April 22, 2025

Latin American focused copper-gold explorer Solis Minerals Limited (ASX: SLM) (“Solis Minerals” or the “Company”) is pleased to announce an update on copper mineralisation identified in channel samples at the Cinto Project in Peru.

HIGHLIGHTS

- More copper porphyry mineralisation identified at Cinto (100% Solis Minerals) from channel sample assays (highlights):

- 26.5m @ 0.28% Cu (Channel 11), including 5.4m @1.0% Cu Previous Cinto channel sample assays returned highlights1:

- 23.4m @ 0.88% Cu (Channel 1)

- 16.8m @ 0.52% Cu (Channel 6)

- Results indicate porphyry copper mineralisation of various styles across a potential area 3km long and 0.75km wide.

- Induced-Polarisation (IP) survey planning underway to support drill target definition.

- Permitting initiated for drilling at Cinto in second half of 2025.

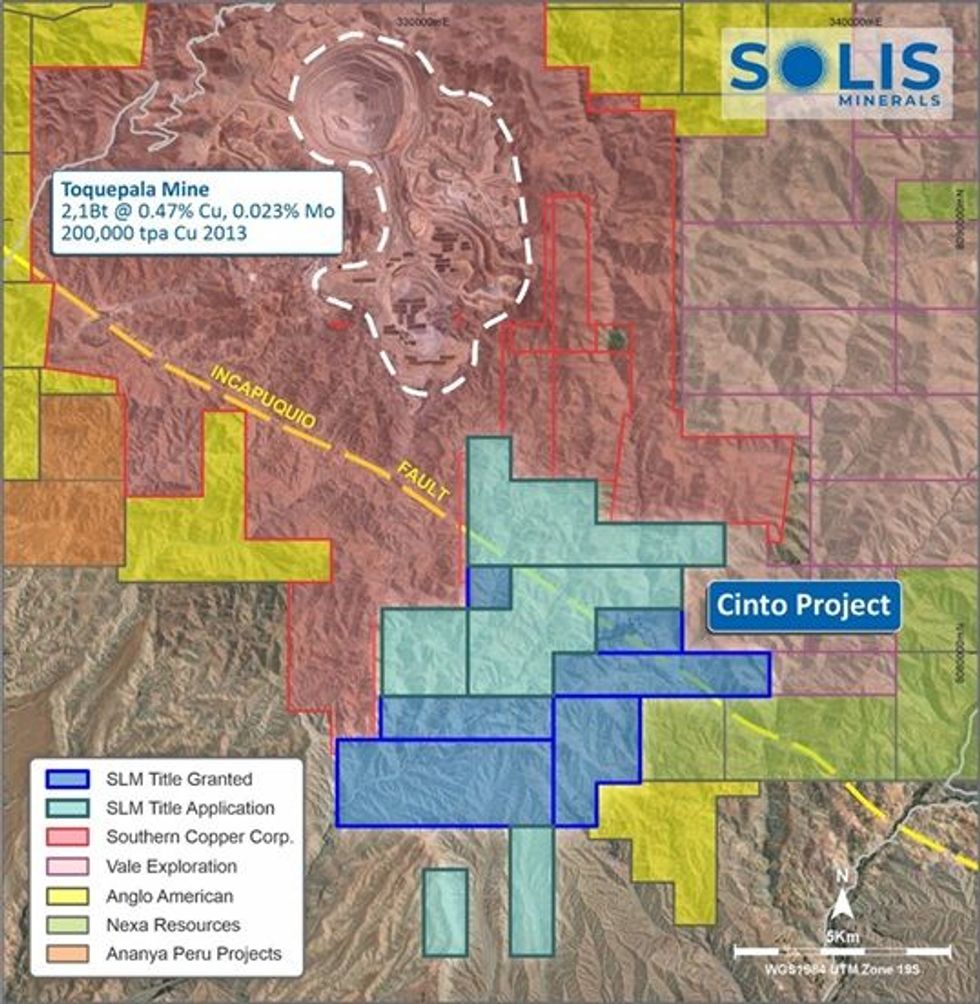

- Solis Minerals considers copper mineralisation at Cinto consistent with nearby Toquepala (one of Peru’s largest copper mines with 2.1Bt @ 0.47% Cu – 200ktpa Cu production)2.

Chief Executive Officer, Mitch Thomas, commented:

“These results confirm the significant potential at the Cinto Project, where we've substantially expanded Solis’ porphyry copper mineralisation footprint. Notably, we're seeing mineralisation styles similar to those at the major Toquepala mine, just 15km away. Geophysical data from drone magnetometry supports scale potential and highlights new target areas. As a stand-alone project, Cinto is a compelling copper porphyry target.

Our on-ground team recently hosted site visits for our technical director Mike Parker and myself across our project portfolio. Visible mineralisation at surface at Ilo Este and Cinto was a highlight. The clear, visible prospectivity in our projects very much aligns with our objective of identifying copper-gold resources that have potential to host large-scale mining in one of the world’s leading copper producing regions.

With drilling set to begin at Chancho al Palo3 and Ilo Este this quarter, and Cinto advancing toward drilling in the second half of 2025, Solis Minerals’ portfolio of 100% owned projects has incredible potential for discovery of multiple copper-gold resources capable of supporting mining operations.”

Summary

Exploration results at Cinto from channel sampling (Table 1) show a continuation of the mineralised breccia zones previously announced on 11 February 2025. A new channel, Channel 11, situated between previously reported Channels 7 and 8, reported 26.5m @ 0.28% Cu, including 5.39m @ 1.0% Cu.

The copper mineralisation encountered at Cinto to date is predominantly in breccias, the major mineralisation host at Toquepala, 15km northwest of Cinto. Four mineralisation types have been identified in distinct zones. Cinto is situated on the major Incapuquio Fault System which favoured the emplacement of intrusions related to large-scale porphyry copper deposits of Toquepala, Quellaveco, and Cuajone (Figure 1). Toquepala is one of Peru’s oldest and largest copper producers (200ktpa copper production).

Click here for the full ASX Release

This article includes content from Solis Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

19 February

Northern Dynasty Shares Plunge as DOJ Backs EPA Veto of Alaska’s Pebble Mine

Northern Dynasty Minerals (TSX:NDM,NYSEAMERICAN:NAK) shares plunged on Wednesday (February 18) after the US Department of Justice (DOJ) filed a court brief backing the Environmental Protection Agency’s (EPA) January 2023 veto of the company’s long-contested Pebble project in Alaska.The brief... Keep Reading...

18 February

BHP Reports Strong Half-Year Copper Results, Boosts Guidance for 2026

BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has published its financial results for the half-year ended December 31, 2025.The mining giant said its copper operations, which span multiple continents, accounted for the largest share of its overall earnings for the first time, coming in at 51 percent of... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00