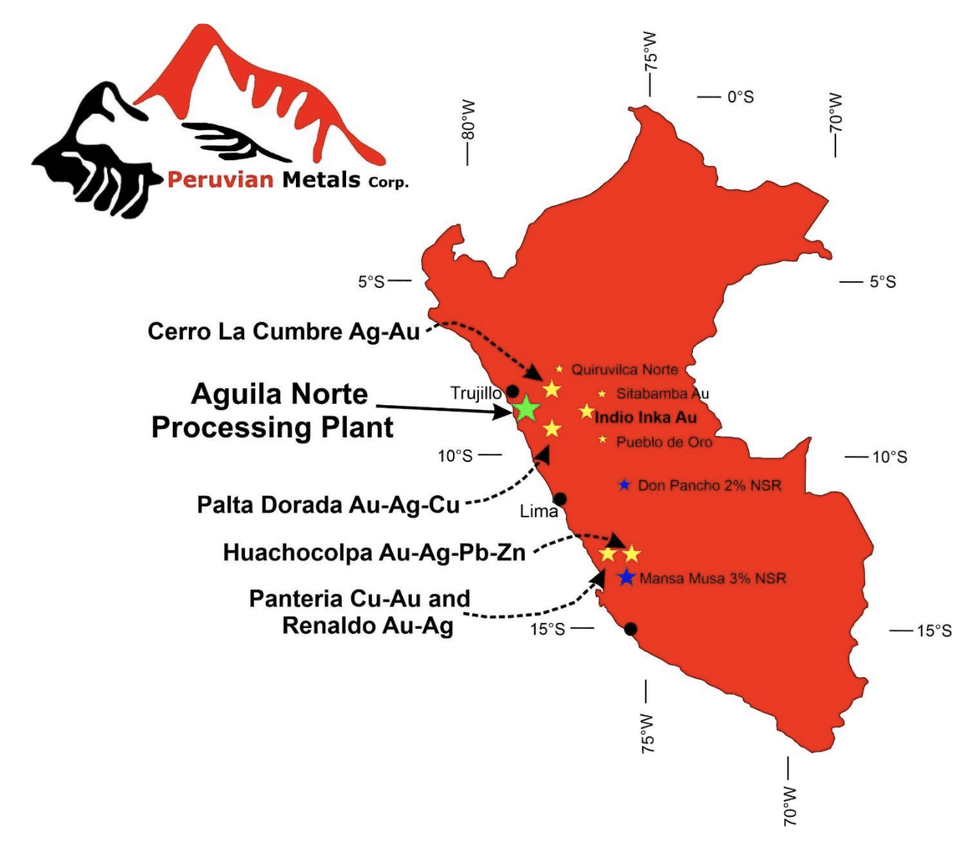

One company focused on finding success in Peru is Peruvian Metals (TSXV:PER, OTC Pink:DUVNF), a Canadian mineral processing and exploration company with reported revenue exceeding C$1.6 million for 2019. The company has an 80 percent stake in the Aguila Norte processing plant, which has a processing capacity of 100 tonnes per day.

Peruvian Metals is acquiring new high-grade properties within the plant's region. It has acquired and assembled the Cerro La Cumbre silver-gold project and obtained 50 percent ownership in the gold-silver-copper Palta Dorada project. Both properties are located within trucking distance to the Aguila Norte plant and have permits in place to extract minerals for processing. The company expects to process minerals from Palta Dorada in Q1, 2021.

The Cerro La Cumbre property has the potential to host a high-grade silver-gold resource that mimics yields of other past-producing gold-silver producers in the same Calipuy volcanic complex in Northern Peru. Mineralization at Palta Dorada is hosted in granitic rocks similar to the gold-rich Pataz region in Northern Peru. The average of the assay results from the sulphide rich quartz veins is 10.51 grams per tonne (g/t) gold, 329 g/t silver and 1.74 percent copper.

Other notable properties include:

- The silver rich Minas Maria Norte property

- The Mansa Musa high sulphidation gold-silver project

- The Indio Inka gold property

- The Pueblo de Oro gold-silver property

- The Panteria copper-gold porphyry project

- The Renaldo gold-silver target

The company's dedication to property development has created strong relationships and support from small-scale artisanal miners and local officials. Government bodies are enthusiastic as there is a strong push to formalize and tax the artisanal and informal mining operations taking place in Peru. This could help regulate mining in the area, creating a more secure system for future development and exploration. Peruvian Metals is building key relationships with many of these miners.

*Disclaimer: This profile is sponsored by Peruvian Metals ( TSXV:PER ). This profile provides information which was sourced by the Investing News Network (INN) and approved by Peruvian Metals in order to help investors learn more about the company. Peruvian Metals is a client of INN. The company's campaign fees pay for INN to create and update this profile.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Peruvian Metals and seek advice from a qualified investment advisor.