Aranjin Resources Ltd. (TSXV: ARJN) ("Aranjin") is very pleased to announce that it has have entered into a term sheet agreement (the "Term Sheet") which sets out the terms for an exploration joint venture with ION Energy Ltd (the "Joint Venture"). The Joint Venture will consist of both Parties granting one another reciprocal exploration rights on their respective exploration licences within Mongolia.

Both ION and Aranjin will leverage one another's expertise in their respective metals, with Aranjin being granted a right to explore ION's properties for base metals (including copper, lead, zinc, nickel, cobalt and associated metals), and ION being granted a right to explore Aranjin's properties for lithium. This structured approach is aimed at enlarging both Parties' exploration area within the mineral rich regions of Mongolia, thus ensuring that both ION and Aranjin maximize their chances of carrying a property to the development stage.

The area covered by the Joint Venture consists of all mineral rights in Mongolia currently held by the Parties, which consists of the Sharga Project, the Bayan Undur Project, the Baruun Tal Project (pending final purchase), the Baavhai Uul Project, the Urgakh Naran Project and all mineral rights acquired by the Parties in Mongolia after the date of entering into the Joint Venture.

Highlights:

- Maiden auger drill program was completed in the fall of 2021 at ION's Baavhai Uul project and included 222 auger holes for a total of 1,304.5 meters

- To date, only 50% of the assay samples have been returned

- Initial drilling results are highly encouraging with a new Copper and Nickel discovery at the center of the Baavhai Uul licence

- Drill hole AU-83 returned results of up to 2,150 ppm Nickel from 5.0 to 5.5m depth in clay samples and average 202 ppm Nickel. Numerous auger holes with over 200 ppm and up to 480 ppm Nickel were assayed in the eastern area of the licence and these will be subject to follow up infill drilling programs

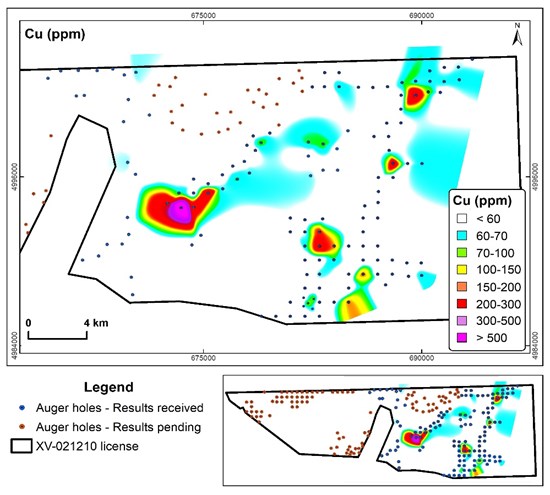

- Drill hole AU-85 returned up to 570 ppm Copper from 2.5-3m depth and averaged 103 ppm Copper. seven auger holes that were drilled in the eastern part of the licence returned over 100 ppm Copper

- The copper geochemical anomaly is over 4 sq km in size and the Nickel Geochem anomaly is over 2 sq km in size, anomalies located in the central part of the licence overlap each other.

Auger holes were drilled to a maximum depth of six meters with samples being collected every 0.5 meter and were located over 1 kilometer apart. This represented a broad pass of the licence prospectively. The remaining results from this drilling program are expected before the end of February 2022.

The main aim of Aranjin's 2022 exploration program is to expand the revealed Nickel and Copper high grade anomalies and plan to drill infill auger holes in a 250m grid. A total of 321 holes are planned over 1,926 meters. The Aranjin drilling program is scheduled to begin no later than February 5, 2022. Aranjin also plans to test the high grade zones using IP Geophysics and diamond drill holes at shallow depth. ION will continue its exploration with Hydrogeological sampling and advanced Lithium exploration techniques over the coming months.

Figure 1: Copper Anomalies at Baavhai Uul (ION Energy Ltd.)

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/4933/112252_35fc6fedc4deeaf4_002full.jpg

Figure 2: Nickel Anomalies at Baavhai Uul (ION Energy Ltd.)

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/4933/112252_35fc6fedc4deeaf4_003full.jpg

Joint Venture Highlights

- ION and Aranjin will grant each other a reciprocal right to explore one another's properties, with Aranjin earning an 80% interest and ION earning a 20% interest in all base metal projects discovered on ION's properties, and ION earning an 80% interest and Aranjin earning a 20% interest in all lithium projects discovered on Aranjin's properties, subject to existing royalties.

- If a Party has prepared a Feasibility Study (as defined by the Canadian Institute of Mining, Metallurgy and Petroleum) in respect of a deposit on a licence of the other Party, and the Party wishes to undertake development of the deposit (the "Development Project"), the Parties shall negotiate a separate joint venture or similar agreement governing the development and operation of the Development Project, with the initial participating interest being 80% for the Party initiating the Development Project, and 20% for the other Party.

- Each Party will bear their own costs of exploration on the properties of the other Party, with ION obligated to expend at least USD$500,000 and Aranjin USD$3,000,000 over the three (3) years commencing from the date of the Term Sheet. Aranjin shall be entitled to satisfy any shortfall of its required expenditures in cash up to USD$2,500,000.

- If a Party fails to prepare a Feasibility Study in respect of a deposit on the licence of the other Party within five (5) years of the date of the Term Sheet, the rights of the non-performing Party under the Term Sheet will be terminated.

- Aranjin shall appoint Ali Haji, Chief Executive Officer of ION, to the board of directors of Aranjin, and further appoint him as President and Chief Executive Officer of Aranjin.

- Matthew Wood will resign as President and Chief Executive Officer of Aranjin and will continue to act as Executive Chairman of Aranjin.

Aranjin intends to issue 1% of the outstanding common shares to Mr. Haji as an inducement to act as President and CEO of Aranjin. The common shares issued to Mr. Haji will be subject to a hold period of four months and a day.

Ali Haji, incoming President and CEO of Aranjin, commented: "This joint-venture allows for ION Energy to work alongside Aranjin on two very important elements that are required for the clean, green energy revolution. The synergistic makeup of each company will allow for this joint-venture drive the electrification of the future and represent the largest lithium and copper exploration licence holders in Mongolia. We look forward to working together and receiving the balance of our exploration results."

Matthew Wood, Executive Chairman of Aranjin, noted: "With the promising early results and evidence of copper at the Baavhai Uul Project we are excited to expand our portfolio of prospective copper assets. Partnering with ION allows us to diversify our asset footprint and our exploration spend."

Final approval of the Joint Venture and the share issuance to Mr. Haji remains subject to the approval of the TSX Venture Exchange.

About ION Energy Ltd.

ION Energy Ltd. is committed to exploring and developing Mongolia's lithium salars, which includes the Baavhai Uul and Urgakh Naran Project. ION's flagship, 81,000+ hectare Baavhai Uul lithium brine project, represents the largest and first lithium brine exploration licence awarded in Mongolia. ION Energy is well-poised to be a key player in the clean energy revolution, positioned well to service the world's increased demand for lithium. Information about the Company is available on its website, www.ionenergy.ca, or under its profile on SEDAR at www.sedar.com.

About Aranjin Resources Ltd.

Aranjin Resources Ltd. is committed to exploring and developing its prospective copper projects, the Sharga Project, the Bayan Under Project and the Baruun Tal Project (pending final purchase) located in Mongolia. Information about the Company is available on its website, www.aranjinresources.com, or under its profile on SEDAR at www.sedar.com.

Contact Information

ION Energy Ltd.

Siloni Waraich

Media Relations

+1 416-432-4920

siloni@ionenergy.ca

Cautionary Statements

Certain information contained herein constitutes forward-looking information or statements under applicable securities legislation and rules. Such statements include, but are not limited to, statements with respect to the anticipated completion of the Joint Venture, contemplated expenditures of the Parties, anticipated development of mineral projects into the exploitation phase, appointments of certain executives and board members, issuances of common shares of Aranjin in connection with the appointment of Mr. Haji, and completion of acquisitions. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of ION and/or Aranjin to be materially different from those expressed or implied by such forward-looking statements, including, but not limited to: (i) any inability of the parties to satisfy the conditions to the completion of the Joint Venture on acceptable terms or at all; (ii) any inability to effect the acquisition of any mineral projects, or produce a favorable feasibility study; (iii) any inability to effect appointments of individuals to the board or management of Aranjin; (iv) any inability to effect a share issuance to Ali Haji, including due to a failure to obtain the requisite regulatory approvals; and (v) receipt of necessary domestic and foreign stock exchange, court, shareholder, and other regulatory approvals. Although management of each of ION and Aranjin has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate. Accordingly, readers should not place undue reliance on forward-looking statements. Neither party will update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. The parties caution readers not to place undue reliance on these forward-looking statements and it does not undertake any obligation to revise and disseminate forward-looking statements to reflect events or circumstances after the date hereof, or to reflect the occurrence of or non-occurrence of any events.

This press release is not and is not to be construed in any way as, an offer to buy or sell securities in the United States. This press release shall not constitute an offer to sell or the solicitation of an offer to buy the ION or Aranjin common shares, nor shall there be any offer or sale of the ION or Aranjin common shares in any jurisdiction in which such offer, solicitation or sale would be unlawful.

Neither the TSX, the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX and TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/112252