- WORLD EDITIONAustraliaNorth AmericaWorld

April 18, 2023

Latin Resources Limited (ASX: LRS) (“Latin” or the “Company”) is pleased to announce that it has received firm commitments to raise A$37.1 million through a two-tranche placement of new fully paid ordinary shares (“New Shares”) to institutional, sophisticated and professional investors (“Placement”). Latin is particularly pleased to welcome several new funds to the register, including specialist North American battery metals funds, a well-regarded domestic institution and two major Brazilian funds. Latin’s largest shareholder, Integra Lithium, also participated in the Placement. The Brazilian funds that have taken a shareholding in Latin Resources are BTG Pactual, Brazil’s largest investment bank and JPG one of Brazil’s largest asset and wealth management institutions.

HIGHLIGHTS

- Latin has received firm commitments to raise A$37.1 million through an institutional two-tranche

- placement priced at A$0.105 per share.

- Placement funds will primarily be used to accelerate exploration activity and development approvals at the Company’s flagship 100% owned Salinas Lithium Project in Brazil.

- The Placement was well supported by a number of specialist, North American battery metals funds; Integra Lithium, the Company’s largest shareholder and two Brazilian institutional funds.

- Upon settlement of the Placement, Latin will have a cash balance of approximately A$57 million (before costs).

The Placement provides the Company with a significant capital injection to expand and accelerate its exploration program at the Salinas Lithium Project in Brazil, in addition to funding the Definitive Feasibility Study (“DFS”); fast-tracking environmental studies; securing development license approvals; and further exploration work on recently acquired tenure to the north of the Colina Deposit.

Latin’s Managing Director, Chris Gale, commented:

“We are delighted to announce the completion of the Placement which has enabled us to introduce a number of high quality, North American, Brazilian and domestic institutions to the Company’s register. The Placement provides significant validation of Latin’s portfolio of assets and the Company’s ongoing resource expansion drill program, feasibility studies and development approvals for Salinas.

“I would like to thank all new and existing shareholders for their ongoing support and look forward to accelerating the development of Latin’s Salinas Project in this emerging lithium district in Brazil.

“We look forward to releasing to the market further drilling results from Colina and the updated JORC Mineral Resource expected in June 2023.”

Funds raised by the Placement will be applied towards fast-tracking the Salinas Lithium Project, including:

- Aggressive resource definition program to increase the size and indicated JORC Mineral Resource at the Colina Deposit;

- Further exploration work on the recently acquired tenure of 29,940 hectares north of the Colina Deposit; and

- General working capital.

The Company is now fully funded through to a resource upgrade, DFS, environmental studies and development licence approval application at the Salinas Lithium Project.

The Company’s ongoing 65,000 metre resource definition diamond drilling campaign is progressing well, with a total of 32,000 meters completed in 109 diamond drill holes at the flagship Colina Deposit in Brazil1. The Company’s aggressive exploration program includes the recent addition of four diamond drilling rigs, taking the total rigs onsite to eight, operating on a double shift basis. The Company is on track to close off its drilling database in mid-May to enable the mineral resource upgrade estimation process to commence in June 2023.

The Company is well-placed for fast-track approvals with the recent signing of a non-binding Memorandum of Understanding (“MoU”) with the State of Minas Gerais2. The partnership reinforces the existing cooperation between Latin and the State of Minas Gerais and assists with streamlining the approvals pathway for Latin to take the Colina Deposit through feasibility studies and into production.

Metallurgical test work is ongoing, with the final selection of a representative bulk sample for the next round of metallurgical test work in the final stages and drilling of large diameter PQ size drill core set to commence in late May. The proposed test work will follow on from the existing Heavy Liquid Separation (“HLS”) test work which returned exceptional recoveries of over 80.5% of lithium recovered in a concentrate grading up to 6.6% Li2O. This test work is designed to provide information for the upcoming DFS.

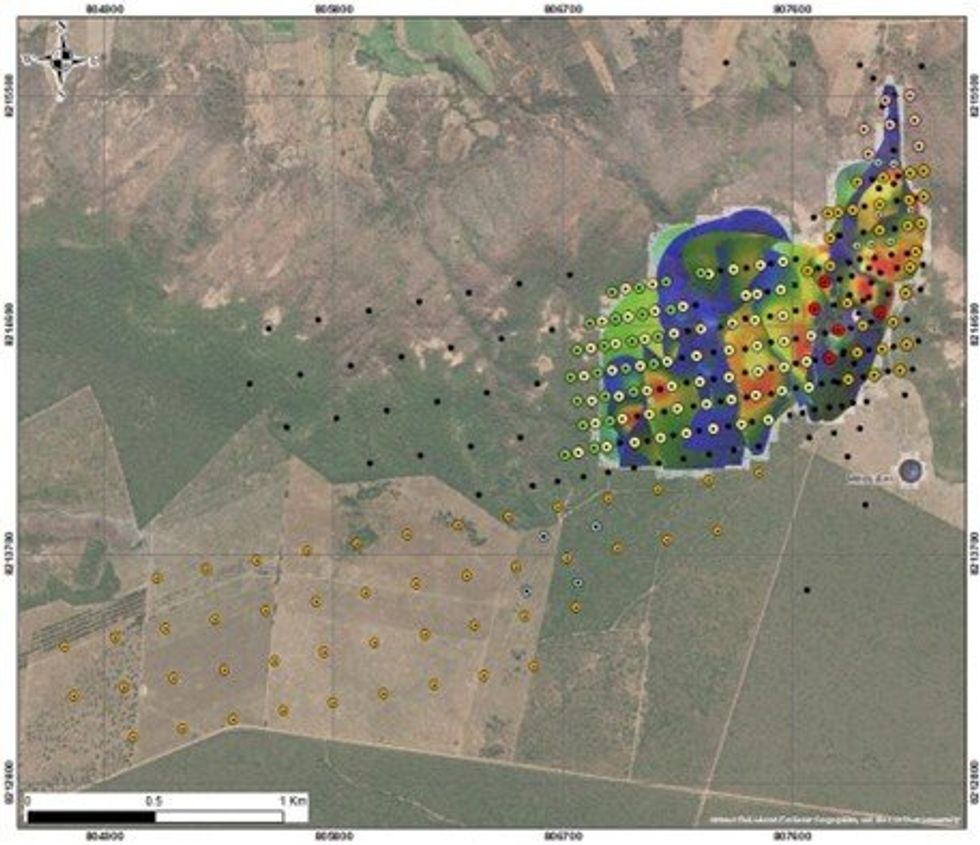

Figure 1: Colina Deposit - Proposed expanded diamond drill plan overlain on the current pegmatite wireframe thickness model, showing existing and planned drill collar positions designed to upgrade the existing Colina MRE to Indicated JORC classification and fast-track mineral resource expansion to the south west

Click here for the full ASX Release

This article includes content from Latin Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LRS:AU

The Conversation (0)

02 February 2022

Latin Resources

Developing mineral projects to support the global decarbonization

Developing mineral projects to support the global decarbonization Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Trading Halt

6h

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00