- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

August 09, 2022

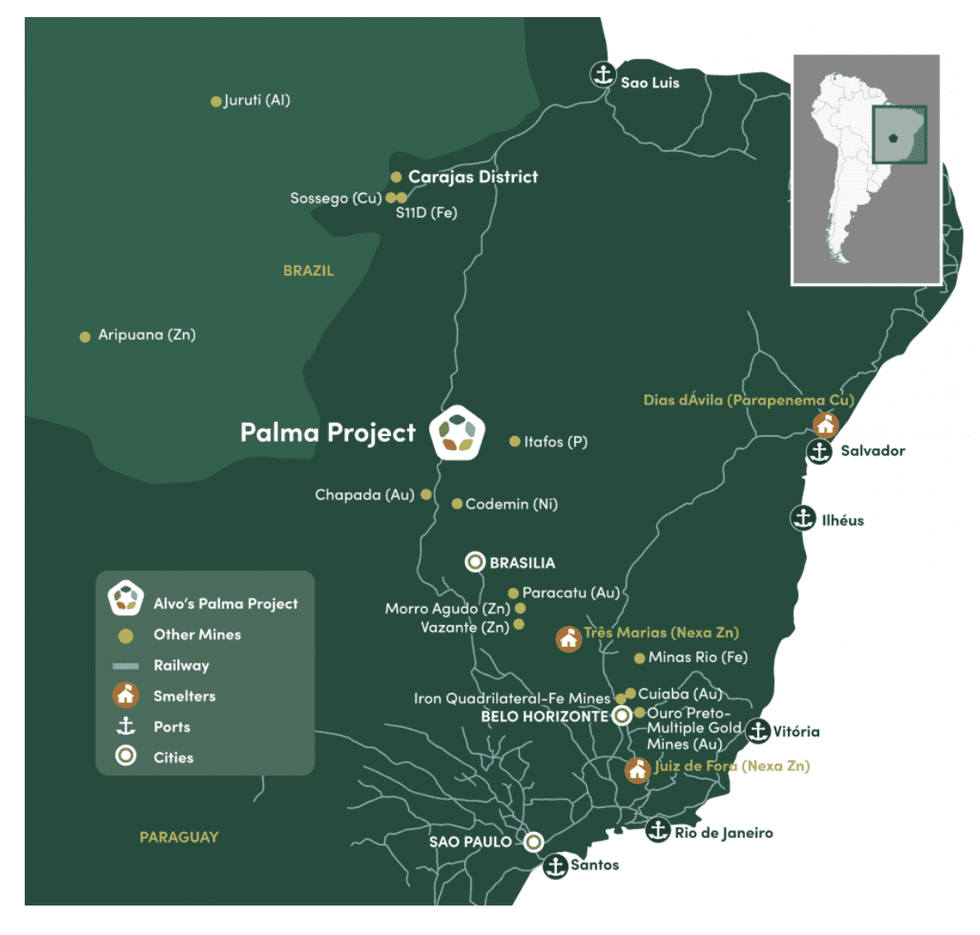

Alvo Minerals (ASX:ALV) focuses on a district-scale opportunity in an underexplored asset in Palmeiropolis region of central Brazil. The advanced-stage Palma project has produced exploration results that indicate high-grade copper-zinc deposits in a rich volcanogenic massive sulphide (VMS) zone. It has the right rocks to become a new VMS camp essential in global sources of copper, zinc, lead, silver and gold. The project is surrounded by active mines, including Lundin Mining’s Chapada copper-gold mine and Serra Verde’s REE project.

The Palma project was discovered in the 1970s, yet it has been idle for approximately 30 years. Once Alvo Minerals acquired the project, it became the first mining company to apply modern, systematic, and aggressive exploration techniques. A 2012 JORC inferred mineral resource estimate indicated 4.6 million tonnes at 1.0 percent copper, 3.9 percent zinc, 0.4 percent lead and 20 g/t silver. The company also recently released assays on the C3 deposit- with highlights including 7.0m @ 5.2 percent Cu, 8.0 percent Zn & 7.4m @ 2.2 percent Cu, and 23.1 percent Zn.

Company Highlights

- Alvo Minerals is an exploration and development company with a district-scale project in Tocantins and Goias states, central Brazil.

- Historic exploration programs have indicated high-grade copper-zinc deposits containing lead and silver. These results were confirmed in the 2012 JORC resource estimate that indicated 4.6 million tonnes of these metals.

- The Palma project has received minimal attention since its discovery, and Alvo Minerals is the first explorer to apply modern and systematic exploration techniques.

- Only the outcropping prospects in the Palma project have been drilled to date, leaving much of the VMS deposits unexplored.

- Palma is surrounded by active mines, including Lundin Mining’s Chapada copper-gold mine and Serra Verde’s REE project. There are also major Nickel, gold and phosphate operating mines within the district.

- The Palma project has robust infrastructure along with community and political support.

- An experienced management team leads the company with the right experience to fully capitalise on its promising district-scale opportunity.

This Alvo Minerals profile is part of a paid investor education campaign.*

Click here to connect with Alvo Minerals (ASX:ALV) to receive an Investor Presentation

ALV:AU

The Conversation (0)

08 August 2022

Alvo Minerals

District-Scale Copper-Zinc VMS Project in Brazil

District-Scale Copper-Zinc VMS Project in Brazil Keep Reading...

06 February

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data shows that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drill Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia took part in a ministerial meeting hosted by the US this week. The gathering was aimed at exploring a... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00