- WORLD EDITIONAustraliaNorth AmericaWorld

April 08, 2024

Lithium Universe Limited (referred to as "Lithium Universe" or the "Company," ASX: "LU7") provides a strategic update on addressing the gap in lithium conversion capacity and enhancing the North American supply chain.

Highlights

- Lithium Universe to play pivotal role in closing the lithium conversion gap

- Lithium Universe to convert supply in North America.

- Target conversion contracts with OEMs who have spodumene off take

- Target "take or pay" agreements with OEMs to reduce market/price risks

- Geopolitical shift to onshore the battery supply chain in North America

- Canada emerges as next key global lithium supply chain

- LFP batteries expected to capture 87% of the ESS market share by 2033

- Strong Federal and Provincial government financing support within the industry

- Lithium Universe committed to building through the lithium cycle

What is the ‘Lithium Gap’?

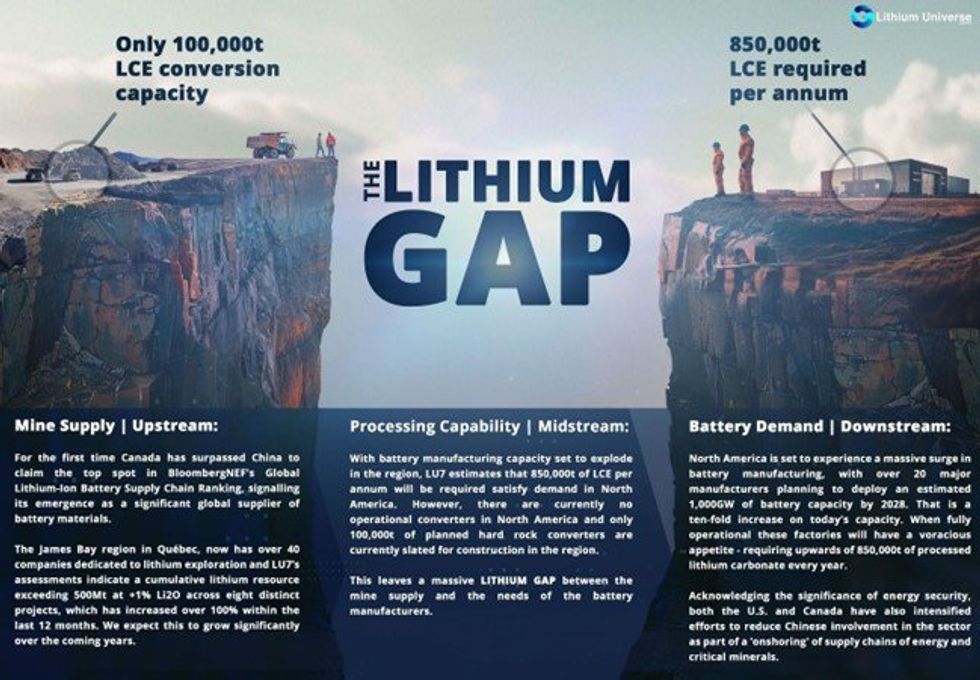

North America anticipates a surge in battery manufacturing, with over 20 major manufacturers planning to deploy an estimated 1,000GW of battery capacity. Canada has ascended to the top spot in BloombergNEF's Global Lithium-Ion Battery Supply Chain Ranking, signalling its emergence as a significant global supplier of battery materials. However, bridging the gap between the growing supply of lithium ore and the increasing demand for highly processed lithium carbonate remains a challenge and opportunity.

Lithium Universe is advancing a mine-to-battery-grade lithium carbonate strategy in Canada through the Québec Lithium Processing Hub (QLPH). The QLPH includes a multi-purpose independent 1 Mtpa concentrator and an independent 16,000 tpa battery-grade lithium carbonate refinery.

Over the past decade, numerous lithium conversion plants worldwide have encountered technical and startup challenges. Even established lithium producers have found lithium conversion to be a challenging task. Lithium Universe presents a solution to mitigate these risks. The company has formed a team, dubbed the Lithium Dream Team, comprising experts in hard rock lithium extraction and downstream conversion operations. Additionally, strategic partnerships with engineering consultants Hatch Ltd and Primero Group have been forged. By leveraging proven technology in spodumene concentration and lithium conversion design, the company aims to minimize execution risk. Notably, the Dream Team previously spearheaded the successful construction of the Jiangsu Lithium Carbonate facility, surpassing design expectations to produce the world's premier battery-grade carbonate. This project was built by Hatch Ltd. Lithium Universe intends to replicate the design and operational methodologies implemented at Jiangsu, viewing this, coupled with the expertise of the Dream Team, as pivotal in establishing conversion capacity in North America.

The Emerging James Bay Supply

The Company has engaged with numerous exploration entities operating within the region of James Bay, Québec and estimate there are over 40 companies dedicated to lithium exploration in the area. Our assessments indicate a cumulative lithium resource exceeding 500Mt at +1% Li2O across eight distinct projects, which has increased over 100% within the last 12 months. This significant increase is due to the upgraded resource of 110.2Mt at 1.3% Li2O by Arcadium Lithium at the James Bay Project, the maiden resource of Patriot Battery Metals at Corvette of 109Mt at 1.42% Li2O and most recently the announcement of Winsome Resource’s 59Mt at 1.12% Li2O resource at their Adina Project.

This article includes content from Lithium Universe Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LU7:AU

The Conversation (0)

03 September 2025

Macquarie Electro Jet Silver Extraction Recovery

Lithium Universe (LU7:AU) has announced Macquarie Electro Jet Silver Extraction RecoveryDownload the PDF here. Keep Reading...

12 August 2025

Acquisition of Silver Extraction Technology

Lithium Universe (LU7:AU) has announced Acquisition of Silver Extraction TechnologyDownload the PDF here. Keep Reading...

30 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Lithium Universe (LU7:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

30 July 2025

Lithium Universe Ltd Quarterly Activities Report

Melbourne, Australia (ABN Newswire) - During the June quarter, Lithium Universe Ltd (ASX:LU7,OTC:LUVSF) (FRA:KU00) (OTCMKTS:LUVSF) announced the acquisition of the global rights to commercially exploit a patented photovoltaic solar panel recycling technology known as "Microwave Joule Heating... Keep Reading...

17 July 2025

Completion of PV Solar Cell Recycling Acquisition

Lithium Universe (LU7:AU) has announced Completion of PV Solar Cell Recycling AcquisitionDownload the PDF here. Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00