January 29, 2025

Westport Fuel Systems (NASDAQ:WPRT,TSX:WPRT) delivers advanced fuel system technologies, focused on heavy-duty and light-duty vehicles, to reduce carbon emissions without compromising engine performance. The company offers innovative solutions that enable internal combustion engines to operate on alternative low-carbon fuels, including natural gas, renewable natural gas (RNG) and hydrogen.

Westport operates in a rapidly growing and changing clean transportation market driven by stringent emission regulations, increasing fuel costs, and rising demand for sustainable mobility solutions.

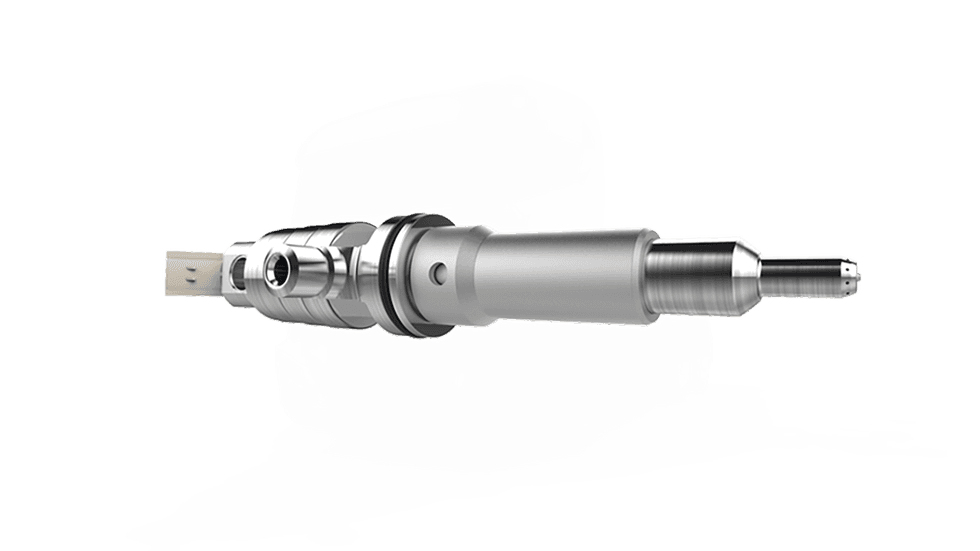

The HPDI system features a revolutionary, patented injector with a dual concentric needle design that delivers small quantities of diesel fuel and large quantities of natural gas, at high pressure, to the combustion chamber.

The HPDI system features a revolutionary, patented injector with a dual concentric needle design that delivers small quantities of diesel fuel and large quantities of natural gas, at high pressure, to the combustion chamber. The HPDI fuel system is engineered for heavy-duty trucks and industrial applications. By injecting high-pressure natural gas or hydrogen directly into the combustion chamber, HPDI delivers diesel-like torque and power with up to 98 percent lower CO₂ emissions when using hydrogen. This technology is critical for long-haul trucking and other high-load applications, where maintaining performance and range is essential. This technology is now owned under the Cespira JV, which generated a revenue of $16.2 million in Q3 2024.

Company Highlights

- Westport is a pioneer in the development and commercialization of alternative fuel delivery systems for natural gas, renewable natural gas (RNG), propane, and hydrogen-powered internal combustion engines (ICEs).

- The company is rooted in both the heavy-duty and light-duty vehicle market, leveraging Westport’s proprietary fuel technologies to deliver reductions in carbon emissions for both commercial and passenger vehicles.

- Westport’s High-Pressure Controls and Systems segment focuses on fuel management solutions for hydrogen and other pressurized alternative fuels.

- The flagship HPDI technology, now part of the company’s Cespira joint venture with Volvo Group, enables heavy-duty trucks to operate on natural gas or hydrogen, thereby substantially lowering CO₂ emissions while delivering diesel-equivalent or better performance.

- Westport’s growth trajectory is enhanced by key collaborations, most notably via the formation of Cespira, a joint venture with Volvo Group aimed at accelerating the global adoption of the HPDI technology.

This Westport Fuel Systems profile is part of a paid investor education campaign.*

WPRT

Sign up to get your FREE

Westport Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

04 September 2025

Westport

Advanced, clean fuel systems and components that deliver both economic and environmental benefits

Advanced, clean fuel systems and components that deliver both economic and environmental benefits Keep Reading...

04 February

Westport Announces $6.5 Million Milestone Payment From Light-Duty Divestiture

~ Previously announced Light-Duty divestiture providing non-dilutive capital that strengthens Westport's cash position~ Westport Fuel Systems Inc. ("Westport") (TSX:WPRT Nasdaq: WPRT), a supplier of alternative fuel systems and components for the global transportation industry, today announced... Keep Reading...

19 January

Westport Announces Start of Production at Two Key High-Pressure Controls and Systems Facilities

~ Global Production Expansion Strengthens Hydrogen and Alternative Fuel System Manufacturing Capacity ~ Westport Fuel Systems Inc. ("Westport") (TSX:WPRT Nasdaq: WPRT), a supplier of alternative fuel systems and components for the global transportation industry, announces the commencement of... Keep Reading...

02 January

Westport Announces Board of Directors Update

Westport Fuel Systems Inc. ("Westport") (TSX:WPRT Nasdaq: WPRT), a supplier of alternative fuel systems and components for the global transportation industry, today announces changes to its Board of Directors. Chair Dan Hancock, appointed to the Board in July 2017, retired from the Board,... Keep Reading...

06 November 2025

Westport Reveals CNG Solution for Natural Gas HPDI Engines and North America's Clean Transportation Future

Westport Fuel Systems Inc. ("Westport") (TSX:WPRT Nasdaq: WPRT), a supplier of alternative fuel systems and components for the global transportation industry, today announces a breakthrough solution designed to dramatically expand the addressable market for HPDI™ while significantly improving... Keep Reading...

22 October 2025

Westport to Issue Q3 2025 Financial Results on November 10, 2025

Westport Fuel Systems Inc. (TSX: WPRT Nasdaq: WPRT) ("Westport" or "The Company") announces that the Company will release Q3 2025 financial results on Monday, November 10, 2025, after market close. A conference call and webcast to discuss the financial results and other corporate developments... Keep Reading...

04 March

Funding to Advance 2026 Development Milestones

Provaris Energy (PV1:AU) has announced Funding to Advance 2026 Development MilestonesDownload the PDF here. Keep Reading...

02 March

Trading Halt

Provaris Energy (PV1:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

25 February

Acquisition of Critical Infrastructure Services Platform

European Green Transition plc (AIM: EGT) announces that in line with its strategy set out at IPO, EGT has entered into a share purchase agreement ("SPA") to acquire an established, EBITDA profitable onshore wind turbine operating, maintenance, repairing, and remote monitoring business (the "O&M... Keep Reading...

25 February

CHARBONE confirme de nouvelles commandes en hydrogene UHP et une premiere commande en oxygene UHP aux Etats-Unis

(TheNewswire) Brossard, Quebec, le 25 février 2026 TheNewswire - CORPORATION Charbone (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) (« Charbone » ou la « Société »), un producteur et distributeur nord-américain spécialisé dans l'hydrogène propre Ultra Haute Pureté (« UHP ») et les gaz industriels... Keep Reading...

25 February

CHARBONE Confirms New UHP Hydrogen Orders and its First UHP Oxygen Order in the United States

(TheNewswire) Brossard, Quebec, February 25, 2026 TheNewswire - Charbone CORPORATION (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) ("Charbone" or the "Company"), a North American producer and distributor specializing in clean Ultra High Purity ("UHP") hydrogen and strategic industrial gases, is... Keep Reading...

24 February

Carbonxt Secures $500,000 Convertible Note Funding

Carbonxt Group (CG1:AU) has announced Carbonxt Secures $500,000 Convertible Note FundingDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Westport Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00