January 22, 2025

Description:

Shaw and Partners' recent research note, dated December 16, 2024, highlights a promising outlook for silver in 2025, emphasizing Boab Metals' (ASX:BML) strategic position to benefit from this trend.

With its flagship Sorby Hills Project in Western Australia, the company is poised to capitalize on rising silver demand and constrained global supply. The report highlights Sorby Hills' robust metrics, including a pre-tax net present value (NPV) of AU$411 million and a pre-tax internal rate of return (IRR) of 37 percent, underpinned by low operating costs and a significant lead-silver concentrate output.

The analyst firm also underscores the importance of the binding offtake agreement with Trafigura, which includes a US$30 million prepayment, providing financial flexibility and market access. Boab Metals' advanced project timeline and favorable economics position it as a standout player in the silver sector.

Key Insights:

- Silver Market Dynamics: The report identifies two primary drivers for silver's anticipated strength: its historical correlation with a rising gold price and increasing demand from the solar panel industry. This uptick is largely attributed to the solar sector, which has seen its share of silver consumption rise from around 5 percent in 2015 to approximately 14 percent in 2023.

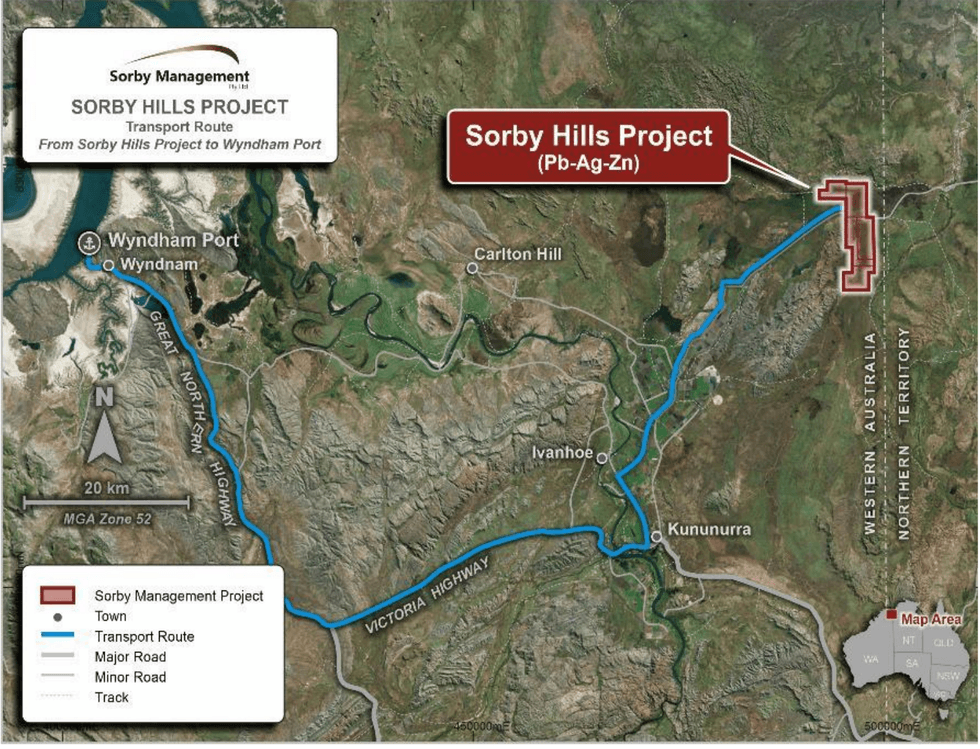

- Sorby Hills Project: Boab Metals' Sorby Hills Project, located in Western Australia's Kimberley Region, stands out as one of the most advanced silver projects on the ASX. The project's Front-End Engineering and Design study, completed in June 2024, outlines compelling metrics: an upfront capital expenditure of AU$264 million, an average C1 cost of US$0.36 per pound of payable lead (inclusive of silver credits), a pre-tax NPV of AU$411 million, a pre-tax IRR of 37 percent, and an average annual EBITDA of AU$126 million.

- Offtake Agreement and Financing: A significant milestone for Boab Metals is the binding offtake agreement with Trafigura for the lead-silver concentrate from Sorby Hills. This agreement includes a US$30 million prepayment, bolstering the project's financing strategy. Additionally, the company is exploring debt funding opportunities with entities like the Northern Australia Infrastructure Facility, which offers concessional loans for infrastructure projects in northern Australia.

- Lead Market Perspective: Contrary to common misconceptions, the report underscores that lead consumption has been on an upward trajectory, averaging a 3.2 percent annual increase from 2004 to 2023. The forecast anticipates continued growth at 2.2 percent annually through 2030, driven by sustained demand in various industrial applications.

For the full analyst report, click here.

This content is intended only for persons who reside or access the website in jurisdictions with securities and other applicable laws which permit the distribution and consumption of this content and whose local law recognizes the scope and effect of this Disclaimer, its limitation of liability, and the legal effect of its exclusive jurisdiction and governing law provisions [link to Governing Law section of the Disclaimer page].

Any investment information contained on this website, including third party research reports, are provided strictly for informational purposes, are general in nature and not tailored for the specific needs of any person, and are not a solicitation or recommendation to purchase or sell a security or intended to provide investment advice. Readers are cautioned to seek the advice of a registered investment advisor regarding the appropriateness of investing in any securities or investment strategies mentioned on this website.

BML:AU

The Conversation (0)

09 January 2025

Boab Metals Limited

Advancing toward near-term lead and silver production in Western Australia

Advancing toward near-term lead and silver production in Western Australia Keep Reading...

07 September 2025

Extension of Option to Acquire 100% of Sorby Hills

Boab Metals Limited (BML:AU) has announced Extension of Option to Acquire 100% of Sorby HillsDownload the PDF here. Keep Reading...

03 September 2025

EPBC Approval Granted for Sorby Hills

Boab Metals Limited (BML:AU) has announced EPBC Approval Granted for Sorby HillsDownload the PDF here. Keep Reading...

30 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Boab Metals Limited (BML:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

23 June 2025

Completion of Capital Raising

Boab Metals Limited (BML:AU) has announced Completion of Capital RaisingDownload the PDF here. Keep Reading...

16 June 2025

A$6 Million Placement to Advance the Sorby Hills Project

Boab Metals Limited (BML:AU) has announced A$6 Million Placement to Advance the Sorby Hills ProjectDownload the PDF here. Keep Reading...

27 February

Obonga Project: Wishbone VMS Update

Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to provide an update for the Obonga Project's Wishbone Prospect which is an emerging and highly prospective base metal volcanogenic massive sulphide ("VMS") system in Ontario,... Keep Reading...

26 February

Agadir Melloul Mining Licence

Critical Mineral Resources is pleased to announce that a Mining Licence has been awarded for Agadir Melloul, marking an important step forward as the Company accelerates development towards production.The Mining License is 14.6km 2 and covers Zone 1 North and Zone 2, which remain the focus of... Keep Reading...

26 February

EIA Approval for Agdz Cu-Ag Project and Funding

Aterian plc (AIM: ATN), the Africa-focused critical metals exploration company, is pleased to announce the approval of it's recently commissioned Environmental Impact Assessment (''EIA'') for the 100%-owned Agdz Mining Licence, part of the Agdz ("Cu-Ag") Project ("Agdz" or the "Project") in the... Keep Reading...

25 February

Clem Chambers: I Sold My Gold and Silver, What I'm Buying Next

Clem Chambers, CEO of aNewFN.com, explains why he sold his gold and silver, and where he's looking next, mentioning the copper and oil sectors. He also speaks about the importance of staying positive as an investor: "The media negativity is the most wealth-crushing thing you can fall for. So be... Keep Reading...

25 February

What Was the Highest Price for Silver?

Like its sister metal gold, silver has been attracting renewed attention as a safe-haven asset. Although silver continues to exhibit its hallmark volatility, a silver bull market is well underway. Experts are optimistic about the future, and as the silver price's momentum continues in 2026,... Keep Reading...

23 February

Stefan Gleason: Silver Wakeup in the West — What's Happening, What's Next

Stefan Gleason, CEO of Money Metals, breaks down recent silver and gold dynamics, discussing trends in the US retail market, as well as backups at refineries. While the situation has begun to normalize, he sees potential for further disruptions in the future. Don't forget to follow us... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00