July 16, 2023

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) is pleased to provide an update on activities at the Company’s’ exploration projects in the Ashburton and Gascoyne regions of Western Australia.

- Heritage approval received for Whaleshark EIS co-funded diamond drilling

- Drilling contractor appointed – diamond drilling to commence at end of month

- New tenement granted at Dooley Downs - Bangemall Ni-Cu-PGE Project

Whaleshark IOCG Project

Miramar acquired the Whaleshark Project in 2020, as part of the Company’s IPO, and is exploring for Iron- Oxide Copper-Gold (IOCG) mineralisation beneath younger sediments of the Northern Carnarvon Basin.

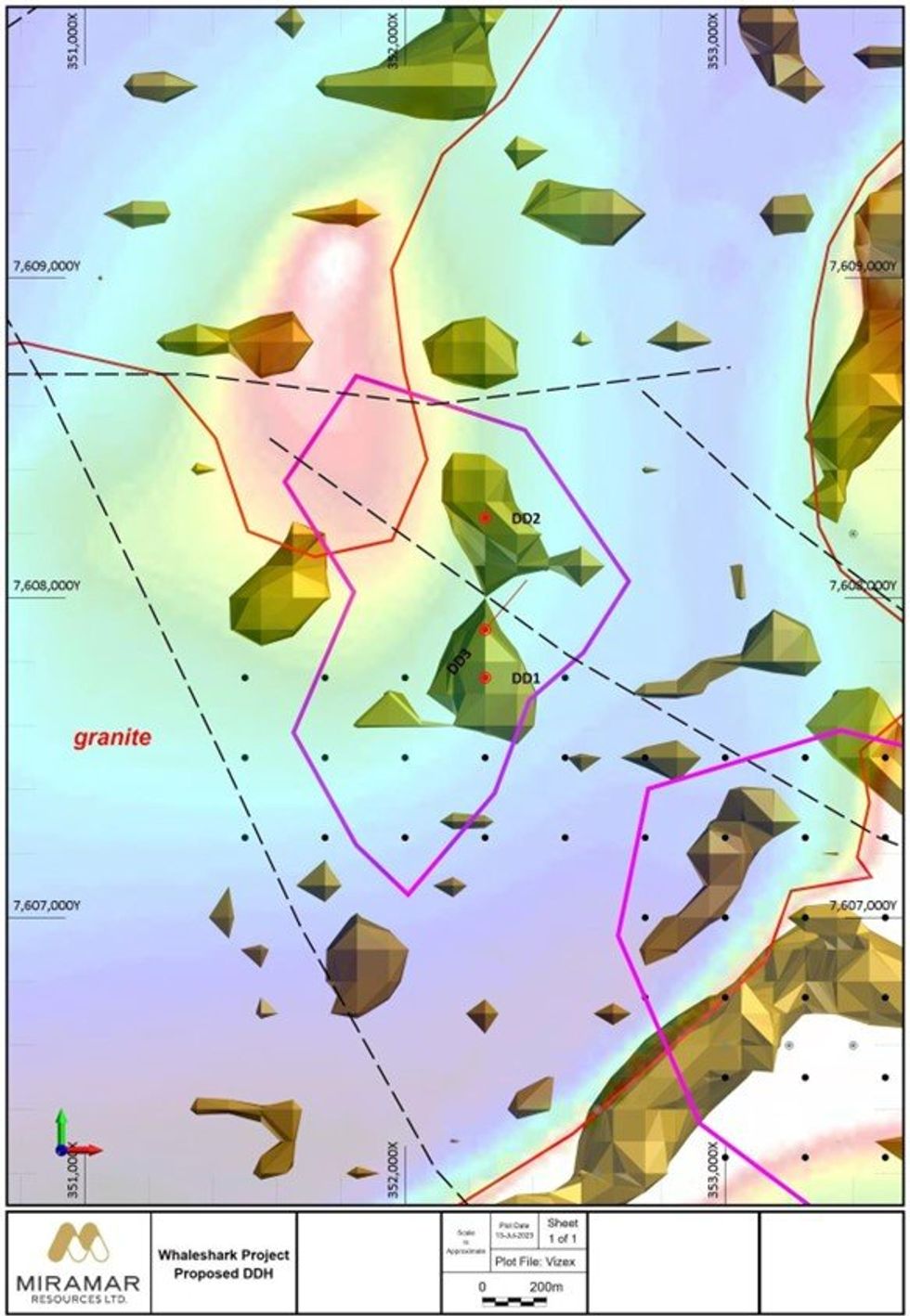

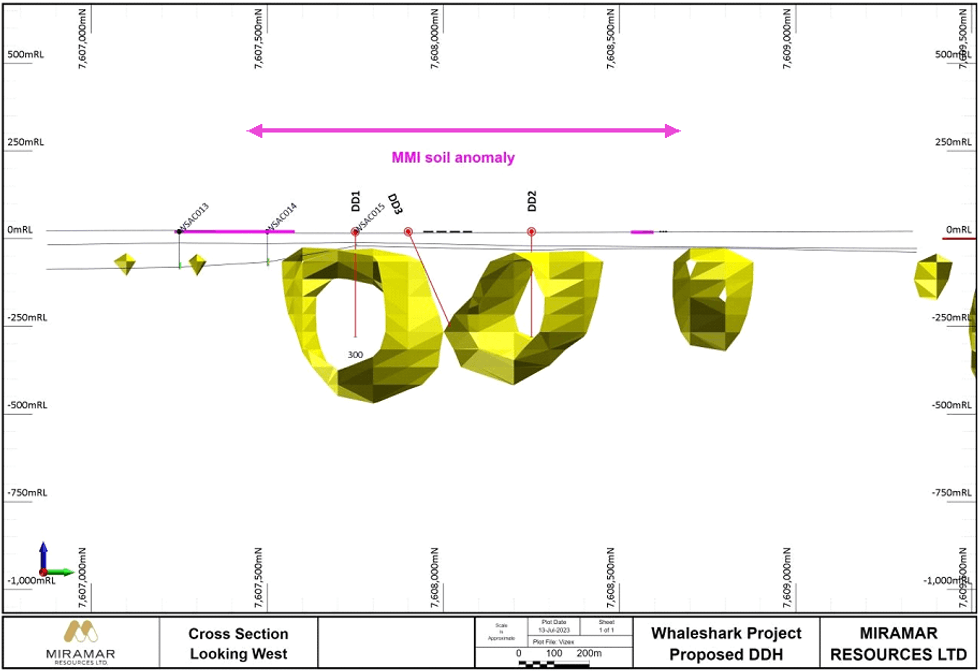

Since the Whaleshark tenement was granted in early 2021, Miramar has defined high-priority bedrock IOCG drill targets within the Whaleshark granite (Figures 1 and 2) comprising a combination of:

- Mobile Metal Ion (MMI) surface geochemical anomalism

- A gravity anomaly in the “neck” of the granite crosscut by a NW-trending structure

- Strongly elevated copper, cobalt, gold and silver results in “interface” aircore drilling

- REE anomalism consistent with published data from the Prominent Hill IOCG deposit

As previously advised, the Company has been successful in securing up to $180,000 through the Western Australian government’s Exploration Incentive Scheme (EIS) co-funded drilling programme for the initial diamond drilling programme.

Miramar recently completed a heritage survey over the proposed drill hole locations and has now received the final report from that survey allowing for commencement of drilling.

The Company has recently signed an agreement with a drilling contractor, will complete site preparation within the next 2 weeks and aims to commence drilling at Whaleshark at the end of the month.

Miramar’s Executive Chairman, Mr Allan Kelly, said the Company believed that Whaleshark had the potential to host a significant IOCG deposit, like Ernest Henry, Carrapateena or Prominent Hill.

“Since commencing work at Whaleshark in mid-2021, we have defined a robust IOCG target which has been further validated by the recent successful EIS application,” Mr Kelly said.

“IOCG deposits can be very large, and potentially very valuable, meaning exploration success at Whaleshark would have a very significant positive impact on our Company’ valuation,” he added.

“We are therefore very excited to commence diamond drilling at Whaleshark in the near future,” Mr Kelly said.

Bangemall Projects

Miramar is pleased to advise that E09/2647, part of the Dooley Downs Project, has recently been granted.

The newly granted Exploration Licence covers the contact between the older Edmund Basin and younger Collier Basin (Figure 3) and has potential for:

- Ni-Cu-PGE mineralisation associated with Proterozoic dolerite sills.

- Sediment hosted copper mineralisation within the Edmund Basin evident by elevated results in historic rock chip and soil samples

The Company will now compile all previous exploration data before planning the first fieldwork.

Sampling planned for the Mt Vernon Ni-Cu-PGE Project will be completed after the diamond drilling at Whaleshark.

Click here for the full ASX Release

This article includes content from Miramar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

06 February 2024

Miramar Resources

Aiming to create shareholder value through the discovery of world-class mineral deposits

Aiming to create shareholder value through the discovery of world-class mineral deposits Keep Reading...

16h

Quarterly Activities and Cashflow Report - December 2025

Asara Resources (AS1:AU) has announced Quarterly Activities and Cashflow Report - December 2025Download the PDF here. Keep Reading...

20h

Gold Price at New Record Over US$4,900; Silver Surges to All-time High Above US$96

Gold and silver prices are skyrocketing as investors flock to safe-haven assets.The spot price of gold rose as high as US$4,924.29 per ounce on Thursday (January 22), even as US President Donald Trump walked back his threats to take over Greenland by force in his Davos speech. That's because... Keep Reading...

20h

What Was the Highest Price for Gold?

Gold has long been considered a store of wealth, and the price of gold often makes its biggest gains during turbulent times as investors look for cover in this safe-haven asset.The 21st century has so far been heavily marked by episodes of economic and sociopolitical upheaval. Uncertainty has... Keep Reading...

23h

Interpol-Backed Operation Nets 198 Arrests in South America’s Illegal Gold Trade

Police across four South American jurisdictions have carried out their first coordinated cross-border operation against illegal gold mining, arresting nearly 200 suspects and seizing cash, gold, mercury and mining equipment.The operation, known as Guyana Shield, brought together law enforcement... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00