Investor Insight

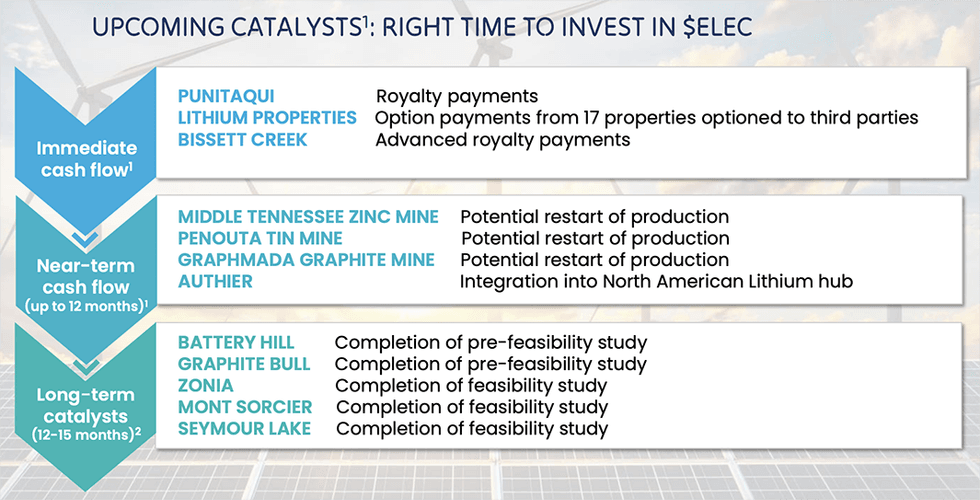

Electric Royalties is uniquely positioned to capitalize on the clean energy transition with a diversified, low-risk portfolio of high-value royalties that offer sustained growth and cash flow potential, making it a compelling investment opportunity.

Overview

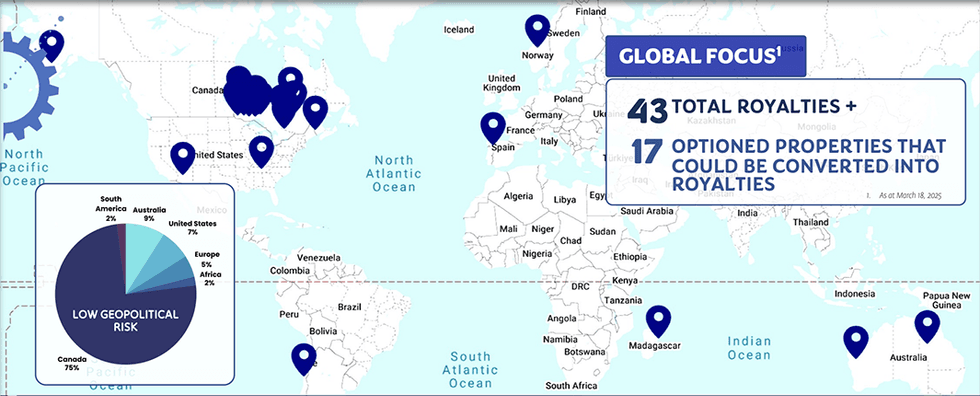

Electric Royalties (TSXV:ELEC,OTCQB:ELECF) is an innovative royalty company offering investors exposure to the clean energy transition through its growing portfolio of clean energy metal royalties. The company stands out as the only fully diversified royalty firm in the space, holding 43 royalties across nine key clean energy metals, ensuring strategic access to the growing electrification and renewable energy industries.

The company’s strategy for shareholder value growth is centered on acquiring royalties in safe jurisdictions (primarily, the US and Canada) and focusing on properties with near-term production potential. This approach ensures steady cash flow generation while reducing operational risks. The company’s current royalty portfolio consists of assets that are either in production, advanced stage projects or exploration assets, ensuring cash flow generation and future growth potential.

The acquisition of the Punitaqui Copper Mine royalty provides immediate exposure to production, while assets like Authier Lithium and Battery Hill Manganese are expected to enter production in the near term.

This collective expertise within Electric Royalties' management and advisory teams ensures a strategic and well-governed approach to capitalizing on opportunities in the clean energy metals sector.

Company Highlights

- Electric Royalties is the only royalty company that is fully diversified in clean energy metals, with royalties on nine different metals, including copper, lithium, manganese, nickel and vanadium.

- Electric Royalties currently holds 43 total royalties across clean energy metals, with 17 additional optioned properties that could be converted into future royalties.

- The company’s portfolio includes assets that are in production or near-term production, ensuring cash flow generation and future growth potential. The acquisition of the Punitaqui copper mine royalty provides immediate exposure to production, while assets like Authier Lithium and Battery Hill Manganese are expected to enter production in the near term.

- The company prioritizes low-risk mining jurisdictions, with most of its assets located in Canada and the United States.

- Led by CEO Brendan Yurik, the leadership team brings extensive expertise in royalty acquisitions, mine financing and strategic growth.

Key Royalties

Punitaqui Copper Mine (Producing) – Chile

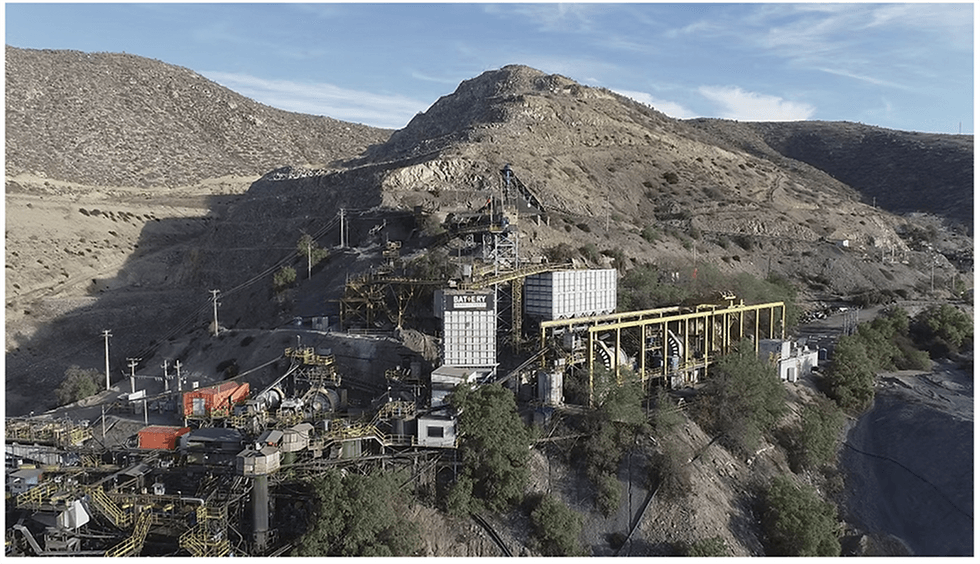

The Punitaqui Mining Complex includes the copper processing plant that is currently permitted for 100,000 tonnes per month. (Source: Battery Mineral Resources Corp.)

The Punitaqui copper mine is a producing asset operated by Battery Mineral Resources (TSXV:BMR; OTCQB:BTRMF), on which Electric Royalties holds a 0.75 percent gross revenue royalty (GRR). Located in the Coquimbo Region of Chile, the mine benefits from four satellite copper deposits, strong infrastructure, and established processing facilities.

The mine is permitted for 100,000 tonnes per month of processing capacity, with regional exploration potential that could further extend its operational life and increase production.

In July 2025, Battery Mineral Resources reported that its Chilean subsidiary, Minera BMR SpA, had received unanimous approval of the Environmental Impact Statement (EIS) for the Los Mantos Copper Plant in Punitaqui, Chile. This extends the facility’s operational life by up to ten years and supports hundreds of jobs in the Punitaqui and Ovalle communities.

Authier Lithium Project (Pre-production) – Canada

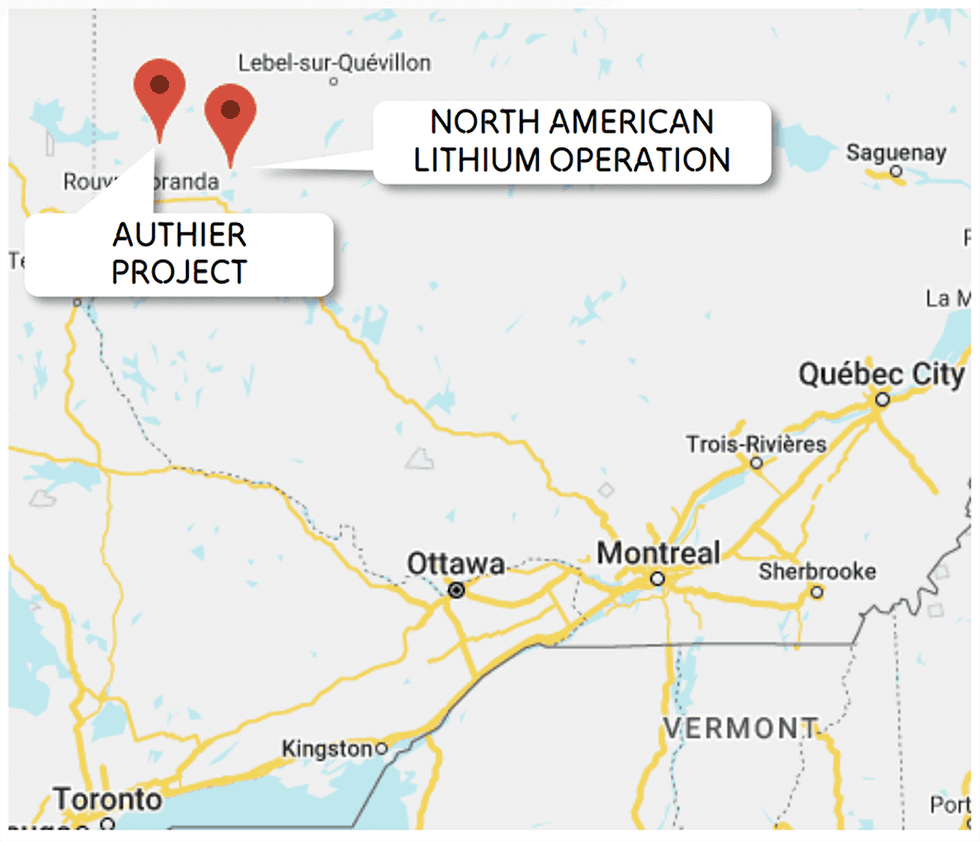

The Authier lithium project is a key lithium asset in Quebec, Canada, operated by Sayona Mining (ASX:SYA). Electric Royalties holds a 0.5 percent gross metal royalty (GMR) on part of the deposit. This project is a major component of Sayona's integration plan with North American Lithium (NAL), which commenced production in early 2023. Authier is expected to provide a stable supply of lithium for North America's growing EV battery industry, aligning with the push for localized supply chains.

The Authier lithium royalty is expected to be integrated into the producing North American Lithium (NAL) mine operated by Sayona Mining, which is set to merge with Piedmont Lithium. According to NAL’s Feasibility Study, the integration of Authier has the potential to contribute to Electric Royalties’ cash flow in the near term.

Battery Hill Manganese Project (Prefeasibility Stage) – Canada

The Battery Hill manganese project, located in New Brunswick, Canada, is an advanced-stage project operated by Manganese X Energy. Electric Royalties holds a 2 percent GMR on the project, which is currently undergoing a

prefeasibility study. The asset is well-positioned to support the growing demand for high-purity manganese, a critical component in EV batteries and energy storage technologies. Recent metallurgical testing has demonstrated strong recovery rates, further increasing its economic potential.

Mont Sorcier Vanadium Project – Canada

The Mont Sorcier vanadium project in Quebec, Canada, is operated by Cerrado Gold, with Electric Royalties holding a 1 percent vanadium GMR. Acquired when the project only had a resource estimate, Mont Sorcier has since advanced through additional metallurgical testing in partnership with Glencore and is now progressing through feasibility and permitting, with a Feasibility Study targeted for Q1 2026. As a large iron-vanadium deposit, the project has the potential to supply vanadium for both steel production and the growing vanadium redox flow battery sector, positioning it as a strategically important long-term asset.

Zonia Copper Project – USA

The Zonia copper project, located in Arizona, USA, is operated by World Copper (TSXV:WCU). Electric Royalties holds a 0.5 percent GRR on Zonia, with an option to add 1 percent GRR on Zonia North. Zonia is an oxide copper deposit with near-surface, leachable ore, making it a low-cost, open-pit mining opportunity. The project has undergone resource expansion, and a feasibility study is targeted for completion in 2025. Given the strong US push for domestic copper production, Zonia is well-positioned to benefit from critical minerals policies supporting infrastructure and electrification efforts.

The Zonia copper royalty, one of the leading copper oxide projects in North America, is being acquired by Plata Latina Minerals Corporation with plans to move toward construction in the near to medium term following closing of the transaction. World Copper reported last fall that the resource at Zonia nearly doubled.

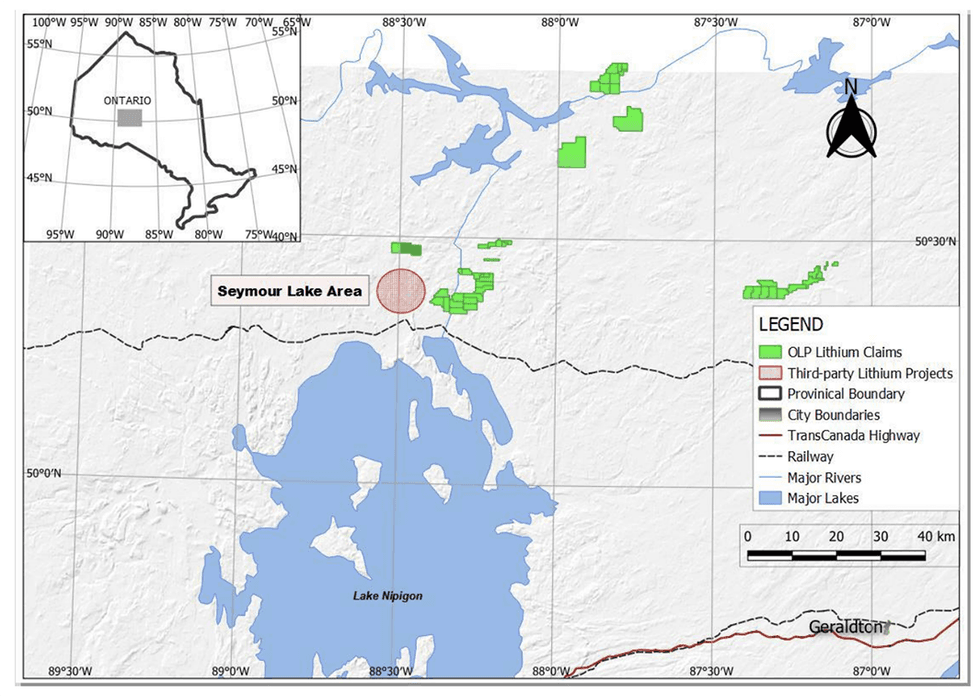

Seymour Lake - Canada

The Seymour Lake lithium project in Ontario, Canada, is subject to a 1.5 percent NSR royalty held by the company. Acquired in an all-share transaction valued at C$1 million, the project has advanced significantly under operator Green Technology Metals (ASX:GT1), which has raised more than C$70 million and secured a C$100 million LOI with the Canadian government. Since acquisition, Seymour Lake has progressed from a historical resource to a Preliminary Economic Assessment (PEA) and resource upgrade. In February 2025, Green Technology Metals released an updated PEA assessing Seymour Lake on a standalone basis, following earlier combined development studies with the Root Project. A pre-feasibility study is underway.

Management Team

Craig Lindsay - Chairman of the Board

Craig Lindsay has 30 years’ experience in corporate finance, venture capital and public company management and is the managing director of Arbutus Grove Capital. Lindsay was the founder, president, and CEO of Otis Gold until its merger with Excellon Resources in April 2020. He is a director of Revolve Renewable Power, Excellon Resources, VR Resources and Silver North Resources.

Brendan Yurik – Chief Executive Officer

Brendan Yurik is the founder and CEO of Evenor Investments, a financial advisory group to junior mining companies for alternative financing, debt, equity and M&A with experience in over $2 billion in mining financing transactions throughout his career. He has prior global experience as a research analyst as well as in business development and mining financial advisory roles with Endeavour Financial, Cambrian Mining Finance Ltd, Northern Vertex Mining Corp. and King & Bay West Management Corp.

Robert Scott – Chief Financial Officer

Robert Scott has more than 25 years’ experience in accounting, corporate finance, compliance and banking. Throughout his career, Scott has helped raise more than $200 million in equity financing and developed extensive experience in IPOs, reverse takeovers, mergers and acquisitions, and corporate restructuring.

Robert Schafer – Independent Director

Appointed in November 2020, Robert Schafer brings more than 30 years of international experience in mineral exploration and mining, enhancing the board's technical and strategic capabilities.

Stefan Gleason - Director

Stefan Gleason is the president, CEO, and majority shareholder of Money Metals Exchange LLC, a privately held company that is among the largest precious metals dealers and depositories in North America with over C$1 billion in annual revenues. Gleason is also the managing director of Gleason & Sons LLC, a Charlotte, N.C.-based family limited liability company which holds and manages debt, equity, and real estate investments. With past appearances on U.S. television networks such as CNN, FoxNews, Fox Business, and CNBC, Gleason is also a regular columnist for Seeking Alpha and Investing.com and has been published by the Wall Street Journal, Newsweek, Mining.com and TheStreet, among other publications.