(TheNewswire)

Vancouver, British Columbia December 22, 2022 Xander Resources Inc. ("Xander" or the "Company") (TSXV:XND) (OTC:XNDRF) (FSX:1XI), a North American mineral acquisition and exploration company focused on the development of drill-ready battery and precious metal projects, is pleased to announce that, further to its news releases of November 17, 2022 and December 19, 2022, and subject to the final approval of the TSX Venture Exchange (the " Exchange "), it has raised aggregate gross proceeds of $1,304,575.03 through the issuance of the following non-brokered private placements (the " Private Placement s"):

-

17,602,143 flow-through units (each a FT Unit ") at a price of $0.035 per FT Unit for aggregate gross proceeds of $616,075.0;

-

11,427,273 Quebec flow-through shares (each a QFT Share ") at a price of $0.055 per QFT Share for aggregate gross proceeds of $628,500.02; and

-

1,714,286 hard dollar units (each a Unit ") at a price of $0.035 per Unit for gross proceeds of $60,000.

Each FT Unit consists of one flow-through common share (a " FT Share ") and one transferable common share purchase warrant (each a " Warrant ") exercisable into common shares (each a " Share ") of the Company at a price of $0.07 per Share for two years from the date of closing.

Each Unit consists of one Share and one Warrant exercisable into Shares at $0.07 per Share for a period of three years from the date of closing.

The net proceeds from the Private Placement of QFT Shares and FT Units will be used for exploration at the Company's Quebec and Ontario properties, respectively, while the net proceeds from the Private Placement of Units will be used for general working capital, including payment of finders' fees associated with the financings. The FT Shares and the QFT Shares will qualify as flow-through shares for purposes of the Income Tax Act (Canada). The Company will renounce said expenditures to the investors for the taxation year ending December 31, 2022.

Deepak Varshney, CEO of the Company, stated: "I would like to thank our shareholders and welcome new shareholders for their support and endorsement of the Company. We very much look forward to advancing our projects efficiently during a very active 2023."

In connection with the Private Placements, the Company paid finders' fees totalling $84,411 cash, 1,252,309 finder's warrants (each a " Finder's Warrant "), and 713,714 broker warrants (each a " Broker's Warrant ") to arm's-length parties in accordance with applicable securities laws. Finder's Warrants for the FT Units are exercisable at $0.07 per Share for a period of 2 years from the closing date while Finder's Warrants for the FT Shares are exercisable at a price of $0.07 per Share for a period of 3 years from the closing date. Broker's Warrants are exercisable into broker units (each a " Broker's Units ") at a price of $0.035 per Broker Unit for a period of 2 years from the date of closing. Each Broker's Unit is exercisable into Shares and non-transferable Warrants exercisable into Shares of the Company at $0.07 per Share for a period of 2 years from the date of closing.

All securities issued in the Private Placements are subject to the Exchange hold period expiring on April 22, 2023.

Timmins Exploration Update

The Company is also pleased to announce that it has concluded the first phase of its maiden drill program at its Timmins nickel project located in Timmins, Ontario. A total of approximately 2,171 metres were drilled over 5 targets at the North Claim block, with a particular focus on the targeted conductors that are near Canada Nickel Company's (CNC) recently identified Reid discovery, which has already been tested through drilling to have a mineralized footprint 90 per cent as large as CNC's Crawford project. Samples have been submitted to AGAT Laboratories Ltd. The Company intends on resuming drilling in 2023 and will provide updates as its exploration program progresses.

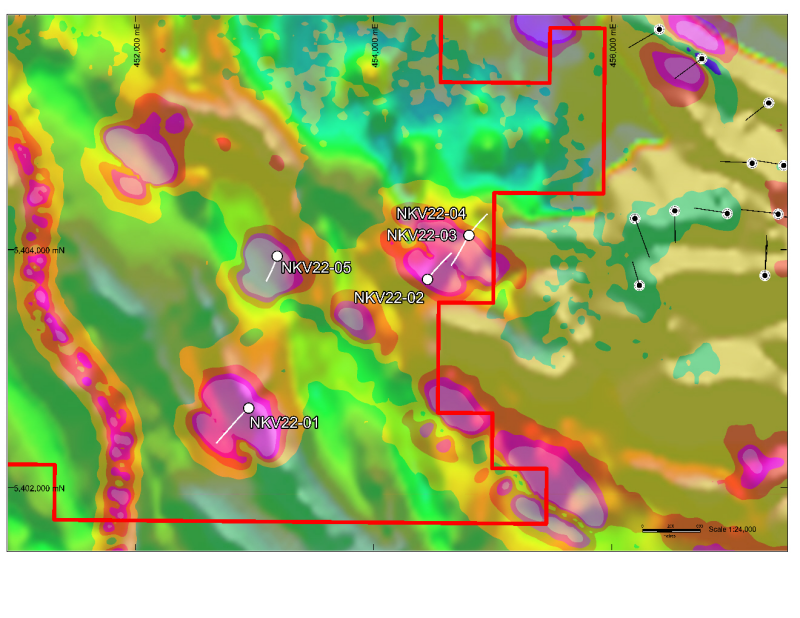

Figure 1 - Location of drillholes NKV22-01 to NKV22-05 overlain on VTEM conductors identified. The targeted conductors coincide with favourable geometries for sulphide accumulation within a mineralized ultramafic intrusion, as interpreted by a 3D magnetic inversion. Xander's claim boundaries are enclosed in red. Canada Nickel Company's Reid Discovery is located to the east, adjacent of Xander's claims.

Management Changes and Option Grants

The Company is also pleased to announce the appointment of Peter Michel as the Chief Financial Officer and Aaron Atin as the Corporate Secretary of the Company, each effective immediately.

Peter Michel is a CPA, CA who currently works as a financial consultant to various TSX Venture and NEO listed companies in the mining and health care industries. He obtained a Bachelor of Accounting and Financial Management from the University of Waterloo. Additionally, he worked as a Senior Manager at BDO Canada LLP where he worked in its audit and assurance practice. He has expertise in strategic planning. Financial reporting, budgeting, acquisitions, cash management and audit.

Aaron Atin is a corporate lawyer who works as a legal consultant to various TSX, TSX Venture and NEO-listed companies in the mining, medical, and technology industries. He was previously an associate at a large Toronto corporate law firm, where he worked on a variety of corporate, securities and commercial transactions. Mr. Atin studied at the University of Toronto, Faculty of Law, and the University of Waterloo, where he obtained a Juris Doctor and a Bachelor of Arts degree, respectively.

The appointments of Messrs. Michel and Atin follow the resignations of Zara Kanji as Chief Financial Officer and Dwayne Yaretz as Corporate Secretary, respectively, each also effective immediately. Ms. Kanji and Mr. Yaretz have tendered their resignations to focus on other endeavours. The management and board of directors of Xander would like to thank both Ms. Kanji and Mr. Yaretz for their services and wish them well in their future endeavours.

The Company also announces that it has granted incentive stock options to purchase a total of 3,000,000 Shares at an exercise price of $0.04 per Share for a period of 5 years to certain directors, officers and consultants in accordance with the provisions of its stock option plan.

Qualified Person

The technical content of this news release has been reviewed and approved by Mr. Andrew Tims, P.Geo., a qualified person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101").

About Xander Resources Inc.

Xander Resources Inc. is a Canadian mineral acquisition and exploration company based in Vancouver, BC, Canada focused on developing accretive gold and battery metal properties within Canada. The Company currently has a focus on projects located within the Provinces of Ontario and Quebec.

Xander is exploring for commercially exploitable mineral deposits and is currently focused on deposits located in Val-d'Or, Quebec, including the Senneville Claim Group which comprises over 100 sq. km and is contiguous in the south to Probe Metals' new discovery, and contiguous in the north to Monarch Mining, in close proximity to Eldorado Gold's (formerly QMX Gold) projects, and east of the North American Lithium Deposit, Great Thunder Gold's Chubb Lithium property and East of the Sayona Quebec's Authier Lithium Deposit, all in the Val-d'Or Mining Camp, plus its newly acquired nickel-sulphide project in Timmins, Ontario near Canada Nickel's MacDiarmid and Crawford Projects.

ON BEHALF OF THE BOARD OF DIRECTORS

Deepak Varshney, P.Geo., President and CEO

For more information, please email ir@xanderresources.ca , or visit www.xanderresources.ca .

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking statements

This news release contains "forward-looking information" under applicable Canadian securities legislation. Such forward-looking information reflects management's current beliefs and are based on a number of estimates and/or assumptions made by and information currently available to the Company that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors that may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Readers are cautioned that such forward-looking information are neither promises nor guarantees and are subject to known and unknown risks and uncertainties including, but not limited to, general business, economic, competitive, political and social uncertainties, uncertain and volatile equity and capital markets, lack of available capital, actual results of exploration activities, environmental risks, future prices of base and other metals, operating risks, accidents, labour issues, delays in obtaining governmental approvals and permits, and other risks in the mining industry.

The Company is presently an exploration stage company. Exploration is highly speculative in nature, involves many risks, requires substantial expenditures, and may not result in the discovery of mineral deposits that can be mined profitably. Furthermore, the Company currently has no reserves on any of its properties. As a result, there can be no assurance that such forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.

No Offer or Solicitation to Purchase Securities in the United States

This press release does not constitute or form a part of any offer or solicitation to purchase or subscribe for securities in the United States. The securities referred to herein have not been and will not be registered under the Securities Act of 1933, as amended (the "Securities Act" ), or with any securities regulatory authority of any state or other jurisdiction in the United States, and may not be offered or sold, directly or indirectly, within the United States or to, or for the account or benefit of, U.S. persons, as such term is defined in Regulation S under the Securities Act, except pursuant to an exemption from or in a transaction not subject to the registration requirements of the Securities Act.

Copyright (c) 2022 TheNewswire - All rights reserved.