September 12, 2024

Description

Positive progress on the development of Ora Gold’s (ASX:OAU) Crown Prince project is a key factor in Argonaut Securities’ recent equity research report issuing a speculative buy recommendation for Ora Gold.

“OAU is making steady progress on its Crown Prince development targeting first production towards the middle of next year. Once in production, we expect Crown Prince to be a high-margin, open-pit operation with a ~2-year mine-life,” the report said,

The report also noted the potential for extending the mine life given recent “encouraging exploration results” at Crown Prince.

“We make a slight price target increase to $0.019 ($0.018 prior) and maintain our speculative buy recommendation,” the report said. The valuation is modeled based on Ora Gold entering production in the second quarter of 2026, with a small but high-grade open pit mine returning cash flows.

The project’s prospects are further de-risked by the ore purchase agreement with Westgold (ASX:WGX), the report said.

Key Highlights:

- Diamond drilling for geotechnical studies is currently underway to finalise the open pit designs for Crown Prince. Environmental studies have been completed and metallurgy work indicates excellent free milling material with total recoveries ranging between 98 to 99 percent.

- OAU plans to submit a mining proposal to DEMIRS mid to late H2 of CY2024. OAU’s cash position totalling AU$7 million is expected to fund development work up to a decision to mine. Pre-production capex and working capital requirements for Crown Prince is AU$15 million.

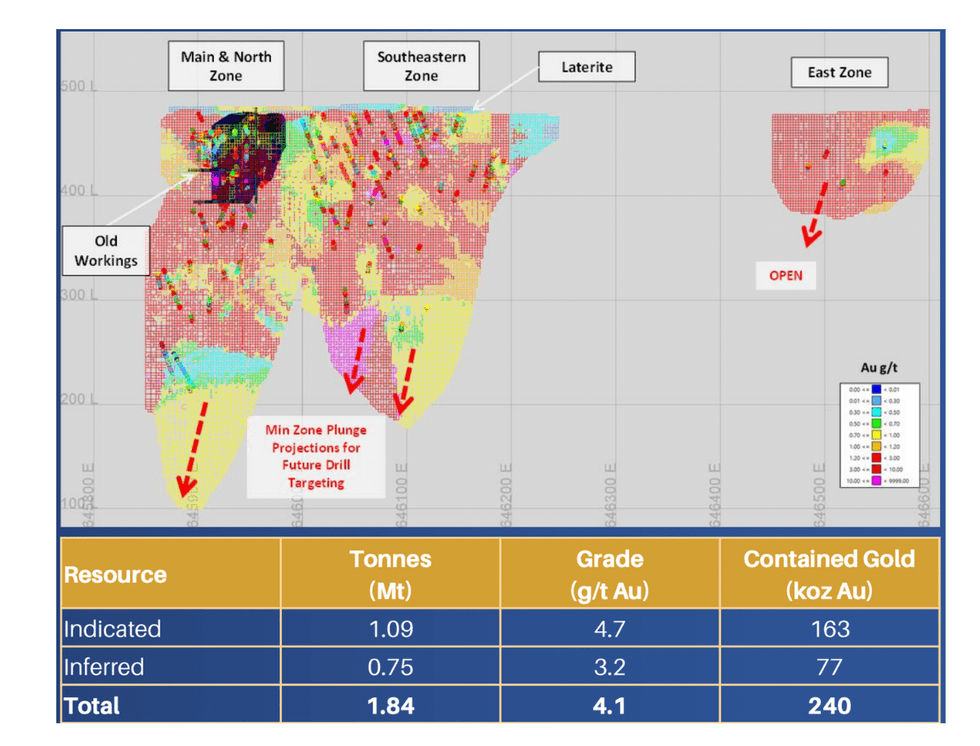

- An updated mineral resource estimate (MRE) is expected in October 2024. Current MRE totals 240 koz at 4.1 g/t gold with 67 percent in the indicated category.

- Despite its relatively small production size, Crown Prince is one of the highest margin development projects, with a resource that includes 164 koz shallow high-grade (5.2 g/t gold) ounces, driving a compelling economics.

For the full analyst report, click here.

This content is intended only for persons who reside or access the website in jurisdictions with securities and other applicable laws which permit the distribution and consumption of this content and whose local law recognizes the scope and effect of this Disclaimer, its limitation of liability, and the legal effect of its exclusive jurisdiction and governing law provisions [link to Governing Law section of the Disclaimer page].

Any investment information contained on this website, including third party research reports, are provided strictly for informational purposes, are general in nature and not tailored for the specific needs of any person, and are not a solicitation or recommendation to purchase or sell a security or intended to provide investment advice. Readers are cautioned to seek the advice of a registered investment advisor regarding the appropriateness of investing in any securities or investment strategies mentioned on this website.

OAU:AU

The Conversation (0)

30 January

Editor's Picks: Gold and Silver Prices Hit New Highs, Then Drop — What's Next?

Gold and silver are wrapping up a record-setting week once again. Starting with gold, the yellow metal left market participants hanging last week after finishing just shy of US$5,000 per ounce. However, it made up for it in spades this week, breaking through that level and continuing on up to... Keep Reading...

30 January

Lobo Tiggre: Gold, Silver Hit Record Highs, Next "Buy Low" Sector

Did gold and silver just experience a blow-off top, or do they have more room to run? Lobo Tiggre, CEO of IndependentSpeculator.com, shares his thoughts on what's going on with the precious metals, and how investors may want to position.Don't forget to follow us @INN_Resource for real-time... Keep Reading...

30 January

Ross Beaty: Gold, Silver in "Bubble Territory," What Happens Next?

Ross Beaty of Equinox Gold (TSX:EQX,NYSEAMERICAN:EQX) and Pan American Silver (TSX:PAAS,NASDAQ:PAAS) shares his thoughts on gold and silver's record-setting runs. While high prices are exciting, he noted that even US$50 per ounce silver is good for miners. "At the end of the day, there's still... Keep Reading...

30 January

Is it Time to Take Profits? Experts Share Gold and Silver Strategies in Vancouver

Optimism was building at last year’s Vancouver Resource Investment Conference (VRIC), with fresh capital flowing back into the mining sector, lifting project financings and investor portfolios alike.This year's VRIC, which ran from January 25 to 26, saw that optimism tip into outright... Keep Reading...

30 January

Adoption of Omnibus Incentive Plan & Private Placement Update

iMetal Resources Inc. (TSXV: IMR,OTC:IMRFF) (OTCQB: IMRFF) (FSE: A7VA) ("iMetal" or the "Company"). The Company confirms shareholders approved the adoption of a new omnibus incentive plan (the "Plan") at the annual general and special meeting (the "Meeting") of shareholders held on August 7,... Keep Reading...

30 January

Flow Metals Announces Closing of Shares for Debt

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to announce that, further to its news release dated January 23, 2026, it has closed a debt settlement transaction (the "Debt Settlement") with certain insiders' of the Company pursuant to which the Company settled... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00