Cabral Gold Inc. (TSXV: CBR,OTC:CBGZF) (OTCQB: CBGZF) ("Cabral" or the "Company") is pleased to announce drill results from 10 RC drill holes and 6 diamond drill holes recently completed at the PDM target located 2.5km NW of the Central gold deposit and within the Cuiu Cuiu district.

Highlights

- Drill hole RC0579 Intersected 6m @ 2.74 g/t gold from 9m depth in saprolite Including 1m @ 13.06 g/t gold from 10m depth

- Multiple zones of lower grade gold mineralization were also intersected within near-surface saprolite material at PDM, including;

- 11m @ 0.88 g/t gold from 26m depth in saprolite in RC0573

- 10m @ 0.39 g/t gold from surface in saprolite in RC575

- 6m @ 1.46 g/t gold from 11m depth in saprolite including 1m @ 7.98 g/t gold in RC583

- 9m @ 0.50 g/t gold from surface plus 5m @ 1.96 g/t gold from 41m depth including 1m @ 9.08 g/t gold in DDH334

- 2.75m @ 3.05 g/t gold from 123.25m depth in saprolite in DDH335

- 12.7m @ 0.50 g/t gold from 10.3m depth in saprolite in DDH337

- 13m @ 0.54 g/t gold from surface in blanket sediments including 1.4m @ 3.17 g/t gold from 7.4m depth in DDH338

- Recent drilling at the PDM target has now expanded the surface area of the gold-in-oxide mineralized blanket by 50% from 0.26 km² to 0.39 km² which is expected to have positive implications for the existing gold-in-oxide resource base at PDM

- Drilling in the primary mineralization below the gold-in-oxide blanket has also added 2 new zones of mineralization which are NW-SE trending, are parallel to the existing mineralized zones, extend at least 600m along strike and are open to the north and south

Alan Carter, Cabral's President and CEO commented, "These latest drill results from the PDM target at Cuiú Cuiú have extended the surface extent of the gold-in-oxide blanket by 50% indicating a significantly larger gold-in-oxide resource base. This is important given that the existing resource base at PDM was not included in the recently released updated PFS study for the gold-in-oxide starter operation. Of greater importance, however, is the fact that additional drilling has increased the number of NW trending primary mineralized zones in the underlying intrusive rocks at PDM, from two to four. All of these mineralized zones remain open along strike to the north and south and at depth. Drilling is currently in progress at the previously untested Mutum target where surface trenches average 0.9 to 1g/t gold in quartz vein stockwork mineralization in altered intrusive rocks. Drilling is also currently in progress at the Machichie and Machichie NE targets."

PDM Drill Results

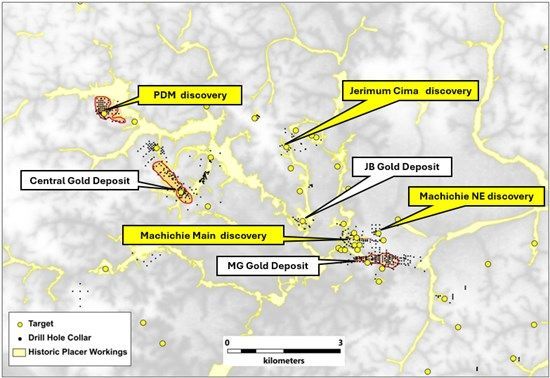

The PDM (Pau de Merenda) target is located 2.5km northwest of the Central gold deposit at Cuiú Cuiú (Figure 1) within a prominent northwest-trending +100ppb gold-in-soil anomaly, which has been traced for more than 5km along strike, and remains open. The Central gold deposit, as well as the Central SE, Central North, PDM and Mutum targets all lie within this trend.

Figure 1 Map showing location of PDM discovery and primary gold deposits with 43-101 compliant Indicated and Inferred resources at Central, MG, and JB. The PDM, Machichie Main, Machicie NE and Jerimum Cima gold discoveries are also shown - all of these discoveries have along strike continuity. The main exploration targets (yellow dots) and distribution of historic placer gold workings (pale yellow outlines) are also shown.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3900/267939_61055d51b45fcb15_002full.jpg

The objective of the current drill program at PDM is to add ounces to both the current gold-in-oxide resource base, and to calculate a maiden resource for the mineralized zones in the underlying primary intrusive rocks.

Previous results from initial diamond-drill holes in granitic basement rocks below the gold-in-oxide blanket at PDM include; 22.4m @ 4.8 g/t, including: 1.35m @ 62.0 g/t gold, and 11.9m @ 3.3 g/t gold, including 0.5m @ 16.1 g/t gold, and 1.2m @ 16.0 g/t gold in DDH239; and 18.0m @ 2.5 g/t gold from 92.0m, including 3.0m @ 10.5 g/t gold, in DDH275. (see press releases dated December 15, 2021, January 12, 2022 and April 28, 2022). These higher grade intercepts occur within brecciated structural zones and mostly remain open at depth as well as along strike.

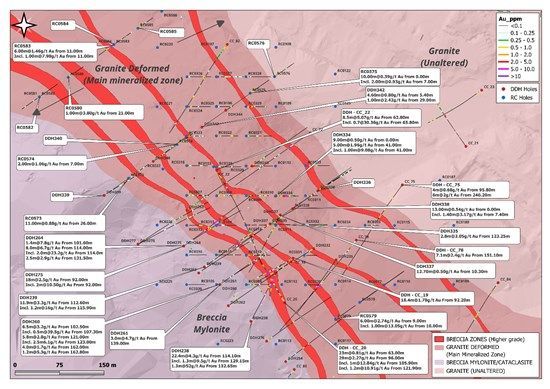

Results were recently received on 10 additional RC holes and 6 diamond drill holes at PDM (Figure 2). All of the holes were completed on three NE-SW sections and were drilled to the north-east. RC holes RC0573 to RC0576 and diamond drill hole DDH340 were all drilled on section 9347060N. Results are pending on two additional drill holes, DDH342 and DDH344 on this section.

Diamond drill holes DDH334 to DDH338 were all drilled on section 9346906N, 200m to the south. Of these holes, DDH334 returned 9m @ 0.50 g/t gold from surface plus 5m @ 1.96 g/t gold from 41m depth including 1m @ 9.08 g/t gold.

These drill results suggest the presence of two additional NW trending mineralized zones that are parallel to the two existing mineralized zones known in the primary intrusive rocks at PDM. Of particular significance, is the result from RC0579 which was drilled on section 9346780N and is one of the most southerly holes drilled at PDM. It returned 6m @ 2.74 g/t gold from surface including 1m @ 13.06 g/t gold from 10m depth. The mineralized zone intersected at the top of this hole is interpreted to be the most southerly extension of one of the main mineralized zones at PDM and extends mineralization 150m further south. All of the mineralized zones remain open to the south and the north.

These recent results suggest the presence of a significantly larger gold-in-oxide mineralized blanket zone which can now be traced over blanket 0.39 km² and includes the Mutum area to the south-east where previous trenching returned gold values including 32m @ 1g/t gold, 25.5m @ 0.9g/t gold and 16.5m @ 0.9g/t gold. This represents a 50% increase on the previous area of the gold -in-oxide blanket at PDM which previously extended over 0.26 km². The blanket area remains open to the north. Reconnaissance RC drilling at the previously untested Mutum target is currently in progress.

Results are pending on two additional diamond drill holes at PDM (DDH342 and DDH344). Drilling is currently in progress with three rigs turning at the Mutum target as well as the Machichie Main and Machichie NE targets. Drilling during recent months at the Machichie NE target returned 12m @ 27.7 g/t incl. 5m @ 65.5 g/t gold, 11m @ 33.0 g/t incl. 4m @ 89.3 g/t gold, 6m @ 13.3 g/t incl. 1m @ 77.5 g/t gold and 5m @ 24.5 g/t incl. 2m @ 60.5 g/t gold (see press releases dated May 30, 2024, July 25, 2024, October 28, 2024 and April 3,2025).

Figure 2: Map showing the PDM target with recent drill results and selected previous results.

Terms: g/t = grams / tonne, m = metres, Au = gold

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3900/267939_61055d51b45fcb15_003full.jpg

| Drill Hole # | Weathering | From | To (m) (m) | Thickness (m) | Grade g/t gold | |

| RC0573 | Blanket | 0.00 | 10.00 | 10.00 | 0.17 | |

| Saprolite | 10.00 | 15.00 | 5.00 | 0.12 | ||

| 26.00 | 37.00 | 11.00 | 0.88 | |||

| EOH 77.50 | ||||||

| RC0574 | Blanket | 0.00 | 9.00 | 9.00 | 0.45 | |

| Incl. | 7.00 | 9.00 | 2.00 | 1.06 | ||

| Saprolite | 9.00 | 12.00 | 3.00 | 0.54 | ||

| 23.00 | 24.00 | 1.00 | 0.53 | |||

| EOH 77.00 | ||||||

| RC0575 | Blanket | 0.00 | 10.00 | 10.00 | 0.39 | |

| Incl. | 7.00 | 9.00 | 2.00 | 0.93 | ||

| Saprolite | 10.00 | 16.00 | 6.00 | 0.24 | ||

| EOH 76.00 | ||||||

| RC0576 | Blanket | 0.00 | 10.00 | 10.00 | 0.29 | |

| Saprolite | 10.00 | 12.00 | 2.00 | 0.13 | ||

| 23.00 | 24.00 | 1.00 | 0.59 | |||

| 26.00 | 27.00 | 1.00 | 0.35 | |||

| EOH 73.00 | ||||||

| RC0579 | Blanket | 0.00 | 9.00 | 9.00 | 0.22 | |

| Saprolite | 9.00 | 15.00 | 6.00 | 2.74 | ||

| Incl. | 10.00 | 11.00 | 1.00 | 13.06 | ||

| 19.00 | 20.00 | 1.00 | 0.71 | |||

| EOH 82.00 | ||||||

| RC0580 | Blanket | 0.00 | 6.00 | 6.00 | 0.14 | |

| Saprolite | 6.00 | 9.00 | 3.00 | 0.44 | ||

| 21.00 | 22.00 | 1.00 | 3.80 | |||

| EOH 62.00 | ||||||

| RC0582 | Blanket | 1.00 | 4.00 | 3.00 | 0.43 | |

| EOH 74.00 | ||||||

| RC0583 | Blanket | 0.00 | 4.00 | 4.00 | 0.24 | |

| Saprolite | 11.00 | 17.00 | 6.00 | 1.46 | ||

| Incl. | 11.00 | 12.00 | 1.00 | 7.98 | ||

| 28.00 | 29.00 | 1.00 | 0.84 | |||

| 41.00 | 42.00 | 1.00 | 0.39 | |||

| EOH 62.00 | ||||||

| RC0584 | Blanket | 0.00 | 4.00 | 4.00 | 0.44 | |

| EOH 73.00 | ||||||

| RC0585 | Blanket | 0.00 | 10.00 | 10.00 | 0.19 | |

| Saprolite | 19.00 | 20.00 | 1.00 | 0.65 | ||

| EOH 61.00 | ||||||

| DDH334 | Blanket | 0.00 | 9.00 | 9.00 | 0.50 | |

| Saprolite | 21.00 | 25.00 | 4.00 | 0.45 | ||

| 26.50 | 30.50 | 4.00 | 1.17 | |||

| 41.00 | 46.00 | 5.00 | 1.96 | |||

| Incl. | 41.00 | 42.00 | 1.00 | 9.08 | ||

| 49.00 | 50.00 | 1.00 | 0.42 | |||

| EOH 78.00 | ||||||

| DDH335 | Blanket | 0.00 | 11.00 | 11.00 | 0.28 | |

| Fresh Rock | 104.70 | 105.70 | 1.00 | 0.46 | ||

| 123.25 | 126.00 | 2.75 | 3.05 | |||

| EOH 152.90 | ||||||

| DDH336 | Blanket | 0.00 | 6.10 | 6.10 | 0.34 | |

| Saprolite | 6.10 | 8.00 | 1.90 | 0.23 | ||

| 22.00 | 32.00 | 10.00 | 0.29 | |||

| 38.00 | 39.00 | 1.00 | 0.36 | |||

| EOH 136.60 | ||||||

| DDH337 | Blanket | 0.00 | 10.30 | 10.30 | 0.23 | |

| Saprolite | 10.30 | 23.00 | 12.70 | 0.50 | ||

| 42.00 | 42.50 | 0.50 | 0.53 | |||

| Fresh Rock | 89.50 | 90.65 | 1.15 | 0.37 | ||

| EOH 127.75 | EOH | 127.75 | ||||

| DDH338 | Blanket | 0.00 | 13.00 | 13.00 | 0.54 | |

| 7.40 | 8.80 | 1.40 | 3.17 | |||

| Fresh Rock | 75.90 | 89.00 | 13.10 | 0.16 | ||

| Incl. | 82.70 | 83.20 | 0.50 | 2.06 | ||

| 111.55 | 114.00 | 2.45 | 0.83 | |||

| EOH 228.85 | ||||||

| DDH339 | Blanket | 2.90 | 4.35 | 1.45 | 0.31 | |

| Saprolite | 75.00 | 76.00 | 1.00 | 0.89 | ||

| EOH 147.4 | ||||||

| DDH340 | Blanket | 0.00 | 15.00 | 15.00 | 0.22 | |

| Saprolite | 27.00 | 29.00 | 2.00 | 1.01 | ||

| 45.00 | 47.00 | 2.00 | 0.33 | |||

| 78.00 | 80.15 | 2.15 | 0.27 | |||

| EOH 153.3 |

Table 1: Drill results from RC drill holes RC573 to RC576, RC579, RC580, RC582 to RC585

and diamond drill holes DDH334 to DDH340 at the PDM target

Update on Construction Financing

Management continues to focus on securing the necessary construction financing for its gold-in-oxide starter operation at Cuiú Cuiú aimed at leaching the near surface mineralized saprolite and soil material. As per the Updated PFS study of July 29, 2025, the construction capex is US$37.7M and the post-tax IRR is 78% with an NPV of US$73.9M with a payback of 10 months based on the base case gold price of US$2,500 per oz. The All-in sustaining costs (AISC) are $1,210 / oz of gold produced.

In parallel with our work on securing the construction financing, we are continuing our work on completing the detailed engineering for the project. At the same time, we are building out our construction and operating team under Luiz Celaro, our recently appointed Construction Manager.

About Cabral Gold Inc.

The Company is a junior resource Company engaged in the identification, exploration, and development of mineral properties, with a primary focus on gold properties located in Brazil. The Company has a 100% interest in the Cuiú Cuiú gold district located in the Tapajós Region, within the state of Pará in northern Brazil. Three main gold deposits have so far been defined at the Cuiú Cuiú project which contain National Instrument ("NI") 43-101 compliant Indicated resources of 12.29Mt @ 1.14 g/t gold (450,200oz) in fresh basement material and 13.56Mt @ 0.50 g/t gold (216,182oz) in oxide material. The project also contains Inferred resources of 13.63Mt @ 1.04 g/t gold (455,100oz) in fresh basement material and 6.4Mt @ 0.34 g/t gold (70,569oz) in oxide material. The resource estimate for the primary material is based on the NI 43-101 technical report dated October 12, 2022. The resource estimate for the oxide material at PDM and MG is based on a NI 43-101 technical report dated October 21, 2024. The resource estimate for the oxide material at Central and Machichie is based on a NI43-101 technical report ("Updated PFS") dated July 29, 2025.

The Tapajós Gold Province is the site of the largest gold rush in Brazil's history which according to the ANM (Agência Nacional de Mineração or National Mining Agency of Brazil) produced an estimated 30 to 50 million ounces of placer gold between 1978 and 1995. Cuiú Cuiú was the largest area of placer workings in the Tapajós and produced an estimated 2Moz of placer gold historically.

FOR FURTHER INFORMATION PLEASE CONTACT:

"Alan Carter"

President and Chief Executive Officer

Cabral Gold Inc.

Tel: 604.676.5660

Technical information included in this release was supervised and approved by Brian Arkell, B.S. Geology and M.S. Economic Geology, SME (Registered Member), AusIMM (Fellow) and SEG (Fellow), Cabral Gold's Vice President, Exploration and Technical Services, and a Qualified Person under NI 43-101.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as such term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking Statements

This news release contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively "forward-looking statements"). The use of the words "will", "expected" and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Such forward-looking statements should not be unduly relied upon. The Company believes the expectations reflected in those forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct.

Notes

Gold analysis has been conducted by SGS method FAA505 (fire assay of 50g charge), with higher grade samples checked by FAA525. Analytical quality is monitored by certified references and blanks. Until dispatch, samples are stored under the supervision the Company's exploration office. The samples are couriered to the assay laboratory using a commercial contractor. Pulps are returned to the Company and archived. Drill holes results are quoted as down-hole length weighted intersections.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/267939