Overview

As decarbonization and electrification continue to develop around the world, carbon-free nuclear power is required to achieve both changes. Why is this the case? It's simple - nuclear power produces zero carbon emissions, prevents air pollution, spans a small land footprint and produces minimal waste. Nuclear power is central to the clean energy movement. As a result, the uranium market presents an exciting opportunity for investors seeking to capitalize on the clean energy movement.

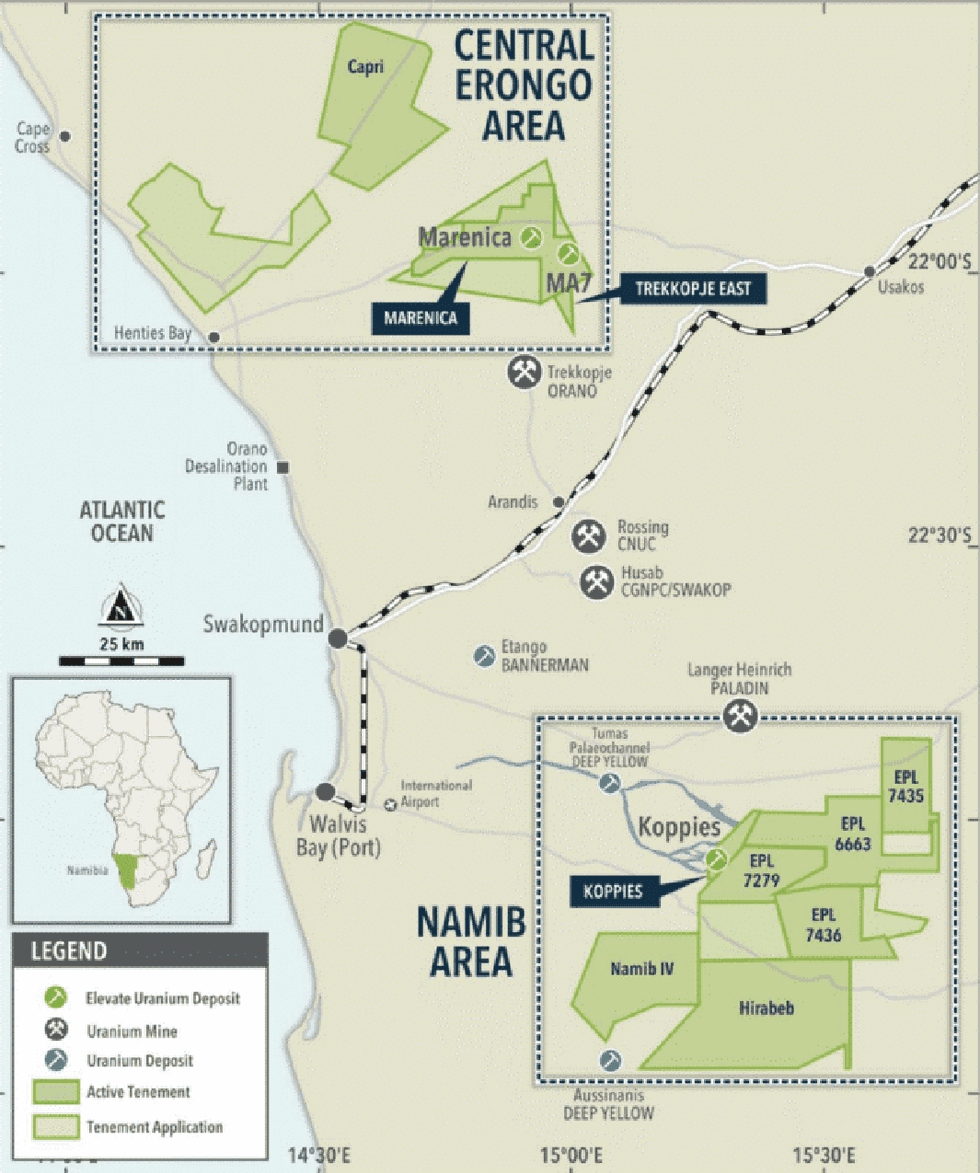

Elevate Uranium Limited (ASX:EL8; OTCQX: ELVUF; NSX:EL8) is an Australian mineral exploration and development company specializing in identifying, exploring and acquiring highly prospective uranium projects in Australia and Namibia. The company is the largest tenement holder for uranium in Namibia, which is the fourth-highest uranium-producing country in the world. The company is backed by a management team with over 50 years of experience in the uranium sector and a proven track record in the exploration and development of various mining projects.

In Namibia, the company has two areas of interest, the Namib Area and the Central Erongo Area. The Namib Area contains the recent discoveries of Koppies, Namib IV and Hirabeb, including the 20 million pound Koppies Uranium Project JORC resource, while the Central Erongo Area contains the 61 million pound Marenica Uranium Project JORC resource and the recent Capri discovery.

Meanwhile, in Australia, the company has the 100-percent-owned Angela, Thatcher Soak, Minerva and Oobagooma projects, as well as the Bigrlyi, Walbiri and Malawiri joint venture projects, and other joint venture interests.

“There are two things that excite us. First is the uranium market and where nuclear energy is headed, which is out of our control. The second is what we can control, and that is what we're doing. We're aggressively exploring. We've got multiple projects, we're geographically diverse, and we stand out from our peers because we have U-pgradeTM," said Elevate Uranium CEO Murray Hill.

The company's fully owned and patented breakthrough U-pgradeTM is a beneficiation process developed in collaboration with CSIRO that could provide Elevate Uranium with a significant competitive advantage. U-pgradeTM enables the removal of non-uranium bearing minerals by rejecting more than 95 percent of the mass of mined ore. U-pgradeTM allows Elevate Uranium to capitalize on exploration opportunities by potentially reducing overall capital and operating expenditures by 50 percent. Additionally, U-pgradeTM provides potential environmental benefits.

The company expects that U-pgradeTM will apply to all of its assets.

Elevate Uranium's notable Marenica project in Namibia has a resource estimate of 61 million pounds at 93 parts per million (ppm) of uranium. U-pgradeTM has demonstrated to increase the Marenica project ore grade from 93 ppm to approximately 5,000 ppm of uranium, thus reducing overall costs and increasing value.

Elevate Uranium is a proud sponsor of Vultures Namibia, which is a conservation initiative for preserving the endangered lappet-faced vultures. The company provides satellite GPS tracking on fledgling vultures for the protection program and is committed to fostering change.

The company also possesses a strong financial structure. As at 31 December 2022, Elevate Uranium has 276 million shares issued and 21 million options issued, with a market capitalization of $102 million. Elevate Uranium has $12.5 million in cash on hand and does not have any debt.Company Highlights

- Elevate Uranium Limited is the largest tenement holder for uranium in Namibia, the fourth-highest uranium-producing country in the world.

- Elevate Uranium is actively exploring in Namibia, with four recent discoveries including Koppies, Capri, Namib IV and Hirabeb.

- Elevate Uranium has JORC resources of 81 million pounds of uranium in Namibia and 48 million pounds of uranium in Australia.

- Elevate Uranium's fully-owned and patented breakthrough U-pgradeTM beneficiation process has the potential to provide Elevate Uranium with a significant competitive advantage and cost reduction.

- The company is backed by a management team with over 50 years of experience in the uranium sector with a proven track record in the exploration and development of various mining projects.

Get access to more exclusive Uranium Investing Stock profiles here