November 14, 2023

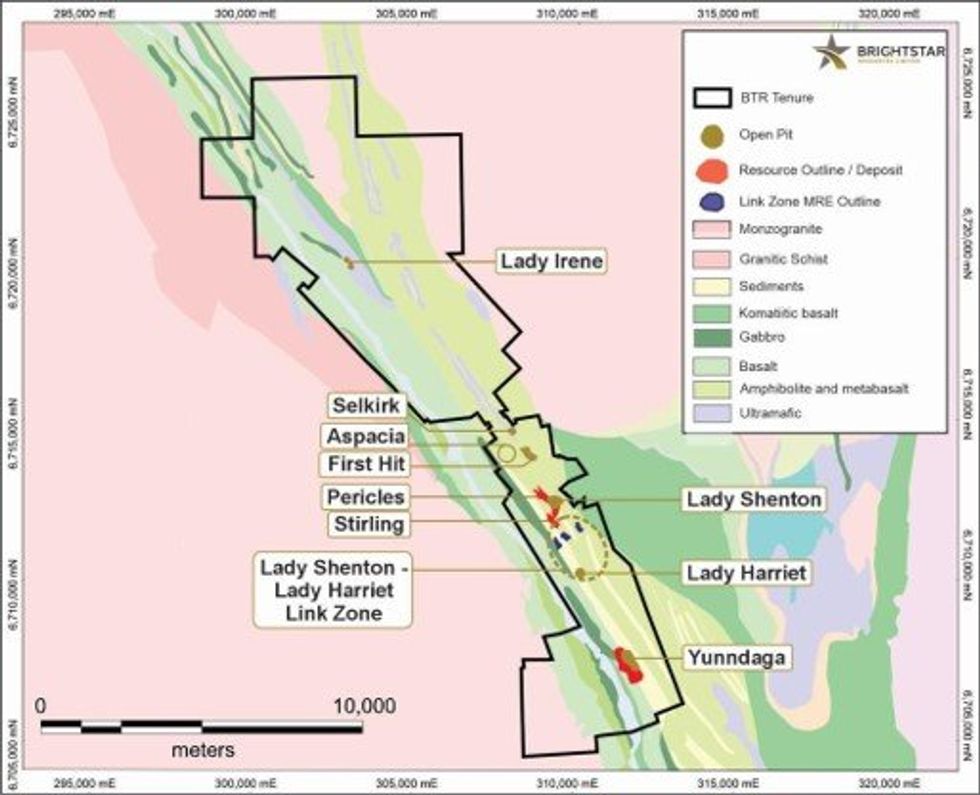

Brightstar Resources Limited (ASX: BTR) (Brightstar) is pleased to announce a maiden Mineral Resource Estimate (MRE) at Link Zone, located ~1km south of the 287koz Lady Shenton System and ~1km north of the 43koz Lady Harriet System at the Menzies Gold Project (MGP). This MRE was undertaken on over 200 RC holes including a recent program completed by Brightstar with gold intercepts including 1m @ 13.95g/t and 4m @ 3.21g/t as released on 8th August 20231.

HIGHLIGHTS

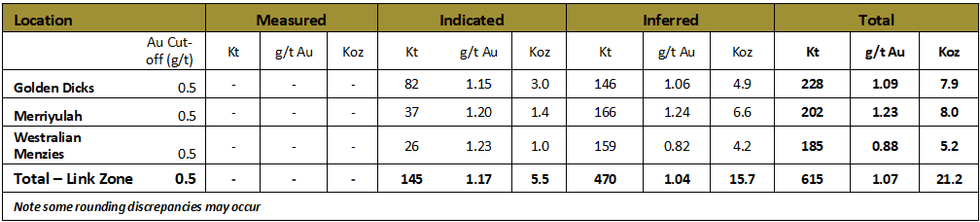

- Maiden JORC2012 Mineral Resource Estimate at the Link Zone of +21koz @ 1.1g/t Au from shallow, near surface material at the Menzies Gold Project

- Brightstar has identified the Link Zone as having the potential for early-stage mining opportunities to generate operational working capital to organically fund exploration and development activities

- The MRE displays favourable orebody characteristics of near surface stacked lodes, oxidised material, likely low strip mining and is still open at depth and along strike at all three deposits within the Link Zone

- A higher-grade core within the MRE of approximately 100kt @ 2.0g/t Au for +6koz illustrates the potential for modest scale mining operations that is synergistic and value- accretive to the larger scale development of Brightstar’s Menzies and Laverton Gold Projects

- Pre-Feasibility Study work streams for the Menzies and Laverton Gold Projects are underway with drilling to be completed at the Link Zone and Aspacia deposits in Q4

- Further work planned for Link Zone to advance the deposit includes infill & extensional drilling, fast-tracking mining approvals and assessing mining scenarios

Brightstar’s Managing Director, Alex Rovira, commented “We are excited to announce this latest increase to our gold inventory, with the new ounces at Link Zone providing strong potential for future near-term mining scenarios.

In addition to completing the necessary approvals, permitting and mine planning, Brightstar are also assessing whether Link Zone can be extracted under a mining joint venture similar to the current Selkirk mining JV, on a stand-alone basis in the short term or alternatively in conjunction with proposed open pit mining activities at Menzies which is presently being advanced as part of our Pre-Feasibility Study.

The Link Zone prospect is a near surface opportunity with potential for strong economics given the shallow depth to mineralisation and favourable ore body geometry.

With the PFS work streams underway, RC drilling will be commencing this quarter at the Menzies Gold Project, focusing on infill/extensional drilling at Link Zone (for potential fast-tracked development optionality) and at the high-grade Aspacia Prospect, which represents significant potential to delineate a maiden high-grade mineral resource for inclusion in the PFS mine plan. The previous BTR drilling in Q2/Q3 highlighted the grades at Aspacia (up to 40g/t Au) and with a historic mined head grade of +30g/t Au1, Aspacia represents a potential high-grade underground mining operation at Menzies that sits outside the impressive economics highlighted in the recent Scoping Study.”

As shown in Tables 1 & 3, Brightstar’s resources at Menzies have increased to 525koz with global resources expanding to 1,036,000oz due to the increased resource base at Link Zone, which sits halfway between Lady Shenton and Lady Harriet and approximately 2km south of the Menzies townsite.

Technical Discussion – Link Zone

ABGM Pty Ltd (ABGM), were engaged by Brightstar Resources Ltd to undertake a maiden Mineral Resource Estimate for the three “Link Zone” Gold Deposits following completion of recent drill programs and re- interpretation of historic data. The following text is a summary of their report issued to Brightstar.

Project Location

The MGP is centred on the town of Menzies which lies 130km north of Kalgoorlie and is accessed by the Goldfields Highway and then by well-maintained shire roads and exploration tracks as outlined in Figure 2. The railway from Kalgoorlie-Leonora also services Menzies.

Click here for the full ASX Release

This article includes content from Brightstar Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BTR:AU

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

08 January

Brightstar Resources

Emerging gold producer and district-scale resource developer in Western Australia

Emerging gold producer and district-scale resource developer in Western Australia Keep Reading...

03 March

Brightstar Secures US$120M Bond to Fund Goldfields Project

Brightstar Resources (BTR:AU) has announced Brightstar Secures US$120M Bond to Fund Goldfields ProjectDownload the PDF here. Keep Reading...

02 March

Results of Oversubscribed Share Purchase Plan

Brightstar Resources (BTR:AU) has announced Results of Oversubscribed Share Purchase PlanDownload the PDF here. Keep Reading...

22 February

High-grade Assays incl 4m @ 26.7g/t Au in Sandstone Drilling

Brightstar Resources (BTR:AU) has announced High-grade assays incl 4m @ 26.7g/t Au in Sandstone drillingDownload the PDF here. Keep Reading...

16 February

GNG: Preferred Contractor - Laverton Processing Plant

Brightstar Resources (BTR:AU) has announced GNG: Preferred Contractor - Laverton Processing PlantDownload the PDF here. Keep Reading...

04 February

High grade assays continue from Sandstone RC drilling

Brightstar Resources (BTR:AU) has announced High grade assays continue from Sandstone RC drillingDownload the PDF here. Keep Reading...

19h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

20h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00