May 20, 2024

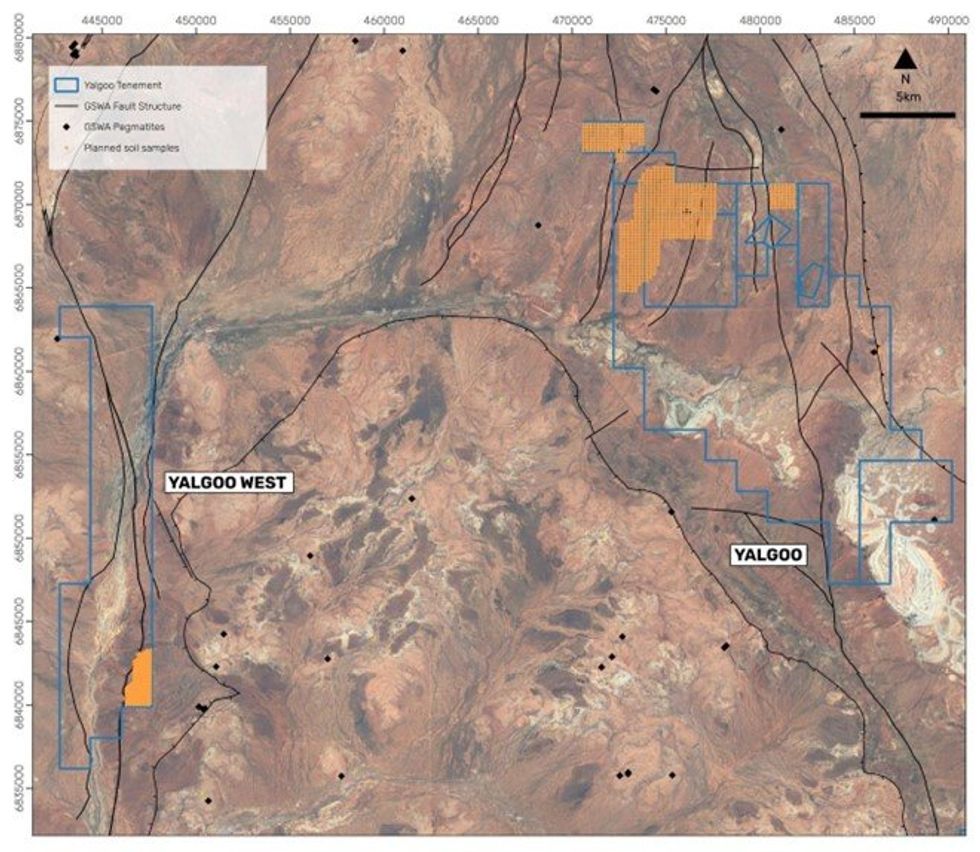

Premier1 Lithium Limited (ASX:PLC) (“Premier1” or the “Company”) is pleased to announce the commencement of fieldwork at its Yalgoo lithium projects. Target delineation work includes tenement - wide soil and rock chip sampling over the main target areas previously identified by machine learning (ML) in the northern part of the Yalgoo project and the southeastern part of the Yalgoo West project. A total of 930+ soil samples will be collected on a 200x200m grid for Yalgoo and on a 100x200m grid for Yalgoo West (subject to pending land access approvals).

HIGHLIGHTS

- Fieldwork commenced at the Yalgoo lithium projects

- Large scale soil and rock chip sampling program underway

- First phase to test main ML targets with almost 1000 soil samples to be collected

- Proximate to known lithium occurrences

The two projects are located within the northern part of the Yalgoo-Singleton greenstone belt (YSGB) in the Murchison province. Both sequences are typical greenstones consisting of submarine tholeiitic and high-Mg basalt lava flows, large intrusive gabbro bodies overlain by BIF and volcanic rocks with minor ultramafic and felsic rocks. The greenstone belt is intruded and bounded by granitoids, predominantly granodiorite and monzogranite to tonalite with minor syenogranite. Pegmatites associated with the granites are recognised throughout the project area and especially along the granite greenstone contacts.

Tectonically the greenstone is bounded by major faults and shear zones, with the major Mulloo and Wagga Wagga Shear Zones on the eastern contact covered by the Yalgoo project and the major Salt River Shear Zone covered by the Yalgoo West project. Premier1 (utilising SensOre ML technology) identified a large, predicted lithium target within a region not previously highlighted for its lithium exploration potential. During target analysis lithium mineralised LCT pegmatites were identified by a number of adjoining companies, including Firetail Resources and Zenith Minerals, validating the emerging potential of the area for LCT pegmatites.

At Yalgoo, the predicted target forms a large cluster of Li prospectivity that was previously unidentified and untested representing lithium potential over the northern portion of the greenstone belt. Additionally, the eastern portion of the project is prospective for VMS copper and zinc. At Yalgoo West another cluster of Li prospectivity predicted unidentified and untested lithium potential over the western portion of the greenstone belt.

The greater Yalgoo project area encompasses two joint ventures. In the eastern portion of the project area (Yalgoo), Premier1 has the rights to earn up to 70% of all commodities except Rare Earth Elements in a farm-in announced on 12 May 2023 with Venture Minerals (ASX:VMS). In the western portion of the project area (Yalgoo West), the Company is in a farm in with Firetail Resources (ASX:FTL) where Premier1 may earn 80% of lithium rights by spending announced 7 November 2023..

The next steps on the broader Yalgoo project involve extensive target delineation activities to generate drilling targets for the second half of 2024.

Click here for the full ASX Release

This article includes content from Premier1 Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

PLC:AU

The Conversation (0)

05 June 2024

Premier1 Lithium

AI-based and data-driven approach to lithium exploration in Western Australia

AI-based and data-driven approach to lithium exploration in Western Australia Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00