May 30, 2022

The following Management’s Discussion and Analysis (“MD&A”) is intended to supplement the condensed interim consolidated financial statements of Sarama Resources Ltd. (the “Company” or “Sarama”) and its subsidiaries for the three months ended March 31, 2022.

The condensed interim consolidated financial statements for the three months ended March 31, 2022 have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). All amounts are expressed in United States dollars, unless otherwise stated.

This MD&A is current as at May 30, 2022.

Additional information relating to the Company is available on SEDAR at www.sedar.com under the Company’s profile

OVERVIEW

Sarama is a Canadian-incorporated mineral exploration and development company whose principal business objective is to explore for and develop gold deposits in West Africa.

The Company was incorporated on April 8, 2010 under the Business Corporations Act (British Columbia). The Company’s primary office is located in Perth, Western Australia. The Company’s common shares are listed on the TSX Venture Exchange (“TSXV”) and the Australian Securities Exchange (“ASX”) under the respective codes ‘SWA’ and ‘SRR’.

The Company has built and advanced substantial exploration landholdings in prospective and underexplored areas in south-west Burkina Faso, West Africa. The Company has significant interests in three projects located principally in the Houndé and Banfora Belts, which are considered highly prospective for gold and remain underexplored.

Sarama’s 100%-owned(10) Sanutura Project is principally located within the prolific Houndé Greenstone Belt in south-west Burkina Faso and is the exploration and development focus of the Company. The project hosts the Tankoro and Bondi Deposits which have a combined mineral resource of 0.6Moz gold (Indicated) and 2.3Moz gold (Inferred)(1).

Together, the deposits present a potential mine development opportunity featuring an initial, long-life CIL project which may be established and paid for by the significant oxide mineral resource base.

Sarama has built further optionality into its portfolio including a 467km², 100%-owned(10) exploration position in the highly prospective Banfora Belt in south-western Burkina Faso. The Koumandara Project hosts several regional-scale structural features and trends of gold-in-soil anomalism extending for over 40km along strike.

Sarama also holds an approximate 18% participating interest in the Karankasso Project Joint Venture (“JV”) which is situated adjacent to the Company’s Sanutura Project in Burkina Faso and is a JV between Sarama and Endeavour Mining Corp (“Endeavour”) in which Endeavour is the operator of the JV. In February 2020, an updated mineral resource estimate of 709koz gold (Inferred)(9) was declared for the Karankasso Project JV.

CORPORATE

Treasury

As at March 31, 2022, the Company had cash and cash equivalents of $459,237.

Second Listing on the Australian Stock Exchange

On May 2, 2022, the Company commenced trading its securities on the Australian Securities Exchange (“ASX”) in addition to the continued listing of its common shares on the TSXV. In conjunction with the ASX listing the Company raised gross proceeds of A$8 million via the issue of 38,095,238 Chess Depositary Instruments (“CDIs”) at an issue price of A$0.21 per CDI on April 22, 2022. The Lead Manager, Euroz Hartleys Securities Limited, received 2,500,000 Broker options at an exercise price of A$0.273 and expire three years from the date of issue. It also received a capital raising fee of 6% of total gross funds raised, excluding any funds subscribed for under an agreed Chairman’s list, for which a 2% management fee was applied, and a separate management fee of A$75,000.

Proceeds raised pursuant to the ASX listing will be used, in part, to expedite an extensive drilling campaign planned to total approximately 50,000m. The planned drill programs aim to augment and upgrade the currently defined mineral resources with a focus on oxides and near surface material, to test a number of high priority targets that have the potential to significantly impact project growth, and to evaluate early-stage targets.

EXPLORATION AND EVALUATION EXPENDITURE

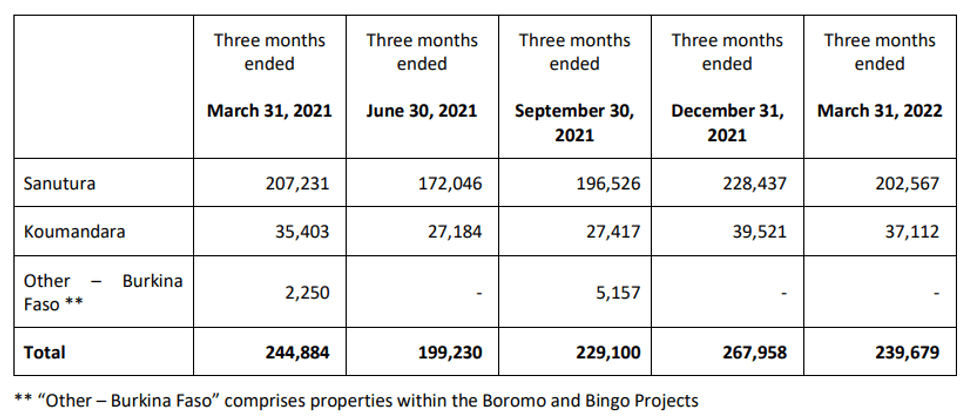

During the current quarter the Company incurred exploration expenditure of $239,679. The costs per active project area per each quarter for the current period ending March 31, 2022 and preceding four quarters is as follows;

For the quarter ended March 31, 2022, the Company incurred exploration expenditure of $240k. Expenditure incurred at the Sanutura Project was $203k which included drilling consumables in preparation for the exploration program ($20k), plus allocation of administration, camp and technical support ($183k). Costs at Koumandara Project of $37k which included allocation of administration, camp and technical support ($37k).

Click here for the full ASX Release

This article includes content from Sarama Resources Ltd. , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SRR:AU

Sign up to get your FREE

Sarama Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

04 November 2025

Sarama Resources

Promising new gold projects in Western Australia, plus a large fully funded arbitration claim.

Promising new gold projects in Western Australia, plus a large fully funded arbitration claim. Keep Reading...

14 August 2025

Q2 2025 Interim Financial Statements

Sarama Resources (SRR:AU) has announced Q2 2025 Interim Financial StatementsDownload the PDF here. Keep Reading...

04 August 2025

Sarama Provides Update on Arbitration Proceedings

Sarama Resources (SRR:AU) has announced Sarama Provides Update on Arbitration ProceedingsDownload the PDF here. Keep Reading...

09 July 2025

Completion of Tranche 1 Equity Placement & Cleansing Notice

Sarama Resources (SRR:AU) has announced Completion of Tranche 1 Equity Placement & Cleansing NoticeDownload the PDF here. Keep Reading...

29 June 2025

A$2.7m Equity Placement to Fund Laverton Drilling Campaign

Sarama Resources (SRR:AU) has announced A$2.7m Equity Placement to Fund Laverton Drilling CampaignDownload the PDF here. Keep Reading...

25 June 2025

Trading Halt

Sarama Resources (SRR:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

5h

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

17h

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

18h

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

18h

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

19h

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

19h

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

Latest News

Sign up to get your FREE

Sarama Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00