- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

September 19, 2023

Basin Energy Limited (ASX:BSN) (‘Basin’ or the ‘Company’) is pleased to provide an update on exploration activities at its 60% owned Geikie Uranium Project (‘Geikie’ or the ‘Project’), located on the eastern margin of the world-class Athabasca Basin in Canada.

Key Highlights

- Maiden drilling program at Geikie intersects anomalous uranium in four of the eight holes drilled. Significant intersections include;

- 0.5m at 0.27% U3O8 (2,680ppm U3O8) from 185m (GKI-002)

- 9m at 263ppm U3O8 from 84m within a broader 27m uranium anomalous intersection (GKI-004)

- Elevated lead isotope anomalies and extensive hydrothermal alteration observed in five holes indicate potential for a major uranium mineralising system

- The drilling results supported an immediate Airborne Gravity Survey designed to map alteration systems which is now complete and results expected early October

- This is an effective targeting technique that has mapped similar basement-hosted uranium alteration systems within the Athabasca Basin

- Basin remains fully funded to conduct follow up drill program in the winter season

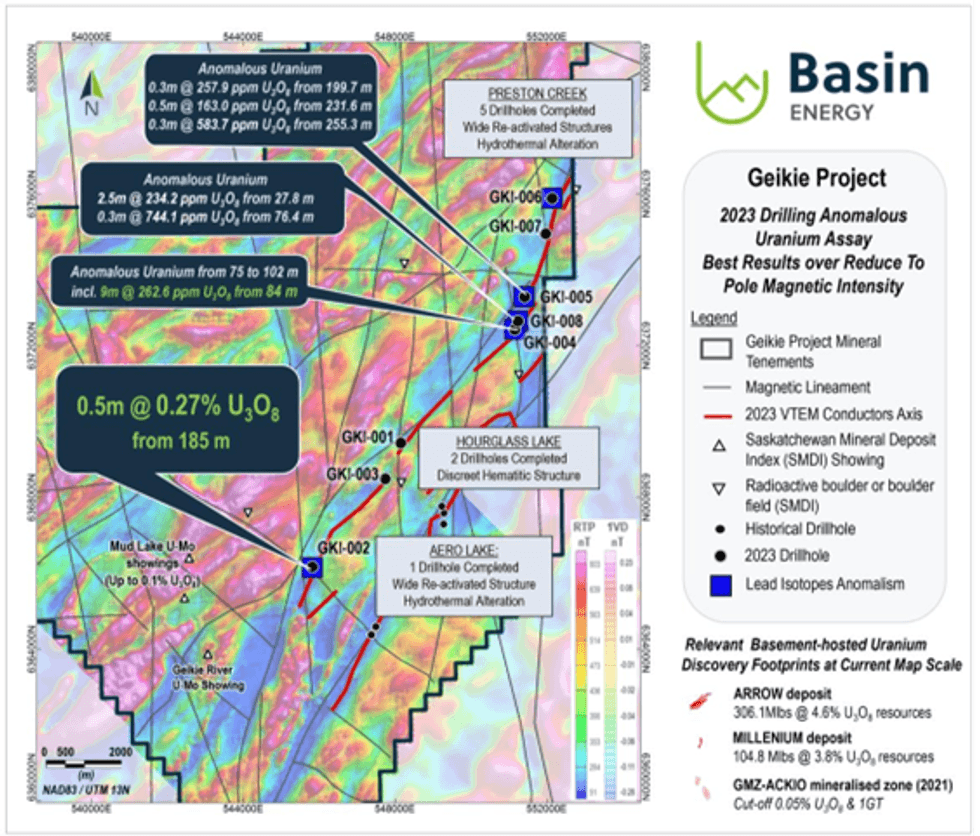

Basin’s maiden drilling program at Geikie consisted of eight (8) diamond drill holes for 2,217 metres (Figure 1) and was completed in August 2023. All geochemical assay results have now been received and the results are highly encouraging.

Drilling has successfully identified uranium mineralisation, with assays up to 0.27% U3O8. Uranium mineralisation is located proximal to two regionally significant structures at Aero Lake and Preston Creek with associated extensive hydrothermal alteration indicative of large uranium mineralising systems. Furthermore, an extensive geochemical pathfinder halo has been identified at Preston Creek, characteristic of uranium mineralising systems seen elsewhere in the district.

Basin is now awaiting the results of its high resolution airborne gradient gravity survey, specifically designed to map the extent of alteration along the now proven fertile fault corridors. These results along with the exciting data from the maiden drilling program will form the basis for follow-up targeting for the Company’s upcoming phase two drilling program planned for early 2024.

Basin’s Managing Director, Pete Moorhouse, commented:

“Basin’s maiden drill program has identified significant uranium mineralisation within a system that is demonstrating the scale potential to produce a major discovery.

The presence of uranium, along with a coherent pattern of pathfinder elements associated with extensive and pervasive hydrothermal alteration, which is typical of basement mineralisation of the Athabasca Basin, is an excellent result for our maiden drill program.

We eagerly await the results of the now completed gravity survey, which has been specifically designed to map the extent of alteration discovered to date. This will drive the planning for the next phase of drill testing as we explore this emerging, historically overlooked portion of the prolific Athabasca Basin.

As the demand for uranium tightens, Basin is strongly positioned with exposure to multiple high quality uranium targets in the world’s leading jurisdiction for uranium discoveries.”

Phase 1 Drilling Geochemical Results

A total of eight (8) drillholes for 2,217 metres were drilled at Geikie this summer on three prospects. Basin’s maiden drilling program targeted potential structural disruption of a 15-kilometre conductive trend visible in the electromagnetic and magnetic data acquired in 2023 and 2022 respectively1.

Drilling successfully identified a series of regionally significant alteration patterns associated with the intersection of north-south and northwest trending faults within the Project area2. Additionally, multiple localised zones of radiometric anomalies were identified. Uranium assay results returned anomalous uranium in three drillholes at Preston Creek and one drillhole at Aero Lake (Figure 1, Table 1).

Drilling at Aero Lake intersected the highest uranium value of the drilling program: 0.27% U3O8 over 0.5 metres starting from 185 metres in GKI-002. This drillhole also intersected hydrothermal alteration consisting of argillization and chloritization spatially associated with large scale brittle-ductile faulting where multiple stages of reactivation were noted.

Drilling at Preston Creek identified anomalous uranium concentrations in excess of 100 ppm U3O8 in drillholes GKI-004, GKI-005 and GKI-008 (Table 1, Figure 1). Drillholes GKI-004, GKI-005 and GKI-008 were drilled in a zone of structural disruption, where a north-south to north-northwest striking Tabbernor Fault is transecting a conductor trend. The drillholes were positioned at a bend in the conductor’s axis where the electromagnetic data identified potential fault splays with stacks of electromagnetic plates. Significant zones of hydrothermal alteration were encountered (Figure 2), commonly observed within or at the periphery of major structures (Figure 3).

Recent studies3 from major basement hosted uranium deposits demonstrated that utilising lead isotope data is a great tool to indicate areas with elevated potential for uranium mineralisation. Basin’s drilling has identified strongly anomalous lead isotope ratios (i.e., 207Pb/206Pb, 208Pb/206Pb vs 206Pb/204Pb) in GKI-004, GKI-005, GKI-006 and GKI-008 (Table 1), associated with anomalous uranium, structured intervals and zones of hydrothermal alteration. Anomalous lead isotopes proximal to mineralisation display radiogenic signatures, with ‘excess lead’ suggestive of derivation from greater uranium concentrations nearby3.

Click here for the full ASX Release

This article includes content from Basin Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BSN:AU

Sign up to get your FREE

Basin Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

31 August 2025

Basin Energy

Targeting uranium and rare earth elements (REEs) in Australia, Canada, Sweden and Finland.

Targeting uranium and rare earth elements (REEs) in Australia, Canada, Sweden and Finland. Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

17 December 2025

Completes phase one drilling and expands Sybella-Barkly

Basin Energy (BSN:AU) has announced Completes phase one drilling and expands Sybella-BarklyDownload the PDF here. Keep Reading...

30 November 2025

Expands REE and Uranium Footprint at Sybella-Barkly

Basin Energy (BSN:AU) has announced Expands REE and uranium footprint at Sybella-BarklyDownload the PDF here. Keep Reading...

11 November 2025

Drilling Commenced for Sybella-Barkly Uranium and Rare Earth

Basin Energy (BSN:AU) has announced Drilling commenced for Sybella-Barkly uranium and rare earthDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Basin Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00