- WORLD EDITIONAustraliaNorth AmericaWorld

March 24, 2024

Australian Vanadium Limited (ASX: AVL, “the Company” or “AVL”) is pleased to announce that it has demonstrated the capability to produce greater than 99.9% ultra-high purity vanadium pentoxide (V2O5) at pilot scale, using AVL ore. These results confirm a processing route that can easily be incorporated into the AVL flowsheet, employing well known processing technology that can be readily scaled to meet market demand.

KEY POINTS

- Pilot testwork achieves greater than 99.9% purity vanadium pentoxide from Australian Vanadium Project ore.

- Ultra-high purity flowsheet provides a scalable ‘bolt-on’ option to produce ultra-high purity vanadium oxides which demand a premium price.

Ultra-high purity vanadium pentoxide is critical in applications where even the smallest impurities can significantly affect performance, such as the chemical industry and specialty alloys for the aerospace industry, including defence. These growing market segments demand higher purity levels. AVL has identified the importance of satisfying this expanding market, in addition to other steel and battery markets which can use the Company’s standard 99.5% purity level.1

CEO, Graham Arvidson, comments, “AVL’s ability to produce 99.9% ultra-high purity vanadium pentoxide, in addition to our 99.5% standard high purity vanadium pentoxide, allows us to further strengthen our competitive advantage in specialised markets in which premium products attract a higher value.

“Our distinct advantage as a business continues to be our outstanding technical and economic vanadium processing acumen and I commend the team for the work undertaken to create and substantiate a new pathway for additional value creation. Our conviction remains that vanadium producers who can achieve the highest quality vanadium oxides will stand above the rest and command the greatest and most enduring returns. In addition to our proposed world-class vanadium project, our lowest quartile unit cost competitiveness strategy and our focus on product quality will provide further long-term competitive advantages to the Company and superior investor return.

“We have been pleased to work with the team at ANSTO and for the support that the Australian Government has provided us in achieving this milestone. Adding value to vanadium through downstream processing in Australia aligns with the Federal Government’s Critical Minerals Strategy 2023-2030 and helps to keep the value of Australia’s minerals in the country as we transition to a net zero future.”

The work undertaken to achieve ultra-high purity vanadium pentoxide was partly funded through a $3.69 million Australian Government Modern Manufacturing Initiative Translation grant under the National Manufacturing Priority Roadmap.2

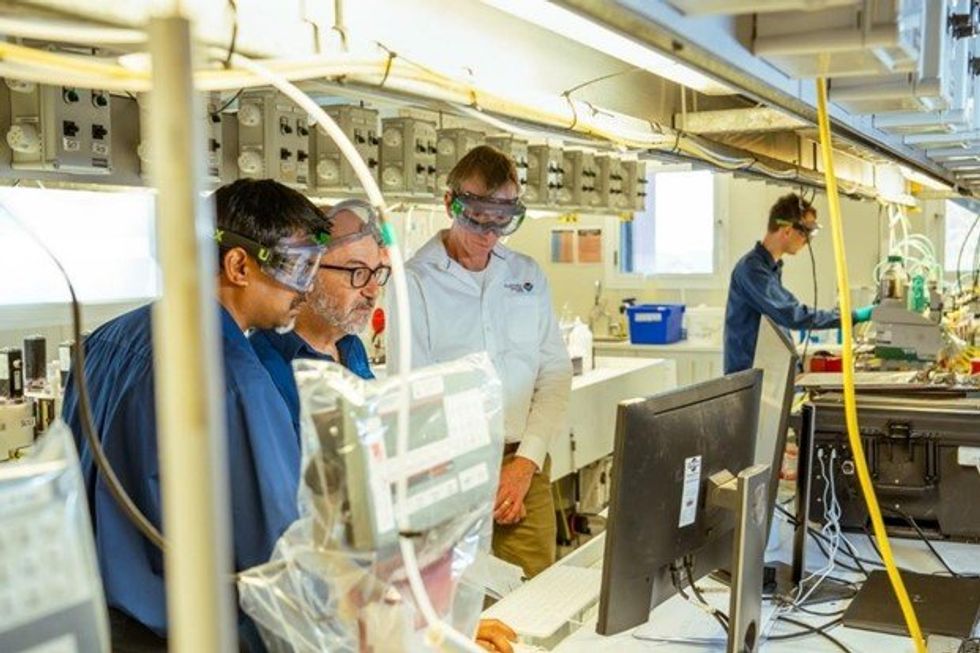

AVL worked in conjunction with Australia's Nuclear Science and Technology Organisation (ANSTO) in Sydney to develop a feasible processing route. The pilot for producing ultra-high purity vanadium pentoxide is the culmination of two years of work, exploring the most economic method for producing this product. The pilot was designed and operated to simulate processing of a stream diverted from the leach circuit developed in the AVL Bankable Feasibility Study (BFS) flowsheet.3 This concept allows for easy integration of an ultra-high purity process, in addition to the Company’s high purity process, that can be scaled to match ultra-high purity demand.

The feed for the pilot was generated during AVL’s pilot beneficiation,4 pyrometallurgy5 and hydrometallurgy6 programs, conducted as a part of the BFS work undertaken in 2021. The feed materials for this sequence of pilot programs comprised two composites of drill core, designed to be indicative of the average first five years of production and life of mine production.7

Click here for the full ASX Release

This article includes content from Australian Vanadium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AVL:AU

The Conversation (0)

29 April 2024

Australian Vanadium

An Australian vanadium leader

An Australian vanadium leader Keep Reading...

10h

Western Australia Implements 2.5 Percent Vanadium Royalty Rate

A royalty rate of 2.5 percent has been applied to all vanadium products in Western Australia as of February 4, 2026.In a joint announcement by Minister for Mines and Petroleum David Michael and Minister for Energy and Decarbonisation Amber-Jade Sanderson, the government said that the new rate... Keep Reading...

21 January

Vanadium Market Forecast: Top Trends for Vanadium in 2026

The vanadium market remained subdued in H1 2025, weighed down by persistent oversupply and weak usage from the steelmaking sector, even as new demand avenues like energy storage gained attention.Price data shows that vanadium pentoxide in major regions such as the US, China and Europe traded in... Keep Reading...

20 January

Carbon Black Substitute Memorandum of Understanding

Ferro-Alloy Resources Limited (LSE:FAR), the vanadium producer and developer of the large Balasausqandiq vanadium deposit in Southern Kazakhstan, is pleased to announce that it has entered into a non-binding, non-exclusive, memorandum of understanding ("MOU") for the supply of up to 360,000... Keep Reading...

25 July 2025

Top 5 Australian Mining Stocks This Week: Vanadium Resources Soars on DSO Offtake Deal

Welcome to the Investing News Network's weekly round-up of Australia’s top-performing mining stocks on the ASX, starting with news in Australia's resource sector.This week, gold companies continued to shine in Australia, joined by battery and base metals explorers and developers. In corporate... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00