April 05, 2022

Feed Stocks Delivered and Ready for Piloting

Blackstone Minerals Limited ("Blackstone" or the "Company") is pleased to inform investors that key nickel and cobalt feed stocks for the Ta Khoa Refinery Piloting Program have been delivered to the ALS Metallurgical Laboratory in Balcatta Western Australia, and the contractor is in final preparation to commence piloting in April.

Key piloting preparation activities recently completed include:

- Safe completion of 541m of underground development for the ongoing bulk sample project delivering 2,088t of disseminated sulfide (DSS) sample to the mill for processing

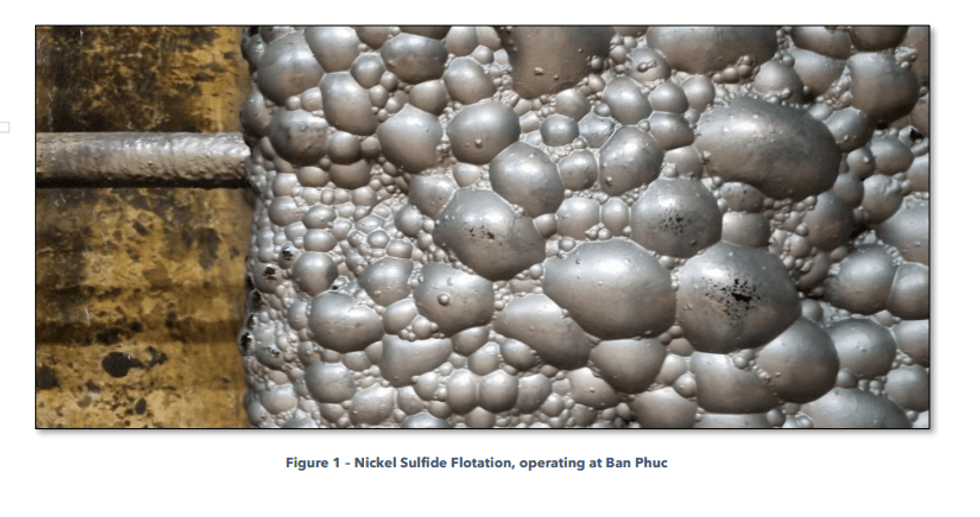

- Successful restart and operation of the Ban Phuc nickel concentrator, and processing of 1,400t of DSS sample ore (refer Figure 1)

- Delivery of 24.5t of samples to ALS Laboratories including:

- 7.5t of Ban Phuc sulfide flotation product

- 10t of sulfide flotation products from Trafigura

- 6t of sulfide flotation products from other third-party sources

- It of Cobalt Hydroxide (from Trafigura) as low-cost alternative to battery grade cobalt sulfate

- Fabrication and installation of the Ta Khoa Upstream Pilot plant at Ban Phuc.

Scott Williamson, Blackstone's Managing Director, said:

"The Ban Phuc mining, processing and maintenance teams have worked tirelessly to refurbish and recommission the Ban Phuc nickel concentrator. Blackstone is excited to commence the Ta Khoa piloting program with ALS, as we continue to de-risk the project.

"Blackstone is committed to sustainable mining and its development plans to recommence full commercial scale operations in Vietnam. As we progress further into pilot plant testing and feasibility studies, we will continue to advance our engagement and collaboration with potential partners and customers for our vertically integrated development strategy."

Click here for the full ASX Release

This article includes content from Blackstone Minerals Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BSX:AU

Sign up to get your FREE

Blackstone Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

25 July 2025

Blackstone Minerals

A diversified developer of battery-grade nickel and copper-gold assets in Southeast Asia

A diversified developer of battery-grade nickel and copper-gold assets in Southeast Asia Keep Reading...

27 January

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals (BSX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

28 December 2025

Managing Director Resignation and Board Changes

Blackstone Minerals (BSX:AU) has announced Managing Director Resignation and Board ChangesDownload the PDF here. Keep Reading...

24 October 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals (BSX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 August 2025

BSX Secures JV Partner & Funding for Ta Khoa Nickel Project

Blackstone Minerals (BSX:AU) has announced BSX Secures JV Partner & Funding for Ta Khoa Nickel ProjectDownload the PDF here. Keep Reading...

25 August 2025

Trading Halt

Blackstone Minerals (BSX:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

16 January

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Ontario government said Tuesday (January 13) that it is accelerating permitting and... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

Latest News

Sign up to get your FREE

Blackstone Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00