NORTH BEACON AND NORTH CREST PROJECT HIGHLIGHTS

- Uriniferous boulder train discovered on the North Beacon Project – with grades of up to 11.3% U 3 O 8 – analysis of the boulder train ice direction show they are likely derived from a source coincident with the Snowbird Tectonic Zone, on the Crest Project.

- Geotech's ZTEM and Mag survey was successfully deployed at the North Beacon and North Crest Projects, with a total of 6,905-line km flown.

- The North Beacon Project is located approximately 34 km southwest of the past producing Nisto Mine, near Black Lake and within 18 km to the east of the Fond Du Lac uranium showing, while the North Crest Project is situated 16 km along-trend to the southwest of the Nisto Mine. High prospectivity was discovered at each of the North Beacon Project and North Crest Project:

- The North Beacon Project hosts two locations where uranium mineralization has been discovered.

- The North Crest hosts three locations where uranium mineralization has been discovered.

- Additional uranium showings have been identified on untested structures that extend on to the properties of both Projects, highlighted by a uranium showing that returned 3552 ppm U 3 0 8 in drillhole BL-02 below the unconformity, which is located 10 km from the North Beacon Project and 7 km from the North Crest Project.

- Numerous conductors with interpreted cross-cutting structures were identified across both Projects, with these types of general structures capable of acting as traps for uranium mineralization:

- At the North Beacon Project, the survey identified 88 km of prospective conductors that are associated with sympathetic structures related to the Grease River Shear Zone and the Snowbird Tectonic Zone.

- At the North Crest Project, the survey identified 34 km of prospective conductors that are associated with sympathetic structures related to the Snowbird Tectonic Zone.

- The survey results indicate that both Projects are prospective for hosting Unconformity and Basement styles of uranium mineralization.

ATHA Energy Corp. ( CSE: SASK ) ( FRA: X5U ) ( OTCQB: SASKF ) (" ATHA " or the " Company "), holder of the largest uranium exploration portfolio in two of the highest-grade uranium districts in the world, is pleased to announce results from its large-scale electromagnetic (" EM ") surveys at its 100%-owned North Beacon Project and North Crest Project (together, the " Projects "). The Projects are located in Saskatchewan's Athabasca Basin, within the Company's North Rim Exploration District (the " North Rim Exploration District ").

EXPLORATION OUTLOOK

ATHA's recently announced acquisition of Latitude Uranium (CSE: LUR) (" Latitude ") and 92 Energy (OTCQB: NTELF) (" 92E ") is expected to provide the pro-forma company with a newly diversified portfolio of uranium projects across the exploration risk curve on top of a strong balance sheet to sufficiently capitalize its exploration-at-scale strategy. Going forward, ATHA's exploration approach is designed with the intention of providing maximum exploration exposure by investing at scale in a large number of early-stage projects, while also seeking to deliver advanced exploration upside through the expansion of known uranium deposits and discoveries. Subject to the completion of ATHA's acquisition transactions with 92E and Latitude, ATHA intends to leverage its forecasted $65 million pro-forma cash position to pursue a fully-funded growth strategy with focus on:

- Deposit and Discovery Expansion: Historical resource deposits at the Angilak Deposit and CMB Discoveries, as well as the GMZ Corridor (host to Gemini Discovery) remain underexplored and is expected to provide significant resource and discovery expansion potential on a regional scale.

- Advanced Exploration: Drill ready targets on a number of advanced projects owned by Latitude and 92E have identified uranium mineralization, with active geophysical surveys informing future exploration program decisions by ATHA.

- Greenfield Exploration: Pro-forma land position of 7.1 million acres across some of the highest-grade uranium districts in the world provide ATHA with a robust pipeline of early-stage projects that are currently undergoing geophysical and geochemical analysis.

GREENFIELD EXPLORATION PROGRAM

The completed surveys at the North Beacon and North Crest Projects are part of the Company's maiden 2023 greenfield exploration program, which comprises a total of seventeen EM surveys being conducted across ATHA's current 3.8-million-acre exploration portfolio in the Athabasca Basin. To date, full results have been received and processed from seven of seventeen project areas, resulting in over 377 km of conductive lineaments and the definition of 28 prospective targets that have now been identified across the North Rim, East Rim, and Cable Bay exploration districts. The results from today's announcement represent three of those prospective targets, coincident with uranium mineralization. Additional EM surveys on the remaining twelve projects have also been completed and are now being processed, with the anticipation of those results further defining the prospectivity of the largest exploration portfolio in the Athabasca Basin. The remaining portion of the first phase of ATHA's greenfield strategy in the Athabasca Basin will include the full integration of the 2023 geophysics and regional geochemistry scheduled for completion in the first quarter of 2024.

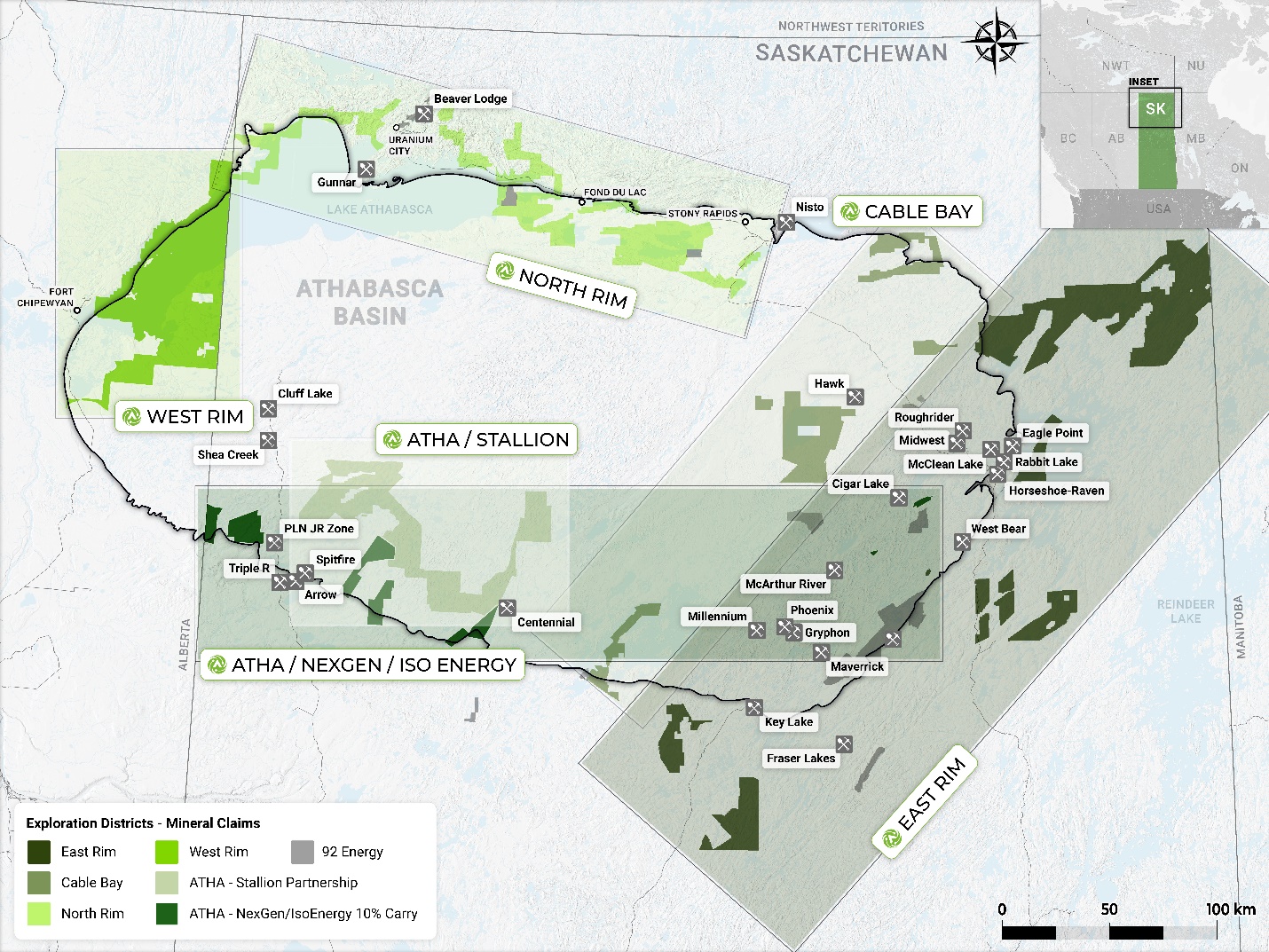

Figure 1: ATHA Energy Land Package & Exploration Districts

Doug Adams, VP Exploration added: "In 2023, ATHA set out to evaluate an industry-leading land position and with a strategy in place to advance 17 projects and 3.4 million acres, ATHA continues to generate high-priority targets in the world's leading uranium district. Historic showings in the area have identified anomalous surface geochemistry coincident with the magnetic lows and conductive highs in the ZTEM. These results have elevated North Beacon and North Crest to be high-tier targets for immediate follow-up exploration. A gravity survey has been scheduled in Q1 of 2024 to further evaluate the 122 km of conductive lineaments."

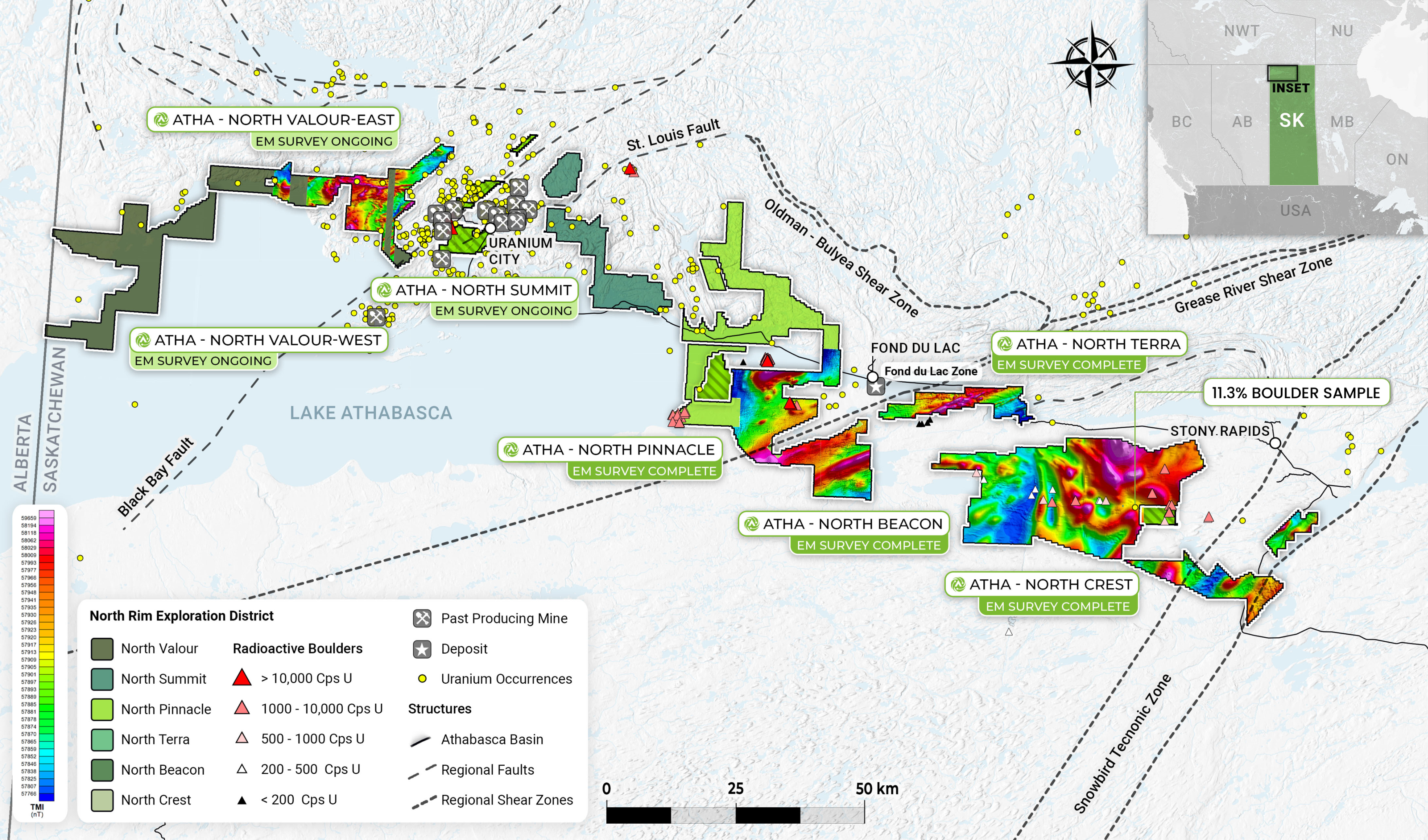

NORTH RIM EXPLORATION PROGRAM

Historic exploration at the North Rim began in the early to mid 1900's with production ending at mines located near Uranium City once the Eldorado mining and milling facility closed in the early 1980's. Uranium in the Beaverlodge Mining District is structurally controlled with mineralization found in vein-filled fractures, breccias, and faults. The North Rim District remains highly prospective and is vastly under explored with modern exploration techniques. Furthermore, mining method innovation, proximity to surface, and the presence of existing infrastructure contribute to the prospectivity of this district.

The North Rim District's exploration program covers a total of 688,268 acres of 100% ATHA owned claims using a combination of Xcite TDEM, ZTEM, MMT, and QMAGt survey types. The objective of the EM program is to identify prospective conductive units such as graphitic sheers and mapping of lithological contacts, which will then be targeted for further investigation. The graphitic sheers are typically formed in pelitic host rock which are known traps for uranium mineralization in the Athabasca Basin.

The North Beacon Project is comprised of 16 mineral claims, totalling 78,435 hectares, positioned in the structural wedge created by the ENE trending Grease River Shear Zone and the northeast trending Snowbird Tectonic Zone. Historic exploration drilling completed in 1967 on the eastern extent of the North Beacon Project intersected anomalous uranium within boulders in the overburden. Unfortunately, drilling did not progress deep enough – approximately 200 m in the North to approximately 800 m in the south – to intersect the unconformity.

The North Crest Project is comprised of 4 mineral claims, totalling 17,797 Hectares that cut across the Snowbird Tectonic Zone, approximately 18 km south of Nisto Mine. Notably, Cameco's Centennial Deposit is an off-conductor deposit of 60MM lbs hanging wall from the conductive corridor of the Snowbird Tectonic Zone and is located 172 km south of North Crest Project. In 2008, exploration on the North Crest Project included four diamond drill holes targeting the southeast margin of the Snowbird Tectonic Zone, in an area similar to the Centennial discovery hole. The upper 100-300 meters of drilling intersected anomalous geochemistry and prospective alteration associated with brittle and brecciated structures that is often indicative of proximal uranium mineralization.

The recently completed EM surveys at North Beacon, North Crest, North Terra, North Pinnacle Projects, and North Valour-East along with the currently ongoing surveys at North Valour-West, and North Summit, notably represent the first modern exploration work on the projects in fifteen years.

Figure 2: Initial Survey Results Over North Rim Exploration District

TRANSACTION UPDATE

On December 7, 2023, ATHA entered into a definitive arrangement agreement with Latitude Uranium pursuant to which ATHA proposes to acquire all of the issued and outstanding shares of Latitude by way of a court-approved plan of arrangement under the Business Corporations Act (Ontario) and entered into a binding scheme of implementation deed with 92 Energy Limited pursuant to which ATHA proposes to acquire all of the issued and outstanding fully paid ordinary shares of 92E by way of a scheme of arrangement pursuant to Part 5.1 of the Australian Corporations Act 2001 (Cth). The ATHA transactions with Latitude and 92E are expected to respectively close in Q1 2024 and Q2 2024.

In connection with the announced transactions, on December 28, 2023 ATHA completed an upsized $23.5 million private placement of charitable federal flow-through common shares ($13.1 million), charitable Saskatchewan flow-through common shares ($6.4 million), and subscription receipts ($4.0 million), with such subscription receipts automatically convertible for one ATHA common share upon closing of the acquisition of Latitude. Upon closing of the transactions, ATHA will become the holder of an unparalleled portfolio of premier uranium assets in a number of the most desirable uranium districts in the world. The portfolio includes 7.1 million acres across three jurisdictions, the high-grade GMZ discovery, and the high-grade Angilak project containing a historic resource of 43.3 million lbs at 0.69% U 3 O 8 . 1

Qualified Person

The scientific and technical information contained in this news release as it relates to the Claims have been reviewed and approved by Chris Brown, P.Geo., a "qualified person" as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects .

About ATHA

ATHA is a mineral exploration company focused on the acquisition, exploration, and development of mineral resource properties. ATHA holds the largest cumulative exploration package in each of the Athabasca Basin and Thelon Basin, two of the world's most prominent basins for uranium discoveries, with 6.4 million total acres along with a 10% carried interest portfolio of claims in the Athabasca Basin operated by NexGen Energy Ltd. (TSX: NXE) and Iso Energy Ltd. (TSX‐V: ISO).

For more information visit www.athaenergy.com

For more information, please contact:

Troy Boisjoli

Chief Executive Officer

Email: troy@athaenergy.com

1-306-460-5353

www.athaenergy.com

Historical Mineral Resource Estimates

All mineral resources estimates presented in this news release are considered to be "historical estimates" as defined under NI 43-101, and have been derived from the following. In each instance, the historical estimate is reported using the categories of mineral resources and mineral reserves as defined by the CIM Definition Standards for Mineral Reserves, and mineral reserves at that time, and these "historical estimates" are not considered by any of the Parties to be current. In each instance, the reliability of the historical estimate is considered reasonable, but a Qualified Person has not done sufficient work to classify the historical estimate as a current mineral resource, and none of ATHA, Latitude or 92E are treating the historical estimate as a current mineral resource. The historical information provides an indication of the exploration potential of the properties but may not be representative of expected results.

Notes on the Historical Mineral Resource Estimate for the Angilak Deposit:

- This estimate is considered to be a "historical estimate" under NI 43-101 and is not considered by any of to be current. See below for further details regarding the historical mineral resource estimate for the Angilak Property.

- Mineral resources which are not mineral reserves do not have demonstrated economic viability.

- The estimate of mineral resources may be materially affected by geology, environment, permitting, legal, title, taxation, sociopolitical, marketing or other relevant issues.

- The quality and grade of the reported inferred resource in this estimation are uncertain in nature and there has been insufficient exploration to define these inferred resources as an indicated or measured mineral resource, and it is uncertain if further exploration will result in upgrading them to an indicated or measured resource category.

- Contained value metals may not add due to rounding.

- A 0.2% U3O8 cut-off was used.

- The mineral resource estimate contained in this press release is considered to be "historical estimates" as defined under NI 43-101 and is not considered to be current.

- Reported by ValOre Metals Corp. in a Technical Report entitled "Technical Report and Resource Update For The Angilak Property, Kivalliq Region, Nunavut, Canada", prepared by Michael Dufresne, M.Sc., P.Geol. of APEX Geosciences, Robert Sim, B.Sc., P.Geo. of SIM Geological Inc. and Bruce Davis, Ph.D., FAusIMM of BD Resource Consulting Inc., dated March 1, 2013.

- As disclosed in the above noted technical report, the historic estimate was prepared under the direction of Robert Sim, P.Geo, with the assistance of Dr. Bruce Davis, FAusIMM, and consists of three-dimensional block models based on geostatistical applications using commercial mine planning software. The project limits area based in the UTM coordinate system (NAD83 Zone14) using nominal block sizes measuring 5x5x5m at Lac Cinquante and 5x3x3 m (LxWxH) at J4. Grade (assay) and geological information is derived from work conducted by Kivalliq during the 2009, 2010, 2011 and 2012 field seasons. A thorough review of all the 2013 resource information and drill data by a Qualified Person, along with the incorporation of subsequent exploration work and results, which includes some drilling around the edges of the historical resource subsequent to the publication of the 2013 technical report, would be required in order to verify the Angilak Property historical estimate as a current mineral resource.

- The historical mineral resource estimate was calculated in accordance with NI 43-101 and CIM standards at the time of publication and predates the current CIM Definition Standards for Mineral Resources and Mineral Reserves (May, 2014) and CIM Estimation of Mineral Resources & Mineral Reserves Best Practices Guidelines (November, 2019).

Cautionary Statement Regarding Forward-Looking Information

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". These forward-looking statements or information may relate to the Transactions, including statements with respect to the expected benefits of the Transactions to ATHA, the ATHA shareholders, the anticipated composition of the Company Board, the anticipated mailing of the 92E scheme booklet, ATHA Circular and Latitude Circular and the date of the 92E Meeting, ATHA Meeting and Latitude Meeting, timing for closing of the Transactions and receiving the required regulatory, ATHA shareholders, 92E Shareholders, Latitude Shareholders and court approvals, stock exchange (including the CSE and ASX) and other approvals, the ability of ATHA, Latitude and 92E to successfully close the Transactions, the terms and closing of the Offering, the incurrence and renunciation of Qualifying Expenditures by ATHA, and the participation therein by any Key Investors on the timing and terms described herein, or at all, the filing of materials on SEDAR+, the successful integration of the businesses of ATHA, Latitude and 92E, the prospects of each companies' respective projects, including mineral resources estimates and mineralization of each project, and any expectations with respect to defining mineral resources or mineral reserves on any of ATHA's, Latitude's and 92E's projects, the anticipated makeup of the Company Board and management, and any expectation with respect to any permitting, development or other work that may be required to bring any of the projects into development or production.

Forward-looking statements are necessarily based upon a number of assumptions that, while considered reasonable by management at the time, are inherently subject to business, market and economic risks, uncertainties and contingencies that may cause actual results, performance or achievements to be materially different from those expressed or implied by forward-looking statements. Such assumptions include, but are not limited to, assumptions regarding the Company following completion of the Transactions, that the anticipated benefits of the Transactions will be realized, completion of the Transactions, including receipt of required shareholder, regulatory, court and stock exchange approvals, the ability of ATHA, 92E and Latitude to satisfy, in a timely manner, the other conditions to the closing of the Transactions, other expectations and assumptions concerning the Transactions, the ability of ATHA, 92E and Latitude to complete its exploration activities as currently expected, and that general business and economic conditions will not change in a material adverse manner. Although each of ATHA, 92E and Latitude have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

Such statements represent the current views of ATHA, 92E and Latitude with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by ATHA, 92E and Latitude, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Risks and uncertainties include, but are not limited to the following: inability of ATHA, 92E and Latitude to complete the Transactions and the Offering, a material adverse change in the timing of any completion and the terms and conditions upon which the Transactions is completed; inability to satisfy or waive all conditions to closing the Transactions as set out in the 92E SID and Latitude Arrangement Agreement; 92E Shareholders not approving the 92E Scheme; Latitude Shareholders not approving the Latitude Arrangement; ATHA shareholders not approving the ATHA Transactions Resolution and the alterations to the Company Board; the inability of ATHA to complete the Offering; failure by the Key Investors to participate in the Offering as expected; the inability of ATHA to obtain the requisite shareholder approval to consummate the Transactions (as applicable); the CSE not providing approval to the Transactions and all required matters related thereto; the inability of the consolidated entity to realize the benefits anticipated from the Transactions and the timing to realize such benefits, including the exploration and drilling targets described herein or elsewhere; unanticipated changes in market price for ATHA Shares, 92E Shares and/or Latitude Shares; changes to ATHA's, 92E's and/or Latitude's current and future business and exploration plans and the strategic alternatives available thereto; growth prospects and outlook of the business of each of ATHA, 92E and Latitude; treatment of the Transactions under applicable competition laws and the Investment Canada Act; regulatory determinations and delays; any impacts of COVID-19 on the business of the consolidated entity and the ability to advance the Company projects; stock market conditions generally; demand, supply and pricing for uranium; and general economic and political conditions in Canada, Australia and other jurisdictions where the applicable party conducts business. Other factors which could materially affect such forward-looking information are described in the filings of ATHA and Latitude with the Canadian securities regulators which are available, respectively, on each of ATHA's and Latitude's profiles on SEDAR+ at www.sedarplus.ca and filings of 92E with the Australian regulatory authorities. None of ATHA, 92E or Latitude undertake to update any forward-looking information, except in accordance with applicable securities laws.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/40a156d3-1ce9-4279-b410-708dfcebed13

https://www.globenewswire.com/NewsRoom/AttachmentNg/6034c8ed-aeec-4a5c-a158-3b6a30f43264