October 02, 2024

Chariot Corp Limited (ASX:CC9) (“Chariot” or the “Company”) today announces that it has revised its strategy for the Black Mountain hard rock lithium project in Wyoming U.S.A. (“Black Mountain”) and will shift from exploring for a large-scale resource to testing the viability of establishing a smaller-scale “pilot mine” at Black Mountain (“Pilot Mine”), with the goal of supplying spodumene concentrate to several lithium hydroxide refineries under construction in the southwestern United States.

HIGHLIGHTS:

- NEW STRATEGY: Chariot has revised its strategy for Black Mountain and now envisions a ”Pilot Mine” at Black Mountain in Wyoming, U.S.A., that could rapidly produce spodumene concentrate to capitalize on the growing lithium supply deficit in the U.S. market

- RESOURCE DEFINITION TARGET: Phase 2 drilling aims to define a high-priority, small-scale lithium resource (minimum JORC (2012) Indicated category) to underpin the Pilot Mine and establish the foundation for future larger-scale resource definition

- PHASE 2 DRILL PROGRAM: Chariot will conduct a reverse circulation drilling program at Black Mountain, drilling a total of up to 43 holes and up to 4,300 metres of total drilling (which may be completed in stages through the balance of 2024 and early 2025)

- METALLURGICAL TESTING: Chariot has approximately 200 kg of mineralized HQ diamond drill core in storage in Wyoming which will be transported to Perth for metallurgical testing by an experienced Perth-based metallurgical laboratory facility

- URGENT SUPPLY NEEDS: U.S. lithium demand is projected to surge by 2030, creating an urgency for new domestic supply sources

- WYOMING’S STRATEGIC ADVANTAGE: Wyoming’s small-mine permit system offers a pathway for the establishment of a pilot mine

- COST-EFFICIENT MODULAR PLANT DESIGN: The contemplated modular plant design is expected to reduce upfront costs and offer flexibility to scale up rapidly

- LONG-TERM VISION: The Pilot Mine strategy could provide short-term cash flow and potentially could optimize the development of larger-scale mining operations in the future

The following factors relating to the Black Mountain Project render it particularly suitable for the establishment of a Pilot Mine:

1) Indications of near-surface lithium mineralization at Black Mountain makes it suitable for a shallow, open-pit Pilot Mine.

2) Wyoming’s advantageous small-mine permit system offers a pathway for small mine permits that does not impose limits on the mineral volume which can be extracted but rather places annual limits on the mining activities to 10 acres (4.05 hectares) of disturbance and 35,000 cubic yards (26,760 cubic metres) of overburden removal (refer Part 3 of this announcement).

3) Black Mountain’s proximity to U.S. lithium hydroxide refineries currently under construction in the southwestern United States is expected to provide a geographic advantage in marketing product extracted from the Pilot Mine.

1. Target Small-scale Lithium Resource Definition

The Black Mountain Phase 2 drilling program (“Phase 2 Drilling Program”) will be completed during the coming months within the 5 acre disturbance limit applicable under the existing “Notice of Intent” level drill permit. The Phase 2 Drilling Program will seek to:

1) Quickly and cost-effectively define a small-scale lithium resource (at a minimum JORC (2012) “Indicated” category level of confidence) to support the construction of a Pilot Mine (“Small-scale Lithium Resource”).

2) Advance the understanding of mineralization and geology to identify drilling targets for further exploration of the project and delineation of a resource to support future large-scale mining.

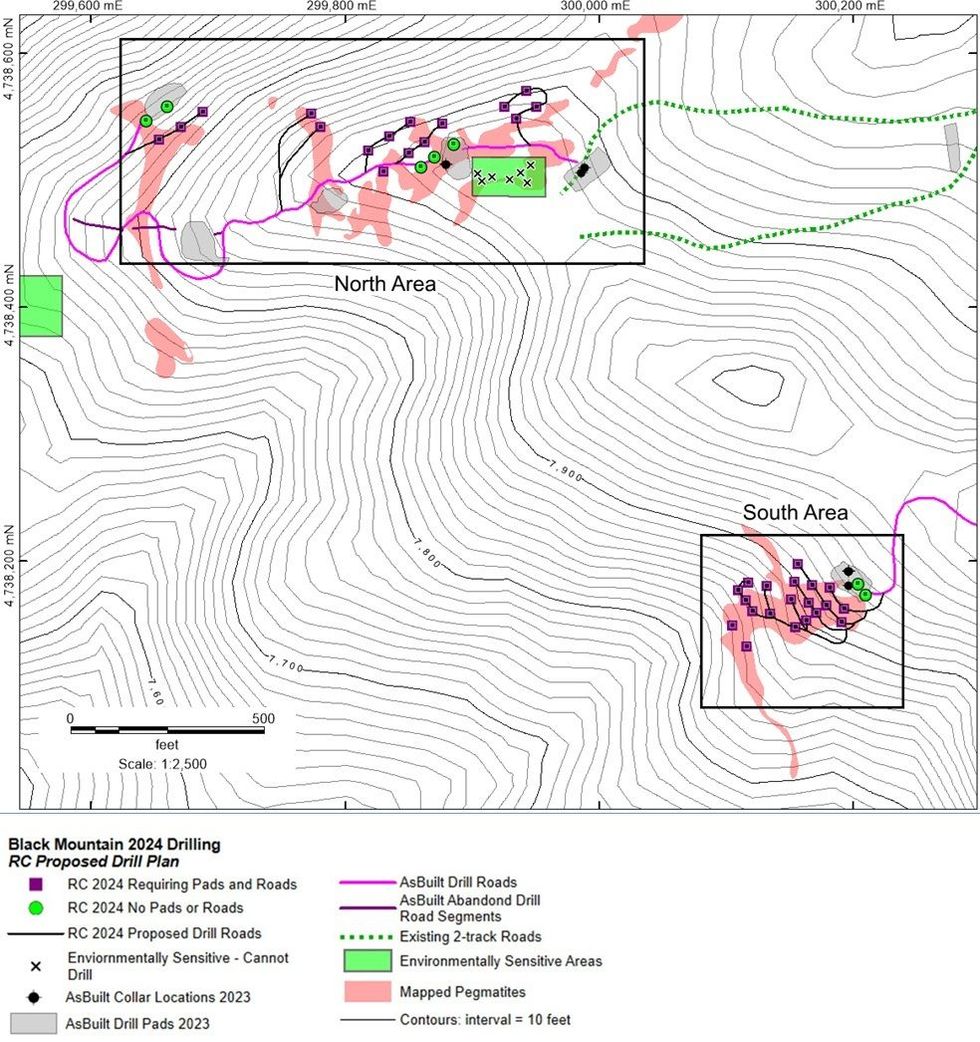

The Phase 2 Drilling Program will be focused on the two southern pegmatite outcrops (Figure 1) which exhibit high fractionation (see Chariot’s ASX announcements dated 2 February 2024 and 20 August 2024) and contain spodumene at surface.

A previous drilling program conducted by the Company has already shown at and near-surface lithium mineralisation in these areas (see Chariot’s ASX announcement dated 2 February 2024).

ERM (see Part 4 of this announcement below) has assisted in the development of the Phase 2 Drilling Program. It will consist of up to 43 holes, totaling up to 4,300m of total drilling depth. The drilling method utilized will be small-format reverse circulation (”RC”) drilling, which is a proven method for quick and cost-effective drilling with a minimal disturbance footprint.

As part of its revised strategy for Black Mountain, the Company is replacing the previously announced drilling plans (see Chariot’s ASX announcements dated 19 June 2024) with the Phase 2 Drilling Program.

The Company is in discussions with a drilling company and will commence drilling as soon as an RC drill rig and crew can be redeployed from their current projects.

The Company notes that completion of the full Phase 2 Drilling Program will require additional funding. Discussions regarding potential fundraising are currently underway and the Company will provide further updates as details are finalised.

Click here for the full ASX Release

This article includes content from Chariot Corporation, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CC9:AU

The Conversation (0)

07 February 2025

Chariot Corporation

Largest lithium exploration land holdings in the US

Largest lithium exploration land holdings in the US Keep Reading...

27 March 2025

Second Amendment to Black Mountain Purchase Option

Chariot Corporation (CC9:AU) has announced Second Amendment to Black Mountain Purchase OptionDownload the PDF here. Keep Reading...

26 March 2025

Convertible Note Financing of up to A$2.0 Million

Chariot Corporation (CC9:AU) has announced Convertible Note Financing of up to A$2.0 MillionDownload the PDF here. Keep Reading...

18 February 2025

High-Potential WA Lithium & Gold Tenements Secured

Chariot Corporation (CC9:AU) has announced High-Potential WA Lithium & Gold Tenements SecuredDownload the PDF here. Keep Reading...

31 January 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Chariot Corporation (CC9:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

26 November 2024

Black Mountain Phase 2 Program has Commenced

Chariot Corporation (CC9:AU) has announced Black Mountain Phase 2 Program has CommencedDownload the PDF here. Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00