(TheNewswire)

VANCOUVER, BC TheNewswire - MAY 7 th 2025 American Salars Lithium Inc. ("AMERICAN SALARS" OR THE "COMPANY") (CSE: USLI, OTC: USLIF, FWB: Z3P, WKN: A3E2NY ) announces that it has commenced a Phase 2 sampling program on its 100% owned, highly prospective 18,083 Hectares (180 sq km) Hardrock LCT ("Lithium-Cesium-Tantalum") Pegmatite Project including Rare Earth Elements ("REEs") and Critical Minerals (the "Jaguaribe Project ").

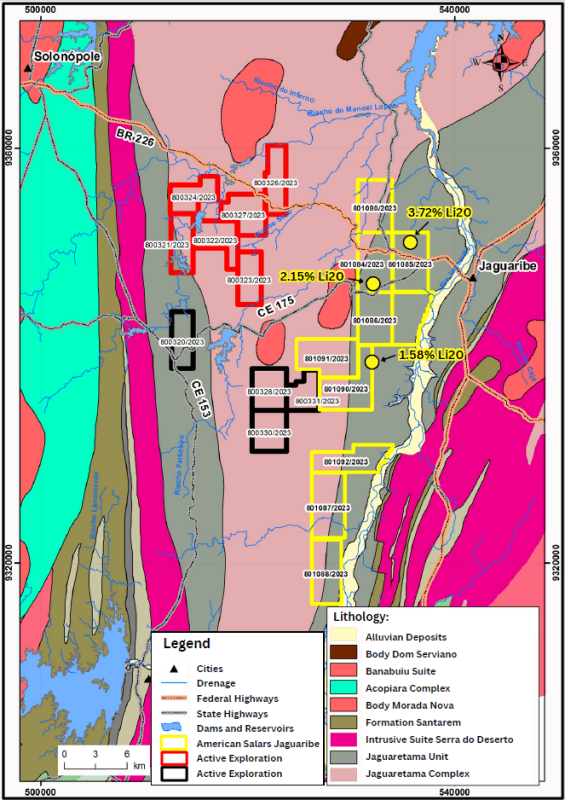

The Jaguaribe Project is located in the Jaguaribe/Solonópole region in the State of Ceará, in Northern Brazil and hosts multiple extensive Lithium and REE bearing pegmatite dykes that have returned initial Phase 1 sample discoveries of up to 3.72% Li 2 O, 2.15% Li 2 O and 1.58% Li 2 O as well as 554.5 ppm of Cesium,

135 ppm of Tantalum, 177 ppm of Niobium. One sample showed high values for Rubidium (>10,000ppm); Tin (675 ppm) and Zinc (387ppm).

American Salars CEO & Director R. Nick Horsley states, " We are thrilled to launch the second phase of exploration at our Jaguaribe Project, building on the promising lithium and rare earth element (REE) discoveries from phase one. Brazil is a global hub for hard rock lithium production, and our Jaguaribe Project, located in a well-known pegmatite district, has already yielded high-grade lithium samples and significant REE values. This next phase will focus on identifying and sampling additional pegmatites to further delineate the scale and quality of this critical mineral-rich region."

The initial phase 1 exploration program revealed multiple long and wide pegmatite dykes that measure up to 30 meters in width and up to 300 meters in length that are largely unexplored. American Salars has secured field crews, a Brazil focussed senior geologist, and lithium specialist QP to oversee a more extensive Phase 2 work program to map new pegmatite outcrops as well as sampling new and known areas of mineralization. The Company has secured sampling and exploration crews and is working with local Brazil based geological consultants to help plan a follow up drilling program to test priority targets.

About the Jaguaribe Property

-

The Jaguaribe Property covers historic artisanal mining sites previously mined for lithium, coltan (tantalum and niobium) and tin.

-

Initial sampling of the Jaguaribe Pegmatites returned Spodumene bearing pegmatite samples that graded up to 3.72% Li2O as well as Rare Earth Elements.

-

Phase 2 sampling will test multiple additional LCT Pegmatite targets.

-

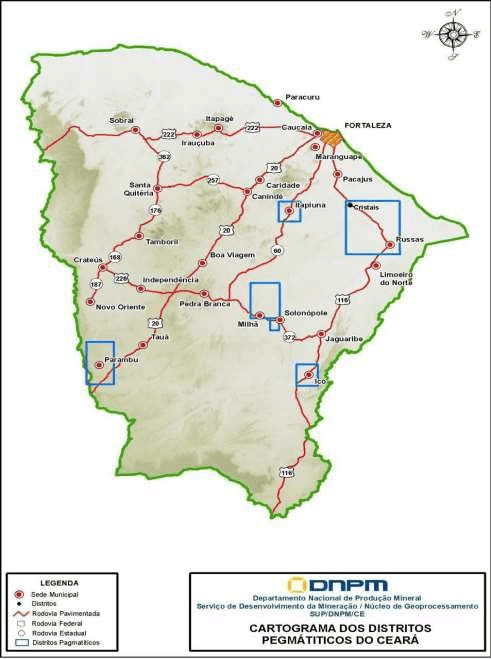

Ideal project location - Historical Pegmatite Province Brazil.

-

4-hour drive on paved roads to port and international airport (Fortaleza).

-

The topography, land use and vegetation at Jaguaribe Property is well suited for exploration activities.

-

Arid, sparsely populated farmland, no rain forest.

-

Northern Brazil provides shipping routes and deep-water ports to North American and European battery chemical markets.

Figure 1. Geological Map of the Solonópole/Jaguaribe Region, with location of the Jaguaribe claim blocks shown in YELLOW color .

Multi elements ICP analysis (55 elements) of 13 pegmatites sampled across the Jaguaribe Project, returned: Lithium, Rubidium, Tantalum and Niobium. Of the 13 samples, one (VM-EJ-R-01) is mineralized with Lithium at (3.72% Li2O), a normal occurrence, because it was the first geological reconnaissance work carried out on the Project. The presence of Li bearing Lepidolite and Spodumene minerals were observed in the pegmatites during the initial fieldwork.

Pegmatite VM-EJ-01 is an LCT (Lithium-Cesium-Tantalum) pegmatite, in addition to samples of 3.72 Li2O, anomalous values of 554.5 ppm of Cesium and 135 ppm of Tantalum were recorded, accompanied by 177 ppm of Niobium and high values for Rubidium (>10,000ppm); Tin (675 ppm) and Zinc (387ppm). Initial fieldwork also detected two additional pegmatites with 2.15% and 1.58% Li2O, respectively, which led to the exploration and acquisition of the 10 claim blocks that make up the Jaguribe Property.

Figure 2. LCT pegmatite Outcrops and Surface Samples from vein in a North -Northeast direction and embedded in gneiss.

Figure 3. Location of the Pegmatite Districts of Ceará, Brazil.

Geochemical Characteristics of Pegmatites, Jaguaribe Project, Ceará, Brazil

A multi-element analyse was conducted at the SGS laboratory for 58 elements including REE, from 12 samples from the Jaguaribe Project. These samples were analyzed by the ICM90A method: determination with fusion in sodium peroxide-ICP OES/ICP MS.

Geochemistry of the Pegmatites samples from the Jaguaribe Project area, was compared with the standard sample or standard analysis provided by the SGS laboratory, with the common elements and their contents in an LCT-type Pegmatite (Lithium, Cesium and Tantalum).

The pegmatite from the VM-R-01 Pegmatite sample, which contained Lepidolite and a content of 1.54% Li 2 O, shows a strong geochemical correlation with the standard sample, in terms of the contents of Li, Cs, and Ta, the latter being much higher (135 ppm Ta) than the Ta content of the SGS standard sample (18 ppm Ta). The VM-R-1 sample also shows a correlation with the SGS standard, in terms of Rb, Nb, Sn and P. Other pegmatite samples from the Jaguaribe Project, namely VM-R-6 and VM-R-7, are iron enriched and present less marked correlations, in relation to the contents of the standard sample only in the elements Li, Rb and Ba, although they show anomalous geochemical values of Cs.

The results of the VM-R-8 and VM-R-10 analyses show a good correlation with the results of the SGS standard sample, regarding the contents of Rb, Ba, Cs, Ta, Nb and P, but the Li levels fell, respectively, to 110 ppm and less than 10 ppm. This sharp drop in the Li levels of these samples is mainly due to the leaching of Li minerals by surface waters, notably Spodumene, a phenomenon observed in most of the pegmatites in the region, whose Li levels increase substantially in the subsurface in mining pits, in the companies' research excavations and mainly in drill holes.

QUALIFIED PERSON

The technical content regarding the Jaguaribe Project, in this release has been reviewed and approved by Mitchell E. Lavery, P. Geo, who is an Independent Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects.

ABOUT AMERICAN SALARS

American Salars Lithium is an exploration company focused on exploring and developing high-value battery metals projects to meet the demands of the advancing electric vehicle market.

All Stakeholders are encouraged to follow the Company on its social media profiles on , , TikTok , and Instagram .

On Behalf of the Board of Directors,

" R. Nick Horsley "

R. Nick Horsley, CEO

For further information, please contact:

American Salars Lithium Inc.

Phone: 604.740.7492

E-Mail: info@americansalars.com

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

Disclaimer for Forward-Looking Information

Certain statements in this release are forward-looking statements, which reflect the expectations of management regarding American Salar's intention to continue to identify potential transactions and make certain corporate changes and applications. Forward looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations, or intentions regarding the future. Such statements are subject to risks and uncertainties that may cause actual results, performance, or developments to differ materially from those contained in the statements. No assurance can be given that any of the events anticipated by the forward-looking statements will occur or, if they do occur, what benefits American Salars will obtain from them. These forward-looking statements reflect managements' current views and are based on certain expectations, estimates and assumptions which may prove to be incorrect. A number of risks and uncertainties could cause actual results to differ materially from those expressed or implied by the forward-looking statements, including American Salars results of exploration or review of properties that American Salars does acquire. These forward-looking statements are made as of the date of this news release and American Salars assumes no obligation to update these forward-looking statements, or to update the reasons why actual results differed from those projected in the forward-looking statements, except in accordance with applicable securities laws.

Copyright (c) 2025 TheNewswire - All rights reserved.