February 04, 2025

Anteros Metals (CSE:ANT) is leveraging modern data science methodologies to advance its projects in Newfoundland and Labrador, Canada. The company focuses on sustainable and cost-effective exploration targeting high-value deposits in underexplored yet geologically rich regions. Anteros Metals' portfolio covers 2,775 hectares and commodities essential to global technology and energy transitions.

Anteros prioritizes asset acquisition capitalizing on growing global demand for critical and base metals. Its properties encompass nine metals and minerals, five of which are classified as critical minerals, reflecting the company’s alignment with the accelerating energy transition and technological advancement.

Key Projects

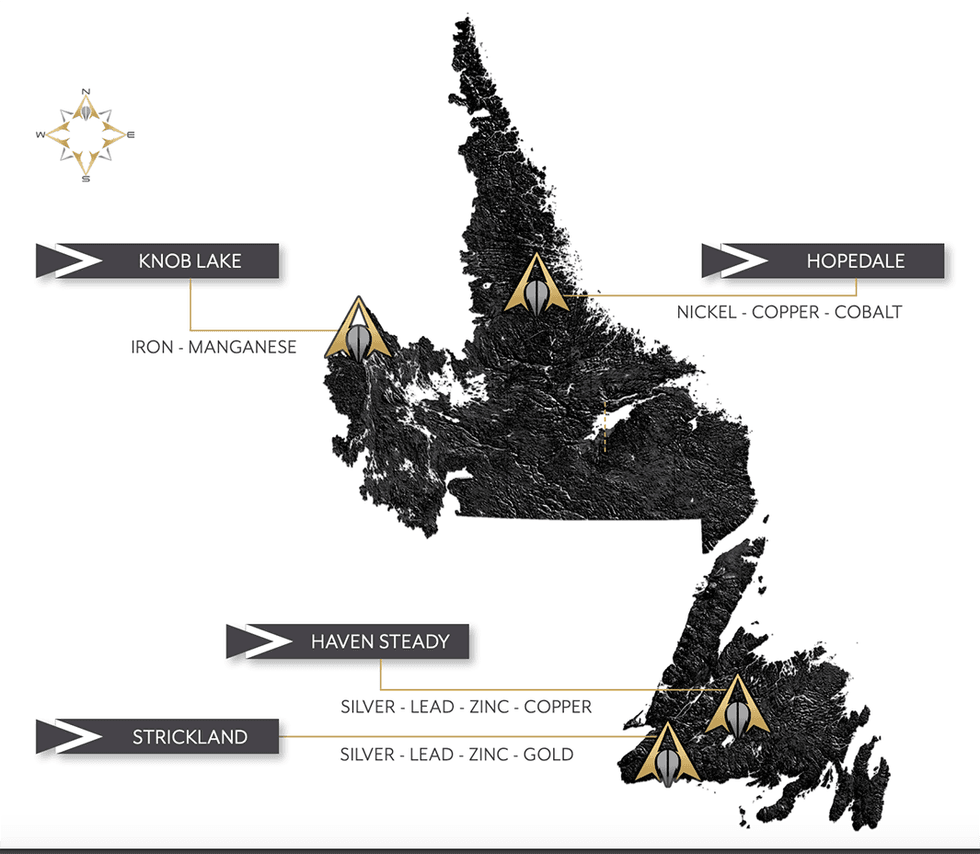

Key ProjectsAnteros has four 100 percent owned properties in Newfoundland and Labrador targeting critical and base metals. Commodities include copper, cobalt, nickel, manganese, zinc and others vital for green technologies.

Company Highlights

- The flagship Knob Lake iron-manganese project is an advanced exploration project with a historical resource located near significant iron ore infrastructure in Schefferville, Quebec.

- Haven Steady is a proven VMS asset accessible by road and hosts silver-lead-zinc mineralization with high-grade intersections and untapped geophysical anomalies.

- The Strickland project includes seven mineralized zones with significant silver-lead-zinc and gold potential, located near the prolific Hope Brook gold deposit.

- The Hopedale asset has a nickel-copper-cobalt focus, situated 90 kilometers south of Vale’s Voisey’s Bay in a geologically favorable zone with unexplained geochemical anomalies and untested electromagnetic conductors.

- Anteros follows a structured approach, with projects at various exploration stages: prospecting (Hopedale), early-stage (Haven Steady), intermediate (Strickland), and advanced exploration (Knob Lake). By balancing its portfolio, Anteros ensures a continuous pipeline of project advancement, reducing risks and maintaining steady value creation.

- The company is led by an experienced team with over a century of combined expertise in exploration, mining and financial markets, ensuring robust project execution.

This Anteros Metals profile is part of a paid investor education campaign.*

Click here to connect with Anteros Metals (CSE:ANT) to receive an Investor Presentation

ANT:CC

Sign up to get your FREE

Anteros Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

17 August 2025

Anteros Metals

Science-based, diversified mineral exploration in Eastern Canada

Science-based, diversified mineral exploration in Eastern Canada Keep Reading...

27 February

Obonga Project: Wishbone VMS Update

Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to provide an update for the Obonga Project's Wishbone Prospect which is an emerging and highly prospective base metal volcanogenic massive sulphide ("VMS") system in Ontario,... Keep Reading...

26 February

Agadir Melloul Mining Licence

Critical Mineral Resources is pleased to announce that a Mining Licence has been awarded for Agadir Melloul, marking an important step forward as the Company accelerates development towards production.The Mining License is 14.6km 2 and covers Zone 1 North and Zone 2, which remain the focus of... Keep Reading...

26 February

EIA Approval for Agdz Cu-Ag Project and Funding

Aterian plc (AIM: ATN), the Africa-focused critical metals exploration company, is pleased to announce the approval of it's recently commissioned Environmental Impact Assessment (''EIA'') for the 100%-owned Agdz Mining Licence, part of the Agdz ("Cu-Ag") Project ("Agdz" or the "Project") in the... Keep Reading...

25 February

Clem Chambers: I Sold My Gold and Silver, What I'm Buying Next

Clem Chambers, CEO of aNewFN.com, explains why he sold his gold and silver, and where he's looking next, mentioning the copper and oil sectors. He also speaks about the importance of staying positive as an investor: "The media negativity is the most wealth-crushing thing you can fall for. So be... Keep Reading...

25 February

What Was the Highest Price for Silver?

Like its sister metal gold, silver has been attracting renewed attention as a safe-haven asset. Although silver continues to exhibit its hallmark volatility, a silver bull market is well underway. Experts are optimistic about the future, and as the silver price's momentum continues in 2026,... Keep Reading...

23 February

Stefan Gleason: Silver Wakeup in the West — What's Happening, What's Next

Stefan Gleason, CEO of Money Metals, breaks down recent silver and gold dynamics, discussing trends in the US retail market, as well as backups at refineries. While the situation has begun to normalize, he sees potential for further disruptions in the future. Don't forget to follow us... Keep Reading...

Latest News

Sign up to get your FREE

Anteros Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00