April 16, 2023

BMG delivers first Mineral Resource for Abercromby at the Capital Deposit to underpinproject’s potential to deliver significant value

Gold and lithium explorer BMG Resources Limited (ASX: BMG) (BMG or Company) is pleased to announce a maiden Mineral Resource of 11.12Mt @ 1.45 g/t Au for 518koz Au for the Capital Deposit, part of its Abercromby Gold Project in the Wiluna-Agnew region of Western Australia.

HIGHLIGHTS

- Major Abercromby Project milestone with maiden Mineral Resource for Capital Deposit of 11.1Mt @ 1.45 g/t Au for 518koz Au (0.4g/t and 1.25g/t cut-offs for open pit and underground zones respectively)

- Open Pit area: 354koz @ 1.17g/t Au (>0.4g/t Au between surface and 200mbs)

- Underground area: 164koz @ 3.09g/t Au (>1.25g/t Au between 200 and 500mbs)

- 353koz (68%) Au Indicated and 165koz (32%) Au Inferred (using resource constraint above)

- 345koz in oxide and transitional material, 173koz in fresh material

- Higher grade component of the resource is 430koz @ 2.01g/t Au at a 1.0g/t lower cut-off

- Low $8.35/oz discovery cost

- Abercromby is on granted mining leases providing an expedited pathway to mining approvals

- Capital Deposit has open pit potential, with mineralisation starting from near surface extending at depth and along strike beyond Mineral Resource footprint

The maiden Mineral Resource, combined with metallurgical work that confirmed the orebody as free milling across all zones1, is a strong indicator of the potential for a straight-forward open-pit mining operation.

BMG will now commence development studies alongside high-impact expansion drilling to further convert Inferred resources to the higher-confidence Indicated category. BMG is also preparing for further exploration activities across the Abercromby Project area to test large regional gold anomalies to the south, which could deliver further Capital-style discoveries.

BMG Resources Managing Director Bruce McCracken said:

“This large maiden Mineral Resource at Abercromby, delivered at a discovery cost of just $8.35 per ounce, is a step-change in value for BMG. Through efficient use of exploration spend across three major drilling campaigns, BMG has shifted from pure explorer to potential developer with a large resource base and huge potential for further growth.

“Abercromby now has a metric for valuation that BMG can use to quantitatively demonstrate to the market its success in leveraging value from the drill bit.

“Abercromby is well located for development. The potential to monetise the project in a rapidly appreciating gold price environment, underpinned by this maiden resource for the Capital Deposit, places BMG in an enviable position as we continue to pursue sustained, long-term shareholder value.”

The Abercromby Gold Project

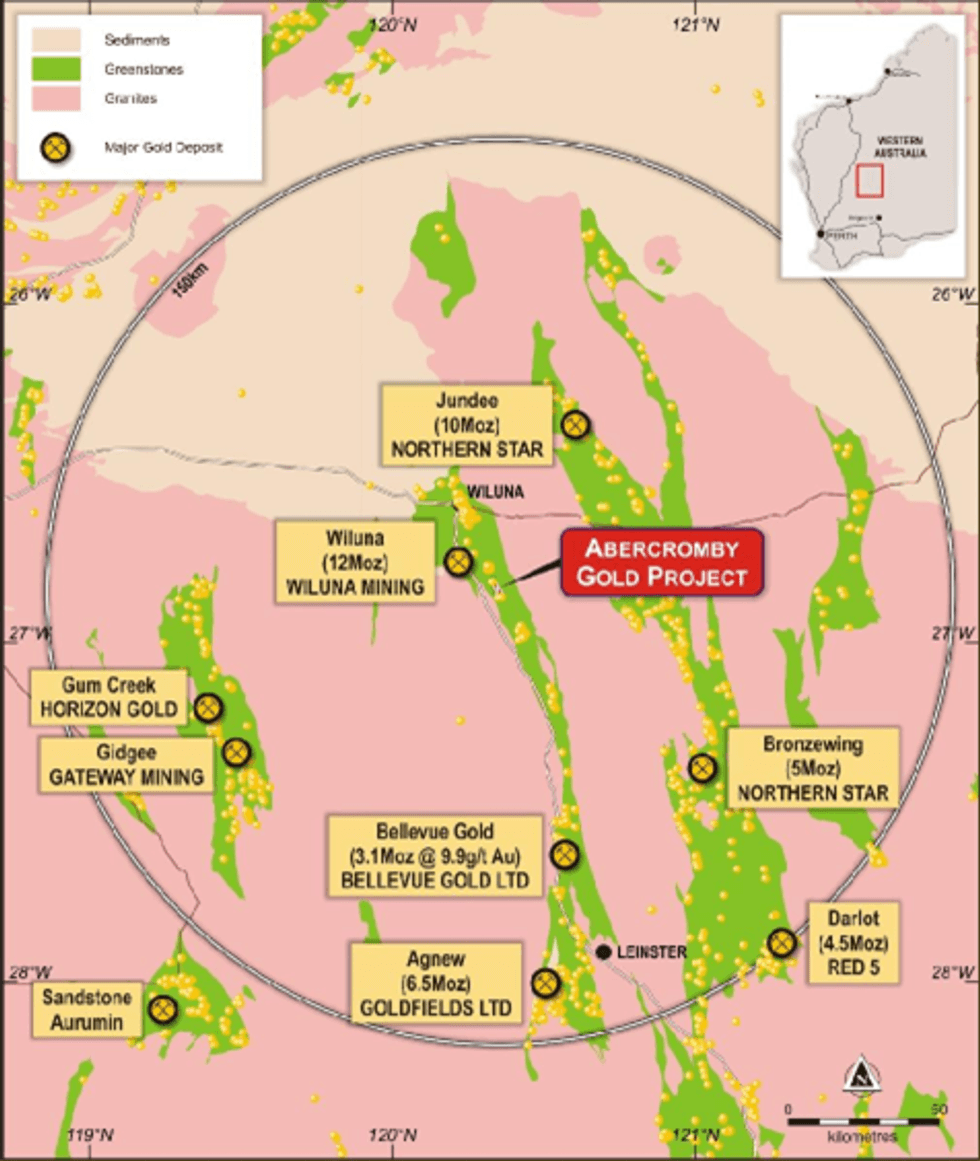

The Abercromby Gold Project is located on the Wiluna Greenstone Belt, one of Western Australia’s most significant gold-producing regions with a gold endowment of +40Moz Au – second only to Kalgoorlie globally in terms of historic production.

The geology at Abercromby is favourable for gold mineralisation, with drilling having intersected multiple thick intervals of high-grade gold mineralisation confirming the presence of a large, high-grade gold system. BMG holds 100% of Abercromby, which comprises the gold and other mineral rights (ex-uranium) of two granted mining leases (M53/1095 and M53/336). The mining leases provide for an expedited development pathway for the Company to secure mining approval.

Since acquiring the project in mid-2020, BMG has completed three reverse circulation and diamond drill programs primarily targeting the high-priority Capital Deposit. The Capital Deposit sits within the northern third of Abercromby’s 12km2 project area.

In parallel to the drill program, BMG has completed metallurgical test work on core samples from the Capital Deposit which confirmed its free-milling status and therefore amenability to conventional carbon-in-leach (CIL) processing, with high gold recoveries achieved. See our ASX announcement dated 6 February 2023 “High Gold Recoveries – Abercromby Metallurgical Test” for full discovery of the outcomes of the metallurgical test work.

The Mineral Resource estimation at the Capital Deposit was completed by ordinary kriging within 3D-modelled mineralisation wireframes and block modelling in Surpac, utilising a comprehensive data set generated by recent work undertaken by BMG as well as work completed by previous owners.

Click here for the full ASX Release

This article includes content from BMG Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BMG:AU

The Conversation (0)

4h

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

15h

Canadian Investment Regulatory Organization Trade Resumption - IMR

Trading resumes in: Company: iMetal Resources Inc. TSX-Venture Symbol: IMR All Issues: Yes Resumption (ET): 10:30 AM CIRO can make a decision to impose a temporary suspension (halt) of trading in a security of a publicly-listed company. Trading halts are implemented to ensure a fair and orderly... Keep Reading...

15h

iMetal Resources Intersects 16.65 Metres at 1.24 g/t Gold Within 62.25 Metres at 0.61 g/t Gold at Gowganda West

iMetal Resources Inc. (TSXV: IMR,OTC:IMRFF) (OTCQB: IMRFF) (FSE: A7VA) ("iMetal" or the "Company") has intersected 16.65 metres at 1.25 gt gold within 62.25 metres at 0.61 gt gold at its Gowganda West Gold Project, southwest of Timmins, Ontario. Drilling in the West Zone intersected broad levels... Keep Reading...

25 February

Precious Metals Price Update: Gold, Silver, PGMs Boosted by Geopolitical and Trade Tensions

Precious metals are recovering their safe-haven demand appeal this week.Gold, silver and platinum are up this week, all still down from the all-time highs recorded in January. Escalating geopolitical tensions and US trade policy shifts are once again at center stage in this sector of the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00