October 02, 2024

Chariot Corp Limited (ASX:CC9) (“Chariot” or the “Company”) today announces that it has revised its strategy for the Black Mountain hard rock lithium project in Wyoming U.S.A. (“Black Mountain”) and will shift from exploring for a large-scale resource to testing the viability of establishing a smaller-scale “pilot mine” at Black Mountain (“Pilot Mine”), with the goal of supplying spodumene concentrate to several lithium hydroxide refineries under construction in the southwestern United States.

HIGHLIGHTS:

- NEW STRATEGY: Chariot has revised its strategy for Black Mountain and now envisions a ”Pilot Mine” at Black Mountain in Wyoming, U.S.A., that could rapidly produce spodumene concentrate to capitalize on the growing lithium supply deficit in the U.S. market

- RESOURCE DEFINITION TARGET: Phase 2 drilling aims to define a high-priority, small-scale lithium resource (minimum JORC (2012) Indicated category) to underpin the Pilot Mine and establish the foundation for future larger-scale resource definition

- PHASE 2 DRILL PROGRAM: Chariot will conduct a reverse circulation drilling program at Black Mountain, drilling a total of up to 43 holes and up to 4,300 metres of total drilling (which may be completed in stages through the balance of 2024 and early 2025)

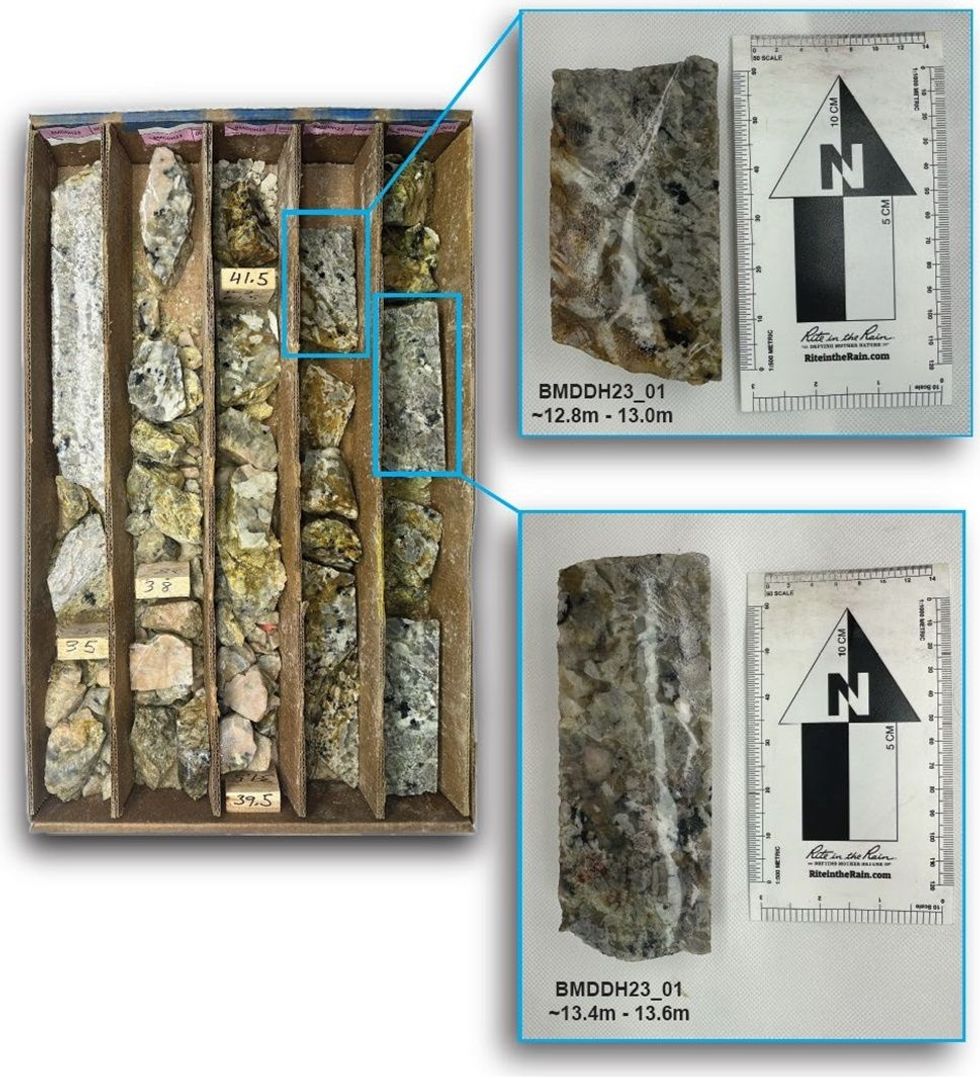

- METALLURGICAL TESTING: Chariot has approximately 200 kg of mineralized HQ diamond drill core in storage in Wyoming which will be transported to Perth for metallurgical testing by an experienced Perth-based metallurgical laboratory facility

- URGENT SUPPLY NEEDS: U.S. lithium demand is projected to surge by 2030, creating an urgency for new domestic supply sources

- WYOMING’S STRATEGIC ADVANTAGE: Wyoming’s small-mine permit system offers a pathway for the establishment of a pilot mine

- COST-EFFICIENT MODULAR PLANT DESIGN: The contemplated modular plant design is expected to reduce upfront costs and offer flexibility to scale up rapidly

- LONG-TERM VISION: The Pilot Mine strategy could provide short-term cash flow and potentially could optimize the development of larger-scale mining operations in the future

The following factors relating to the Black Mountain Project render it particularly suitable for the establishment of a Pilot Mine:

1) Indications of near-surface lithium mineralization at Black Mountain makes it suitable for a shallow, open-pit Pilot Mine.

2) Wyoming’s advantageous small-mine permit system offers a pathway for small mine permits that does not impose limits on the mineral volume which can be extracted but rather places annual limits on the mining activities to 10 acres (4.05 hectares) of disturbance and 35,000 cubic yards (26,760 cubic metres) of overburden removal (refer Part 3 of this announcement).

3) Black Mountain’s proximity to U.S. lithium hydroxide refineries currently under construction in the southwestern United States is expected to provide a geographic advantage in marketing product extracted from the Pilot Mine.

1. Target Small-scale Lithium Resource Definition

The Black Mountain Phase 2 drilling program (“Phase 2 Drilling Program”) will be completed during the coming months within the 5 acre disturbance limit applicable under the existing “Notice of Intent” level drill permit. The Phase 2 Drilling Program will seek to:

1) Quickly and cost-effectively define a small-scale lithium resource (at a minimum JORC (2012) “Indicated” category level of confidence) to support the construction of a Pilot Mine (“Small-scale Lithium Resource”).

2) Advance the understanding of mineralization and geology to identify drilling targets for further exploration of the project and delineation of a resource to support future large-scale mining.

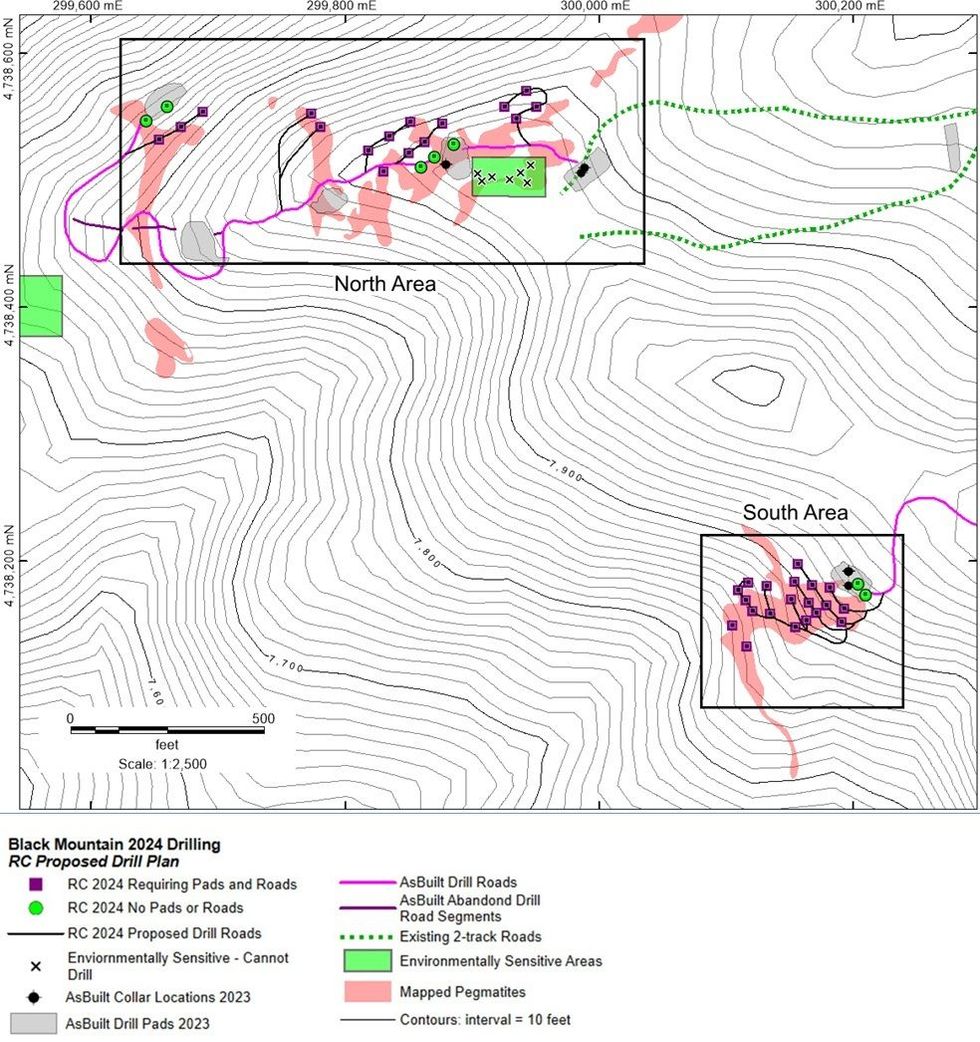

The Phase 2 Drilling Program will be focused on the two southern pegmatite outcrops (Figure 1) which exhibit high fractionation (see Chariot’s ASX announcements dated 2 February 2024 and 20 August 2024) and contain spodumene at surface.

A previous drilling program conducted by the Company has already shown at and near-surface lithium mineralisation in these areas (see Chariot’s ASX announcement dated 2 February 2024).

ERM (see Part 4 of this announcement below) has assisted in the development of the Phase 2 Drilling Program. It will consist of up to 43 holes, totaling up to 4,300m of total drilling depth. The drilling method utilized will be small-format reverse circulation (”RC”) drilling, which is a proven method for quick and cost-effective drilling with a minimal disturbance footprint.

As part of its revised strategy for Black Mountain, the Company is replacing the previously announced drilling plans (see Chariot’s ASX announcements dated 19 June 2024) with the Phase 2 Drilling Program.

The Company is in discussions with a drilling company and will commence drilling as soon as an RC drill rig and crew can be redeployed from their current projects.

The Company notes that completion of the full Phase 2 Drilling Program will require additional funding. Discussions regarding potential fundraising are currently underway and the Company will provide further updates as details are finalised.

Click here for the full ASX Release

This article includes content from Chariot Corporation, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CC9:AU

The Conversation (0)

07 February 2025

Chariot Corporation

Largest lithium exploration land holdings in the US

Largest lithium exploration land holdings in the US Keep Reading...

27 March 2025

Second Amendment to Black Mountain Purchase Option

Chariot Corporation (CC9:AU) has announced Second Amendment to Black Mountain Purchase OptionDownload the PDF here. Keep Reading...

26 March 2025

Convertible Note Financing of up to A$2.0 Million

Chariot Corporation (CC9:AU) has announced Convertible Note Financing of up to A$2.0 MillionDownload the PDF here. Keep Reading...

18 February 2025

High-Potential WA Lithium & Gold Tenements Secured

Chariot Corporation (CC9:AU) has announced High-Potential WA Lithium & Gold Tenements SecuredDownload the PDF here. Keep Reading...

31 January 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Chariot Corporation (CC9:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

26 November 2024

Black Mountain Phase 2 Program has Commenced

Chariot Corporation (CC9:AU) has announced Black Mountain Phase 2 Program has CommencedDownload the PDF here. Keep Reading...

5h

Lake Johnston drill program testing extensions to Xmas Gold Discovery and Medcalf Lithium Resource

Charger Metals NL (ASX: CHR, “Charger” or the “Company”) is pleased to provide a drilling progress update at its 100%-owned Lake Johnston Lithium and Gold Project (“Lake Johnston”) in the Yilgarn, Western Australia. Charger has completed a total of 3,054m drilling this quarter to date, including... Keep Reading...

10 March

Laguna Verde CEOL Terms Agreed with Chilean Government

CleanTech Lithium (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is delighted to announce that the Company and the Mining Ministry in Chile have formally agreed the contractual terms on which the Special Lithium Operating... Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00