April 27, 2025

Nutritional Growth Solutions Limited (ASX:NGS) ("NGS" or "the Company"), is pleased to announce that it has received binding commitments for the issue of 1,000,000 convertible notes (Placement CNs), to be issued at $1.00 each (CN Placement).

HIGHLIGHTS

- NGS has secured commitments of A$1.0 million under a placement of convertible notes.

- Under the placement, 1,000,000 convertible notes will be issued at A$1.00 each, with the conversion of the convertible notes into ordinary shares in NGS at a price of between A$0.03 and A$0.025 per ordinary share to occur within 10 business days of NGS shareholders approving their conversion including for the purposes of ASX Listing Rule 7.1.

- Each investor who is issued with ordinary shares on conversion of the convertible notes will be issued with one option for each fully paid ordinary share that is issued on conversion of the convertible notes, with that issuance of options to take place on the same date as the ordinary share issuance date. This is expected to be within 10 business days of NGS shareholders approving that issuance of options including for the purposes of ASX Listing Rule 7.1. These options will be exercisable on a 1:1 basis into fully paid ordinary shares in NGS at an exercise price of $0.04 per option, and will expire 3 years following their issue date if they have not been exercised during that 3 year period.

- The placement of convertible notes was supported by Australian sophisticated and professional investors.

- Funds raised from the placement of convertible notes will be used to purchase inventory for retail expansion in CVS and Wakefern, as well as working capital and corporate expenses.

The offer of the Placement CNs was made to sophisticated and professional investors in Australia and successfully closed, achieving binding commitments of A$1.0 million.

Stephen Turner, NGS CEO and Managing Director, commented on the CN Placement:

“We are very pleased with the strong support shown by investors in this placement, which provides important growth capital to support our retail expansion into leading U.S. retailers, including CVS and Wakefern. We would like to thank our shareholders for their ongoing support as we execute our growth strategy and build on the momentum from our recent distribution achievements.”

The conversion of the convertible notes into fully paid ordinary shares in NGS will take place at a price of between A$0.03 and A$0.025 per ordinary share within 10 business days of NGS shareholders approving their conversion including for the purposes of ASX Listing Rule 7.1. NGS expects to convene a general meeting of its shareholders to consider whether to approve the conversion of the convertible notes into fully paid ordinary shares in NGS and whether to approve the issuance of options within the next few weeks.

Until the convertible notes are converted into ordinary shares or redeemed, they bear interest which is payable quarterly in arrear at either 10% per annum (if the holder of the convertible notes elects not to receive ordinary shares in NGS in lieu of cash interest), or 15% per annum (if the holder of the convertible notes elects to receive ordinary shares in NGS in lieu of cash interest). Issuance of ordinary shares in NGS in lieu of cash interest is subject to NGS being in compliance with the ASX Listing Rules. If the convertible notes have not been converted by the date that is 2 years after their issue date, they will be redeemed by NGS at their issue price.

Each investor who is issued with ordinary shares on conversion of the convertible notes will be issued with one option for each fully paid ordinary share that is issued on conversion of the convertible notes, with that issuance of options to take place on the same date as the ordinary share issuance date. This is expected to be within 10 business days of NGS shareholders approving that issuance of options including for the purposes of ASX Listing Rule 7.1. These options will be exercisable on a 1:1 basis into fully paid ordinary shares in NGS at an exercise price of $0.04 per option, and will expire 3 years following their issue date if they have not been exercised during that 3 year period (the CN Holder Options). Quotation of the CN Holder Options on the ASX will be sought.

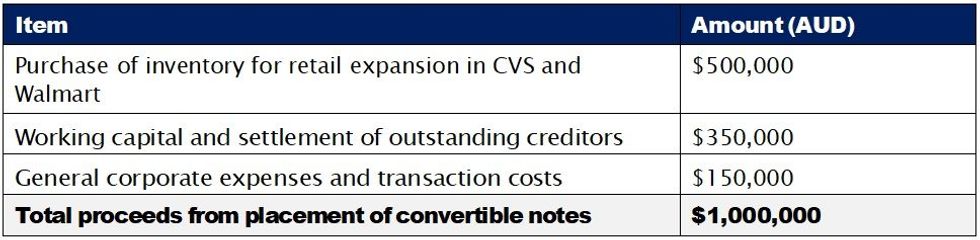

USE OF PROCEEDS

The net proceeds from the issue of the convertible notes are planned to be used in the following areas:

LEAD MANAGER OPTIONS

The Company engaged GBA Capital Pty Ltd (AFSL 544680) to act as lead manager for the CN Placement (Lead Manager).

Under the terms of the mandate with the Lead Manager, the Lead Manager will be issued with 30% of the number of CN Holder Options (the Lead Manager Options). The Lead Manager Options will be exercisable on a 1:1 basis into fully paid ordinary shares in NGS at an exercise price of $0.04 per Lead Manager Option. The Lead Manager Options will expire 3 years following their issue date if they have not been exercised during that 3 year period.

The Lead Manager Options will be issued within 10 business days of NGS shareholders approving that issuance including for the purposes of ASX Listing Rule 7.1. NGS expects the Lead Manager Options to be issued at the same time as the issuance of the CN Holder Options. Quotation of the Lead Manager Options on the ASX will be sought.

Click here for the full ASX Release

This article includes content from Nutritional Growth Solutions Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00