February 29, 2024

Antilles Gold Limited (“Antilles Gold” or the “Company”) (ASX: AAU, OTCQB: ANTMF) advises that the Company has entered into an Agreement with Patras Capital Pte Ltd to provide up to three A$1.0 million Convertible Loan Notes to Antilles Gold Limited over the next three months.

The provision of the second and third Loan Note will be at the Company’s option, and may require shareholder approval with respect to placement capacity.

The aim is to raise funds to maintain the momentum of the near-term development of the Nueva Sabana gold-copper mine in Cuba while waiting on the outcome of the Groups’ arbitration of approximately A$45 million of claims against the Dominican Republic Government resulting from a project that was completed in 2019.

The Tribunal undertaking the arbitration has advised that the Award will be issued by the end of March 2024. It is anticipated that if the Award is favourable for the Company, and does not need to be enforced, the second and third Notes would not be issued.

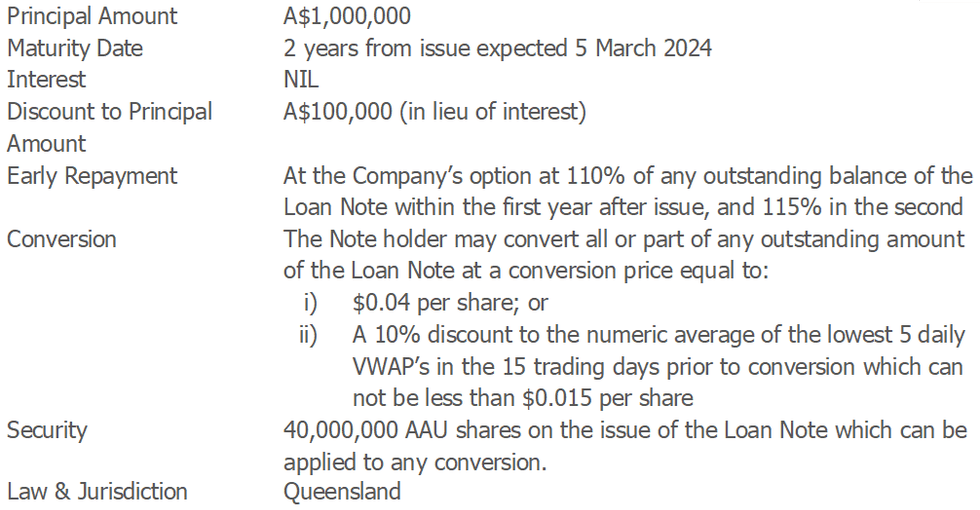

The basic terms of each Loan Note are as follows;

Antilles Gold has sufficient placement capacity under Listing Rule 7.1 for the first Loan Note.

The 50:50 joint venture in Cuba expects to commence construction of the site works and a short access road from the central highway in April 2024, and the mine and associated infrastructure in July 2024.

The Chairman of Antilles Gold, Mr Brian Johnson, said that “the dilution of shareholders with recurring capital raises was extremely disappointing but unavoidable when the Company had no existing operations producing a cashflow.

In his opinion, irrespective of the dilution, and the current low market capitalisation, the value of the Company’s projects in Cuba is increasing significantly with continuing expenditure.

Antilles Gold is assisting the Cuban joint venture company, Minera La Victoria, in negotiations that have commenced with three potential Investors showing interest in buying into the company, and supporting its progressive growth. Successful negotiations with any Investor, would minimise additional raises by Antilles Gold in the foreseeable future.

Recent meetings with the Company’s Cuban partner, GeoMinera, have indicated it will be possible for the existing Joint Venture Agreement to be amended to permit majority foreign ownership in order to accommodate additional shareholders.

Drafting of amendments to the Agreement, and the joint venture company’s Articles is proceeding.”

Click here for the full ASX Release

This article includes content from Antilles Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AAU:AU

The Conversation (0)

23 June 2024

Antilles Gold Limited

Developing Gold and Copper Projects in mineral‐rich Cuba

Developing Gold and Copper Projects in mineral‐rich Cuba Keep Reading...

17 February 2025

Antilles Gold to Raise $1.0M for Working Capital

Antilles Gold Limited (AAU:AU) has announced Antilles Gold to Raise $1.0M for Working CapitalDownload the PDF here. Keep Reading...

31 January 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Antilles Gold Limited (AAU:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

12 January 2025

Summary of Pre-Feasibility Study for Nueva Sabana Mine

Antilles Gold Limited (AAU:AU) has announced Summary of Pre-Feasibility Study for Nueva Sabana MineDownload the PDF here. Keep Reading...

11 December 2024

Revision to Updated Scoping Study Nueva Sabana Mine, Cuba

Antilles Gold Limited (AAU:AU) has announced Revision to Updated Scoping Study Nueva Sabana Mine, CubaDownload the PDF here. Keep Reading...

12h

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

13h

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

13h

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

14h

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

14h

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

09 February

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00