April 30, 2024

Gladiator Resources Ltd (ASX: GLA) (Gladiator or the Company) is pleased to provide shareholders with the Company’s Activities and Appendix 5B Report for the quarter ending 31 March 2024.

HIGHLIGHTS

The Company raised $4M at $0.03 per share from a consortium of private investors led by Mr Ian Stalker, with funds to be used toward the Company’s exploration and drilling program at the Mkuju Uranium Project in Tanzania.

Preparations for drilling at the Mkuju Project in southern Tanzania commenced, with drilling expected to commence in May to test the Southwest Corner target and test potential extensions to the Mtonya and Likuyu North deposits.

Samples from shallow reconnaissance pits at Minjingu Project in northern Tanzania returned results of 202ppm and 269ppm U3O8.

URANIUM PROJECTS - TANZANIA

MKUJU URANIUM PROJECT

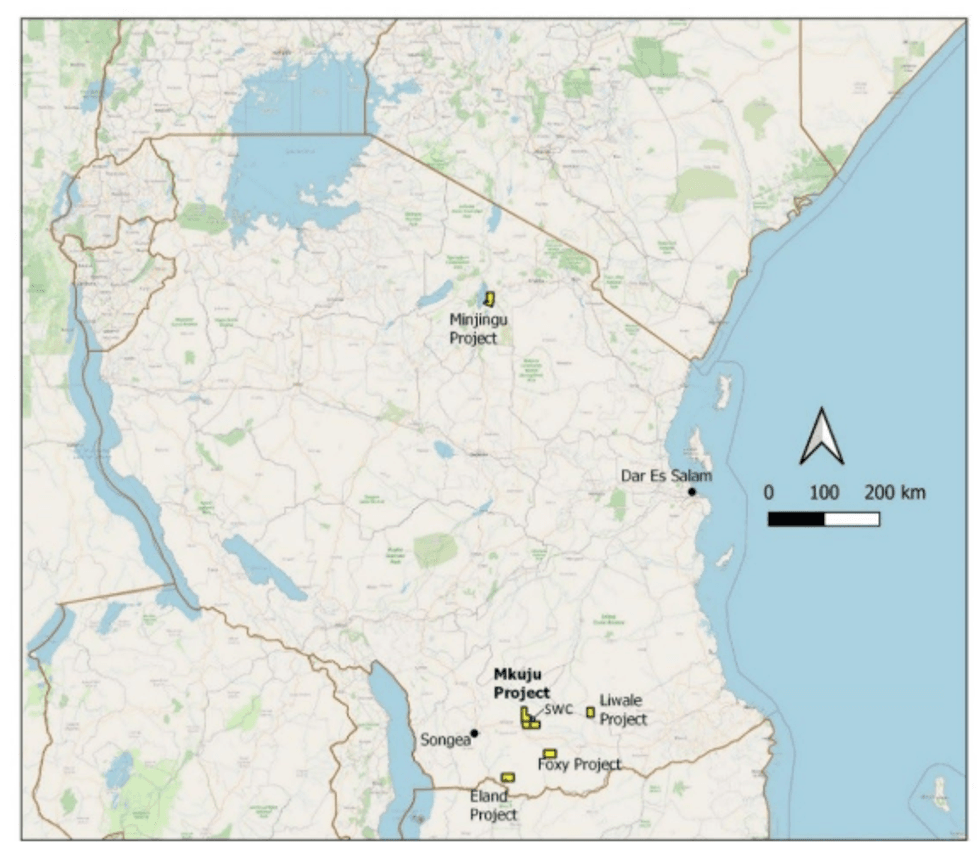

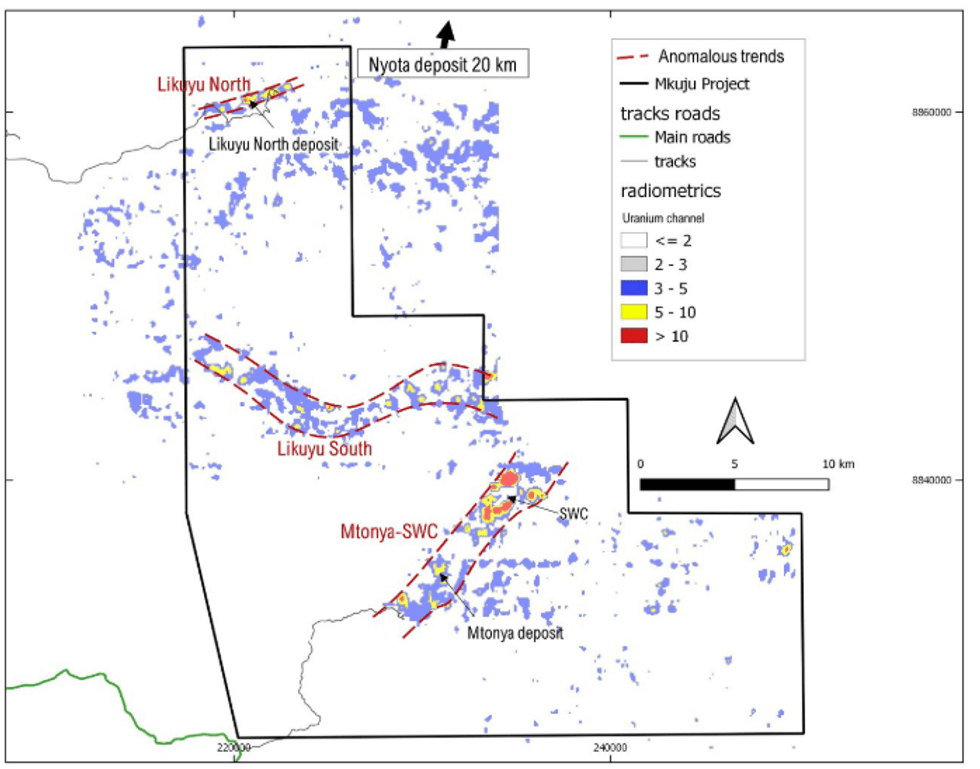

The Prospecting Licenses (PLs) of the Mkuju Project cover 725 km2 as shown in Figure 2 and include two existing uranium deposits and several exploration prospects. The area is 20-30 km south of the Nyota deposit. Nyota hosts a Measured and Indicated Mineral Resource Estimate of 187 Mt at 306 ppm U3O8 containing 124.6 Mlbs U3O8. Nyota is being developed by global uranium company Uranium One. The Nyota deposit and the deposits and prospects on the Mkuju Project are underlain by continental sediments of Triassic aged sediments of the Karoo Supergroup which are considered highly prospective for uranium.

During the quarter no fieldwork was carried out as access to the area is extremely difficult during Tanzania’s wet season which typically lasts from November/December until early May. During the quarter significant progress was made in preparation for an initial 2000m drilling program planned to commence during May, to test the Southwest Corner target and test potential extensions to the Mtonya and Likuyu North deposits, summarised below with further details found in the Company’s recent ASX announcements.

- At Southwest Corner, the drilling is to test the potential for down-dip extension of the recently trenched high-grade surface uranium (refer announcement dated 10 Jan 2024).

- At Mtonya holes to follow up on excellent uranium intersections not followed up by previous explorers in 2012 (refer announcement dated 10 October 2023).

- At Likuyu North the drilling will test for potential new zones that if present would add to the existing 4.6 Mlb U3O8 (JORC) Resource.

Click here for the full ASX Release

This article includes content from Gladiator Resources , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLA:AU

The Conversation (0)

29 May 2024

Gladiator Resources

Capitalizing on the uranium momentum with prolific assets in Tanzania

Capitalizing on the uranium momentum with prolific assets in Tanzania Keep Reading...

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00