- WORLD EDITIONAustraliaNorth AmericaWorld

September 27, 2023

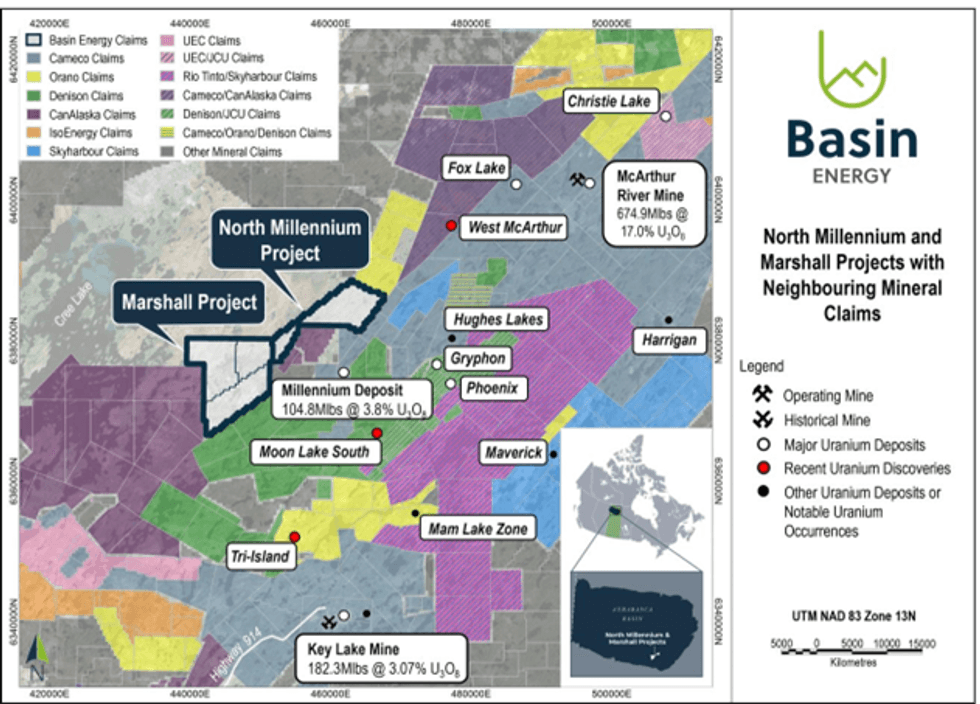

Basin Energy Limited (ASX:BSN) (‘Basin’ or the ‘Company’) is pleased to provide an update on its Marshall Project (the ‘Project’) located in the southeastern part of the world-class Athabasca Basin (Figure 1).

Key Highlights

- 3D inversion of historical geophysical datasets completed1

- Multiple priority anomalies identified above and below the Athabasca unconformity in both sandstone and basement stratigraphy at Marshall

- Positive uranium market sentiment continues to build, with U3O8 SPOT price exceeding US$70/Lb

- Work continues at Geikie Project following maiden drilling program, with airborne gravity survey results expected in October

- Basin remains funded for next round of exploration drilling

As part of our ongoing assessment of the Project, the Company engaged geophysical experts Computational Geosciences Inc. and Convolutions Geoscience to conduct modern 3D inversion and processing works of historic geophysical data. This work has identified multiple geophysical anomalies above and below the Athabasca unconformity within the sandstone and basement stratigraphy at the Marshall Project. The identification of these anomalies is highly encouraging given that little exploration has ever been conducted on these tenements. Basin will utilise these interpretations as a basis for future exploration works, in conjunction with the ongoing works at Geikie.

Basin’s Managing Director, Pete Moorhouse, commented “Basin has continued advancing the Marshall Project through the reprocessing of historic geophysical data – this is a continuation of the recently updated work at North Millennium which identified a significant unconformity target.

The identified sandstone conductivity anomalies, with corresponding basement anomalies provide immediate targets for Athabasca unconformity and basement hosted uranium mineralisation exploration and we are very excited with the results from the review of the historical data.

Combined with Basin’s recent work at North Millennium, the studies support our prospectivity analysis for this area, located within the heartland of the traditional uranium discoveries of the eastern Athabasca.

With U3O8 spot prices continuing to surge, we are positioning Basin in the enviable position of having multiple top-quality exploration targets in the world’s best uranium jurisdiction.”

Current Interpretation of the Marshall Project

The 100% owned Marshall project is located in the southeastern portion of the Athabasca Basin and situated 11 km west of the Millennium deposit, around 50 km southwest of the McArthur River mine.

Minimal historical mineral exploration at the Project occurred between 1979 to 2012, and there are no known historical exploration drill holes. Historical geophysical exploration work was limited to regional- scale airborne surveys, and small-scale airborne and ground-based electromagnetic surveys.

The depth of the unconformity is estimated to be between 700 and 900 metres. Z‐Tipper Axis Electromagnetics (“ZTEM”) was the only geophysical method used to date that appears to accurately detect the location of graphitic basement conductors.

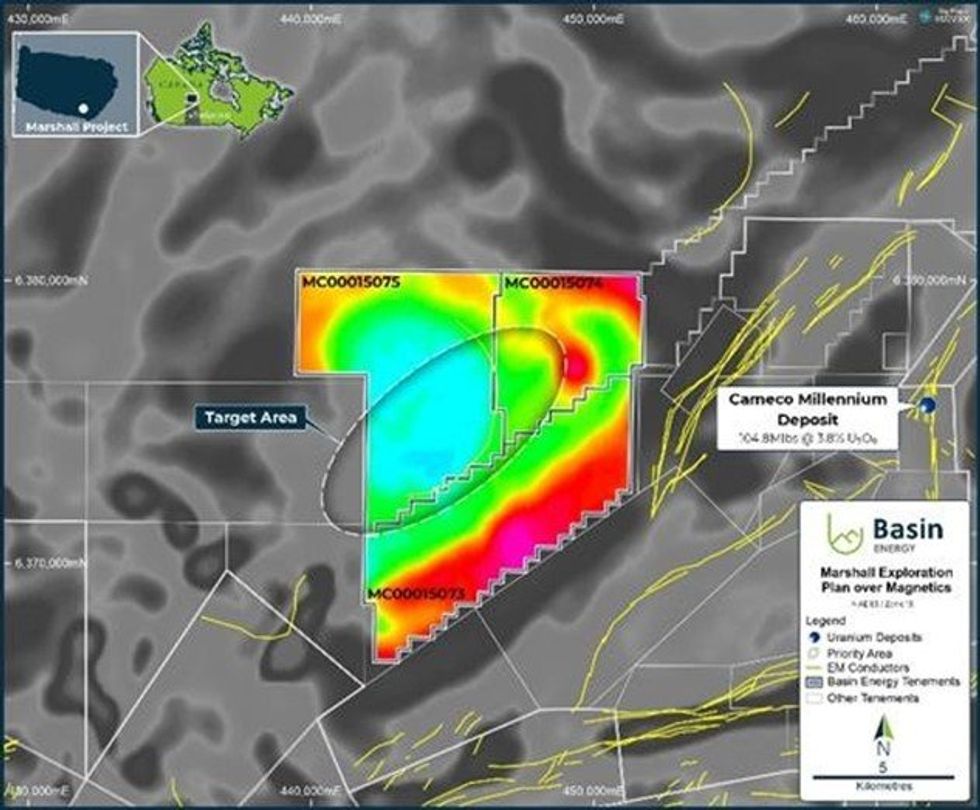

The Marshall Project is centred on an arc-shape magnetic low feature outlined by airborne and ground geophysics. Interpretation of ZTEM and Transient Electromagnetic survey data shows conductive anomalies along the edge of the magnetic low and suggests a deep-rooted fold bearing conductive layers.

3D Inversion of ZTEM data

Computational Geosciences Inc. was contracted to invert a ZTEM dataset collected over Kodiak Exploration’s historical McTavish project partially covering the Marshall mineral claims (Figure 3 and 4). ZTEM is an airborne electromagnetic geophysical technique which detects anomalies in the earth’s natural magnetic field. ZTEM surveys are designed to map resistivity contrasts to great depths, exceeding 1-2 km, making the technique well-suited to unconformity related uranium mineralisation exploration in the Marshall Project area.

3D models of electric conductivity have been produced, accounting for survey geometry and topography, and constrained by a basin-wide unconformity surface. The ZTEM inversion model 200 m below the modelled unconformity surface shows strong conductive anomalies along the edge of the magnetic low (Figure 3) Basin is currently interpreting this arc-shape feature as a deep-rooted fold reminiscent of Mudjatik deformation events. In addition to this, the data highlights a set of north northwest conductive anomalies which are interpreted as possible cross-cutting conductive structures. ZTEM 3D inversion 200 m above the unconformity (Figure 4) shows a number of relative conductivity anomalies in the sandstone, including a NE-SW structure set also highlighted by magnetic data. Basin interprets this to represent the potential presence of alteration within the sandstone, which could have been caused by mineralizing fluids breaching the unconformity contact.

Click here for the full ASX Release

This article includes content from Basin Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BSN:AU

Sign up to get your FREE

Basin Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

31 August 2025

Basin Energy

Targeting uranium and rare earth elements (REEs) in Australia, Canada, Sweden and Finland.

Targeting uranium and rare earth elements (REEs) in Australia, Canada, Sweden and Finland. Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

17 December 2025

Completes phase one drilling and expands Sybella-Barkly

Basin Energy (BSN:AU) has announced Completes phase one drilling and expands Sybella-BarklyDownload the PDF here. Keep Reading...

30 November 2025

Expands REE and Uranium Footprint at Sybella-Barkly

Basin Energy (BSN:AU) has announced Expands REE and uranium footprint at Sybella-BarklyDownload the PDF here. Keep Reading...

11 November 2025

Drilling Commenced for Sybella-Barkly Uranium and Rare Earth

Basin Energy (BSN:AU) has announced Drilling commenced for Sybella-Barkly uranium and rare earthDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Basin Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00