October 09, 2023

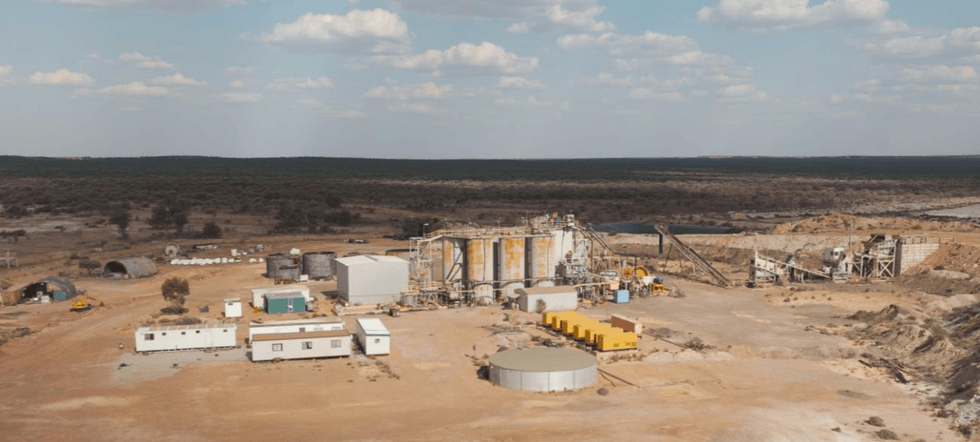

Brightstar Resources Limited (ASX: BTR) (Brightstar, or the Company) is pleased to provide an update regarding its ongoing assessment of the Brightstar Processing Facility (Brightstar Plant) located south- east of Laverton.

Following release of the Company’s recent Scoping Study (Menzies and Laverton Gold Project Mine Restart Study, ASX Announcement 06/09/2023), Brightstar is progressing with work streams under its Pre- Feasibility Study regarding the refurbishment and expansion of the Brightstar Plant to support further potential increased throughput and consequential increased annual production profile from its Laverton operations.

As part of these works, Brightstar commissioned an independent valuation of the mill and associated site infrastructure. The purpose of this report is to inform the appropriate level of insurance cover to protect these strategic assets while the Company continues its regional development and assessment of potential options to commence accelerated production operations.

This report has valued the Brightstar Plant and associated infrastructure at $60.9 million on an “as new” replacement value basis.

Brightstar’s Managing Director, Alex Rovira, commented:

“The Brightstar Processing Plant and related infrastructure represents a significant advantage from a time and cost perspective for Brightstar as we advance towards re-start of mining operations at the Menzies and Laverton Gold Projects. As outlined in the recently released Scoping Study, the ability to execute a low-cost refurbishment and expansion of the processing infrastructure is a key strategic advantage for the Company that differentiates Brightstar from other aspiring WA gold explorers and developers. We are actively assessing opportunities to further increase the throughput of the mill to 1Mtpa to support an increased production profile at our Laverton Gold Project.”

The $60 million value on an ‘as new’ basis for the existing processing and associated infrastructure represents a significant cost that we do not have to incur to build our mining operations, which in the context of continued challenging debt and equity capital markets is an important asset for our business. Many of the components of the plant are brand new and have never operated since being installed, including the gravity circuit and 450kW ball mill below."

Click here for the full ASX Release

This article includes content from Brightstar Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BTR:AU

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

08 January

Brightstar Resources

Emerging gold producer and district-scale resource developer in Western Australia

Emerging gold producer and district-scale resource developer in Western Australia Keep Reading...

4h

Strategic $180M capital raising funds Goldfields development

Brightstar Resources (BTR:AU) has announced Strategic $180M capital raising funds Goldfields developmentDownload the PDF here. Keep Reading...

30 January

Quarterly Activities/Appendix 5B Cash Flow Report

Brightstar Resources (BTR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Updated Goldfields Feasibility Study

Brightstar Resources (BTR:AU) has announced Updated Goldfields Feasibility StudyDownload the PDF here. Keep Reading...

29 January

Updated Goldfields DFS Presentation

Brightstar Resources (BTR:AU) has announced Updated Goldfields DFS PresentationDownload the PDF here. Keep Reading...

28 January

Trading Halt

Brightstar Resources (BTR:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

30 January

Editor's Picks: Gold and Silver Prices Hit New Highs, Then Drop — What's Next?

Gold and silver are wrapping up a record-setting week once again. Starting with gold, the yellow metal left market participants hanging last week after finishing just shy of US$5,000 per ounce. However, it made up for it in spades this week, breaking through that level and continuing on up to... Keep Reading...

30 January

Lobo Tiggre: Gold, Silver Hit Record Highs, Next "Buy Low" Sector

Did gold and silver just experience a blow-off top, or do they have more room to run? Lobo Tiggre, CEO of IndependentSpeculator.com, shares his thoughts on what's going on with the precious metals, and how investors may want to position.Don't forget to follow us @INN_Resource for real-time... Keep Reading...

30 January

Ross Beaty: Gold, Silver in "Bubble Territory," What Happens Next?

Ross Beaty of Equinox Gold (TSX:EQX,NYSEAMERICAN:EQX) and Pan American Silver (TSX:PAAS,NASDAQ:PAAS) shares his thoughts on gold and silver's record-setting runs. While high prices are exciting, he noted that even US$50 per ounce silver is good for miners. "At the end of the day, there's still... Keep Reading...

30 January

Is it Time to Take Profits? Experts Share Gold and Silver Strategies in Vancouver

Optimism was building at last year’s Vancouver Resource Investment Conference (VRIC), with fresh capital flowing back into the mining sector, lifting project financings and investor portfolios alike.This year's VRIC, which ran from January 25 to 26, saw that optimism tip into outright... Keep Reading...

30 January

Adoption of Omnibus Incentive Plan & Private Placement Update

iMetal Resources Inc. (TSXV: IMR,OTC:IMRFF) (OTCQB: IMRFF) (FSE: A7VA) ("iMetal" or the "Company"). The Company confirms shareholders approved the adoption of a new omnibus incentive plan (the "Plan") at the annual general and special meeting (the "Meeting") of shareholders held on August 7,... Keep Reading...

30 January

Flow Metals Announces Closing of Shares for Debt

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to announce that, further to its news release dated January 23, 2026, it has closed a debt settlement transaction (the "Debt Settlement") with certain insiders' of the Company pursuant to which the Company settled... Keep Reading...

Latest News

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00