April 11, 2024

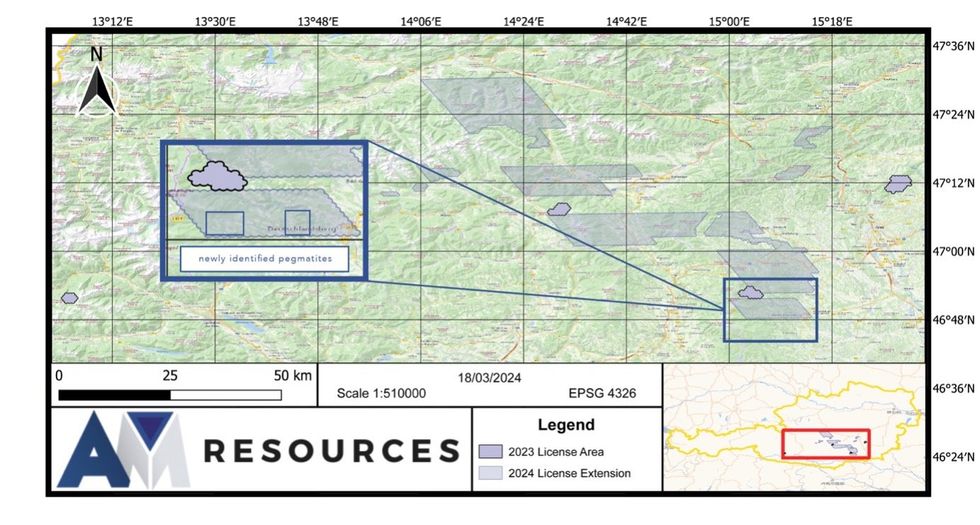

AM Resources Corporation (“AM Resources” or the “Company”) (TSXV: AMR) (Frankfurt: 76A), a dynamic junior mining company focused on the exploration and development of high-potential pegmatite lithium deposits, is pleased to announce the discovery of 26 new pegmatites as a result of its ongoing compilation of government databases since it acquired its 1,500 km2 land package (see press release dated March 21, 2024). AM Resources has now identified a total of 187 pegmatites, consolidating its strategic position in one of Austria’s most prospective lithium areas.

- Recently announced 1,500 km2 land package gives AM Resources control over a large area of the Austrian Pegmatite Belt.

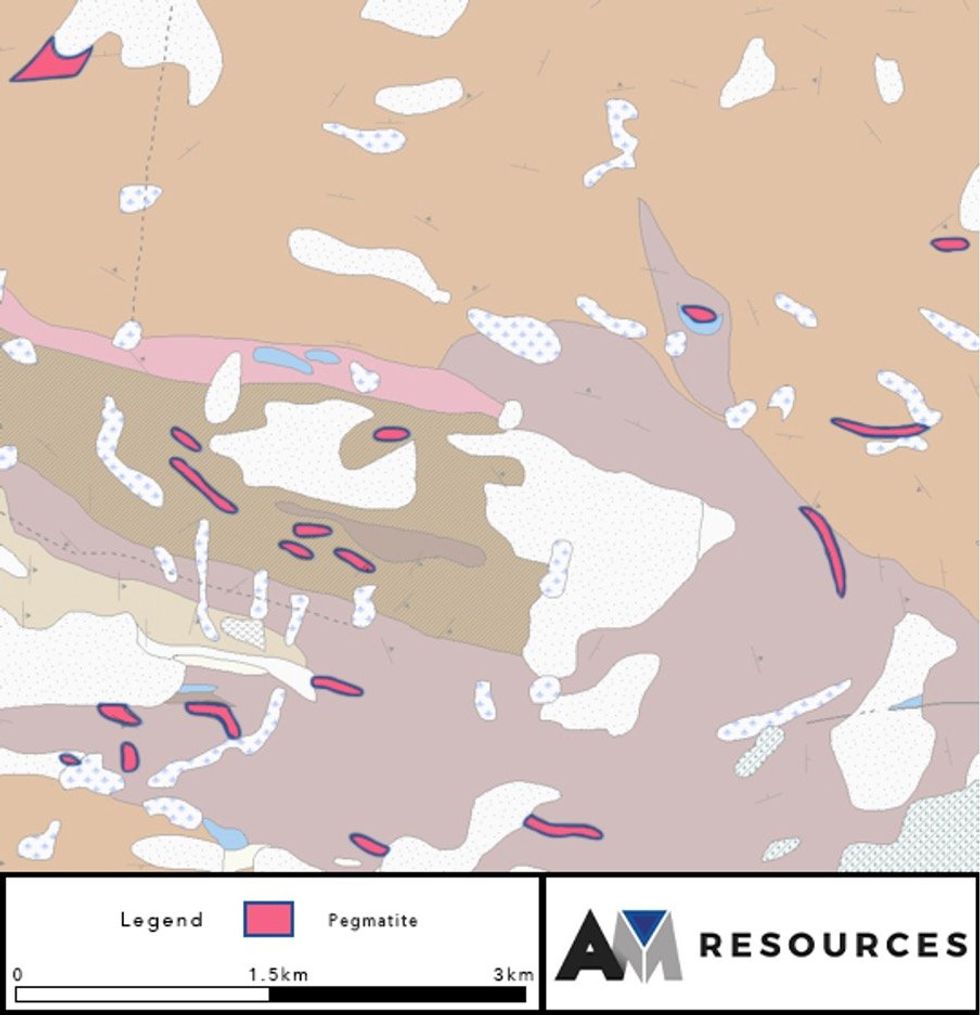

- Ongoing compilation of government data resulted in the discovery of 26 additional pegmatites across two groups, with sizes ranging from 102 metres to 887 metres.

- Many pegmatites are strategically located within mica schists, indicating favorable conditions for lithium-bearing minerals.

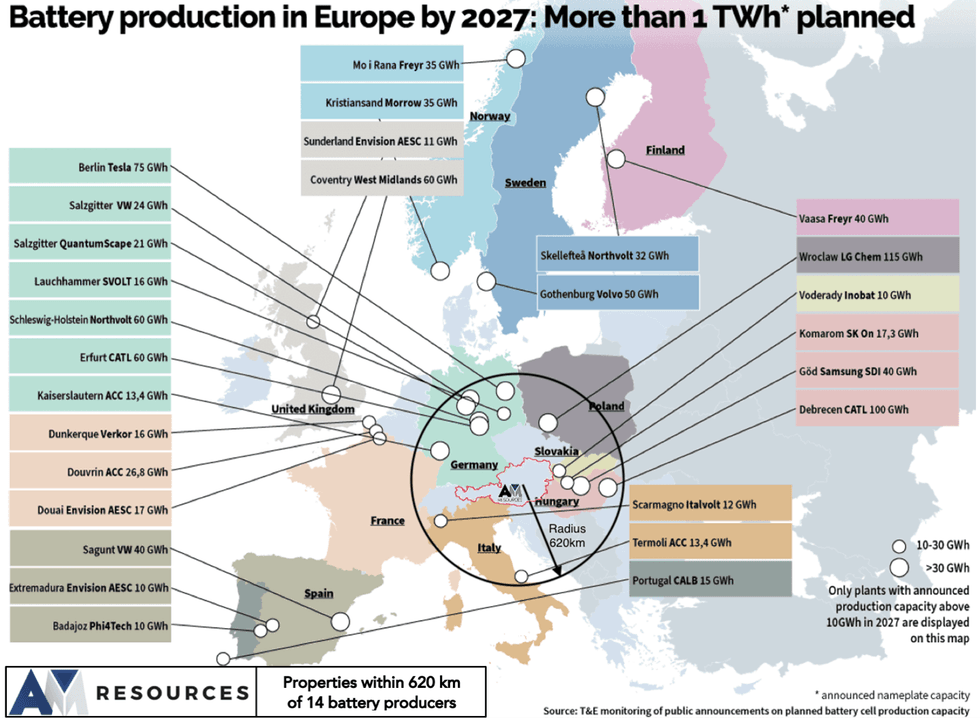

- Latest discoveries continue to reinforce AM Resources' position in the Austrian Pegmatite Belt, located within proximity to European battery manufacturers.

AM Resources’ 1,500 km2 land package

First Group

The Company has identified 8 large pegmatites with lengths varying between 329 metres and 887 metres, with the most extensive pegmatite measuring an impressive 281 metres in width.

Second Group

An additional 18 pegmatites ranging from 102 metres to 560 metres in length were discovered, with the thickest pegmatite reaching 195 metres in width. This group's diversity in size and shape adds to the prospectivity of AM Resources’ holdings. Many of these pegmatites are located within mica schists, a geological setting favorable for the presence of lithium-bearing minerals.

David Grondin, CEO of AM Resources commented: “Since the acquisition, we've been compiling the data available to us in preparation for our upcoming exploration program scheduled for June. We are very pleased with the number and size of the pegmatites found so far. Once we finish compiling the data, we'll have a better picture of the work that needs to be done to fully evaluate the lithium potential of our properties.”

Location, Location, Location

As previously reported, the AM Resources team has been actively assembling a massive prospective land package with four key elements at the core of its strategy: proven geology, proximity to key markets, historical expertise, and a clear, proven mining code. AM Resources’ Austrian properties are located within 620 km of 14 planned battery plants and have direct access to an extensive rail system.

Qualified Person

Technical information related in this news release has been reviewed and verified by Jean Lafleur, P. Geo., of PJLEXPL Inc., a registered geologist with the Ordre des Géologues du Québec (OGQ #833) and is a qualified person (QP) as defined by NI 43-101. Mr. Lafleur is independent from the Company and has reviewed and approved the disclosure of the AM Resources geological information.

About AM Resources

AM Resources Corporation (TSXV: AMR) is a dynamic junior mining company focused on the exploration and development of high-potential pegmatite deposits. With a strategic portfolio of assets and a commitment to responsible resource development, the Company is dedicated to creating long-term value for its stakeholders while adhering to the highest standards of corporate governance and sustainability.

Forward-Looking Statements

This news release contains forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of AM Resources to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects”, “estimates”, “intends”, “anticipates” or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Since forward-looking statements and information address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. Readers are cautioned that the foregoing list of factors is not exhaustive. The forward-looking statements contained in this news release are made as of the date of this release and, accordingly, are subject to change after such date. AM Resources does not assume any obligation to update or revise any forward-looking statements, whether written or oral, that may be made from time to time by us or on our behalf, except as required by applicable law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information:

David Grondin

AM Resources Corporation

President and Chief Executive Officer

1-514-583-3490

AMR:CA

The Conversation (0)

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00