May 18, 2023

Alma Gold (CSE:ALMA) focuses on its Karita Gold project in Guinea, West Africa, a region that's among the most prolific and productive gold exploration regions, globally. As the project advances towards development, the company is currently acquiring additional exploration permits in Guinea while maintaining a high ESG rating throughout the exploration and mining cycle.

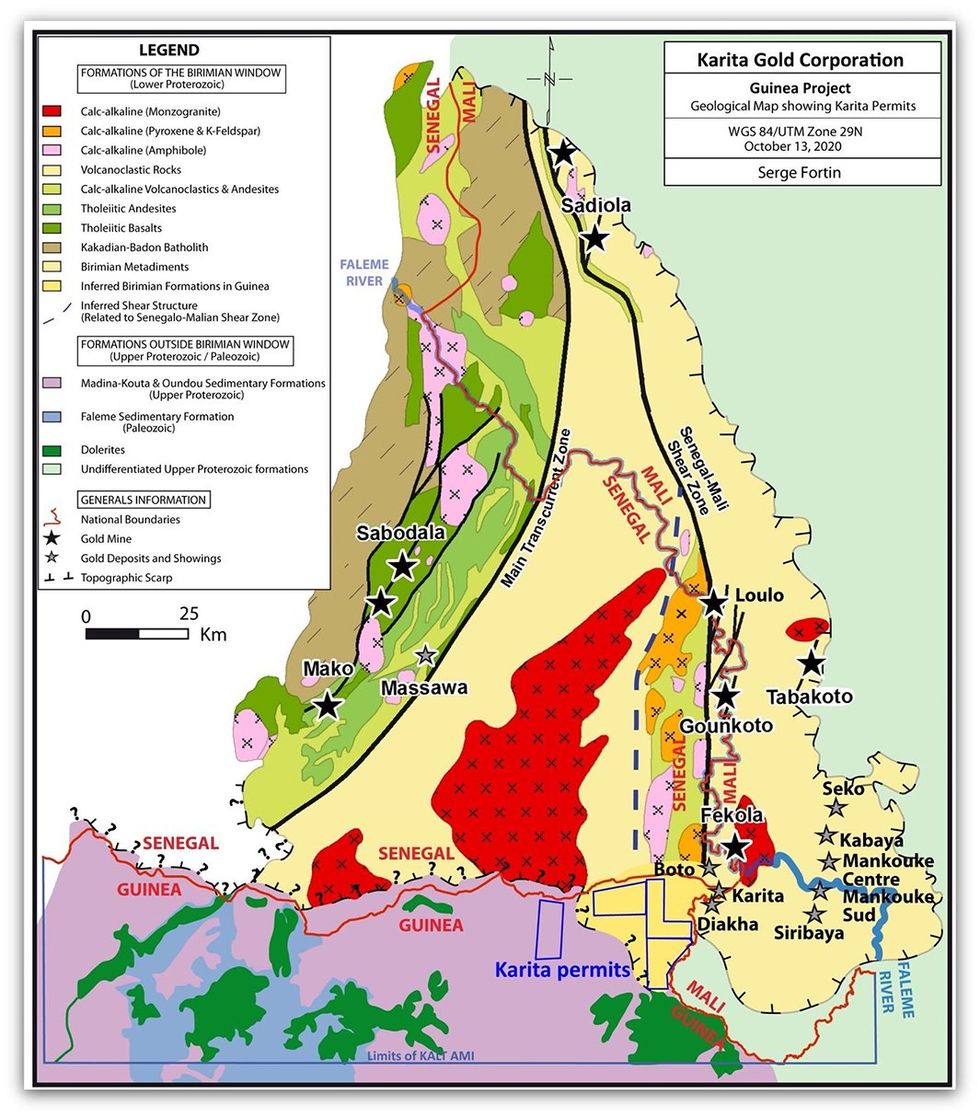

The Karita Gold Project contains a total of four exploration permits located immediately adjacent to IAMGOLD’s newly discovered gold deposit. The Karita Gold Project sits on a Birimian-aged greenstone belt, an extensive mineralization zone that hosts prolific gold deposits. Alma Gold has a comprehensive exploration plan, which is currently moving toward the maiden drilling program stage.

Alma Gold actively engages with local communities, artisanal gold miners, and governments during the permitting process and closely monitors its environmental footprint in each region. Alma Gold CEO Greg Isenor has been widely recognized for his impressive ESG work in previous projects, with more than 20 years of experience working in West Africa, striving to build a strong ESG rating with every project.

Company Highlights

- Alma Gold is an exploration and development gold company focusing on its gold assets in Guinea, including acquiring additional exploration permits.

- The company prioritizes achieving a high ESG rating throughout the exploration and mining cycle by building strong relationships with local communities, artisanal miners, and government officials.

- The Karita Gold Project in West Africa contains four exploration permits adjacent to prolific gold discoveries made by neighboring mining companies including IAMGOLD.

- Alma Gold has developed a comprehensive exploration plan for the Karita Project and is progressing towards commencement of its maiden drilling campaign.

- Alma Gold is actively pursuing additional exploration permits in the region to further increase its land position in East Guinea along the prolific Sanankoro-Kobada-Niaouleni Gold Corridor from Mali.

- Gold reached an 11-year-high spot price in 2022, and demand for the precious metal remains strong amid macroeconomic uncertainty.

- The company’s Clarence Stream North gold project in New Brunswick, Canada recently returned encouraging gold-in-soil assay results indicating the asset's potential.

- Alma Gold’s CEO Greg Isenor has a long track record of working in West Africa and leading projects with a high ESG rating.

- A team of experts with a proven track record of success throughout the mining industry leads the company toward success.

This Alma Gold profile is part of a paid investor education campaign.*

Click here to connect with Alma Gold (CSE:ALMA) to receive an Investor Presentation

ALMA:CNX

The Conversation (0)

25 January 2024

Alma Gold

Promising Gold Exploration Assets in West Africa

Promising Gold Exploration Assets in West Africa Keep Reading...

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

19h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00