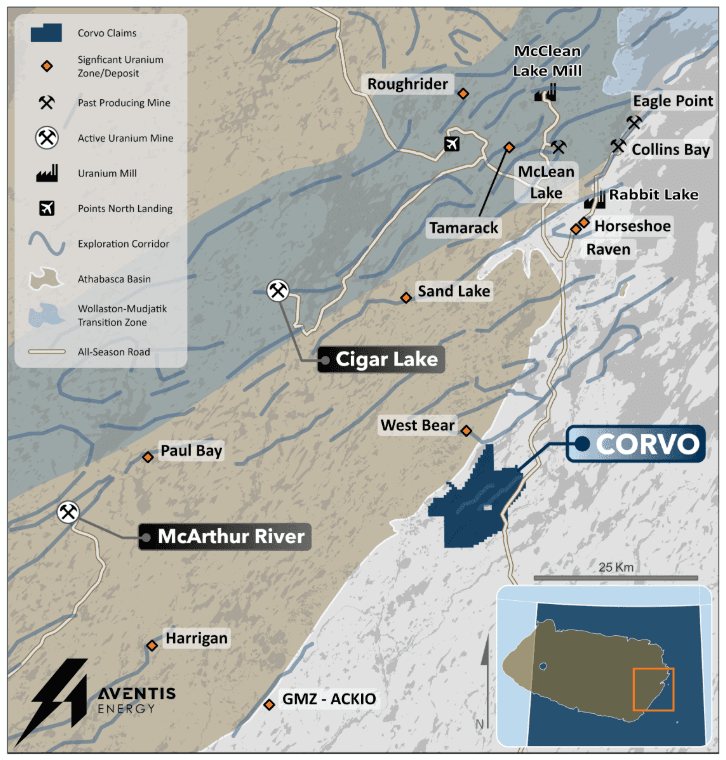

Aventis Energy (" Aventis " or the " Company ") (CSE:AVE | FRA:C0O0 | OTC: VBAMF) is pleased to announce an update from its 2025 exploration program at the Corvo Uranium Project (" Corvo ", or the " Project "), currently under a three-year earn-in option agreement with Standard Uranium Ltd. (" Standard ") (CSE: STND). From July 4 to July 16, 2025, the Company completed a detailed mapping and sampling program across historical uranium showings and zones of interest on the Project.

Highlights:

- Off-Scale** Radioactivity at Surface : Verification of strong radioactivity at the historical Manhattan showing with handheld scintillometer measurements >65,535 counts per second (" cps ") at surface, in addition to 112 further occurrences of highly anomalous*** radioactivity up to 13,500 cps across the Project.

- Discovery of New Radioactive Showings : Scintillometer prospecting uncovered previously undocumented radioactive occurrences across the Project in favorable rock types for uranium and Rare Earth Element (" REE ") mineralization.

- Favorable Uranium Host Rocks : Geological mapping along structural and electromagnetic (" EM ") trends across the Project confirmed the presence of deformed and hydrothermally altered basement lithologies including metasedimentary, calc-silicate, and granitic rocks.

- Ongoing Exploration : An extensive ground gravity survey is being planned for Q4 2025, designed to identify density anomalies potentially representing hydrothermal alteration systems coincident with newly refined EM conductor trends across the Project. A diamond drill program is being planned for Q1 2026 to begin testing targets developed and ranked through the detailed programs executed in 2025.

Michael Mulberry, Chief Executive Officer of the Company, commented, "We are proud to announce preliminary results from our 2025 Exploration Program at the Corvo Project. With the identification of strong radioactivity at the Manhattan showing, and favourable results from geological mapping along key trends at the Project, we are well positioned to complete a near term ground gravity survey."

Figure 1. Regional Map of the Corvo Uranium Project

2025 Prospecting Program – Preliminary Results

Beginning July 4 and concluding July 16, 2025, the technical team completed a detailed mapping, prospecting, and sampling program to ground-truth historical uranium showings at surface on the Project (the " Program "):

- A total of 30 outcrop and boulder grab samples have been submitted to Saskatchewan Research Council Geoanalytical Laboratories in Saskatoon, SK for whole-rock, uranium, and REE geochemical analysis. Results will be released and incorporated into the first NI 43-101 technical report on the Project.

- More than 160 detailed geological observations, structural measurements, and scintillometer readings were taken from several outcrops across the Project within the T-Lake, Dorward, Unnamed, Finger, Snout, Hook, and Sheppard Lake areas.

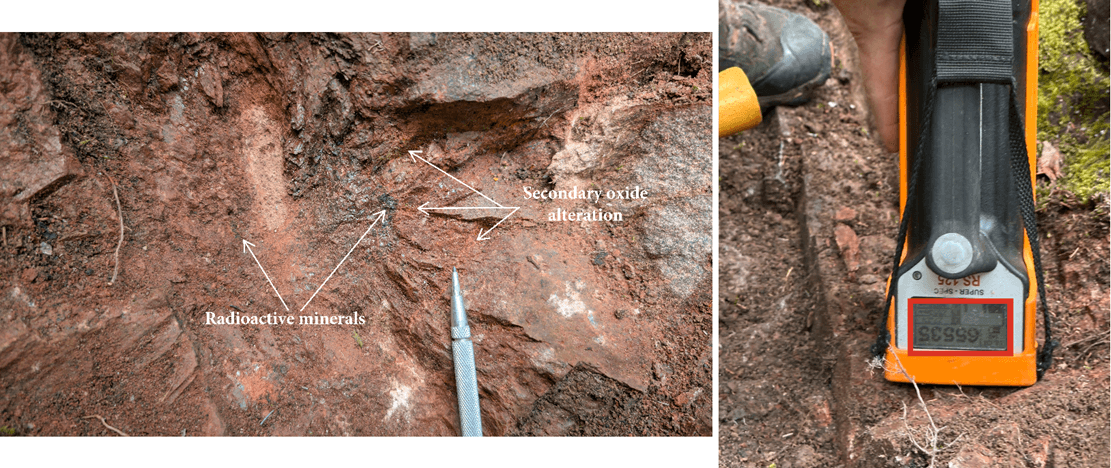

- Prospecting confirmed several uraniferous outcrops and boulders across the Project, including the Manhattan showing (1.19 to 5.98% U3O8) and SMDI showing 2052 (0.137% U3O8 and 2,300 ppm Th). 1 Off-scale radioactivity >65,535 cps was measured at the Manhattan showing (Please see Figures 2 and 3).

- A total of 112 handheld scintillometer readings of anomalous radioactivity >300 cps were recorded, including six measurements >10,000 cps at surface (Please see Figure 4). Prospecting for radioactive boulders and outcrop was completed using handheld RS-120 Super-Scintillometers and RS-125 Super-Spectrometers manufactured by Radiation Solutions Inc.

Figure 2. Close-up photos of fault-controlled mineralization (black vitreous minerals) and secondary iron oxide alteration at surface at the Manhattan showing (Dorward Lake area), reaching >65,535 cps on the RS-125 Super-Spectrometer.

At the Corvo Uranium Project, uranium mineralization is present along a strike length of 800 metres in historical drill holes TL-79-3 (0.057% U3O8 over 3.5 m) to TL-79-5 (0.065% U3O8 over 0.1 m). Recent expansion of the Project adds multiple new data points of uranium anomalism in the south, including surface sample JBWLR011, returning 1,420 ppm U.

Figure 3. Expanded view of fault-controlled mineralization and alteration products on surface at the Manhattan showing, reaching >65,535 cps over more than one metre.

Figure 4. Newly discovered hematized magnetite-rich pegmatitic orthogneiss reaching upwards of 13,500 cps, in the T-Lake area.

Future Exploration Plans

Supplementary geophysical surveys across the Project are being designed to further refine drill targets for an inaugural drill program. The Company plans to complete a high-resolution ground gravity survey across the main conductive trends on the Project, aiming to identify potential hydrothermal alteration halos which could be related to basement-hosted uranium mineralization.

Earlie r this year, Standard Uranium contracte d Axiom Exploration Group Ltd. in partnership wi t h New Resolution Geophysics to carry out a helico p ter-borne Xcite time domain electr o magnetic and total field ma g netic survey over the Project 2 . The survey totalled approximately 1,380 line-kms w ith a traverse line spacing of 100 m and tie-line spacing of 1,000 m. The airborne TDEM survey outlines several kilometers of conductive anomalies and magnetic features in bedrock, effectively enhancing the resolution of more than 29 kilometres of conductive trends on the Project.

The magnetic survey component of the TDEM survey contributes to definition of potential fault systems and structural trends not previously identified across the Project related to historical uranium showings at surface and in historical drill holes.

Ongoing geophysical interpretation and modeling is being completed to integrate historical surveys with newly collected datasets, which will provide high-priority drill targets and significantly derisk the Project prior to modern drilling in 2026.

Qualified Person Statement

The scientific and technical information contained in this news release has been reviewed, verified, and approved by Sean Hillacre, P.Geo., President and VP Exploration of Standard Uranium and a "qualified person" as defined in NI 43-101 – Standards of Disclosure for Mineral Projects.

Historical data disclosed in this news release relating to sampling results from previous operators are historical in nature. Neither the Company nor a qualified person has yet verified this data and therefore investors should not place undue reliance on such data. The Company's future exploration work may include verification of the data. The Company considers historical results to be relevant as an exploration guide and to assess the mineralization as well as economic potential of exploration projects. Any historical grab samples disclosed are selected samples and may not represent true underlying mineralization.

Natural gamma radiation in diamond drill core reported in this news release was measured in counts per second (cps) using a handheld RS-125 super-spectrometer and RS-120 super-scintillometer. Readers are cautioned that scintillometer readings are not uniformly or directly related to uranium grades of the rock sample measured and should be treated only as a preliminary indication of the presence of radioactive minerals. The RS-125 and RS-120 units supplied by Radiation Solutions Inc. ("RSI") have been calibrated on specially designed Test Pads by RSI. Standard Uranium maintains an internal QA/QC procedure for calibration and calculation of drift in radioactivity readings through three test pads containing known concentrations of radioactive minerals. Internal test pad radioactivity readings are known and regularly compared to readings measured by the handheld scintillometers for QA/QC purposes.

References

1 SMDI# 2052: https://mineraldeposits.saskatchewan.ca/Home/Viewdetails/2052 & Mineral Assessment Report MAW00047: Eagle Plains Resources Inc., 2011-2012

2 Standard Uranium Provides Exploration Update Highlighting Results of Gravity and TDEM Surveys on Three Eastern Athabasca Uranium Projects, News Release, March 13, 2025. https://standarduranium.ca/news-releases/standard-uranium-provides-exploration-update-tdem-surveys-on-three-eastern-athabasca-uranium/

*The Company considers uranium mineralization with concentrations greater than 1.0 wt% U3O8 to be "high-grade".

**The Company considers radioactivity readings greater than 65,535 counts per second (cps) on a handheld RS-125 Super-Spectrometer to be "off-scale".

***The Company considers radioactivity readings greater than 300 counts per second (cps) on a handheld RS-125 Super-Spectrometer to be "anomalous".

About Aventis Energy Inc.

Aventis Energy Inc. (CSE: AVE | FRA: C0O0 | OTC: VBAMF) is a mineral exploration company dedicated to the development of strategic projects comprised of battery, base and precious metals in stable jurisdictions. The Company is working to advance its Corvo Uranium & Sting Copper Project.

The Corvo Uranium property has historical drill holes intersected multiple intervals of uranium mineralization, notably along a strike length of 800 metres between historical drill holes TL-79-3 ( 0.116% U 3 O 8 over 1.05 m ) and TL-79-5 ( 0.065% U 3 O 8 over 0.15 m ) 2 . High-grade* Uranium at Surface with the Manhattan showing ( 1.19 to 5.98% U 3 O 8 ) and SMDI showing 2052 ( 0.137% U 3 O 8 and 2,300 ppm Th ).

The Sting Copper Project covers approximately 12,700 hectares and recently had results of 54.8m at 0.32% Cu starting at a depth of 27.0m, with higher-grade intervals including six samples (≥0.5m length) ranging from 0.96% to 5.43% Cu. High grade samples of 0.5m at 2.85% Cu and 0.5m at 1.92% Cu with an additional broader interval of 31.1m at 0.27% Cu.

On Behalf of the Board of Directors

Michael Mulberry

Chief Executive Officer, Director

+1 (604) 229-9772

info@vitalbatterymetals.com

Disclaimer for Forward-Looking Information

This news release includes certain "Forward-Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" under applicable Canadian securities laws. When used in this news release, the words "anticipate", "believe", "estimate", "expect", "target", "plan", "forecast", "may", "would", "could", "schedule" and similar words or expressions, identify forward-looking statements or information.

Forward-looking statements and forward-looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of Aventis, future growth potential for Aventis and its business, and future exploration plans are based on management's reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management's experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of uranium, copper, gold and other metals; costs of exploration and development; the estimated costs of development of exploration projects; Aventis' ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

This news release contains "forward-looking information" within the meaning of the Canadian securities laws. Statements, other than statements of historical fact, may constitute forward looking information and include, without limitation, statements with respect to the Project and its mineralization potential; the Company's objectives, goals, or future plans with respect to the Project; statements with respect to the Program; expected benefits of the Program; and the Company's anticipated exploration program at the Project. With respect to the forward-looking information contained in this news release, the Company has made numerous assumptions regarding, among other things, the geological, metallurgical, engineering, financial and economic advice that the Company has received is reliable and are based upon practices and methodologies which are consistent with industry standards. While the Company considers these assumptions to be reasonable, these assumptions are inherently subject to significant uncertainties and contingencies. Additionally, there are known and unknown risk factors which could cause the Company's actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information contained herein. Known risk factors include, among others: fluctuations in commodity prices and currency exchange rates; uncertainties relating to interpretation of well results and the geology, continuity and grade of uranium, copper, gold and other metal deposits; uncertainty of estimates of capital and operating costs, recovery rates, production estimates and estimated economic return; the need for cooperation of government agencies in the exploration and development of properties and the issuance of required permits; the need to obtain additional financing to develop properties and uncertainty as to the availability and terms of future financing; the possibility of delay in exploration or development programs or in construction projects and uncertainty of meeting anticipated program milestones; uncertainty as to timely availability of permits and other governmental approvals; increased costs and restrictions on operations due to compliance with environmental and other requirements; increased costs affecting the metals industry and increased competition in the metals industry for properties, qualified personnel, and management. All forward-looking information herein is qualified in its entirety by this cautionary statement, and the Company disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events or developments, except as required by law.

The Canadian Securities Exchange (CSE) does not accept responsibility for the adequacy or accuracy of this release.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/e8e733e7-dcb6-4095-8da8-ce86c9ef42f6

https://www.globenewswire.com/NewsRoom/AttachmentNg/d23d1cf1-1881-4c92-b544-929907bbc822

https://www.globenewswire.com/NewsRoom/AttachmentNg/a237ab5b-a971-432e-b537-61b98e4ad47e

https://www.globenewswire.com/NewsRoom/AttachmentNg/598dc24c-5005-4b68-9d4b-de69ab453e53