December 22, 2024

Description

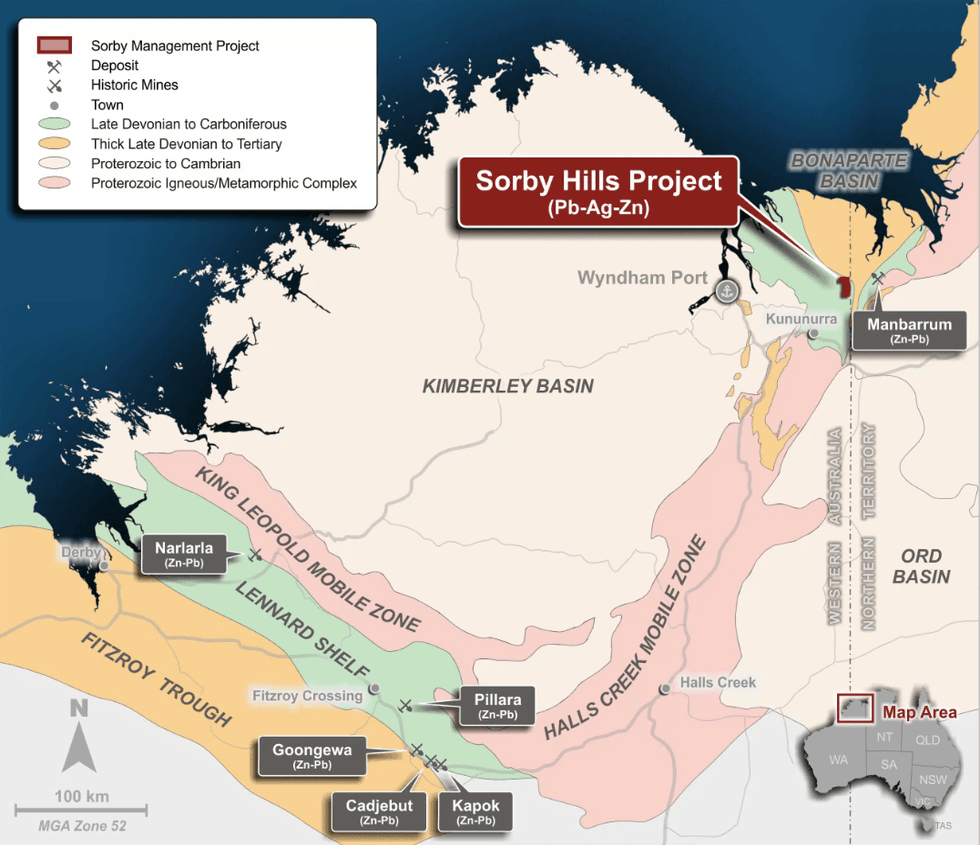

In a game-changing move, Boab Metals (ASX:BML) has locked in crucial funding for its Sorby Hills Project, a significant lead-silver resource nestled in Australia. This financial boost not only fortifies the company's position but also lessens its dependence on equity markets. It's a pivotal stride towards the project's Final Investment Decision (FID), which is on the horizon for late 2025.

Key Financial Highlights

- Financing Structure: The deal comes with attractive terms - a SOFR + 5 percent interest rate spanning five years, kicking off with an 18-month interest-only period.

- FEED Study Results: The recent Front-End Engineering & Design (FEED) study unveiled some eye-catching figures:

- C1 operating cost: A lean US$0.36 per pound of payable lead

- Net Present Value (NPV8): A whopping AU$411 million

- Internal Rate of Return (IRR): An impressive 37 percent

- Strategic Acquisition: Boab is upping the ante, set to snag an extra 25 percent stake in Sorby Hills from its joint venture partner for AU$23 million, showcasing its faith in the project's potential.

Investment Potential

Market watchers are buzzing about Boab Metals, and here's why it's catching their eye:

- Rock-Solid Fundamentals: The FEED study's results paint a picture of a project with robust profit potential and promising returns.

- Smart Positioning: By beefing up its ownership in Sorby Hills, Boab is doubling down on a project that's ripe with growth opportunities.

- Market Sweet Spot: The Sorby Hills Project is perfectly poised to ride the wave of growing global demand for lead and silver.

- Green Credentials: The project's sustainable metal production aligns with eco-friendly trends, potentially drawing in environmentally conscious investors.

Project Development Progress

Securing this funding is more than just a financial win - it's a crucial stepping stone towards the Sorby Hills Project's Final Investment Decision. This progress speaks volumes about Boab Metals' commitment and savvy ability to navigate the tricky terrain of resource development.

Conclusion

Boab Metals' recent triumphs with the Sorby Hills Project - from bagging favorable funding to stellar FEED study results - position it as a tantalizing prospect in the mining sector. The project's blend of sustainable metal production, robust economics, and strategic importance suggests that Boab Metals could be a goldmine for investors looking to dip their toes in the lead and silver markets.

As with any investment, it's crucial to do your homework and weigh the risks before taking the plunge. That said, the recent developments at Boab Metals are certainly turning heads in the resource sector, making it a company worth keeping on your radar.

For the full analyst report, click here.

This content is intended only for persons who reside or access the website in jurisdictions with securities and other applicable laws which permit the distribution and consumption of this content and whose local law recognizes the scope and effect of this Disclaimer, its limitation of liability, and the legal effect of its exclusive jurisdiction and governing law provisions [link to Governing Law section of the Disclaimer page].

Any investment information contained on this website, including third party research reports, are provided strictly for informational purposes, are general in nature and not tailored for the specific needs of any person, and are not a solicitation or recommendation to purchase or sell a security or intended to provide investment advice. Readers are cautioned to seek the advice of a registered investment advisor regarding the appropriateness of investing in any securities or investment strategies mentioned on this website.

The Conversation (0)

09 January 2025

Boab Metals Limited

Advancing toward near-term lead and silver production in Western Australia

Advancing toward near-term lead and silver production in Western Australia Keep Reading...

27 February

Obonga Project: Wishbone VMS Update

Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to provide an update for the Obonga Project's Wishbone Prospect which is an emerging and highly prospective base metal volcanogenic massive sulphide ("VMS") system in Ontario,... Keep Reading...

26 February

Agadir Melloul Mining Licence

Critical Mineral Resources is pleased to announce that a Mining Licence has been awarded for Agadir Melloul, marking an important step forward as the Company accelerates development towards production.The Mining License is 14.6km 2 and covers Zone 1 North and Zone 2, which remain the focus of... Keep Reading...

26 February

EIA Approval for Agdz Cu-Ag Project and Funding

Aterian plc (AIM: ATN), the Africa-focused critical metals exploration company, is pleased to announce the approval of it's recently commissioned Environmental Impact Assessment (''EIA'') for the 100%-owned Agdz Mining Licence, part of the Agdz ("Cu-Ag") Project ("Agdz" or the "Project") in the... Keep Reading...

25 February

Clem Chambers: I Sold My Gold and Silver, What I'm Buying Next

Clem Chambers, CEO of aNewFN.com, explains why he sold his gold and silver, and where he's looking next, mentioning the copper and oil sectors. He also speaks about the importance of staying positive as an investor: "The media negativity is the most wealth-crushing thing you can fall for. So be... Keep Reading...

25 February

What Was the Highest Price for Silver?

Like its sister metal gold, silver has been attracting renewed attention as a safe-haven asset. Although silver continues to exhibit its hallmark volatility, a silver bull market is well underway. Experts are optimistic about the future, and as the silver price's momentum continues in 2026,... Keep Reading...

23 February

Stefan Gleason: Silver Wakeup in the West — What's Happening, What's Next

Stefan Gleason, CEO of Money Metals, breaks down recent silver and gold dynamics, discussing trends in the US retail market, as well as backups at refineries. While the situation has begun to normalize, he sees potential for further disruptions in the future. Don't forget to follow us... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00