Overview

Governments worldwide have ambitious goals to reach net-zero emissions, putting renewable energy in the spotlight. Every emerging clean technology has one material in common: copper. Thanks to its highly conductive properties, the base metal has been a standard component in existing electronics, and global electrification will increase demand drastically. As a result, copper consumption is forecasted to reach 36.6 million metric tons by 2031.

Western Copper and Gold Corporation (TSX:

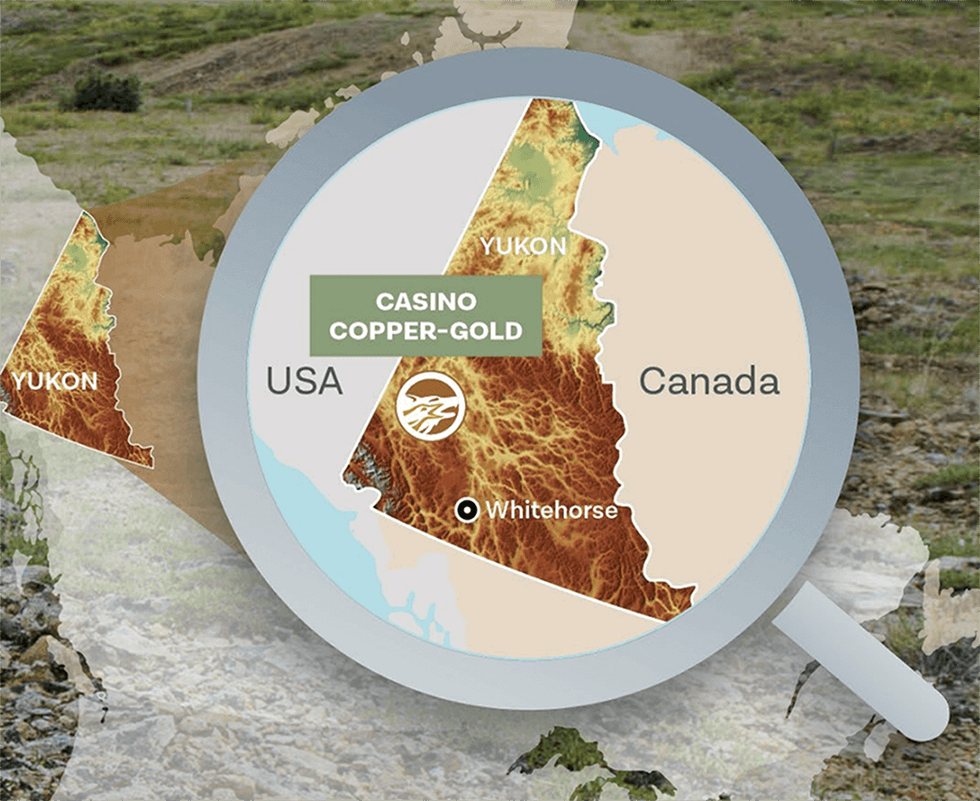

WRN,NYSE American:WRN) is ideally positioned to leverage this trend. It is currently focused on developing Canada’s premier

copper-gold project - the Casino project. The deposit is located in the Yukon Territory, which ranks among the world's most attractive mining jurisdictions.

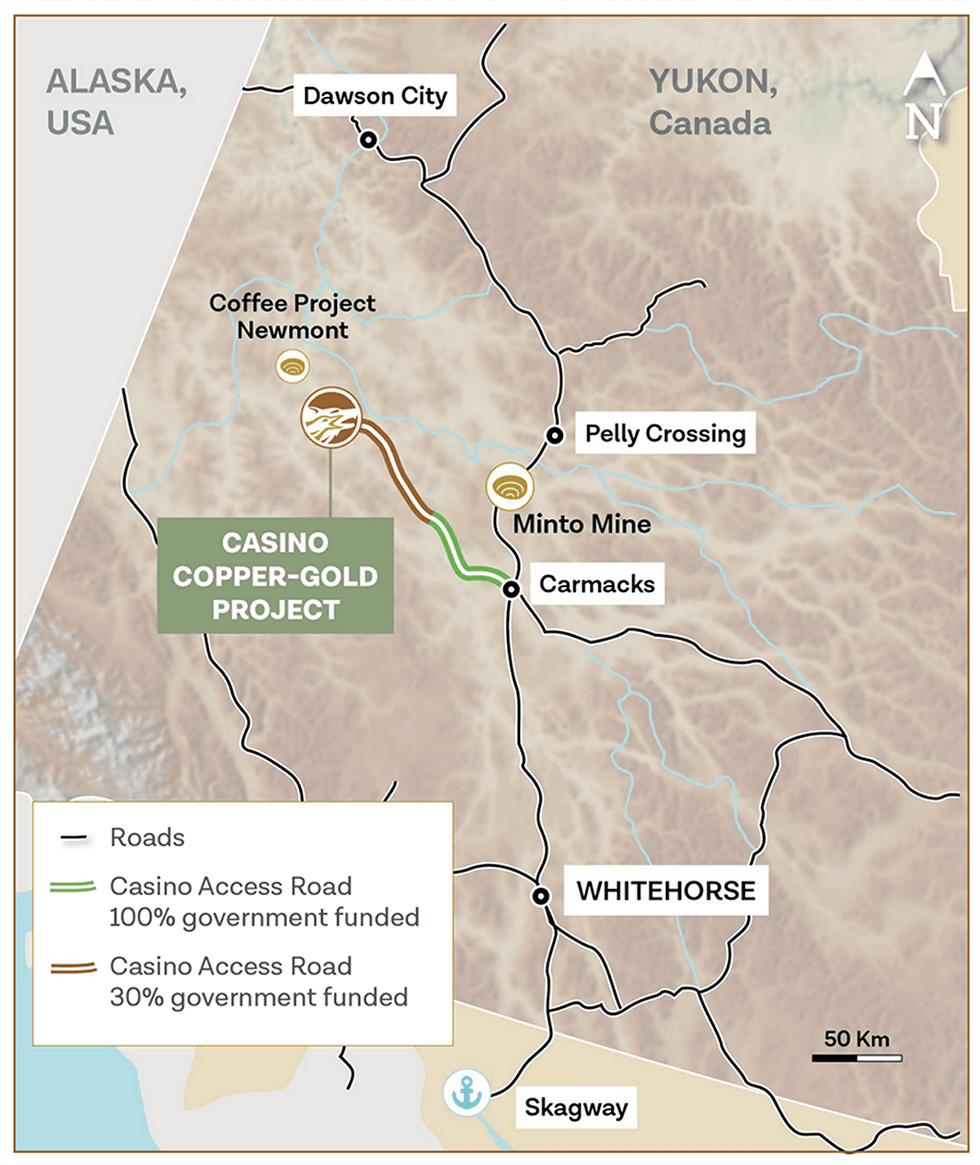

The Yukon is known for its rich mineral deposits, including copper, gold, iron, silver and lead. It has attracted the attention of numerous major mining companies over the last few years, and recent infrastructure funding from the regional and federal governments has spurred additional investment in the territory. Miners in the Yukon, including Western Copper and Gold, are poised to benefit from this spate of new investments. The Carmacks Bypass, for example, is currently being constructed and will play an integral role in the Casino project.

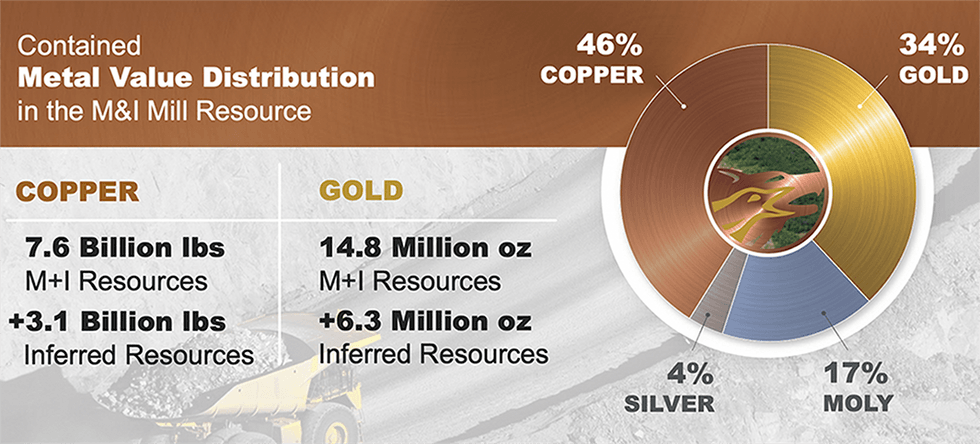

In June 2022, Western Copper and Gold released the results of its feasibility study, which incorporated an updated mineral resource. The updated estimate includes 14.8 million ounces (Moz) of gold in the measured and indicated category, and 6.3 Moz of gold in the inferred category, in addition to 7.6 billion lbs of copper in the measured and indicated category, and 3.1 billion lbs of copper in the inferred category.

Western Copper and Gold’s positive feasibility study on the Casino project indicates a 27-year mine life and cash flow over the first four years of C$951 million per year at base case prices. In addition, the company has provided estimates for potential economic changes in copper prices and indicated the project will remain profitable even if the spot price decreases.

“Casino is a rare asset in that it is sizable, economic, well-advanced and located in a great jurisdiction. Casino is the key asset in the emerging Yukon gold district,” said Paul West-Sells, Western Copper and Gold’s president.

Western Copper and Gold’s 2023 diamond drilling program involvedapproximately 2,244 meters of drilling in seven drill holes, ranging from 130 meters to 556 meters in depth located inside the current pit boundaries. Results from the program showed relatively higher grades encountered from DDH23-05, which intersected 158.5 meters of supergene mineralization, in part oxidized, with 0.82 percent copper equivalent. Fifteen composite samples that represent supergene and hypogene mineralization at various grades will be tested and results will be used to develop a more detailed geometallurgical model of the deposit.

Rio Tinto (NYSE:RIO) made a strategic C$25.6-million investment in 2021 to advance the Casino project. The placement, which was completed in 2024, allowed Rio Tinto to acquire 239,528 common shares of the company for C$1.35 per share for a total of C$323,363, resulting in approximately 9.7 percent ownership.

Additionally, the company announced the completion of a C$21.3 million strategic equity investment by Mitsubishi Materials Corporation to further advance the company's copper-gold Casino project in the Yukon. Mitsubishi Materials acquired 8,091,390 common shares of the company for C$2.63 per share, resulting in Mitsubishi Materials owning approximately 5 percent of Western's issued and outstanding shares.

Western Copper and Gold has entered into an amended agreement with Eight Capital, in which Eight Capital will buy 21,055,000 common shares for $1.90 per common share for gross proceeds of C$40 million. Net proceeds from the sale will be used to advance permitting and engineering activity at the Casino project.

A highly knowledgeable management team with a proven record of success leads Western Copper and Gold and is supported by a highly qualified team of engineers dedicated to bringing Casino into production.

Company Highlights

- Western Copper and Gold is an exploration and development mining company with a significant advanced-stage copper-gold asset in the Yukon.

- The Casino deposit hosts a significant resource of almost 21 Moz of gold and 11 billion lbs of copper (M+I+I).

- A strategic investment from Rio Tinto provides Western access to additional operational funding and technical knowledge, indicating Rio’s confidence in the Casino project.

- The federal government announced a funding package to finance the access road to the Casino project.

- Western Copper and Gold’s positive feasibility study on the Casino project, indicates a 27-year mine life and cash flow over the first four years of C$951 million per year at base case prices.

- The company received a C$21.3-million strategic equity investment from Mitsubishi Materials Corporation to further advance the company's copper-gold Casino project in the Yukon.

- Western Copper and Gold’s 2023 diamond drill program at the Casino Project included a metallurgical and infill drilling program with approximately 2,200 meters in seven drill holes, ranging from 130 meters to 560 meters in depth, and a geotechnical and hydrogeological drilling program with 800 meters of drilling.

Key Project

Casino Project

The Casino project is a large porphyry-type copper-gold-molybdenum deposit located 560 kilometers from the year-round port of Skagway, Alaska and 380 kilometers from the capital city of Whitehorse in the Yukon Territory of Canada.

Skagway’s construction of a marine services platform (MSP) to support ore export for the Yukon mining industry.

The company released its positive PFS for the Casino project in June 2022, which considered the project being constructed as an open-pit mine, with a concentrator processing 120,000 tonnes per day (td) to recover copper, gold, molybdenum and silver, as well as a 25,000 td oxide heap leach facility to recover gold, silver and copper.

The PFS examined the development of the Casino project, which includes the processing of 1.43 billion tons of mineral reserve for both the mill and heap leach, with deposition of mill tailings and mine waste in the tailings management facility consistent with the design concepts considered during the best available tailings technology study as a base case development.

The PFS indicated a $2.3-billion after-tax NPV (8 percent) at base case metal prices with an after-tax IRR of 18.1 percent. The cash flow over the first four years is C$951 million per year contemplating a 27-year mine life.

Results from the company’s 2023 drill program, which consisted of seven holes for 2,244 meters ranging from 130 meters to 556 meters in length, show the importance of the core zone wherein relatively higher grades are encountered. A metallurgical test program is underway to develop a more detailed geometallurgical model of the deposit.

Management Team

Dr. Paul West-Sells - President

Dr. Paul West-Sells has more than 30 years of experience in the mining industry. After obtaining his Ph.D. from the University of British Columbia in metallurgical engineering, he worked with BHP, Placer Dome and Barrick in increasingly senior roles in research and development and project development. West-Sells has worked for Western Copper and Gold since 2006, where he held a number of technical and executive positions and is now the president and CEO overseeing the day-to-day operations of the company. West-Sells sits on the Yukon Minerals Advisory Board, the Board of the Yukon Mining Alliance and is also the chair of the Centre for Northern Innovation in Mining Governing Council.

Bill Williams – Interim Chairman

Bill Williams is an economic geologist with nearly 40 years of experience related to the exploration and development of mining and oil & gas projects, as well as oversight of mining operations. He provides consulting services to the mining industry with a focus on company/project (e)valuations, M&A analyses, risk analysis, project management, and permitting strategies. Most recently, he served as the interim CEO and director of Detour Gold Corporation and was a director and COO of Zinc One Resources Inc., with whom he led the team that made the discovery of the Mina Chica zinc-oxide deposit in the Bongará district, north-central Peru. He is the former CEO, president, and director of Orvana Minerals, prior to which he was a vice-president for Phelps Dodge Exploration overseeing activity in the Americas, which included the discovery of the Haquira porphyry copper deposit in Peru, and working on M&A opportunities. He holds a Ph.D. in economic geology from the University of Arizona and is a certified professional geologist.

Sandeep Singh - Chief Executive Officer

Sandeep Singh is a highly respected mining professional with 20 years of sector expertise. He was previously the president and CEO of Osisko Gold Royalties, where he led the successful turnaround of the company. For the fifteen years prior, Singh was an investment banker focusing on the North American metals and mining sector with BMO Capital Markets, Dundee Securities, and ultimately co-founding Maxit Capital, a leading independent M&A firm. He has advised numerous mining companies on financing alternatives and strategic matters as well as having acted on some of the most complex and value-enhancing M&A transactions in the mining sector. Singh holds a Bachelor of Mechanical Engineering from Concordia University and a Master of Business Administration from Oxford University.

Varun Prasad - CFO

Varun Prasad has been with Western Copper and Gold since 2011 and most recently served as interim CFO. Prior to that, he was corporate controller for the company. He has extensive experience in financial reporting and regulatory matters. Prasad holds a B.A. Technology (accounting) from British Columbia Institute of Technology and is a member of the Chartered Professional Accountants of BC.

Cameron Brown - Special Technical Advisor

Cameron Brown has 45 years of experience in mineral processing and has been responsible for plant maintenance, project engineering and project management of major base and precious metal projects. He was formerly project manager for Western Silver Corporation and worked for 22 years for Bechtel Mining & Metals in various capacities including: project manager, project engineering manager, and manager of engineering for Bechtel Mining & Metals (Global). He was Western Copper and Gold's project manager from 2006 to 2010, served as vice-president, engineering from 2010 to 2023, and is currently special technical advisor.

Shena Shaw - VP, Environmental and Community Affairs

Shena Shaw has been managing projects and contributing to environmental assessments across the North for nearly 20 years and she is supporting the Casino Project through the first ever panel review process in the Yukon. Her knowledge and advice helps the company make strategic and effective decisions when planning and implementing Indigenous and community consultation and engagement. After graduating from the University of Victoria with a Bachelor of Arts in anthropology focusing on First Nations studies and geography, Shaw joined the Yukon Chamber of Commerce supporting community-based entrepreneurship programs and services. A relocation to Yellowknife, NWT introduced her to the mining industry for the first time when she joined DeBeers Canada’s Snap Lake Project. Following that, she embarked on a lengthy career in environmental consulting in Yellowknife and Whitehorse, focusing on responsible development of resource extraction through the environmental assessment and Indigenous engagement processes of large-scale projects in the Yukon, NWT, Alaska and across Canada. Shaw participated in the consultation and socio-economic impact assessment work for the Kaminak Coffee Gold Project, Victoria Gold’s Eagle Gold Project and the Casino Project, all based in the Yukon. She is deeply familiar with the Yukon Environmental and Socio-economic Assessment Act process and was involved in the Mackenzie Gas Project Joint Review Panel process in the NWT. Shaw is currently a director for the Yukon Chamber of Mines.

Dr. Klaus Zeitler - Director

Dr. Klaus Zeitler was the founder and CEO of Inmet from 1987 to 1996. Zeitler was senior vice-president of Teck Cominco Limited from 1997 until 2002, and previously was on the board of directors of Teck Corp. from 1981 to 1997, and Cominco Limited from 1986 to 1996. Zeitler is currently director and executive chairman of Amerigo Resources Ltd. and lead director of Rio2 Limited.

Tara Christie - Director

Tara Christie has over 20 years of experience in the exploration and mining business. Currently the president and CEO of Banyan Gold, Christie serves on the boards of Constantine Metal Resources and Klondike Gold. She was formerly the president of privately owned Gimlex Gold Mines, one of the Yukon’s largest placer mining operations. Christie has been a board member of PDAC, AMEBC and other industry associations and was a founding board member of the Yukon environmental and socioeconomic assessment board. She is active in non-profits and charities, including being president of a registered charity “Every Student, Every Day” that works to improve attendance in Yukon schools.

Michael Vitton - Director

Michael Vitton is the former executive managing director, head, US Equity Sales, Bank of Montreal Capital Markets (BMO Capital Markets), where he originated and placed more than US$200 billion through public and secondary offerings and M&A transactions across all sectors. In the metals and mining sector, Vitton has acted as seed investor, lead/co-lead underwriter or in a M&A capacity in some of the most important deals in the sector, including African Platinum , Arequipa Resources, Bema Gold Brancotte Resources, Comaplex Minerals, Detour Gold, Diamond Fields Resources, Echo Bay Mines, Francisco Gold, Franco-Nevada Gammon Gold, Getchell Gold, among many others. Vitton was also the co-founder of MMX Minerals e Metalicos SA and LLX Logistica SA (Brazil). MMX sold Minas Rio and Amapa assets to Anglo American Corporation for US$5.5 billion in cash in December 2008, returning US$8.8 billion in cash or stock distributions to MMX shareholders, offering six times return from IPO. Additionally, he co-founded Petro Rio SA, one of the leading Brazilian public oil and gas producers, producing over 35,000 bbls per day. Recently, Vitton acted as seed investor and capital markets advisor to Newmarket Gold, which was sold to Kirkland Lake Gold Ltd. for C$1 billion, combining to form a C$2.4-billion company. He acted as investor and capital markets advisor to ASX-listed Gold Road Resources Ltd., raising AU$57 million, and bringing the Gruyere gold mine into production jointly with Gold Fields SA. Vitton is a graduate of the University of Michigan Business School, former seat holder, NYSE, and former president, New York Society of Metals Analysts. Vitton is focused on the energy, infrastructure, industrial and mining sectors.

Frequently Asked Questions

How can I invest in Western Copper and Gold?

Western Copper and Gold is a public company that trades in the top stock exchanges in the world, in both the New York Stock Exchange American and the Toronto Stock Exchange under the symbol "WRN".

Why is Western Copper and Gold a good investment?

Western Copper and Gold is an exploration and development mining company advancing its world-class Casino project, one of the largest copper-gold projects in Canada, located in the Yukon. The Casino deposit hosts a significant resource of almost 21 Moz of gold and 11 billion lbs of copper (M+I+I), and robust economics. According to its feasibility study which considered the project being constructed as an open pit mine, Casino has a 27-year mine life, with $2.33 billion NPV after tax, and 3 years payback period. Casino has also attracted strategic investments from Rio Tinto and Mitsubishi Materials, providing Western Copper and Gold access to additional operational funding and technical knowledge.

What separates Western Copper and Gold from the rest of the field?

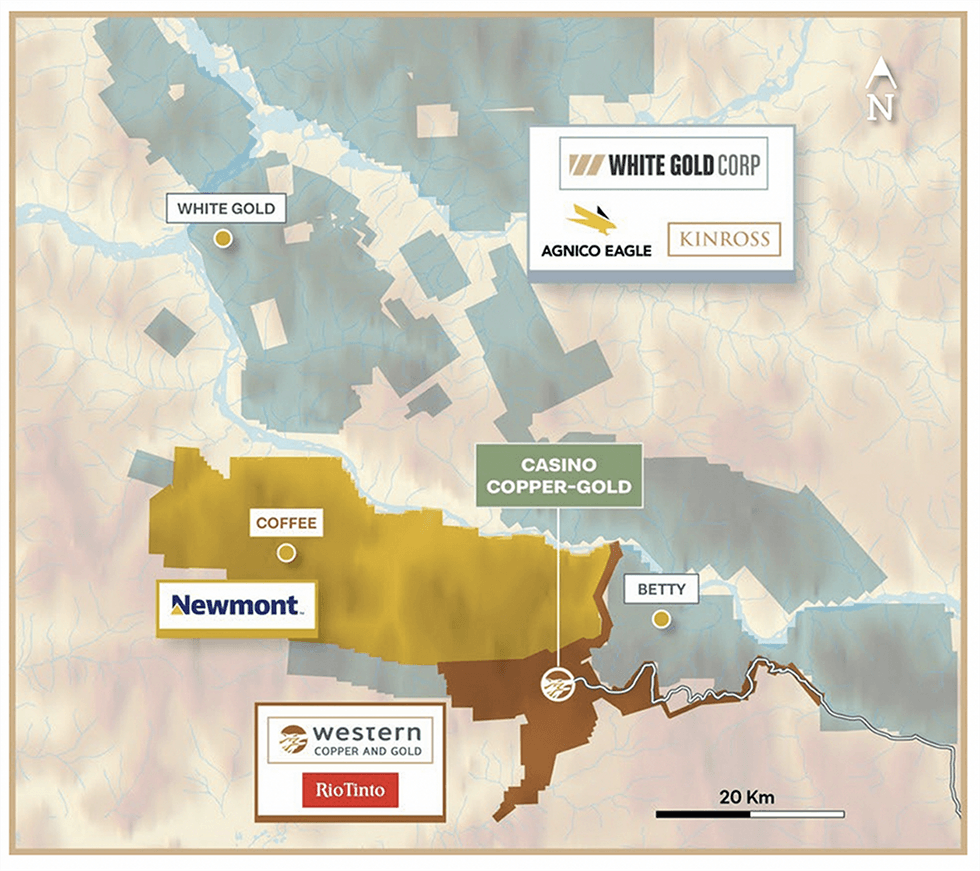

Western Copper and Gold’s president Paul West-Sells, says, “Casino is a rare asset in that it is sizable, economic, well-advanced and located in a great jurisdiction. Casino is the key asset in the emerging Yukon gold district.” Canada’s Yukon territory ranks among the world's top most attractive mining investment jurisdictions, with major miners like Rio Tinto, Newmont, Agnico-Eagle and Kinross developing projects in Casino's neighbouring areas.

What is Western Copper and Gold's sustainability strategy?

Western Copper and Gold is committed to developing the Casino Project guided by the following four objectives: protect public health and safety; minimize, mitigate or prevent adverse environmental impacts; reclaim the site to a land use state consistent with surrounding conditions; and ensure long-term stability of the spent ore and waste rock storage area and site water quality.