Las Chispas drilling hits bonanza grades in multiple veins; Kensington drilling delivers high grades and continuity in key veins

Coeur Mining, Inc. ("Coeur" or the "Company") (NYSE: CDE) today provided updates on the exploration programs at its Las Chispas underground silver and gold mine in Sonora, Mexico and its Kensington underground gold mine in Alaska.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250903426709/en/

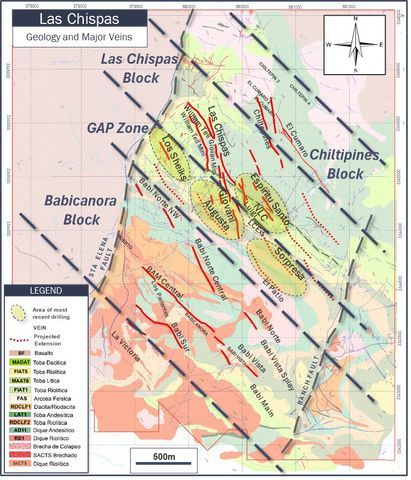

Figure 1: Las Chispas Location of major mineralized blocks, key veins and current areas of exploration focus.

Key Highlights

- Las Chispas

- Recent intercepts reflect some of the highest grades drilled – Drilling at the North Las Chispas vein, discovered in September 2024 and located immediately east of underground infrastructure, has returned exceptionally high-grade mineralization. Intercepts include 1.0 feet at 4.61 ounces per ton ("oz/t") gold and 392 oz/t silver ( or 0.3 meters at 158 grams per metric ton ("g/t") gold and 13,430 g/t silver)

- Growth at recent Augusta discovery – The Augusta vein continues to expand along strike, with standout intercepts including 1.2 feet at 0.81 oz/t gold and 113.8 oz/t silver (or 0.4 meters at 27.7 g/t gold and 3,903 g/t silver)

- Accelerated drilling strategy – Based on year-to-date success, near-mine expansion and infill programs have been ramped up to nine drill rigs to target additional resource growth

- Kensington

- New high-grade zones identified – Drilling at the Upper and Lower Kensington zones continues to encounter multiple parallel veins returning high grades over mineable widths, including 7.1 feet at 11.5 oz/t (2.2 meters at 395.9 g/t gold) in Upper Kensington Zone 30B

- Elmira expansion and new discovery – Drilling has confirmed up-dip expansions and continuity across several vein zones at the Elmira deposit, a key source of current mine production, located approximately 2,500 feet (760 meters) from the Kensington deposit. Results include 9.1 feet at 1.5 oz/t (2.8 meters at 52.1 g/t gold). A new discovery, the Elmira Hanging Wall Mineralization ("EHM"), also identified 2.1 feet at 2.3 oz/t (0.6 meters at 80 g/t gold) providing another area for future expansion potential

"Our sustained focus on organic growth through brownfield exploration over the past several years continues to set us apart by generating multiple new discoveries and driving consistent reserve and resource increases, leading to meaningful mine life extensions and higher returns on invested capital across the portfolio," said Mitchell J. Krebs, Chairman, President and Chief Executive Officer.

"Since acquiring Las Chispas in February 2025, an upscaled scout and expansion drill program has delivered early success by expanding resources in several key veins within the Gap Zone and the Las Chispas Block with the potential for future reserve conversion. Particularly encouraging are the extremely high-grade intercepts returned in the Las Chispas Block, including one assay of 1.4 feet at 390 ounces per ton on a silver equivalent basis—grades that have not typically been encountered outside the Babicanora Block.

"At Kensington, the recently concluded multi-year exploration and development program, which helped drive an increase in its reserve-based mine life to five years, is serving as a springboard for replacing depletion and is identifying potential sources of higher grade material while providing Kensington with significantly enhanced operational flexibility."

Las Chispas Mine, Mexico

Following the completion of the SilverCrest Metals Inc. acquisition in February, a Company review of the existing 2025 drill programs at Las Chispas confirmed that current resources cover only about 55% of the known silver-gold veins. The 2025 drill plan was modified and refocused around the Las Chispas operation to test high-priority targets including strike and depth extensions and infill drilling at the Babicanora and Las Chispas Blocks. The program will also continue to follow up on recent discoveries in the Gap Zone located between the Babicanora and Las Chispas Blocks.

Surface and underground expansion and infill drilling at the Babicanora Block continues to target near-resource extensions, supporting inferred-to-indicated conversion while maintaining a strong pipeline of scout drilling targets. Recent expansion drilling in the Las Chispas Block and Gap Zone has demonstrated growth in multiple veins, including Augusta, La Sorpresa, Los Sheiks, North Las Chispas and Las Chispas Extension (as shown in Figure 1). A newly completed ramp between the Las Chispas and Babicanora Norte veins is providing underground access for infill drilling with the goal of advancing these discoveries into indicated resources.

Drilling in the Gap Zone

The Augusta vein, a significant new discovery in the Gap Zone, has been defined over 1,050 feet (320 meters) along strike and 492 feet (150 meters) down dip, with the main vein averaging 2.3 feet (0.7 meters) in thickness (as shown in Figure 2). Grades of up to 0.81 oz/t gold (27.7 g/t) and 113.8 oz/t silver (3,903 g/t) have been drilled in the main Augusta vein. Augusta remains open in multiple directions and has been traced progressively closer to the new underground decline at Las Chispas, from which further drilling is now underway. The vein shows strong potential to thicken in the southeastward direction as it converges with the projected extension of the William Tell Mini and William Tell veins.

The La Sorpresa vein (shown in Figure 1) has been defined over 984 feet (300 meters) in strike and 230 feet (70 meters) vertically, with an adjacent splay covering 525 feet (160 meters) in strike and 197 feet (60 meters) vertical. Grades improve towards the northwest, as highlighted by an intercept of 0.72 oz/t gold and 100.5 oz/t silver (24.8 g/t gold and 3,444 g/t silver, respectively) in drillhole LCHEXP-25-013. This resource continues to expand towards the connection with the Las Chispas underground workings, with significant areas still undrilled.

Expansion and infill drilling undertaken at the Los Sheiks vein has outlined mineralization over 984 feet (300 meters) along strike and 197 feet (60 meters) vertically, with potential for further southeast expansion. Recent drilling has returned grades up to 3.4 oz/t gold (118 g/t) and 132.9 oz/t silver (4,557 g/t) while historic underground channel sampling by SilverCrest prior to its acquisition reported grades of up to 1.3 oz/t gold (40.1 g/t) and 19.6 oz/t silver (610 g/t) over 0.98 feet (0.3 meters). Los Sheiks lies in the footwall of the Babicanora Norte vein near planned mining areas and the Augusta vein, highlighting its potential to become a new resource target.

Notable results from expansion and infill drilling at Augusta and La Sorpresa include the following true width intercepts:

- Hole AUG-25-012 returned 1.2 feet at 0.81 oz/t and 113.8 oz/t silver (0.4 meters at 27.7 g/t Au and 3,903 g/t silver)

- Hole AUG-25-003 returned 1.0 feet at 0.57 oz/t gold and 73.6 oz/t silver (0.3 meters at 19.4 g/t Au and 2,523 g/t silver)

- Hole LC-25-271 returned 1.5 feet at 0.88 oz/t gold and 121.0 oz/t silver (0.5 meters at 30.2 g/t Au and 4,148 g/t silver)

- LCHEXP-25-013 (La Sorpresa) returned 0.49 feet at 0.72 oz/t gold and 100.45 oz/t silver (0.2 meters at 24.8 g/t Au and 3,444 g/t silver)

For a complete table of all drill results, please refer to the following link: https://www.coeur.com/files/doc_downloads/2025/09/2025-09-03-Exploration-Update-Appendix-Final.pdf . Please see the "Cautionary Statements" section for additional information regarding drill results.

Drilling in the Las Chispas Block

High-grade intercepts from expansion drilling at the William Tell Mini, Luigi, La Sorpresa, Las Chispas Extension, Giovani, Espiritu Santo, Luigi FW3 and the North Las Chispas veins include:

- Hole LCHEXP-25-006 (Las Chispas Extension) returned 0.8 feet at 0.34 oz/t gold and 39.9 oz/t silver (0.3 meters at 11.6 g/t Au and 1,370 g/t silver)

- Hole LCHII-25-007 (North Las Chispas) returned 3.8 feet at 0.36 oz/t gold and 87.0 oz/t silver (1.2 meters at 12.2 g/t gold and 2,983 g/t silver) including 0.9 feet at 1.05 oz/t gold and 288.1 oz/t silver (0.3 meters at 36.0 g/t gold and 9,877 g/t silver)

The William Tell Mini vein (shown in Figure 1) has now been defined over 656 feet (200 meters) along strike and 492 feet (150 meters) down dip, averaging 2.3 feet (0.7 meters) in thickness, and remains open to the southeast. Drilling is outlining a high-grade central zone with the potential to link with the Augusta vein to the southwest, creating a potentially extensive high-grade zone. Recent infill drilling has returned grades up to 1.93 oz/t gold and 251 oz/t silver (66.2 g/t gold and 8,612 g/t silver) over 1.38 feet (0.4 meters) from drillhole LC-25-277.

Expansion drilling at Giovani Mini (shown in Figure 1) has extended the known strike to 525 feet and 426 feet vertical (160 meters and 130 meters respectively). The vein averages 1 foot (0.3 meters) in thickness and is open to depth. Recent expansion results include grades of up to 0.23 oz/t gold and 14.2 oz/t silver (8.1 g/t and 488 g/t respectively) in drillhole LC-25-272.

Expansion and infill drilling at the North Las Chispas vein (shown in Figure 1) have extended mineralization to 1,148 feet (350 meters) along strike and 262.5 feet (80 meters) vertically, with mineralization remaining open to the southeast. Infill holes have returned some of the highest grades ever recorded at Las Chispas, including 4.61 oz/t gold and 392 oz/t silver (158 g/t gold and 13,430 g/t silver over 1.0 feet (0.3 meters) in drillhole LCHIF-25-070. Located just 328 feet (100 meters) east of existing underground infrastructure, the vein is interpreted to extend southeast beneath the Las Chispas system until its anticipated termination against the El Rancho fault.

"Results from the redesigned exploration program at Las Chispas continue to demonstrate the extremely high-grade nature of this deposit, with exciting Babicanora-style grades now being intersected in the Las Chispas Block and into the Gap Zone," said Aoife McGrath, Senior Vice President, Exploration. "The team at Las Chispas is firing on all cylinders and making great progress."

Kensington Mine - Alaska

Kensington consists of multiple vein deposits across a mile-wide east-west zone which includes Kensington, Elmira, Raven, Johnson, plus numerous other prospective zones outside of the main corridor.

In Upper Kensington (shown in Figure 3), drilling has returned higher grades over significant widths across the eastern veins Zone 30 and 30B (inclusive of Zone 30C mentioned in the Company's June 27, 2024 press release) over an area 700 feet in strike by 1,000 feet in dip within the southern portion of the zone, and 900 feet along strike by 500 feet in dip in the central portion of the zones, totaling 1,140,000 square feet (26.2 acres). Approximately 27% of the 106 significant intercepts (over 75 holes) within this drilled area have assayed above 1.0 ounces gold per ton (28.3 g/t) with an average true width of 1.9 feet (0.6 meters).

Zone 10A is also located within Upper Kensington as a parallel vein on the west side of the vein system. Results include both high grades and significant widths over a 200-foot up-dip extension and 650-foot strike length, yielding 42 significant intercepts from 27 holes. This zone is one of the most significant expansions at Kensington given its proximity to near-term planned production. Key drill highlights include:

Upper Kensington Zone 30B (east side of Upper Kensington)

- Hole K24-1765-116-X28 returned 7.1 feet at 11.55 oz/t gold (2.2 meters at 395.9 g/t)

- Hole K24-1765-116-X39 returned 16.0 feet at 1.25 oz/t gold (4.9 meters at 42.7 g/t)

- Hole K24-1765-116-X36 returned 8.8 feet at 1.14 oz/t gold (2.7 meters at 38.9 g/t)

Upper Kensington Zone 10A (west side of Upper Kensington)

- Hole K24-1765-116-X03 returned 4.3 feet at 5.53 oz/t gold (1.3 meters at 189.5 g/t)

- Hole K24-1765-116-X32 returned 31.3 feet at 0.37 oz/t gold (9.5 meters at 12.7 g/t)

Drilling in Lower Kensington Zones 50, 10 and 10 HW has tested an area 750 feet along strike and 1,500 feet along dip from the new exploration development, yielding 43 significant intercepts from 31 holes. These intercepts confirm the continuity of mineralized zones previously identified in the Company's press release dated June 27, 2024 and highlight that mineralization continues at depth and in parallel zones. Extensions within these zones are expected to contribute to near-term operations as production is currently underway. Key drill highlights from Lower Kensington Zone 50 at the southern tip of Lower Kensington include:

- Hole K24-0220-125-X07 returned 19.2 feet at 1.57 oz/t gold (5.9 meters at 53.8 g/t gold)

- Hole K24-0220-125-X14 returned 3.9 feet at 2.21 oz/t (1.2 meters at 75.6 g/t gold)

Drilling at Elmira has confirmed continuity across the upper portions of both the Main and South Zones across a substantial strike length of 2,400 feet (732 meters). A total of 106 significant intercepts from 60 holes were returned, of which over 30% exceed 1.0 ounce per ton (28.3 g/t) gold, with an average true thickness of 1.7 feet (0.5 meters). New Elmira ramp development has allowed access to infill drilling of the up-dip portion of the Elmira resource to the north and provided access for follow-up drilling at Johnson. A new scout target, EHM, was also discovered, with 11 significant intercepts over 11 holes. Notable true width intercepts from Elmira include:

Elmira (Main)

- Hole EL24-1300-135-X01 returned 9.1 feet at 1.52 oz/t gold (2.8 meters at 52.1g/t)

- Hole EL24-1180-095-X26 returned 2.3 feet at 5.55 oz/t gold (0.7 meters at 190.3g/t)

- Hole EL25-1300-135-X02 returned 21.9 feet at 0.53 oz/t gold (6.7 meters at 18.2g/t)

- Hole EL24-1300-135-X07 returned 7.5 feet at 1.52 oz/t gold (2.3 meters at 52g/t)

- Hole EL25-1360-197-X05 returned 5.7 feet at 1.75 oz/t gold (1.7 meters at 60.1g/t)

EHM

- Hole EL25-1180-047-X04 returned 2.1 feet at 2.34 oz/t (0.6m at 80 g/t gold)

Drilling at Johnson focused on a 100 foot by 500 foot up-dip area of expansion resulting in eight significant intercepts from 22 holes, over 30% of which are greater than 2 ounces per ton (56.7 g/t) gold over an average width of 1.0 feet (0.3 meters). Drilling is currently underway to continue expanding Johnson to the north. Results thus far indicate the potential for future resource conversion.

For a complete table of all year-to-date 2025 drill results, please refer to the following link: https://www.coeur.com/files/doc_downloads/2025/09/2025-09-03-Exploration-Update-Appendix-Final.pdf . Please see the "Cautionary Statements" section for additional information regarding drill results.

"Drill results at Kensington continue to be excellent, with high-grades and wide intercepts encountered in Elmira and in Upper and Lower Kensington," added Ms. McGrath. "In addition to maintaining the current mine life, the team is positioned to commence scout drilling to build the pipeline of targets for future growth. As a foundation for this next chapter of Kensington's growth, detailed structural modeling for the Kensington deposit is almost complete, with additional geochemistry, geophysics and district-scale studies being designed and implemented."

About Coeur

Coeur Mining, Inc. is a U.S.-based, well-diversified, growing precious metals producer with five wholly-owned operations: the Las Chispas silver-gold mine in Sonora, Mexico, the Palmarejo gold-silver complex in Chihuahua, Mexico, the Rochester silver-gold mine in Nevada, the Kensington gold mine in Alaska and the Wharf gold mine in South Dakota. In addition, the Company wholly-owns the Silvertip polymetallic critical minerals exploration project in British Columbia.

Cautionary Statements

This news release contains forward-looking statements within the meaning of securities legislation in the United States and Canada, including statements regarding exploration efforts and plans, exploration expenditures and investments, drill results, resource delineation, expansion, upgrade or conversion and mine life extension. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause Coeur's actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, the risk that anticipated additions or upgrades to reserves and resources are not attained, the risk that planned drilling programs may be curtailed or canceled due to budget constraints or other reasons, the risks and hazards inherent in the mining business (including risks inherent in developing large-scale mining projects, environmental hazards, industrial accidents, weather or geologically related conditions), changes in the market prices of gold and silver and a sustained lower price environment, the uncertainties inherent in Coeur's production, exploratory and developmental activities, including risks relating to permitting and regulatory delays (including the impact of government shutdowns), ground conditions, grade and recovery variability, any future labor disputes or work stoppages, the uncertainties inherent in the estimation of mineral reserves and resources, continued access to financing sources, government orders that may require temporary suspension of operations at one or more of our sites and effects on our suppliers or the refiners and smelters to whom the Company markets its production, changes that could result from Coeur's future acquisition of new mining properties or businesses, the loss of any third-party smelter to which Coeur markets its production, the effects of environmental and other governmental regulations, the risks inherent in the ownership or operation of or investment in mining properties or businesses in foreign countries, Coeur's ability to raise additional financing necessary to conduct its business, make payments or refinance its debt, as well as other uncertainties and risk factors set out in filings made from time to time with the United States Securities and Exchange Commission, and the Canadian securities regulators, including, without limitation, Coeur's most recent reports on Form 10-K and Form 10-Q. Actual results, developments and timetables could vary significantly from the estimates presented. Readers are cautioned not to put undue reliance on forward-looking statements. Coeur disclaims any intent or obligation to update publicly such forward-looking statements, whether as a result of new information, future events or otherwise. Additionally, Coeur undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of Coeur, its financial or operating results or its securities.

The scientific and technical information concerning our mineral projects in this news release have been reviewed and approved by a "qualified person" under Item 1300 of SEC Regulation S-K, namely our Vice President, Technical Services, Christopher Pascoe. For a description of the key assumptions, parameters and methods used to estimate mineral reserves and mineral resources included in this news release, as well as data verification procedures and a general discussion of the extent to which the estimates may be affected by any known environmental, permitting, legal, title, taxation, sociopolitical, marketing or other relevant factors, please review the Technical Report Summaries for each of the Company's material properties which are available at www.sec.gov .

Notes

The ranges of potential tonnage and grade (or quality) of the exploration results described in this news release are conceptual in nature. There has been insufficient exploration work to estimate a mineral resource. It is uncertain if further exploration will result in the estimation of a mineral resource. The exploration results described in this news release therefore do not represent, and should not be construed to be, an estimate of a mineral resource or mineral reserve.

For additional information regarding 2024 mineral reserves and mineral resources, see https://www.coeur.com/operations/operations/reserves-resources/ .

- For a complete table of all drill results included in this release, please refer to the following link: https://www.coeur.com/files/doc_downloads/2025/09/2025-09-03-Exploration-Update-Appendix-Final.pdf .

- Rounding of grades, to significant figures, may result in apparent differences.

Conversion Table

| 1 short ton | = | 0.907185 metric tons |

| 1 troy ounce | = | 31.10348 grams |

Appendix: https://www.coeur.com/files/doc_downloads/2025/09/2025-09-03-Exploration-Update-Appendix-Final.pdf

View source version on businesswire.com: https://www.businesswire.com/news/home/20250903426709/en/

For Additional Information

Coeur Mining, Inc.

200 S. Wacker Drive, Suite 2100

Chicago, Illinois 60606

Attention: Jeff Wilhoit, Senior Director, Investor Relations

Phone: (312) 489-5800

www.coeur.com