Bayhorse Silver Inc, (TSXV: BHS) (OTCQB: BHSIF) (FSE: 7KXN) (" Bayhorse" or the "Company") reports it has increased the known extent of mineralization at the Bayhorse Silver Mine, to over 400 m E-W (1,312 feet) and 560 m (1850 ft) N-S with a now known vertical extent of 91 m (300 ft).

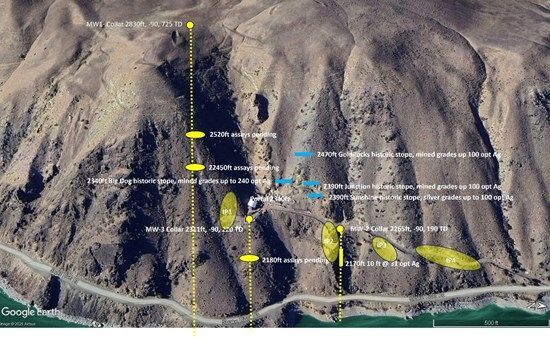

Two new mineralized zones have been confirmed at 310 ft and 380 ft under RC hole MW-1,a 725 foot vertical hole that was collared at 862 m (2,830 ft) ASL elevation, and 365 m (1200 ft) S-W of the Bayhorse Mine portal. The new zone lies 198 m (650 ft) S-W of the historic "Goldilocks" historic mined area at a similar elevation, where mined rounds grading up to 100 oz/t silver were partially mined in 1984 (Silver King Mines, 1984).

A second new mineralized zone has also been identified 30m (100 feet) under RC hole MW-3, a 220 foot vertical hole that was collared 36.6 m (120 ft) S-E of the Bayhorse Mine portal at 713 m (2340 ft) ASL elevation, and which is 126 m (415 ft) south from, and at the same elevation as the recently announced 3 m (10 ft) intersection of 917 g/t (29.6 opt) reported in the Company's news release BHS2025-12, and BHS-2015-16. The width and thickness of the new zones is unknown at this time.

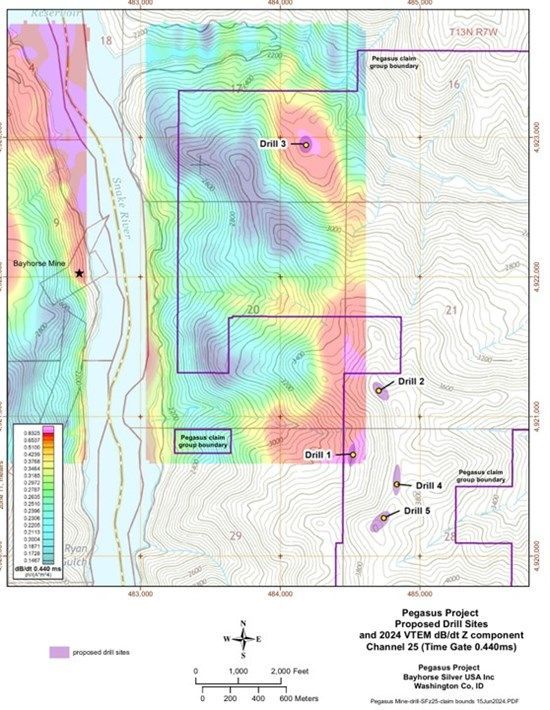

Bayhorse CEO Graeme O'Neill comments that, "By significantly extending the known areas of high-grade silver mineralization, further dill testing and sampling may lead to an increase in the Company's National Instrument 43-101 inferred resource of 292,300 tons at a grade of 21.65 opt (673 g/t) for 6.3 million ounces of silver) (Turner et al. 2018). With the Bayhorse and Pegasus claims renewed until August 2026, we are looking to extend the Bayhorse Silver mineralization onto our adjacent "760 m (2,500 ft ) apart, nearly 9 sq/km (4 sq/mile) Pegasus project with our upcoming IP survey, that may also identify the presence of potential porphyry copper mineralization."

Figure 1. Identified silver bearing zones 1920-1924 average mined grade 33 oz/t Ag. 1% Cu. 1925 average mined grade 29.56 oz/t Ag, 1984 average mined grade 18.5 oz/t Ag (Minex, 2008).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5015/263075_b6151432542c4aef_001full.jpg

Figure 2. Bayhorse Mine and Pegasus proximity

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5015/263075_b6151432542c4aef_002full.jpg

Quality Assurance/Quality Control ("QA/QC") Measures, Chain of Custody

Drill cuttings were split and placed in sealed bags for preparation and subsequent analysis. The balance of the cuttings are retained in secure storage at the Mine. Silver fire assays will be conducted by Christopherson Inc. Umpire Assayers, Smelterville, Idaho. using 30g fire assay with a gravimetric finish for silver. The sample pulps created at Christopherson Inc. will then be submitted to Paragon Geochemical's Sparks, Nevada facility for a 35 element suite using Paragon's 35 AR-OES (Aqua Regia digestion) & ICP (Induced Coupled Plasma) multi-element method. Samples showing anomalous silver in the 35 element scan will also be assayed for silver using Ag 30g fire assay, AQR/digest/AAS or OES finish.

A blank was inserted at the start of the sample submittal and a prepared standard inserted every twenty samples. One duplicate was also inserted into the sample stream. The samples were stored in a secure facility on the property then transported to the laboratory in a secure container in a pickup truck by the project geologist.

This News Release has been prepared on behalf of the Bayhorse Silver Inc. Board of Directors, which accepts full responsibility for its content. Mark Abrams, AIPG, a Qualified Person, and a Director of the Company, has prepared, supervised the preparation of, or approved the technical content of this news release.

On Behalf of the Board.

Graeme O'Neill, CEO

866-399-6539

About Bayhorse Silver Inc.

Bayhorse Silver Inc. is an exploration and production company with a 100% interest in the historic Bayhorse Silver Mine located in Oregon, USA with a National Instrument 43-101 inferred resource of 292,300 tons at a grade of 21.65 opt (673 g/t) for 6.3 million ounces of silver). (Turner et al. 2018) and the Pegasus Project, in Washington County, Idaho. The Bayhorse Silver Mine and the Pegasus Project are 44 km southwest of Hercules Metals' porphyry copper discovery. The Bayhorse Mine is a minimum environmental impact facility capable of processing at a mining rate up 200 tons/day that includes a state of the art 40 ton per hour Steinert Ore-Sorter that reduces waste rock entering the processing stream by up to 85%. The Company has established an up to 60 ton/day mill and standard flotation processing facility in nearby Payette County, Idaho, USA. The Company has an experienced management and technical team with extensive mining expertise in both exploration and building mines.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/263075