September 05, 2023

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) is pleased to advise that it has secured binding commitments to raise A$5.5 million through the issue of approximately 78.6 million shares (New Shares) at an issue price of A$0.07 per share (Placement).

HIGHLIGHTS:

- Firm commitments received from new and existing institutional & sophisticated investors to raise A$5.5m (before costs).

- Firm commitments include $1.0 million in drilling equity from shareholder and contract partner, Topdrill.

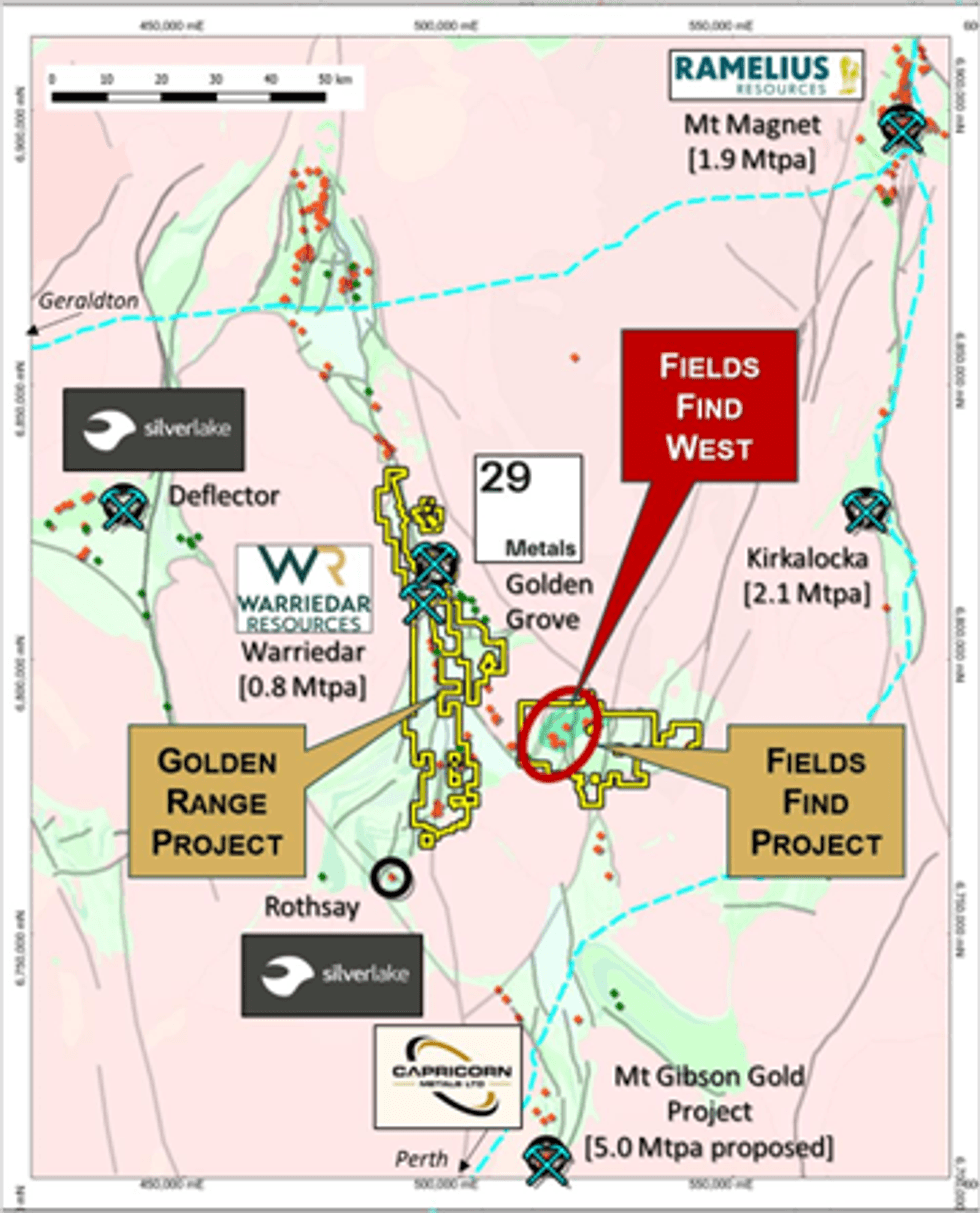

- New funds to accelerate drilling and exploration of priority gold and base metals targets at the Golden Range and Fields Find Projects in the Murchison region, Western Australia.

- Drilling of high-potential base metal targets at Fields Find West to commence in coming weeks.

Warriedar’s Managing Director and CEO, Amanda Buckingham, commented:

“We are very pleased with the strong support received for this capital raising from both our existing shareholders and new investors. The result is a strong endorsement of the exploration potential of our Golden Range and Fields Find Projects, located in the exploration and development hotspot of the Murchison region.

Over the last 9 months, the Warriedar team has worked meticulously to set the business up for success. Following the acquisition of our WA projects, we quickly established a team of high-performing geoscientists, and we surrounded them with an experienced senior management and Board. We have built strong relationships with our key contractors and optimised our exploration processes to deliver efficient and effective exploration targeting that is focused on new discoveries and Resource growth.

This raising allows us to accelerate our exploration and growth drilling activities in WA. The focus of this is twofold: rapid build of further mineable gold Mineral Resource ounces, coupled with drill testing high-potential, advanced base metals targets across the western area of the Fields Find Project.”

Use of funds

Drill testing of high-potential base metals targets with a focus on Fields Find West

As announced to the ASX on 3 August 2023, Warriedar has now received Programs of Work (POWs) approval to drill high-priority geophysical (EM) and geological copper targets on the western side of the Fields Find Project (Fields Find West).

These targets scheduled for drilling are proximal to significant ore-grade copper, gold and other base metals intercepts, including:

- Falcon Prospect: 2m @ 4.4% Ni from 122m, and 1m @ 1.3% Cu & 6.3 g/t Au from 98m

- Sandpiper Prospect: 4m @ 36.9 g/t Au from 104m, and 1m @ 2.5% Cu & 24.5 g/t Au from 96m

- Historic Warriedar Copper mine: Surface rock chip sampling returned: 20.1% Cu (MGRX003134); 17.8% Cu (MGRX003135)

These intercepts were not followed up by previous owners as they were not suitable for the Golden Range processing plant which was designed only to process oxide gold mineralisation.

Fields Find West offers some of the best brownfield and geophysical targets for both base metals and gold from across the Fields Find and Golden Range Projects (see Figure 2, ASX release 3 August 2023 for prospect locations).

The planned drilling at Fields Find West is designed to test an aggregate of 10 specific target areas. The Stage 1 program of approximately 5,600m RC drilling encompasses testing of the initial approved targets being the historic Warriedar Copper Mine and the Falcon Prospect.

Click here for the full ASX Release

This article includes content from Warriedar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

WA8:AU

The Conversation (0)

09 April 2024

Warriedar Resources

Advanced gold and copper exploration in Western Australia and Nevada

Advanced gold and copper exploration in Western Australia and Nevada Keep Reading...

18 November 2024

Targeted Exploration Focus Delivers an Additional 471koz or 99% Increase in Ounces, and a Higher Grade for Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) is pleased to report on an updated MRE for its flagship Ricciardo Gold Deposit, part of the broader Golden Range Project located in the Murchison region of Western Australia. HIGHLIGHTS:Updated Mineral Resource Estimate (MRE) for... Keep Reading...

30 September 2024

Continued Delivery of High Grade Antimony Mineralisation at Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides an update on its initial review of the antimony (Sb) potential at the Ricciardo deposit, located within its Golden Range Project in the Murchison region of Western Australia. HIGHLIGHTS:Review of the antimony (Sb)... Keep Reading...

29 September 2024

Further Strong Extensional Diamond Drill Results from Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides further assay results from its Golden Range Project, located in the Murchison region of Western Australia. HIGHLIGHTS:All residual assay results received from the recent 2,701m (27 holes) diamond drilling program at... Keep Reading...

26 August 2024

Further Step-Out Gold Success and High-Grade Antimony Discovery

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides further assay results from its Golden Range Project, located in the Murchison region of Western Australia. The results reported in this release are for a further 6 of the 27 diamond holes drilled in the current program at... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00