November 25, 2022

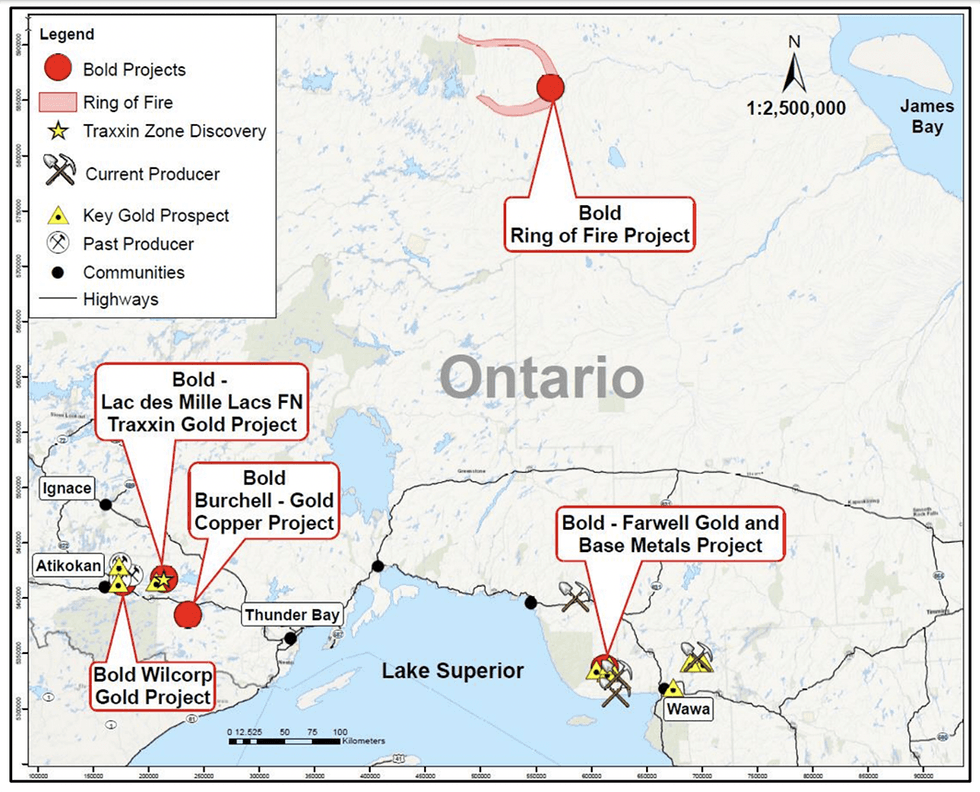

Bold Ventures (TSX.V:BOL) focuses on precious and critical mineral assets in Northwestern Ontario demonstrating dual focus on precious metals and critical minerals, to create consistent value with gold and meet the growing demand for battery and critical metals. Bold Ventures’ projects are located within three active regions throughout Ontario: Thunder Bay West, Wawa West and the Ring of Fire camp located in the James Bay Lowlands. The Thunder Bay West projects contain gold and copper mineralization, while Wawa West and James Bay have assets with copper, nickel, zinc, silver and PGE mineralization.

The Traxxin gold project, west of Thunder Bay, has hosted numerous high-grade gold intersections in drilling. The most recent of which intersected 3.6 g/t gold over 12.3 meters. The project is a joint venture between Bold Ventures, as the operator, and Lac des Milles First Nation, where the joint venture can earn up to 100 percent of the property. The company’s additional assets include projects known for gold and for base metals needed for the growing clean energy market.

Company Highlights

- Bold Ventures is a Canadian mineral exploration company focused on exploring and developing its precious and critical mineral projects in Northern Ontario.

- The company owns and operates several projects throughout three key regions of Ontario: Thunder Bay West, James Bay Lowlands-Ring of Fire and Wawa West.

- The Traxxin gold project is a notable joint venture partnership between Lac des Milles First Nation and Bold Ventures, with the partners earning up to a 100 percent ownership of the property. Bold Ventures is the operator of the agreement.

- The Koper Lake Project is located 300 meters from the Ring of Fire Metals’ (formerly Noront and then Wyloo) flagship Eagle’s Nest Nickel-Copper deposit. It hosts a large chromite resource and attractive nickel potential.

- Bold Ventures’ management team has decades of experience within the mining sector. The management and technical team have participated in three world-class discoveries and have the right experience to guide the company toward its goals.

This Bold Ventures Inc. profile is part of a paid investor education campaign.*

Click here to connect with Bold Ventures (TSX.V:BOL) to receive an Investor Presentation

BOL:CA

Sign up to get your FREE

Bold Ventures Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

06 November 2025

Bold Ventures

Developing precious and critical mineral assets in mining-friendly Ontario

Developing precious and critical mineral assets in mining-friendly Ontario Keep Reading...

4h

The True Value of Olympic Gold: Beyond Metal and Market Prices

As organizers award the medals for the Milan Cortina 2026 Winter Olympics, fans and spectators alike may have pondered a singular question at some point: how much is an Olympic gold medal actually worth?The short answer is far less—and far more—than most people assume.Don’t forget to follow us... Keep Reading...

5h

Tajiri Discovers Potentially Economic Gold Mineralization in Multiple Trenches at Yono Property Including: 12m@ 2.4 g/t; 20m@ 1.4g/t; 8m@ 1.0g/t; 18m@ 0.8g/t & 4m@ 5.5g/t Gold; Bordered by G Mining Ventures Oko West and G2 Goldfields Oko Properties, Guyana

Tajiri Resources Corp. (TSXV: TAJ) ("Tajiri" or the "Company") is pleased to report results from its ongoing Phase II trenching program at the majority owned Yono Project, Guyana, which indicate three significant gold zones potentially hosting economic mineralisation. All results are given in... Keep Reading...

Latest News

Sign up to get your FREE

Bold Ventures Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00