December 10, 2024

Further high-grade mineralisation identified at the Karina prospect

Unico Silver Limited (“USL” or the “Company”) is pleased to announce first assay results from ongoing drilling at the Cerro Leon project, located in the Santa Cruz province of Argentina.

HIGHLIGHTS

- Assay results received for the first G holes for 757m at the Karina prospect.

- Results are pending for a further 42 holes for 3,5G5m.

- The approximately 5,000m RC drill program is progressing well, with completion expected on 15 December 2024.

- Significant silver equivalent (AgEq1) assay results include:

- Karina(PR003-24) 12m at 307gpt AgEq from 49m, inc.

3m at 1,052gpt AgEq from 56m (outside MRE) - (PR004-24) 23m at 104gpt AgEq from 30m (open at depth)

- (PR005-24) 12m at 411gpt AgEq from 18m, inc.

5m at 828gpt AgEq from 23m (open at depth) - PR007-24) 26m at 126gpt AgEq from 31m (open at depth)

- (PR009-24) 35m at 20Ggpt AgEq from 4m (outside MRE)

2m at 1,500gpt AgEq from 7m

- Karina(PR003-24) 12m at 307gpt AgEq from 49m, inc.

- Mineralisation is defined over G00m strike and 75m down dip and is open at depth.

- Drill operations will scale up in the first week of January with two diamond rigs mobilising to site to test the vertical continuity of mineralised across all priority prospects, including Karina.

- These results form part of a fully funded 50,000m drill program across the Cerro Leon and Joaquin projects, contributing to a revised Mineral Resource Estimate (MRE).

Managing Director, Todd Williams: “The first nine holes at Karina exceed expectations and confirms the continuity of mineralisation along 300m strike and the potential for further extensions at depth. Notably, hole PR003-24 reported an exceptional individual assay of 2C03gpt silver, validating the shallow high-grade nature of mineralisation. With assays for 42 additional holes still pending and drilling set to scale up in January, shareholders can look forward to a steady stream of results and updates over the next 12 months, including a revised MRE.

Summary

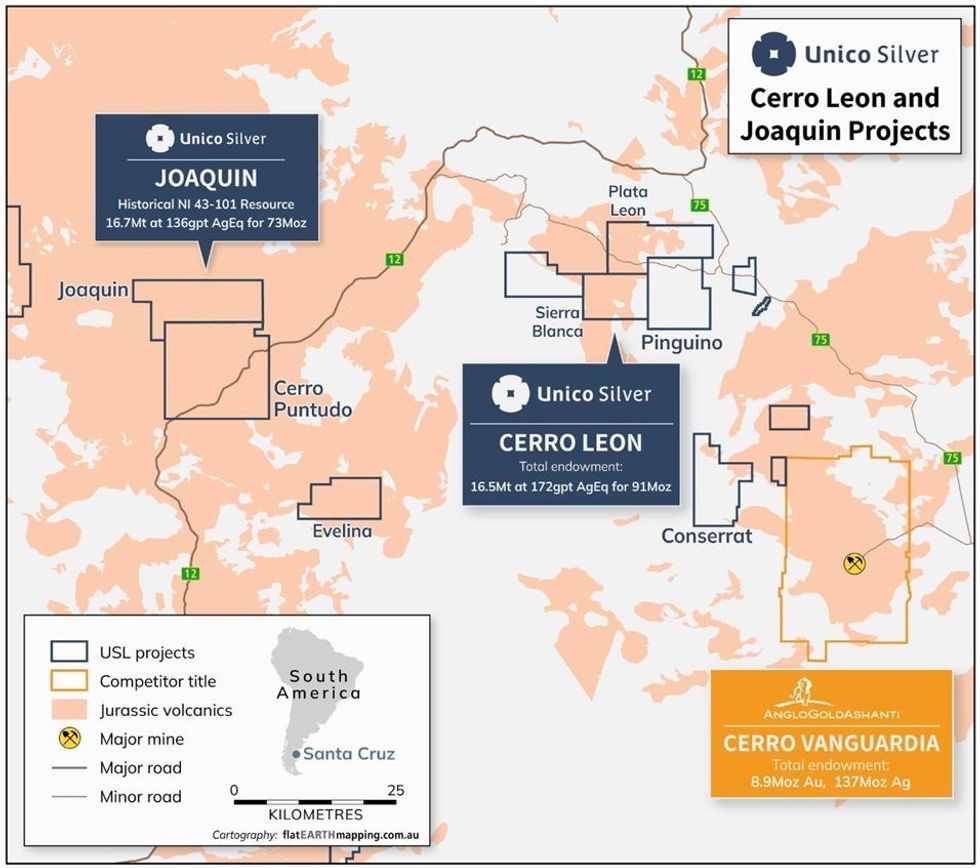

Unico Silver holds 100% of the Cerro Leon and Joaquin silver gold districts located in the central Deseado Massif geological province, Santa Cruz Argentina (Figure 1). The current drill program at Cerro Leon commenced October 2024 and is anticipated to continue through to the end of Q1 2025. It forms part of a broader fully funded 50,000m drill program planned for both projects culminating in a revised MRE late 2025.

Cerro Leon is strategically located within the same structural corridor that is host to AngloGold Ashanti’s world- class Cerro Vanguardia mine. The Project hosts a JORC compliant Mineral Resource Estimate (MRE) of G1Moz AgEq for 16.5Mt at 172gpt AgEq (Table 3).

During August 2024, announced the acquisition of the Joaquin project from Pan American Silver Corp (PAAS). Joaquin is host to a Foreign Estimate of 73Moz AgEq for 16.7Mt at 136gpt AgEq4 (Table 4). Historical production by PAAS from 2019 to 2022 totals 4.3Moz Ag (Table 5).

Click here for the full ASX Release

This article includes content from Unico Silver Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

16 February

How Rick Rule Reinvested His Silver Gains: 5 Silver Stocks He Owns

Over the past year, the spot price of silver has surged past a 40 year record and into triple-digit territory, reaching a high of US$121 per ounce this past January.For silver investors who bought into the physical market when the price was low, this first leg of the silver bull market has... Keep Reading...

16 February

Silver Institute: Market Heading for Sixth Straight Deficit in 2026

Silver surged past US$100 per ounce for the first time in January before retreating below the US$80 level, marking a volatile start to 2026 as the precious metal faces renewed investor appeal.In its latest annual outlook, published on February 10, the Silver Institute notes that the rally comes... Keep Reading...

13 February

Top 5 Canadian Mining Stocks This Week: Trinity One Surges 105 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO) and Glencore (LSE:GLEN,OTCPL:GLCNF) said they will no... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00